[ad_1]

A accountable Airbnb proprietor and host will have to understand how to file Airbnb source of revenue on tax go back. It’s the responsibility of each American to take action.

Desk of Contents

- Mashvisor’s Information on Learn how to File Airbnb Source of revenue on Tax Go back

- Reporting Airbnb Source of revenue on Tax Returns

- In depth Due Diligence Is By no means Overestimated

- Wrapping It Up: Learn how to File Airbnb Source of revenue on Tax Go back

Mashvisor’s Information on Learn how to File Airbnb Source of revenue on Tax Go back

You’ve most probably already heard of the proverb, “Not anything is bound however demise and taxes.” It simply implies that an individual can’t steer clear of the inevitable. There are issues on this global which are simply intended to be. And taxes fall below that class.

Submitting taxes is among the maximum vital tasks all voters of a rustic will have to satisfy. Taxes fund crucial govt services and products and tasks that carry the dwelling requirements and stipulations of a constituency. Merely put, taxes are the lifeblood of a country.

Because of this, genuine property buyers who wish to get started a apartment belongings trade and those that already personal an Airbnb trade will have to understand how to file Airbnb on tax go back source of revenue e-file or publish a real bodily record. Let’s communicate extra about how you can file Airbnb source of revenue on tax go back on this article.

Privileges Come With Duties

Ahead of anything, let’s identify something: Airbnb web hosting is a privilege granted to certified people who are accountable sufficient to run and arrange a apartment trade, together with the criminal duties that compliment it.

Beginning an Airbnb trade is a good way to earn some additional cash at the aspect, particularly if the valuables is situated in a marketplace with so much to provide vacationers and guests. Scorching genuine property markets that draw in masses of 1000’s, even thousands and thousands, through the 12 months generate a good-looking go back on funding for genuine property buyers. Markets with top money on money go back and cap charges have a tendency to additionally result in upper Airbnb income.

For those who’re an Airbnb host or personal a holiday apartment belongings, you’re one of the most fortunate few. Now not everyone seems to be given any such superb alternative to provide wealth. Alternatively, the privilege additionally comes with a price.

Working an Airbnb apartment and even temporary leases on different equivalent platforms, like VRBO, include a protracted record of duties that homeowners and hosts must dutifully carry out. This contains submitting source of revenue tax returns.

For many other folks, tax season will also be slightly… neatly… taxing. This is a time when other people’s pressure ranges move throughout the roof most commonly as a result of all of the confusion that is going with the territory.

Maximum American citizens get slightly uptight proper round April annually, and understandably so. Alternatively, if an individual is aware of, on the very least, the fundamentals of tax submitting and reporting, she or he would most probably be much less fearful when tax season rolls round. It’s the place figuring out how you can file Airbnb source of revenue on tax go back is available in very at hand.

Reporting Airbnb Source of revenue on Tax Returns

With regards to apartment houses despite the fact that, particularly holiday leases like an Airbnb trade, reporting one’s source of revenue can get beautiful complicated. An Airbnb host or proprietor may fall below one in every of two primary classes: source of revenue tax and accommodation tax.

What do the 2 tax varieties must do with an Airbnb host figuring out how you can file Airbnb source of revenue on tax go back? Much more than one can be expecting. Let’s check out every form of tax that must be reported.

Similar: Tax Season 2022: Information for Actual Property Traders

Source of revenue Tax

Source of revenue taxes are typically levied through the federal government (on each the federal and state ranges) as a share of your total source of revenue for the 12 months. An Airbnb host can pay such taxes out-of-pocket once a year.

Via regulation, temporary apartment homeowners will have to file the source of revenue they make off their holiday apartment houses to the IRS as a part of their overall source of revenue. Alternatively, positive workarounds will also be completed to cut back the taxable source of revenue quantity like apartment belongings tax deductions. The deductions can come with bills associated with the control and operation of an Airbnb belongings akin to:

- Assets upgrades and enhancements

- Common repairs

- Working bills

- Airbnb and different holiday apartment platform charges

- Go back and forth and transportation

One exception to the above requirement is what we name the 14-Day Rule. For apartment houses that hire out their position for a length of 14 days and underneath, Airbnb hosts and homeowners don’t want to publish a file on their source of revenue. Alternatively, no longer reporting the stated source of revenue additionally method they don’t get to benefit from deductions on taxes on apartment source of revenue.

Alternatively, if apartment belongings homeowners itemize their deductions total, they may be able to nonetheless take out the standard loan and belongings tax deductions for his or her houses.

Source of revenue Tax Reporting through the Apartment Platform

For many source of revenue resources, the quantity of source of revenue made through a person is reported to the IRS through the supply of the stated source of revenue. The person will then obtain a replica of the file containing a abstract of the source of revenue earned.

With regards to the tax on apartment source of revenue, Airbnb may no longer provide you with an income shape should you best earned not up to $20,000 in a 12 months. Alternatively, should you earned north of $20,000 and generated greater than 200 bookings in three hundred and sixty five days, be expecting to obtain Shape 1099-Okay, Fee Card, and 3rd Celebration Community Transactions. This is because a large number of holiday apartment platforms are thought to be fee agreement entities.

Now if the web platform you’re on withholds federal taxes for you, you’re going to be given a tax shape that states the quantity withheld. If you wish to exchange the quantity withheld for every calendar 12 months, chances are you’ll publish a W-9 shape for any such function.

Let’s say that you simply rented out your home for not up to 14 days in a 12 months and nonetheless Airbnb experiences the source of revenue to the IRS, you simply want to display evidence that it was once best rented for not up to 14 days to unravel the problem. It’s important in figuring out how you can file Airbnb source of revenue on tax go back to attenuate confusion about one’s source of revenue taxes.

Similar: The Actual Property Investor’s Information to Airbnb Tax Deductions

Accommodation Tax

By contrast to source of revenue taxes, accommodation taxes are levied through the state and native governments on lodging. It merely implies that the visitors pay the tax. Alternatively, it’s the apartment belongings proprietor’s accountability so as to add the taxes to the invoice, accumulate the tax, dossier the accommodation tax returns, and pay the quantity. Relying at the location and the jurisdiction, accommodation taxes will also be due per month, quarterly, or annually.

Reporting for accommodation taxes will also be slightly sophisticated in comparison to the easier source of revenue tax submitting. This is because chances are you’ll want to file each your temporary apartment income, in addition to cash gathered as accommodation taxes. It is going to rely at the jurisdiction the place the apartment belongings is situated. In case your apartment platform additionally collects taxes from visitors for your behalf, your reporting necessities can be affected.

Figuring out Accommodation Taxes

As we already discussed, hosts and holiday belongings homeowners could also be accountable for accommodation taxes in numerous jurisdictions. In most cases, accommodation taxes are made up of various taxes imposed through a number of govt entities levied on lodging. They are able to be gross sales tax, brief occupancy tax, lodge tax, mattress tax, town tax, and extra.

The entire other taxes appropriate to a apartment belongings will probably be added to get a hold of the overall tax charge hosts will price their visitors.

For example, the Orlando, FL scene calls for Airbnb hosts and holiday apartment homeowners to assemble taxes that come with a 6% state brief apartment tax plus a nil.5% county discretionary gross sales surtax this is administered through the federal government. Moreover, they’re additionally required to price an extra 6% tax for vacationer building this is administered through the county.

Tax Jurisdictions

It is important to for hosts to grasp which tax jurisdictions their leases fall below so they may be able to file their Airbnb source of revenue accordingly to steer clear of non-compliance fines and consequences.

Submitting accommodation taxes is something, as a number best wishes to easily file the Airbnb income and the quantity of tax gathered. Alternatively, ahead of one will even accumulate and dossier stated accommodation taxes, the landlord must make certain that they’re registered with the best jurisdiction for a license or allow to assemble accommodation taxes from visitors.

For many places, making use of for a tax allow will also be simply completed on-line. Charges will range relying at the location and jurisdiction. As soon as registered, a number can get started amassing accommodation taxes from visitors.

After registration, the native jurisdiction will have to supply crucial knowledge on reporting and submitting accommodation tax returns. It contains frequency and the cut-off dates for submitting. Lacking cut-off dates will entail various quantities in consequences and fines in response to the site and jurisdiction.

Maximum jurisdictions be offering on-line submitting choices to make it more straightforward for apartment belongings homeowners to dossier accommodation tax returns. Submitting on-line will nonetheless require mentioning the quantity of temporary apartment source of revenue made in a length. Bills are normally completed by means of digital switch or take a look at. Bank card bills also are authorized through maximum jurisdictions; then again, remember the fact that paying with a bank card comes with positive charges and fees.

Holiday apartment belongings homeowners and Airbnb hosts will have to additionally be aware that they’re required through maximum jurisdictions to nonetheless dossier through the cut-off date irrespective of whether or not source of revenue was once made or no longer inside the protection length.

Accommodation Tax Accrued through the Apartment Platform

Apartment platforms like Airbnb and VRBO accumulate accommodation taxes at the homeowners’ behalf in some jurisdictions. It implies that they upload appropriate taxes to the visitors’ expenses, accumulate them, and pay for them within the native tax jurisdiction the apartment belongings is in.

The article concerning the above platforms is even though they accumulate accommodation taxes in masses of places and jurisdictions throughout america, there are some jurisdictions that they don’t. And so they additionally would possibly accumulate a portion of the taxes owed and no longer all of the quantity.

Let’s take Austin, TX as our instance. Holiday apartment hosts in Austin are required to assemble and move directly to native tax government a complete of 17% accommodation tax from visitors. It’s the sum of 6% state lodge occupancy taxes and 11% town lodge occupancy taxes. Apartment platforms Airbnb and VRBO accumulate the state taxes but it surely falls to Austin apartment belongings hosts to assemble and pay the town taxes themselves.

Take into account that, normally, the apartment platforms don’t file your income and paid accommodation tax. In Indiana, as an example, holiday apartment marketplaces are required to assemble taxes for your behalf as soon as your house is booked. If the accommodation tax isn’t gathered, you because the host or proprietor are required to file the accommodation taxes.

In maximum jurisdictions, then again, it’s nonetheless a will have to for apartment belongings homeowners and hosts to dossier their accommodation tax returns to file their income and picked up taxes, even though the apartment platforms are amassing on their behalf.

Acquiring the above knowledge on how you can file Airbnb source of revenue on tax go back will make submitting taxes so much easier.

Similar: Airbnb Austin: Must You Invest in 2022?

In depth Due Diligence Is By no means Overestimated

Figuring out the place you stand together with your taxes as apartment belongings homeowners is a huge a part of appearing due diligence. Due diligence isn’t with regards to researching marketplace knowledge and examining apartment marketplace knowledge. It’s more straightforward to do each issues with a site like Mashvisor.

Mashvisor is a web-based genuine property market that focuses on serving to genuine property buyers in finding the best houses that are compatible their funding wishes. They provide customers get entry to to crucial funding equipment, akin to:

- An enormous and extremely correct genuine property marketplace database that covers virtually all spaces of america

- Assets finder equipment that let customers to find the most productive funding houses of their markets of selection

- An actual property warmth map that permits them to review neighborhoods in response to how they carry out in positive classes

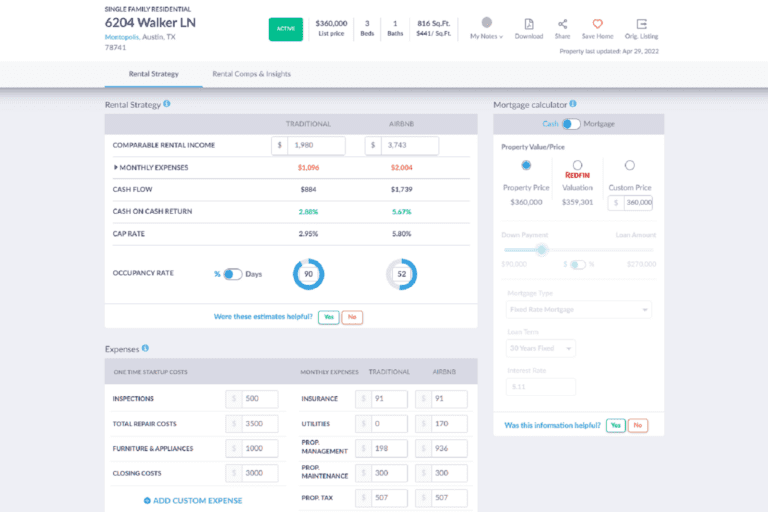

- An funding belongings calculator that is helping them make correct projections in response to real-time marketplace knowledge. It contains an Airbnb calculator that still takes under consideration native taxes

Mashvisor’s Airbnb calculator lets in buyers to resolve the profitability in their genuine property investments, allowing for native taxes.

Mashvisor would possibly look like a one-stop-shop for genuine property buyers. Alternatively, in addition they want to believe achieving out to tax consultants the place their apartment houses are situated so that they know what they’re running with. It will have to give them a greater thought of how you can file Airbnb source of revenue on tax go back and different tax-related issues referring to their funding houses.

Without reference to whether or not the valuables is rented out as a longer term Airbnb apartment or rented out for 14 days or much less, Airbnb laws nonetheless require hosts and homeowners to satisfy their rightful duties as voters and pay their taxes. It’s the price of with the ability to benefit from the superb privilege of proudly owning a holiday apartment belongings.

Wrapping It Up: Learn how to File Airbnb Source of revenue on Tax Go back

Figuring out how you can file Airbnb source of revenue on tax go back is a large reduction for Airbnb operators. You don’t want to be a tax professional to know the sophisticated fine details of submitting a tax go back as a holiday apartment proprietor. Having enough wisdom about the subject material can decrease the tension of tax season.

Figuring out your tax duties is a huge a part of appearing your due diligence as an investor and trade proprietor. After all, a just right a part of it additionally comes to marketplace analysis and information research, together with making correct computations that issue within the appropriate taxes. Mashvisor has helped 1000’s of buyers carry out due diligence and in finding the best houses that line up with their objectives and standards.

To be informed extra about how Mashvisor allow you to in finding winning funding houses, time table a demo.

[ad_2]