Brief-term condominium making an investment may also be truly successful when using Airbnb analytics. Let’s see how Mashvisor Airbnb information can lend a hand with it.

Desk of Contents

- The Advantages and Demanding situations of Making an investment in an Airbnb Condo

- Why Do Traders Want to Do Airbnb Research?

- How Can Mashvisor Lend a hand Traders with Their Airbnb Research?

- Mashvisor’s Very best 2022 Condo Towns for Airbnb

- Conclusion

The Advantages and Demanding situations of Making an investment in an Airbnb Condo

After all, should you’re nonetheless undecided what path to take as a brand new actual property investor, particularly conventional or non permanent condominium making an investment, it’s necessary to concentrate on all of the advantages and demanding situations in relation to Airbnb making an investment.

Primary Advantages of Airbnb Making an investment

Listed below are the principle advantages afforded via making an investment in Airbnb leases:

1. Brief-Time period Making an investment Can Be Extra Profitable In comparison to Conventional Making an investment

While you’re doing all of your Airbnb research, you’ll almost definitely realize that the probabilities of making extra benefit with non permanent leases are without a doubt larger than with conventional ones. In spite of everything, as an Airbnb proprietor, you’ll fee the next worth consistent with day and revel in the advantage of having multiple tenant.

As an example, fresh statistics display that during a town like Seattle, an annual tenant hire can give you the proprietor with about $24,000 in annual income. That is on no account a foul deal, however what about non permanent condominium?

In line with the new Mashvisor Airbnb information, day-to-day condominium worth in the similar town is ready $153 whilst the occupancy fee is 65%. That mentioned, it’s extremely most probably that the landlord will have the ability to hire out their assets for roughly 270 days in a 12 months, which might warrant $41,300 in annual income. That’s a significantly upper overall source of revenue.

Similar: Tips on how to Get admission to Airbnb Occupancy Charge Knowledge in 2022

2. The Talent to Diversify Tenant Portfolio

While you’re doing conventional renting, you depend only on one unmarried tenant on your source of revenue. In that sense, if this tenant skips their hire or just comes to a decision to up and depart, your funds would possibly undergo an important blow.

However, while you’re coping with Airbnb non permanent leases, your source of revenue depends upon many various tenants that naturally come and move. Subsequently, if one tenant comes to a decision to cancel on you, the monetary affect wouldn’t be as sturdy.

3. Higher Regulate of Your Assets

Brief-term leases like Airbnb are necessarily designed to provide a choice of holiday properties. There’s not anything preventing you to make use of your individual assets as your individual holiday position. Identical to another possible tenant, you’ll merely test the dates you need to spend at the position.

It’s not the one technique to inspect your private home although. With the proper of repairs carrier in position, you’ll at all times be notified when positive maintenance and fixes should be made. You’ll be able to additionally be sure that the carrier you employed correctly cleans up after each and every tenant’s keep. What’s extra, Airbnb condominium costs are extra versatile, which means that they differ with the trade of seasons. It permits you to trade the pricing accordingly.

Primary Demanding situations of Airbnb Making an investment

Along with the advantages, Airbnb making an investment comes with the next demanding situations:

1. Bills Can Be a Bit Upper

Once we examine conventional with non permanent leases, it’s transparent that having one unmarried tenant for an extended time period may even require much less effort in relation to repairs and bills. In spite of everything, this tenant will if truth be told survive your private home, which means that they themselves will do a large number of assets control and care. Likelihood is that that you just as an proprietor will best want to soar in once in a while for some emergencies and primary upkeeps.

With a non permanent condominium, you as an proprietor will without a doubt must step up your repairs recreation should you plan to frequently draw in new tenants. Now not best will it’s important to be sure that all of the furnishings, facilities, and decorations are as much as par with the present Airbnb call for, however you’ll additionally want to rent team of workers who will organize and handle the valuables for you.

This isn’t all, then again; with the intention to in point of fact provoke your Airbnb visitors, it will be quite efficient to supply them with some meals and beverage pieces for your assets. Additionally, be sure that there’s a robust Web connection, all of which you pay for your self.

Similar: Tips on how to Estimate Condo Assets Bills Earlier than Purchasing

2. Persistence Is Vital to See Development

In case you’re considering of beginning your individual condominium Airbnb trade, take into account that the growth is slow. While you first checklist your condominium, you’ll’t be expecting to get bookings for each and every unmarried day straight away. The extra glad tenants you get, the simpler your host scores will turn into, which is able to as a result and progressively spice up your bookings as smartly.

Simply because your private home is also the very best holiday spot in a stupendous house, it’s now not sufficient to depend best on the ones issues at first. Subsequently, it will be sensible to get a hold of an incentive plan with the intention to draw in extra visitors. After all, don’t overlook the non permanent funding tax both.

3. The Factor of Unpredictable Source of revenue

As we said ahead of, there are some drawbacks to conventional renting while you best get source of revenue from one tenant. However should you discover a accountable and dependable tenant who plans to stick on your assets for a very long time, it could simply change into an awesome receive advantages. Specifically, such an association would come up with a constant flow of source of revenue, to not point out some peace of thoughts.

However, it’s true that gathering source of revenue from extra tenants may also be more secure however it may be extra unreliable on the identical time. The item is that there’ll definitely be some empty condominium days on your Airbnb calendar all over the 12 months. You may even want to set unoccupied days in between leases with the intention to get ready the valuables for the following visitor.

As discussed, non permanent condominium pricing is versatile, which might permit you to doubtlessly stability the inconsistencies on your time table. Then again, it is very important depend on different elements for it, as smartly. In spite of everything, the occupancy fee is incessantly suffering from seasons, location, climate, and so forth.

Why Do Traders Want to Do Airbnb Research?

With a view to decide whether or not non permanent actual property making an investment is the appropriate selection for you and decide the profitability of various houses, it’s a very powerful to accomplish a radical and complete Airbnb research.

What the research principally includes is the inflow of to be had actual property information that traders can then additional investigate cross-check and interpret with the intention to make a decision whether or not a definite funding is a great deal for them or now not. What’s extra, such information can considerably make the investor’s process and existence more uncomplicated, particularly when you’re making probably the most out of to be had Mashvisor Airbnb data.

Taking into consideration that Airbnb Mashvisor numbers are up-to-date and correct, the accrued information makes for an awesome asset in finding probably the most profitable towns and spaces inside of the actual property marketplace. In this kind of means, traders can pinpoint the most efficient non permanent condominium houses with the easiest ROI utterly relaxing.

With the exception of discovering the perfect assets, traders can use Mashvisor Airbnb information analytics to additionally decide possible drawbacks and dangers {that a} positive funding would possibly have. As an example, should you discover a assets that turns out to suit your entire funding standards, you’ll then flip to the numbers to test simply how large of a benefit it will generate.

Each conventional and predictive tactics of accumulating helpful information may also be very helpful for an in depth research of Airbnb houses. Nonetheless, via the usage of predictions and estimations, traders can safely presume the profitability of a particular assets ultimately. That is the place Mashvisor Airbnb information can end up to be extraordinarily precious.

How Can Mashvisor Lend a hand Traders with Their Airbnb Research?

While you join Mashvisor, you additionally get automated get right of entry to to Mashvisor Airbnb information.

Marketplace-Stage Airbnb Knowledge

Traders can get right of entry to the lively Airbnb listings efficiency on moderate for various towns and neighborhoods.

Actual Property Marketplace Knowledge

Clearly, location is among the maximum necessary elements for non permanent leases. Actual property marketplace information will supply perception into the most efficient towns and spaces in relation to conventional and non permanent leases. Mashvisor Airbnb statistics come with the up to date Airbnb rules via town as smartly.

It’s additional imaginable to clear out the information with other metrics, similar to per 30 days Airbnb source of revenue, moderate Airbnb occupancy fee and ROI, median checklist worth, and so forth.

Community Knowledge Analytics

A very good technique to take advantage of out of Mashvisor Airbnb information is to make use of Mashvisor’s Heatmap instrument. With the exception of permitting traders to slender down their assets seek via towns, the instrument may be a really perfect lend a hand for pinpointing probably the most profitable neighborhoods for making an investment inside of every town.

As an example, if a definite group presentations actual promise in relation to non permanent leases, you’ll then carry out predictive research to test whether or not this luck will proceed sooner or later. Whilst you clear out in the course of the Heatmap, be sure you use your finances and different figuring out elements with the intention to pinpoint the most efficient funding houses on your portfolio.

Assets-Stage Airbnb Knowledge

Moreover, traders can use Mashvisor’s Airbnb calculator with the intention to assess the prospective money glide in line with their very own estimated source of revenue and loan.

Airbnb Condo Source of revenue

Necessarily, the discussed calculator will give you the investor with a whole perception into the valuables’s possible source of revenue. The Airbnb estimate is terribly useful for deciding whether or not to head for a definite funding deal or now not.

Airbnb Go back on Funding

Go back on funding (ROI) is among the maximum necessary information numbers that an investor can get. To get as correct an estimate as imaginable, it’s important to collect different items of information, similar to Airbnb cap fee and money on money go back.

Handbook calculations are imaginable but in addition at risk of error. That is the place the usage of Mashvisor can considerably reduce the danger of constructing a mistake when confronted with an funding resolution.

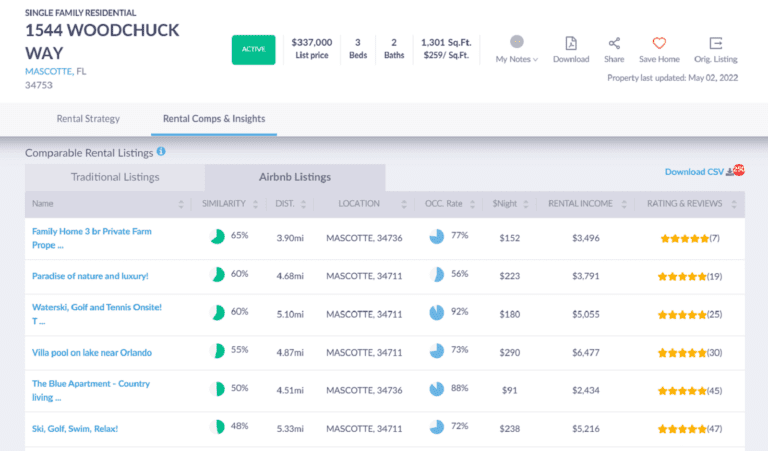

Airbnb Condo Comps

It’s additionally imaginable to pinpoint multiple funding assets on your seek and knowledge research. Then again, if you can not have enough money to shop for multiple assets, it’s crucial to enter the smallest main points with the intention to correctly examine those that fit your standards. Once more, that is the place you’ll use Mashvisor for dependable Airbnb comps and in any case to find the only assets that’s in point of fact above all others on your explicit wishes.

Mashvisor’s Airbnb Condo Comps lets in traders to correctly examine houses in a specific group that fit their funding standards.

Airbnb Money Waft

Being able to get right of entry to Mashvisor Airbnb information for each and every US town in the course of the Mashvisor platform, there’s completely no want to trouble your self with calculating Airbnb money glide manually. You’ll be able to merely click on at the assets that pursuits you and acquire rapid perception into precious metrics, similar to money glide, in addition to the occupancy fee, critiques, funding payback stability, Airbnb charges, different prices, and so forth.

Mashvisor’s Very best 2022 Condo Towns for Airbnb

In line with Airbnb money on money go back charges and Mashvisor Airbnb information, we’ve get a hold of a listing of the highest 20 US towns that display the most efficient possible in the case of non permanent condominium making an investment.

- Monroeville, PA: 9.97%

- Destrehan, LA: 9.62%

- New Berlin, WI: 9.62%

- Petersburg, IL: 9.60%

- Princeton, IL: 9.58%

- Freeport, IL: 9.57%

- Thomson, GA: 9.52%

- Prairieville, LA: 9.44%

- Alton, IL: 9.37%

- Corydon, IN: 9.28%

- Peninsula, OH: 9.27%

- Belding, MI: 9.23%

- Kingston, NH: 9.14%

- South Saint Paul, MN: 9.09%

- Mascotte, FL: 9.07%

- Calera, AL: 9.03%

- Winneconne, WI: 9.02%

- Iciness Springs, FL: 9.01%

- New Fort, PA: 8.99%

- Inkster, MI: 8.96%

Similar: What Is a Just right Money on Money Go back?

Conclusion

When you’re bearing in mind delving into the sector of non permanent condominium making an investment, it’s crucial to rigorously undergo all of the advantages and demanding situations. As discussed, you’ll without a doubt notice a considerable monetary receive advantages in relation to benefit. Then again, it additionally comes with its percentage of bills and energy.

After all, should you’re 100% positive that non permanent making an investment is the appropriate deal for you, you continue to want to just be sure you make a choice the perfect funding assets on your portfolio. So as to take action, thorough and complete analytics, subsidized up via Mashvisor Airbnb information, must end up to be indispensable, particularly when minimizing dangers and calculation mistakes. What’s extra, depending at the Mashvisor platform may even prevent an important period of time.

In case your purpose is to be probably the most a success actual property investor you’ll be, don’t hesitate to make use of the whole lot that Mashvisor has to provide. Join for a 7-day loose trial of Mashvisor nowadays.