As maintaining together with your funding houses can get tough, the escalation clause actual property is also of assist.

Desk of Contents

- What Is an Escalation Clause in Actual Property

- How an Escalation Clause Works

- When to Use an Escalation Clause

- Advantages and Drawbacks of Escalation Clause in Actual Property Contract

- Is It Conceivable to Again Out of an Escalation Clause?

- The right way to Steer clear of Overpaying for an Funding Assets

- Escalation Clause Actual Property Recap

On this article, we can overview the escalation clause and the way it impacts buying funding houses. Then, we can take a look at the advantages and downsides of this clause. Proceed studying to be informed all in regards to the vital clauses everybody must know.

What Is an Escalation Clause in Actual Property?

Necessarily, the escalation clause actual property is part of an be offering for a belongings that claims the prospective purchaser is keen to boost their preliminary be offering worth if the dealers occur to obtain some other be offering that was once larger. On this case, on account of the contract, the consumers with the escalation clause will routinely building up their be offering, sufficient to surpass the opposite consumers’ provides. This procedure may be known as the escalator clause.

Most often, when there’s an escalation clause in actual property as part of the contract, the patron will get a hold of a predetermined worth. This each accounts for a way a lot their be offering will building up every time, in addition to the easiest worth they’re keen to supply total.

The escalation clause actual property is most commonly utilized in instances the place the consumers and dealers expect to obtain a couple of provides on their belongings. This is helping each events. The dealers are in a position to get the easiest worth for his or her belongings whilst the consumers are in a position to stick within the operating to buy an inventory they’re very all for.

Despite the fact that the escalation clause in actual property sounds easy sufficient, it might probably change into a little bit sophisticated because of all the numbers and different problems that may want to be found out. We will be able to take a look at those headaches slightly later within the article.

How an Escalation Clause Works

General, the true property escalation clause works via contract prerequisites. When a purchaser submits an be offering on a belongings, they are able to come with the escalation clause. This can be a dedication from the patron to proceed elevating their be offering if the vendor will get some other be offering for his or her belongings. This continues to occur till the easiest be offering is made by way of the patron with the escalation clause. This easiest worth is predetermined and written within the contract.

This permits the patron to proceed to have the easiest be offering to buy till they hit the predetermined worth.

General, those are the primary questions you wish to have to determine when writing your escalation clause:

- What’s the authentic acquire worth of the valuables?

- What’s your first be offering for the valuables?

- How a lot will you building up your be offering every time a better be offering is gained by way of the vendor?

- What’s the easiest acquire worth you are going to pay in overall for the valuables?

Similar: The right way to Purchase Source of revenue Assets in 5 Simple Steps

Escalation Clause Actual Property Instance

Let’s take a look at a state of affairs wherein the escalation clause is observed in actual property. For instance, you’re a purchaser and you notice a belongings indexed for $400,000. Making a decision to publish that specific be offering for the home, however you additionally come to a decision you truly need this belongings.

You write on your be offering that you’re going to use the escalation clause. Each time any individual else submits a better be offering for the valuables, you are going to building up your be offering by way of $5,000. Making a decision you are going to proceed to try this till the list has an be offering for $500,000. This is your most acquire worth for this belongings, so, as soon as the fee hits $500,000, you are going to not be bidding at the list.

This actual property technique is an effective way for consumers to stick on best in their provides, and proceed to have the easiest worth for his or her belongings of hobby.

When to Use an Escalation Clause

The principle reason why folks use the escalation clause actual property is to safe the easiest worth on their desired belongings, with no need to to start with bid extra money than they wish to. In some instances, this technique is an effective way to aim to economize when purchasing a belongings. The dealer’s marketplace is difficult. No person desires to pay greater than they have got to, so you’ll see how low you’ll be able to acquire the list for.

Consumers additionally like to make use of the escalation clause actual property to turn the dealers they’re extraordinarily within the belongings. The housing marketplace will also be tremendous aggressive, and this technique displays dealers you imply industry.

Earlier than the usage of the true property be offering escalation clause, at all times talk about it together with your agent. They are going to information you in the suitable course if it is a suitable time to make use of this technique.

Similar: Be told the Distinction Between Actual Property Marketplace Worth vs Marketplace Worth

Advantages and Drawbacks of Escalation Clause in Actual Property Contract

Like several actual property technique or clause, the escalation clause has its professionals and cons. Earlier than using any such methods, it’s at all times a good suggestion to get yourself up to speed with all the techniques it may be advisable or damaging to you.

Advantages of the Escalation Clause Actual Property

Under are one of the crucial advantages of the escalation clause:

Creates a Peace of Thoughts for the Consumers

Buying a belongings will also be very anxious. As soon as consumers have discovered an inventory that matches all in their needs and wants, they wish to be certain that they can acquire the valuables. The usage of the escalation clause can assist safe a house underneath contract. There’s no want to fear about different provides being despatched in at the house, because the escalation clause routinely provides for your be offering.

Presentations Dealers You Imply Industry

Because the housing marketplace could be a tough position, dealers love to grasp you are going to observe via together with your intentions to buy their belongings. The escalation clause is an effective way to turn the dealers of the list you have an interest in that you’re fascinated with this acquire. Dealers will also believe accepting your be offering in the event that they see you’ve got the escalation clause on your contract.

Is helping Consumers No longer Overpay

Buying a belongings is typically a large monetary dedication. Particularly if you’re an actual property investor, you don’t wish to spend greater than you wish to have to in your funding belongings to generate a better go back on funding. The escalation clause is helping to make sure you don’t overpay for the valuables. As you are going to best building up your be offering when some other be offering is put into the valuables, you’ll at all times know you might be getting the most efficient worth of the list.

Drawbacks of the Escalation Clause

Under are one of the crucial negatives to bear in mind when the usage of the escalation clause:

No Negotiation Between Consumers and Dealers

As soon as the escalation clause is put into position, there will also be no negotiation between the 2 events about the cost of the valuables. It’s because the clause contains the easiest worth that you’re keen to pay total for the valuables, and it turns into to be had to the vendor. This implies the vendor will already know the utmost quantity that you’re keen to pay.

As soon as the vendor is aware of your easiest worth, some other drawback may well be created. The dealers may just simply decline your be offering, together with the escalation clause, and ask you flat out on your most be offering.

Dealers Can not Counteroffer Different Doable Consumers

If a dealer comes to a decision to just accept an be offering with an escalation clause, they are able to not publish counteroffers to different consumers who position an be offering at the list. That is because of the truth that the patron with the escalation clause would possibly no longer but have their most be offering submitted but. The vendor on this state of affairs can best settle for or reject different provides.

Appraisal Problems

Lenders within the housing marketplace will also be extraordinarily actual in how a lot they’re keen to offer for a belongings, in accordance with the house’s belongings marketplace worth. In occasions the escalation clause is used, a state of affairs may just rise up wherein you win the bidding battle however don’t get licensed by way of the lender as the overall worth finally ends up being upper than the appraised worth. This implies the patron would possibly no longer if truth be told have the ability to pay for the valuables.

In occasions the escalation clause is used, at all times believe the valuables’s appraisal worth when figuring out your most acquire worth.

Similar: 7 Simple Strategies for Funding Assets Financing

Doable Fraud

Despite the fact that that is not going to occur, there can be a case wherein fraud is interested by an be offering with an escalation clause. Because the dealers understand how a lot you might be keen to pay for the valuables, they may ask a chum to additionally publish their be offering at the belongings simply to extend the entire promoting worth. This might theoretically paintings as they simply have to supply slightly underneath your most worth.

Is It Conceivable to Again Out of an Escalation Clause?

If you’re a purchaser and you make a decision to incorporate an escalation clause in your be offering, it may be tough to again out of should you get chilly toes. It’s because it’s principally a freelance. Dealers have most probably grew to become away different provides to just accept yours.

The one manner you’ll again out of an escalation clause contract is should you had positive prerequisites to the home underneath contract that needed to be met for the sale to be ultimate—sometimes called contingencies. If those components weren’t met, then you can have felony grounds to again out of the be offering.

In any of those instances, at all times seek advice from your actual property agent. They are going to information you via all the procedure, particularly if you make a decision to incorporate an acceleration clause actual property on your be offering.

The right way to Steer clear of Overpaying for an Funding Assets

Any investor is aware of how crucial it’s to save lots of as a lot cash as conceivable when making an investment in actual property. To take action, you must at all times behavior an actual property comps research. This may occasionally make sure you don’t seem to be overpaying for any funding belongings. Under are the stairs to observe to finish an actual property comp research:

- Work out vital options for your belongings, akin to sq. toes, belongings worth, and distinctive options.

- Seek for actual property comps very similar to your list.

- In finding the typical worth in line with sq. foot of your comps, and evaluate that worth for your belongings.

The function of that is to determine the typical pricing within the house, in accordance with equivalent listings within reach.

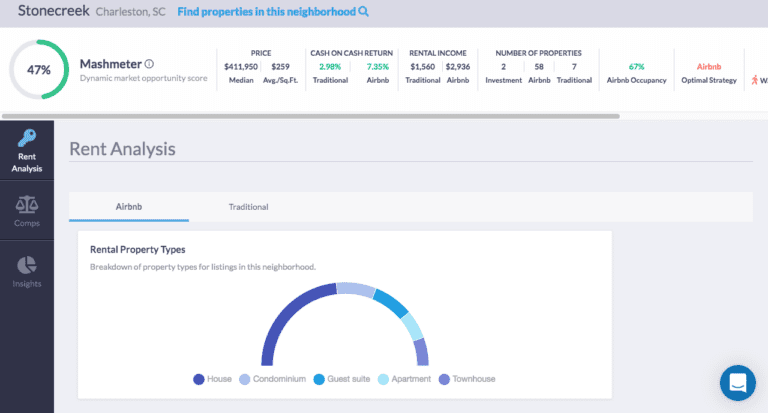

For added assist discovering dependable actual property information, consult with Mashvisor to get entry to a lot of gear and services and products. We provide gear, such because the Funding Assets Calculator, that permit you to behavior actual property comps research in mins. This device no longer best provides pre-calculated information on your explicit belongings but in addition supplies a comparability between how your private home will carry out as a long-term apartment vs as an Airbnb. Mashvisor assist you to make the most efficient selections on your funding belongings.

Mashvisor additionally includes a group analytics web page, which calculates the median worth and moderate worth in line with sq. foot in an area. This may occasionally permit you to estimate the marketplace worth of the valuables you want to acquire.

Escalation Clause Actual Property Recap

The escalation clause is a method in actual property for consumers to ceaselessly have the easiest bid on an source of revenue belongings they’re all for. This can be a contractual settlement that states your be offering will building up a certain quantity each time you might be outbid. This can be a predetermined building up that may happen till your most be offering is hit. When this occurs, you are going to be outbid and out of the operating for the list.

Like several actual property technique, there are specific advantages and downsides you must pay attention to earlier than committing to the method. Particularly since the escalation clause is a contractual settlement, there’s little wiggle room to forfeit the contract. The one occasions wherein a purchaser can again out is when prerequisites and phrases don’t seem to be met by way of the dealers.

To get get entry to to our actual property funding gear, click on right here to enroll in a 7-day loose trial of Mashvisor as of late, adopted by way of 15% off for lifestyles.