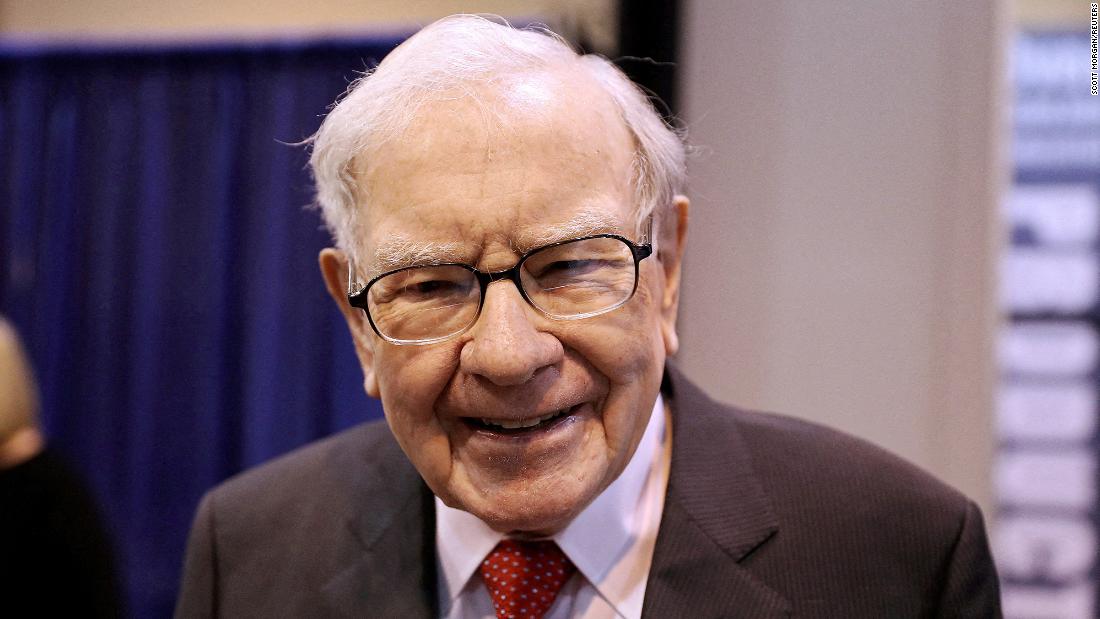

Buffett dismissed compliments from one questioner about how he instances the inventory marketplace so neatly. Buffett mentioned that he by no means in point of fact is aware of what shares or the financial system will do within the momentary.

“We have now by no means timed anything else,” Buffett mentioned, including that the good fortune of the corporate’s long-term “purchase and cling” funding technique is “easy.”

Each Buffett and Berkshire vice president Charlie Munger lamented how speculators have reputedly taken over Wall Side road. Munger described the casino-like surroundings and Buffett known as the marketplace a “playing parlor.”

Worries about inflation however reward for Powell

Buffett did not communicate at nice period all over the assembly about this 12 months’s marketplace volatility. However he did say that inflation is a large drawback, person who “swindles virtually everyone.”

And he gave large plaudits to Federal Reserve chairman Jerome Powell for his movements to combat the industrial disaster brought about through Covid-19, despite the fact that some argue that the Fed’s low charges have helped gas inflation pressures.

Buffett mentioned Powell was once a “hero” for being competitive and temporarily slashing charges at the beginning of the pandemic as a substitute of sitting through and “thumb sucking.”

Buffett additionally hinted that Berkshire may profit from sell-offs, pronouncing that the company “relies” upon marketplace conduct growing mispriced alternatives for the corporate.

Activision’s inventory value is underneath the proposed takeover value. Buffett mentioned that he made the verdict to shop for extra of the inventory as an “arbitrage” wager that the deal will in the end get accomplished.

Those strikes come only some weeks after Buffett wrote in his annual shareholder letter that he was once having issue discovering shares to shop for at horny costs. However following the Berkshire purchasing binge, its money readily available has fallen from about $147 billion on the finish of 2021 to round $106 billion on the finish of the primary quarter.

Why the exchange of middle? Munger, in his in most cases blunt type, mentioned that he and Buffett “discovered some issues we most well-liked proudly owning to Treasury expenses.”