[ad_1]

Promoting juicy places to receives a commission now to be a purchaser of AAPL inventory later and decrease.

shutterstock.com – StockNews

NASDAQ shares had their worst month for the reason that Monetary Disaster in 2008. The VIX, a measure of investor worry, is nearing the best possible ranges for the reason that Covid Disaster started. Reputedly impervious Apple has felt the fury as smartly, even after a record-breaking income quarter.

Stocks of Apple (AAPL) are actually at oversold ranges that experience signaled main purchase issues prior to now. I really like to make use of a simple machine to spot possible technical turning issues. The method used was once offered in a earlier article for many who neglected it.

The AAPL inventory chart under displays instances when 9-day RSI, MACD, and Bollinger % B reached oversold readings on the identical time. AAPL was once additionally buying and selling at a large bargain to the 20-day transferring moderate as smartly. These types of earlier cases proved to mark vital momentary lows in AAPL inventory as highlighted in aqua. Apple as soon as once more generated a technical purchase in line with those signs only in the near past.

There may be main horizontal toughen on the $150 degree for Apple. $140 is further drawback toughen.

Implied volatility (IV) is signaling a purchase as smartly. The new red-hot upward push has taken IV to extremes as soon as once more.

Essential to note how those main spikes in IV have coincided with the main purchase issues from the associated fee chart previous. Combining IV research in conjunction with technical research could make for a a lot more tough timing software.

Implied volatility additionally method possibility costs are a lot more dear. This makes promoting methods more practical when setting up trades.

Let’s stroll via how promoting places now to be paid to be a purchaser of Apple at decrease ranges has change into a extra winning enterprise with decrease possibility.

All issues being equivalent, the next two must hang true relating to put costs:

- Upper inventory costs must equate to decrease put costs

- Much less time till expiration must imply decrease put costs

All issues don’t seem to be equivalent in relation to implied volatility (IV) in AAPL choices from final November till now. A handy guide a rough aspect via aspect comparability whilst spotlight how the hot spike in IV has made put costs dramatically dearer.

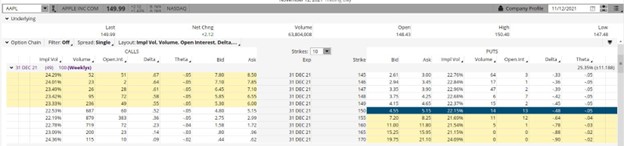

Beneath is the choice montage from 11/12/2021

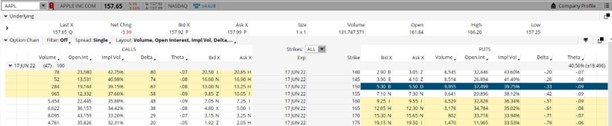

Beneath is the equivalent possibility montage from final Friday – 4/29/2022

The present put costs are a lot more dear even supposing AAPL inventory was once a lot decrease again in November and there are two extra days till expiration. That is as a result of the giant leap in IV.

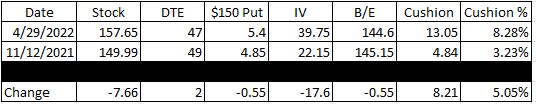

Let’s have a look at simply how a lot the use of the desk above. On November 12 AAPL inventory was once over 7 issues not up to it closed on Friday ($149.99 as opposed to $157.65). The December $150 places again then had 49 days till expiration (DTE) in comparison to 47 for the June $150 places on Friday.

So even supposing the inventory was once sharply decrease and there was once extra time till expiration, the Dec $150 places again in November had been buying and selling 55 cents inexpensive than equivalent June $150 places are actually.

Why? Implied volatility (IV). IV has risen just about 80% from November 12 till lately. This 17.6 level build up method the cost of the choices has shot up against the best possible ranges now we have noticed prior to now one year. And that is even after income.

Promoting places obligates the vendor to shop for the inventory on the strike worth bought. In our instance promoting the June $150 places would obligate the vendor to be a purchaser of AAPL inventory at $150. For this legal responsibility, the vendor receives the choice top class, or the cost of the choice. Promoting an AAPL June $150 put for $5.40 would obligate the vendor to shop for 100 stocks of AAPL inventory at $150 whilst receiving $540 up entrance for that legal responsibility. This successfully places the web purchase worth (or breakeven) at $144.60 ($150 strike much less $5.40 top class won.)

Examine that to the similar situation again on November 12. The put vendor continues to be obligated at $150 however simplest receives $485 up entrance. This places the breakeven purchase worth at $145.15.

The cushion, or distinction between the present inventory worth and breakeven is dramatically larger now than in November because of the massive pop in IV. The cushion now could be simply over 13 issues in comparison to just below 5 again in November. 8.28% cushion now as opposed to simply 3.23% cushion then to place it in proportion phrases. So, promoting places now method a larger prematurely fee in conjunction with a lot more drawback coverage as opposed to only a few months in the past. All as a result of IV has exploded upper because of heightened worry available in the market.

Warren Buffett is a large holder of Apple inventory. It contains just about 50% of the Berkshire Hathaway portfolio. Warren Buffett additionally has an adage that claims “Be Grasping When Others Are Apprehensive”. So be like Warren and benefit from the worry with a bullish brief put place in a crushed down APPL inventory.

POWR Choices

What To Do Subsequent?

If you are searching for the most productive choices trades for lately’s marketplace, you must take a look at our newest presentation Business Choices with the POWR Scores. Right here we display you tips on how to constantly in finding the highest choices trades, whilst minimizing possibility.

If that appeals to you, and you need to be informed extra about this robust new choices technique, then click on under to get get right of entry to to this well timed funding presentation now:

Business Choices with the POWR Scores

All of the Highest!

Tim Biggam

Editor, POWR Choices Publication

stocks closed at $412.00 on Friday, down $-15.81 (-3.70%). 12 months-to-date, has declined -12.99%, as opposed to a % upward push within the benchmark S&P 500 index all through the similar duration.

In regards to the Creator: Tim Biggam

Tim spent 13 years as Leader Choices Strategist at Guy Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Marketplace Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Business Are living”. His overriding interest is to make the complicated global of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices e-newsletter. Be informed extra about Tim’s background, in conjunction with hyperlinks to his most up-to-date articles.

The put up Apple Inventory Is Taking a look Ripe For A Rally seemed first on StockNews.com

[ad_2]