[ad_1]

Enlarge your wisdom at the most fitted techniques to make use of Airbnb analytics to extend income relating to your non permanent funding belongings.

Desk of Contents

- What Is Airbnb Analytics and Why Do Actual Property Traders Want It?

- The Conventional Method of Collecting Information: Helpful or Pointless in These days’s Marketplace?

- The way to Collect Airbnb Information and Spice up Condo Earnings

- What Precise Mashvisor Gear Will have to Actual Property Traders Use?

- The way to Use Airbnb Analytics to Spice up Brief Time period Condo Earnings: Summing Up

Gathering—and manipulating—marketplace knowledge approach turning your consideration to funding gear that let you accumulate the important knowledge slightly than going about it the “conventional” manner.

Whether or not you’re a first-time actual property investor or no longer, the next rule applies:

You will have to depend on a complete research if you want to reach most earnings to your funding belongings. Airbnb analytics let you with examining possible funding houses.

When you’re searching for environment friendly techniques to make use of analytics to seek out the best non permanent condo belongings and generate a gradual passive source of revenue, don’t hesitate to scroll down.

What Is Airbnb Analytics and Why Do Actual Property Traders Want It?

The query that opens all of the dialogue about researching the actual property marketplace and assessing the profitability of possible funding houses pertains to something: Airbnb analytics.

What’s Airbnb analytics—and why is it so essential to actual property traders?

To begin the dialogue the suitable manner, we can first want to explain the definition in the back of the time period “analytics” in actual property.

It’s the tips collected to research condo knowledge additional, interpret it, and lend a hand the investor in coming to a conclusion of whether or not it’s price it—or no longer. But even so the significance that the stated knowledge carries, it makes the task of actual property traders somewhat more straightforward—particularly relating to accuracy and time potency.

The numbers are accumulated to paintings on your want. The information is helping the investor find probably the most successful towns within the space—or a special actual property marketplace—and select the most productive non permanent leases that can generate the easiest go back on funding (ROI).

Some other vital think about the usage of analytics is that they may be able to assist the actual property investor assess the prospective dangers related to their funding.

For instance, when you’ve discovered a profitable funding belongings, you’ll test whether or not it’ll generate benefit or no longer. In response to the findings, you’ll make a decision whether or not or no longer you need to continue with the funding.

We will have to upload that there are two techniques of accumulating Airbnb knowledge analytics in the actual property trade. We’re relating to the “conventional” manner and the more recent, “predictive” manner right here. And to mention the least, each approaches include a dose of importance to them.

Alternatively, the latter is much more likely to turn dependable effects relating to earnings. The use of the ways of predictability and estimation, the investor can see how their holiday house will carry out in the end.

Comparable: The way to Review a Condo Belongings Temporarily

The Conventional Method of Collecting Information: Helpful or Pointless in These days’s Marketplace?

Exploring the actual property marketplace and finding non permanent leases used to be no longer all the time as simple as they’re these days.

Now not too way back, the “conventional” manner of gathering Airbnb analytics used to be in response to occupancy charges and moderate day-to-day charges. So, let’s see how the standard manner of appearing a normal Airbnb research holds up in these days’s actual property marketplace local weather.

Are the 2 metrics on my own helpful—or needless—to actual property traders?

First off, let’s glance into the true definition in the back of the time period “occupancy charges” and cross from there.

In definition, occupancy price is a share (share) of days over the duration of 1 month for which a condo belongings used to be booked. Arguably, it’s probably the most essential metrics for non permanent leases.

There’s a gorgeous easy components for the metric—and it is going like the next:

Occupancy Charge = Days Booked / Days To be had for Hire

The issue happens when it turns into misunderstood amongst rookies within the trade.

Aiming at top Airbnb occupancy price knowledge is very important, needless to say. An occupancy price upper than 65% is thought of as fascinating (allowing for the selection of non permanent leases throughout the USA). Even supposing it will look like your Airbnb trade is prospering, there’s one different hidden reality.

The nightly charges may just nonetheless be low, and due to this fact, the host is probably not making a lot cash.

Discovering the stability between pinning down an reasonably priced worth for vacationers having a look to stick at your non permanent condo and keeping up an high-quality occupancy price might not be easy with none help, particularly relating to different related metrics.

For instance, Airbnb reserving knowledge wishes any other issue considered—lead time knowledge. Reserving lead time knowledge is a very powerful—and it varies by way of location. Ski lodges and beach-side leases can be expecting upper occupancy charges throughout iciness and summer season holidays.

The following metric that used to be recurrently used for normal techniques of accumulating knowledge can be moderate day-to-day charges. Like the former one, this is a metric that is thought of as extremely loyal within the hospitality trade because it is helping the investor measure the common condo income that their funding belongings is producing.

Calculating the common day-to-day price is completed the usage of the next components:

Moderate Day by day Charge = Room Earnings Earned / Selection of Rooms Offered

The important thing this is to extend your ADR by way of making use of the suitable pricing technique—which isn’t simple to do if the one two metrics that you just’re abiding by way of are those we’ve discussed.

What’s the tackle them?

In all reality, the standard manner of gathering Airbnb marketplace knowledge is solely no longer going to chop it in these days’s marketplace local weather. The efficiency of your non permanent condo relies on different components, as neatly—and we’re going to say them in a second.

For now, it’s a very powerful for actual property traders to take hold of the significance of depending on funding gear which can be in control of coping with Airbnb analytics—and the abundance of knowledge they’re offered with each day.

The way to Collect Airbnb Information and Spice up Condo Earnings

To spice up your non permanent condo earnings, we can want to put the “conventional” manner of accumulating Airbnb knowledge within the background—a minimum of in the interim.

One of the best ways to extend your non permanent condo earnings and assist your technique prevail can be to depend on actual property investor web sites and, much more importantly, the integrated gear at your disposal.

On our actual property investor website online, Mashvisor, you’ll discover a dependable manner of accumulating and examining the got knowledge—and the usage of it to best possible your funding technique.

Think you selected Mashvisor’s funding gear. To which extent are you able to be expecting analytics, and the way correct are they?

Airbnb Actual Property Marketplace/Community Information

Relating to the Airbnb actual property marketplace, when you get admission to the Airbnb analytics, you’ll want related knowledge in regards to the actual property marketplace that you’re researching.

Since location is without doubt one of the main components right here, it’s a very powerful to peer how the world’s appearing relating to ROI. Getting the ROI knowledge is a very powerful for the investor. Why?

As it allows them to acquire a extra visible illustration of the marketplace, which cannot be imaginable by way of simply calculating the occupancy and moderate day-to-day price.

When you are carrying out your non permanent condo analysis, you will have to have the ability to “juggle” the next knowledge with a view to get your entire image and, with a bit of luck, achieve a conclusion:

- Median Checklist Worth

- Airbnb Occupancy Charge

- Per thirty days Condo Source of revenue

- Moderate Airbnb Go back on Funding

- Airbnb Cap Charge

Some other factor that’s confirmed to be of vital assist to actual property traders is Mashivors’s Community Research.

What does it do?

Mashvisor’s Airbnb analytics on particular neighborhoods supplies the actual property investor with an opportunity to dig even deeper into the subject of the funding belongings and notice some issues up-close.

For instance, the investor can see a undeniable space’s efficiency within the closing couple of months and, from there, shape the prediction for the next duration.

As a long term host, you’ll get a transparent concept relating to Airbnb money float—together with if it is sure or unfavorable for the stated community.

Comparable: The way to Carry out a Actual Property Marketplace Research

Funding Belongings Information

Whenever you’re set at the desired location, or a minimum of you were given one in thoughts, you’re additionally going to want knowledge at the belongings you’re looking to put money into right here.

The primary metric traders will have to center of attention on is the Airbnb condo source of revenue. And right here, hosts want to get a hold of a host. So, consider it:

How a lot will you rate per 30 days? Will that quantity be reasonably priced to guests—and nonetheless earn you sufficient cash?

To get an estimate of the per 30 days condo price, traders want to have a look at:

- Per thirty days Airbnb Condo Source of revenue

- Airbnb Money on Money Go back

- Worth to Hire Ratio

The following factor traders will have to take into shut attention is the charges they’re obligated to pay, together with upkeep of the funding belongings. You’ll take care of tax charges, insurance coverage, tenant turnover, and belongings control—amongst different issues.

The calculations contain much more paintings—and much more knowledge—that must be handled in due time. A believable answer can be to depend on an Airbnb calculator. And by way of doing so, you’re sure to get correct comments—and a competent estimate of your funding technique.

Whilst we’re at it, Airbnb comps can act as a deal-breaker on your non permanent funding. Inspecting different non permanent condo houses in a particular space you have an interest in isn’t a foul concept.

Get entry to to condo comps knowledge will assist the investor set the suitable nightly price. And by way of “proper,” we imply one who doesn’t stand out because of being too dear even to believe or too reasonable for them to take advantage of it.

Keep in mind that all the above steps will have to be finished previous to cashing out your financial savings on a belongings.

What Precise Mashvisor Gear Will have to Actual Property Traders Use?

Up to now, we’ve offered (and defined) the subject of ways the usage of Airbnb analytics on your analysis may just give a contribution to construction a a success funding technique.

Now, it’s time to say the gear that actual property traders will have to use of their analysis and communicate somewhat extra about their goal.

Belongings Finder

We strongly consider that any funding seek will have to get started off with a competent and thorough belongings seek. And for such reason why, we additionally assume that the usage of Mashvisor’s Belongings Finder will just about be inevitable all the way through your funding occupation.

Right here, the emphasis is on non permanent leases.

Our Belongings Finder software can assist traders seek thru any actual property marketplace at the map. Mainly, it’s a web-based software that may clear out thru Airbnb houses on the market within the desired marketplace space.

It’s price noting that the houses which can be going to pop up to your display screen are in response to private personal tastes—i.e., what you’re searching for in a fascinating funding belongings. The filters we’re speaking about come with:

- Location of the Belongings

- Airbnb Condo Technique

- Belongings Sort

- Finances

- Selection of Rooms (Bedrooms or Bogs)

Actual Property Heatmap

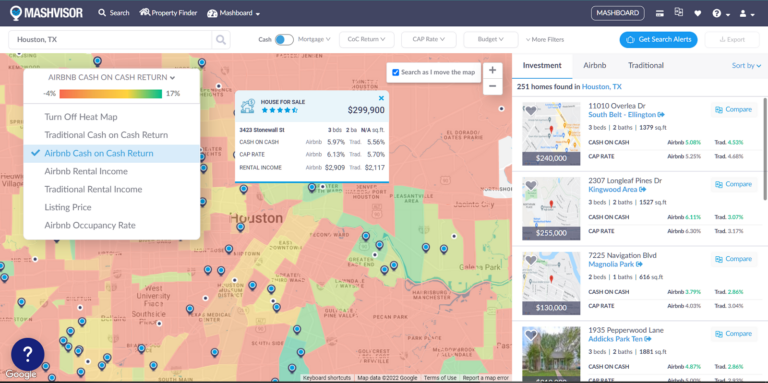

Some other a very powerful funding software is Mashvisor’s Actual Property Heatmap. Right here’s what it does for actual property traders:

The Actual Property Heatmap gifts you with a visible representation of ways a particular location is appearing in comparison to others—relating to the condo trade, this is. It depends upon a color-coded means with numerical knowledge to make it extra visually pleasant—and more straightforward to navigate.

Enticing in such form of analysis gets rid of some inaccuracies that conventional spreadsheets can raise and is helping traders download extra actual and in-depth perception into the community they’re excited about at the present time.

It’s additionally useful in evaluating Airbnb bookings knowledge within the space.

Mashvisor’s Actual Property Heatmap supplies traders with a visible representation of a particular location’s efficiency in comparison to others, in response to a number of metrics corresponding to condo source of revenue, money on money go back, list worth, and occupancy price.

Funding Belongings Calculator

Closing however no longer least, actual property traders are anticipated to take care of the numbers and estimates which can be immediately associated with their non permanent leases. Extra particularly, the investor wishes to peer whether or not the method will assist them generate source of revenue or no longer—and continue accordingly.

An funding belongings calculator, like Mashvisor’s Condo Belongings Calculator, might come in useful right here. The software assists actual property traders in doing key calculations and determines whether or not they will have to continue with their present technique—or if one thing must be altered first.

Traders get the risk to match the numbers and notice how their belongings would carry out as a non permanent or long-term condo, which technique is at risk of be extra a success, and what the estimates are on money on money go back, occupancy price, and many others.

Comparable: What Is a Just right Money on Money Go back?

The way to Use Airbnb Analytics to Spice up Brief Time period Condo Earnings: Summing Up

We’ve effectively lined the subject of the utilization and relevance of Airbnb analytics within the condo trade. Now, let’s simply in short undergo probably the most vital bits we’ve discussed up to now.

At the start, we’ve handled the which means of Airbnb analytics and its significance to the actual property investor. Necessarily, the 2 sorts of accumulating and coping with Airbnb marketplace knowledge come with the so-called “conventional” and “predictive” techniques.

And even if the standard means comes to calculating your non permanent condo belongings’s occupancy and moderate day-to-day price, it’s no longer sufficient for a competent conclusion. The actual property investor wishes concrete numbers—which will most effective be got the usage of funding gear.

On that observe, Mashvisor’s funding gear give you the investor with thorough and up-to-date analysis on any actual property belongings and be offering in-depth perception into estimated earnings.

Enroll for a 7-day unfastened trial of Mashvisor, adopted by way of a fifteen% bargain to your quarterly or annual subscription.

[ad_2]