Is it a good suggestion to put money into a non permanent condo? Most of the people imagine it’s. Why? As a result of non permanent leases have confirmed to be extra profitable than long-term leases. In some eventualities, they may also be awesome.

Desk of Contents

- What Are Brief-Time period Leases?

- Are Brief-Time period Leases a Excellent Funding?

- Find out how to Get Round Brief-Time period Condo Restrictions

- Find out how to Make a choice an House for Your Brief-Time period House

- Best 5 Very best Brief-Time period Condo Markets

- Conclusion

With pandemic restrictions reducing all over the world, commute call for is expanding. Additionally, guests can keep somewhat longer and uncover somewhat extra now that they’re given the strategy to work at home. Non-public inns in much less crowded puts with a home-away-from-home setting enchantment to as of late’s vacationers.

The commute industry is present process an important shift because of fashionable commute web sites comparable to Airbnb. The huge companies and sumptuous inns are now not the trade leaders. Belongings house owners and landlords are actually seeing an expanding percentage of the marketplace with regards to website hosting visitors and vacationers.

On this article, we will be able to duvet the whole thing there’s about Airbnb non permanent condo—from the definition, professionals and cons, why buyers must go for it, and extra.

What Are Brief-Time period Leases?

Brief-term leases are assets leases which can be leased out for an outlined time, normally two to 4 weeks. The valuables is most often in a hectic vacationer house, and the owner is liable for protecting it blank and making sure that each one wishes are glad.

When renting out your own home for a brief length, there are some things to bear in mind.

Initially, do your investigation ahead of choosing a non permanent condo. Take a look at the opinions, examine pricing, and be informed in regards to the median hire in every house. Additionally, ahead of booking, make sure you read about the valuables completely. It is going to help you in figuring out any attainable problems that can expand right through your condo settlement.

Brief-Time period Condo vs Lengthy-Time period Condo

The commonest solution to making an investment in actual property is buying and running a condo assets, comparable to single-family houses or multifamily complexes. Condo assets in residential actual property is incessantly labeled as both non permanent or long-term.

Brief-Time period Condo

They’re normally rented on a day-to-day, weekly, or per thirty days foundation. Holiday condo homes, a house hacker who rentals out an additional room, and a single-family condo assets with a per thirty days rent are all examples of non permanent leases.

Comparable: Actual Property Funding Methods: Brief-Time period Leases

Lengthy-Time period Condo

Normally, a one-year rent time period with a preset annual hire is rented to a tenant. Maximum residential contracts are for one year, whilst some native landlord-tenant regulations might allow greater than a yr’s rent.

Despite the fact that long-term leases supply extra unswerving condo source of revenue and are more uncomplicated to take care of, there are certain the reason why an investor would wish to believe providing a non permanent condo.

Are Brief-Time period Leases a Excellent Funding?

The quick solution is that holiday leases are lovely successful. There are lots of variables to believe, comparable to group, repairs services and products, and prematurely charges, however non permanent leases usually yield a greater go back than long-term leases.

Whilst you examine two equivalent houses in the similar group, a non permanent condo will most often generate no less than two to a few instances the condo source of revenue of a conventional annual condo. Moreover, vacation leases supply extra probabilities to replace the condo value, making them an excellent inflation protect.

There are different benefits to renting for a little while. They may be able to, for instance, help you in saving cash to your housing expenses. Brief-term leases may well be a very good selection in the event you are living in a town and want to search affordable housing.

Moreover, non permanent leases may be offering a ruin from the norm. They may be able to be a just right choice in the event you are living in a town and don’t have the time or cash to buy a house.

On account of the a lot of benefits, a non permanent condo is a wonderful funding. Listed here are a couple of the reason why:

1. Upper Source of revenue

A well-marketed non permanent assets in a fascinating location will all the time beat a long-term condo with regards to profitability. It’s a very powerful to accomplish your analysis on condo call for in the community, however there’s no denying that holiday leases generate extra money than usual annually rentals.

2. More straightforward Repairs

Relating to non permanent condo assets control, non permanent leases show you how to set up your funding higher. With shorter remains, you’ll be able to get in and get the home wiped clean extra incessantly, detecting any repairs issues ahead of they turn into too severe. Many holiday leases price a cleansing charge, so that you received’t want to pay for any repairs your self.

3. Keep an eye on and Flexibility

You’ve gotten general keep an eye on over the calendar and when your non permanent condo is to be had. If making a decision to go through kitchen upkeep, you’ll be able to bring to a halt a month to your time table and whole the undertaking when it’s appropriate for you.

You might be additionally allowed to switch the pricing as you notice suitable. If you want to price extra according to evening after your kitchen makeover is completed, you’ll be able to achieve this. If attainable guests wish to keep for a month, you’ll be able to adjust your condo charge to be extra aggressive. Most people favor running with a house owner over a resort supervisor as it offers them extra freedom.

4. Worth Appreciation

Except the per thirty days source of revenue drift, your home’s price will build up yr after yr. The longer you stay your condo assets, the extra treasured it’ll be when you select to promote. Rates of interest can cross both up or down, however actual property does now not lose price.

5. Ease of Get admission to

In contrast to any other investments, you’ll be able to follow for a mortgage to shop for the valuables and use the borrowed budget to generate further source of revenue. It’s particularly really helpful for first-time buyers who don’t have numerous money. You’ll be able to generate wealth a lot sooner when you know how to make use of debt successfully and set up a non permanent condo settlement.

6. Tax Benefits

Brief-term leases be offering a number of tax advantages that lead them to somewhat tempting. For starters, the hobby paid at the mortgage we simply discussed is tax-deductible, to not put out of your mind all the further deductions for repairs, control, promoting, insurance coverage, and extra. You’ll be able to additionally deduct the price of the valuables’s depreciation.

Comparable: Tax Season 2022: Information for Actual Property Buyers

7. Cultural Interactions

A brief-term condo domestic permits you to meet other folks from numerous cultural backgrounds international. It may be interesting in the event you revel in assembly new other folks and studying new stuff.

Find out how to Get Round Brief-Time period Condo Restrictions

When you’ve questioned how one can get across the regulation and restrictions, it’s all the time beneficial to observe the principles. Alternatively, it varies relying on what the HOA or CCRs state. You’ll be able to hire it long-term to an entity, permitting contributors of the entity to are living there. Theoretically, you have got a long-term rent and don’t seem to be renting a room.

Nonetheless, you must read about the native regulations and rules relating to non permanent leases in a selected town and county. Some towns will price further taxes to deter holiday leases, whilst others might overtly restrict them.

Now and again, making an investment in a area simply 5 mins away may considerably affect your outcome. Further prices are extra not unusual in high-traffic places, however you must all the time verify ahead of committing to a assets with every jurisdiction.

Find out how to Make a choice a Location for Your Brief-Time period House

It will be significant to choose the most efficient location on your Airbnb industry. The similar standards you can make use of for a long-term condo don’t all the time follow when taking a look to shop for a house. Places outdoor of main towns are getting increasingly more horny. Moreover, flats close to outside actions, comparable to mountains, seashores, and nationwide parks, carry out exceptionally effectively.

The next elements are crucial for settling on a profitable funding:

- Points of interest within the surrounding

- Get admission to to main roads and airports

- Holiday condo hobby

- The native economic system

Let’s see how Mashvisor can assist on this state of affairs.

Mashvisor as a Sensible Answer

Brief-term leases can help you rent the valuables as quickly because it turns into to be had, permitting you to optimize your revenues. Moreover, the usage of non permanent condo websites comparable to Mashvisor can make certain that your unit is all the time available, expanding your probabilities of receiving a reserving.

Mashvisor is a web-based actual property platform that gives buyers of every kind with a one-stop vacation spot for services and products. The web site can help buyers in looking for the best funding assets in accordance with their most well-liked location, funds, and assets kind.

Out instrument’s database contains 1000’s of listings from more than a few assets. It employs progressive AI-powered funding analytics for each conventional and Airbnb research, making it easy so that you can in finding the best funding assets.

Comparable: What Makes Mashvisor the Very best Actual Property Making an investment App of 2022?

Actual Property Heatmap

Mashvisor’s Actual Property Heatmap instrument shows knowledge on particular places or neighborhoods. It additionally supplies an summary of the condo marketplace analysis in a selected location, making it easy to decide the best position to obtain a condo assets.

Buyers can use the Actual Property Heatmap to simply take a look at the color-coded map to peer the homes on the market in the most efficient spaces. Whilst it’s not the one factor that may give a contribution to the luck of a holiday condo, buying assets in a fascinating location is step one.

Belongings Research

Mashvisor can come up with a abstract of the valuables’s expected marketplace efficiency after discovering a location and appropriate assets. It is going to show Airbnb knowledge, comparable to median checklist costs, occupancy charges, day-to-day Airbnb charges, per thirty days Airbnb condo source of revenue, and so on.

The occupancy charge is essential when comparing actual property comps for a non permanent condo. Despite the fact that a excessive day-to-day charge and per thirty days source of revenue are essential, the occupancy charge determines the condo’s profitability.

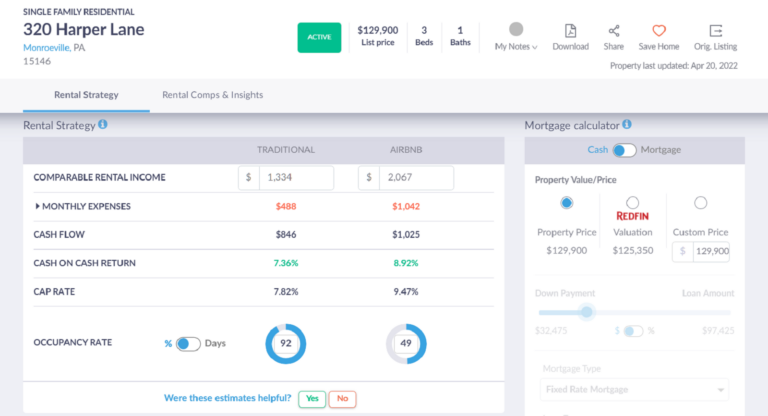

Condo Belongings Calculator

The Airbnb calculator assists buyers in figuring out whether or not a assets will probably be a profitable funding. You might be loose to insert your individual estimates for financing and estimated bills. You’ll see a abstract of the important metrics, comparable to cap charge and money on money go back. It might help you in making an educated funding resolution.

It is going to make certain that your own home is continuously perceived as a just right price for visitors to e book whilst additionally making making an investment in non permanent assets leases a successful funding.

Mashvisor’s Condo Belongings Calculator lets in buyers to decide the profitability of a non permanent condo, in accordance with a number of essential metrics, comparable to money drift, money on money go back, and cap charge.

Actual Property Comps

To ensure that you just’re charging your non permanent condo appropriately, you must glance into Airbnb comps. Mashvisor can help you in finding similar houses to ascertain a aggressive hire worth on your condo domestic. It additionally supplies treasured insights for inspecting the marketplace’s non permanent funding effects in accordance with equivalent houses.

Mashvisor provides its customers a downloadable Excel record that incorporates all vital knowledge to assist the choice to make issues more uncomplicated.

Best 5 Very best Brief-Time period Condo Markets

The towns on this section are reasonable vacationer sights supreme for first-time buyers who do not need an excessive amount of money. Making an investment in those best possible non permanent condo markets will yield a money on money go back of no less than 8%, permitting you to diversify your portfolio additional.

All the knowledge is equipped through Mashvisor for April 2022.

1. Monroeville, PA

- Per thirty days Airbnb Condo Source of revenue: $1,719

- Airbnb Day by day Price: $174

- Airbnb Occupancy Price: 63%

- Airbnb Money on Money Go back: 9.97%

- Median Belongings Worth: $99,563

- Moderate Belongings Worth according to Sq. Foot: —

- Days on Marketplace: 22

- Stroll Rating: 20

2. Corydon, IN

- Per thirty days Airbnb Condo Source of revenue: $1,795

- Airbnb Day by day Price: $100

- Airbnb Occupancy Price: 60%

- Airbnb Money on Money Go back: 9.28%

- Median Belongings Worth: $281,860

- Moderate Belongings Worth according to Sq. Foot: $176

- Days on Marketplace: 59

- Stroll Rating: 60

3. New Citadel, PA

- Per thirty days Airbnb Condo Source of revenue: $4,586

- Airbnb Day by day Price: $164

- Airbnb Occupancy Price: 41%

- Airbnb Money on Money Go back: 8.99%

- Median Belongings Worth: $262,850

- Moderate Belongings Worth according to Sq. Foot: $175

- Days on Marketplace: 43

- Stroll Rating: 41

4. Inkster, MI

- Per thirty days Airbnb Condo Source of revenue: $1,939

- Airbnb Day by day Price: $146

- Airbnb Occupancy Price: 58%

- Airbnb Money on Money Go back: 8.96%

- Median Belongings Worth: $113,267

- Moderate Belongings Worth according to Sq. Foot: $110

- Days on Marketplace: 39

- Stroll Rating: 42

5. Norwalk, OH

- Per thirty days Airbnb Condo Source of revenue: $2,594

- Airbnb Day by day Price: $189

- Airbnb Occupancy Price: 57%

- Airbnb Money on Money Go back: 8.68%

- Median Belongings Worth: $177,100

- Moderate Belongings Worth according to Sq. Foot: $121

- Days on Marketplace: 27

- Stroll Rating: 85

Conclusion

Are you occupied with making an investment in a non permanent condo? The nice information is that there will probably be a variety of alternatives for holiday condo assets buyers in 2022—as a result of excessive Airbnb call for. Alternatively, to decide whether or not non permanent leases are a safe funding for you, you should believe each their benefits and drawbacks.

So, settling on the correct location is step one in terms of making an investment in non permanent leases. It’s important to research the condo marketplace ahead of committing to a assets to steer clear of losses.

To begin searching for and inspecting the most efficient funding houses to your town and group of selection, join for a 7-day loose trial, adopted through 15% off of your quarterly or annual subscription.