The only factor that may make or ruin an actual property funding is location. It’s why a heatmap research is essential for any actual property investor.

Desk of Contents

- The Heatmap Research Information for Apartment Investments 2022 Version

- Discovering the Proper Heatmap for You

- What’s Subsequent?

However what precisely is a heatmap research device? What does it do for actual property traders and pros? Let’s in finding out extra about this extremely interactive and very important device on this article.

The Heatmap Research Information for Apartment Investments 2022 Version

The suitable funding assets and the best alternative gained’t undergo a lot fruit if it isn’t in the best location. A ways too many traders have discovered it the onerous method. Many idea that proudly owning a work of assets is sufficient with out desirous about how its location can a great deal affect its viability ultimately.

You’ve most definitely already heard of a few actual property making an investment horror tales the place a reputedly promising funding had changed into a nightmare. Now not precisely the American dream all of us need.

The nice information is that generation has already made it simple for traders of all enjoy ranges to pinpoint the best location for his or her most well-liked funding assets. Actual property web sites like Mashvisor now permit novice and skilled traders to search out a great place to speculate with out the demanding situations of the standard method of information amassing.

Mashvisor gives its customers a to hand actual property making an investment device referred to as the heatmap.

Heatmap Outlined

An actual property heatmap or a heatmap research device lets in customers to concurrently habits group knowledge research of a number of spaces in a given actual property marketplace.

It resembles heatmaps utilized by climate forecasters. It’s color-coded to turn which spaces of a particular housing marketplace are red-hot, ice-cold, and the whole thing in between. The information research heatmap makes use of knowledge from other dependable assets and places all of that knowledge in combination in a single position for traders to search out. Mashvisor and a few different actual property web sites that provide the similar function make assets seek quicker and extra environment friendly.

What Is Heatmap Research?

To the uninitiated within the tactics of the true property business, a heatmap knowledge research mainly simply refers back to the means of examining group knowledge to decide whether or not making an investment in this is a smart determination or dangerous trade.

All traders would love their funding to generate a excellent go back, however it takes extra than simply purchasing undervalued assets and changing it right into a condo assets. Sensible and skilled traders know the price of group knowledge research and the way it impacts their funding through the years. Because of this, traders use a number of gear, together with actual property heatmaps, to look if the markets they’re making an allowance for align with their targets and make allowance them to reach the stated targets.

Comparable: Actual Property Making an investment for Newbies: A Information to Group Research

Advantages of The usage of a Heatmap for Apartment Investments

In actual property making an investment, the extra gear you were given on your arsenal, the simpler the possibilities of discovering the best revenue assets. It’s very true relating to a heatmap. The usage of one comes with a number of benefits for traders and actual property pros.

For one, it saves customers a large number of money and time at the analysis and research side of making an investment. A large number of onerous paintings and determination must be poured into acting due diligence. Alternatively, as rewarding an idea as onerous paintings is, there’s additionally this idea referred to as operating sensible. The usage of an actual property heatmap falls underneath that class.

Studying tips on how to paintings smarter, or on this case, the use of a heatmap research device, lets in traders to save lots of on lengthy hours and loads – and even 1000’s – of greenbacks going the old fashioned path. By means of “old-fashioned,” we imply doing issues the old fashioned method. It comprises using across the the town for hours on the lookout for actual property comps, speaking to numerous other people about condo knowledge, recording each and every bit of knowledge accrued in notebooks, and examining knowledge on spreadsheets.

We’re no longer knocking off the standard method because it has labored for a large number of traders. Alternatively, no longer everybody has sufficient money and time to manually do all that arduous paintings. The usage of a web-based heatmap cuts down the analysis time to only mins. All they want to do is simply enter the site they’re making an allowance for and obtain the result of their seek.

Simple. Easy. Rapid. Environment friendly.

Any other transparent good thing about the use of heatmaps is it lets you carry out a couple of searches concurrently. Because the map is designed to turn higher spaces, traders mechanically get a glimpse of ways neighborhoods are acting in a specific marketplace.

Let’s believe Boise, ID. In keeping with Mashvisor’s newest knowledge, those are the next numbers tied to the Town of Timber:

- Collection of Listings for Sale: 165

- Median Belongings Worth: $813,475

- Reasonable Worth according to Sq. Foot: $415

- Days on Marketplace: 34

- Collection of Conventional Listings: 306

- Per month Conventional Apartment Source of revenue: $1,412

- Conventional Money on Money Go back: 0.33%

- Conventional Cap Charge: 0.34%

- Worth to Hire Ratio: 48

- Collection of Airbnb Listings: 984

- Per month Airbnb Apartment Source of revenue: $2,503

- Airbnb Money on Money Go back: 1.00%

- Airbnb Cap Charge: 1.01%

- Airbnb Day by day Charge: $129

- Airbnb Occupancy Charge: 58%

- Stroll Rating: 36

Comparable: Idaho Housing Marketplace Forecast 2022

Now, the above numbers are the most recent actual property knowledge for the town. Alternatively, simply because they’re hooked up to the town doesn’t mechanically imply that each one homes in any group in and round Boise will pull the similar numbers. Realistically, sure neighborhoods will outperform others in numerous sides. We can provide an explanation for one of the most knowledge indexed in a second, even if a large number of them are already self-explanatory.

Going again to our instance, one portion of Boise could be doing in reality properly with long-term leases however no longer as a lot in relation to non permanent condo homes. However, some spaces of the town are extra profitable holiday condo funding spots however can carry out rather poorly as conventional condo places.

In most cases, the knowledge displays that Boise is a a lot better position for holiday leases (with a 1.00% money on money go back and 1.01% cap fee) than for normal condo homes (with a measly 0.33% money on money go back and zero.34% cap fee). In spite of its decrease nightly Airbnb fee of $129, its moderately above moderate occupancy fee of 58% offers Airbnb hosts a good per thirty days condo revenue.

Frequently, this is a hit-and-miss scenario, which is why having access to a web-based heatmap may be very treasured to an investor and actual property skilled.

To start out on the lookout for and examining the most efficient funding homes on your town and group of selection, click on right here.

Discovering the Proper Heatmap for You

That being stated, no longer all warmth maps are created equivalent. If we will depart you with one very explicit tip on tips on how to put money into actual property, it’s this: Find the best web site that gives the state of the art heatmap research device that will help you get the task executed.

To get that, you want to make sure that the web site can give you the next knowledge, on the very least:

- Collection of Listings for Sale. This means the collection of homes publicly indexed at the a couple of checklist services and products.

- Median Belongings Worth. That is the midpoint worth of all checklist costs at the MLS. It implies that part of the homes indexed available on the market are costlier whilst the opposite part are inexpensive. It isn’t to be perplexed with moderate assets costs, which consider the entire quantity of checklist costs and divides them through the collection of homes indexed.

- Reasonable Worth according to Sq. Foot. This displays how a lot a sq. foot of assets is price in a specific marketplace.

- Days on Marketplace. This displays what number of days a assets remains indexed at the MLS. This can be a excellent barometer for traders to look whether or not a location is a purchaser’s marketplace or a vendor’s marketplace.

- Collection of Conventional Listings. This displays what number of homes are indexed as conventional condo homes.

- Per month Conventional Apartment Source of revenue. This metric displays the common per thirty days revenue landlords make on long-term condo homes in a particular the town or town.

- Conventional Money on Money Go back. This metric displays the go back on funding in accordance with the money on money go back fee of a conventional condo assets. We will be able to get the CoC go back through dividing the valuables’s internet working revenue (NOI) through the entire sum of money invested.

- Conventional Cap Charge. The cap fee is every other ROI indicator that takes a conventional condo’s NOI and divides it through the valuables’s marketplace worth. It’s other from money on money go back in {that a} cap fee does no longer believe the financing means when arising with a computation while the money on money go back components does.

- Worth to Hire Ratio. This quantity determines if it is wiser for other people to hire a assets or simply purchase one. It’s divided into 3 classes. A low ranking of 15 and underneath tells traders that assets costs are low in comparison to condo charges, so it’s extra affordable to shop for a assets in a low ranking marketplace as a substitute of renting one. A medium ranking of 16 to twenty signifies there’s a excellent steadiness of assets costs and condo charges. A prime ranking of 21 and above implies that assets costs are prime, which makes renting a area probably the most logical selection.

- Collection of Airbnb Listings. This displays traders the collection of Airbnb leases in a space.

- Per month Airbnb Apartment Source of revenue. This information displays traders how a lot they are able to doubtlessly earn in a single month if they have got the valuables indexed on holiday condo platforms like Airbnb. The article about it’s that the per thirty days Airbnb condo revenue will range relying at the time of 12 months. The seasons play an enormous phase in an Airbnb condo’s occupancy fee.

- Airbnb Money on Money Go back. This is equal to the standard money on money go back, best implemented to an Airbnb condo assets.

- Airbnb Cap Charge. This may be the similar as a conventional condo cap fee, best it’s knowledge taken from non permanent leases in a specific marketplace.

- Airbnb Day by day Charge. Airbnb hosts can rate any quantity they would like for his or her day by day charges. Alternatively, figuring out the common going nightly fee in a space lets in traders to stick aggressive with the opposite holiday condo homes of their group.

- Airbnb Occupancy Charge. The occupancy fee signifies the period of time a condo assets is occupied as opposed to the time it’s indexed. A prime occupancy fee manner a greater per thirty days Airbnb condo revenue.

- Stroll Rating. This determines how “walkable” a particular group is. It relates to how out there the valuables is to sure public facilities with none use of a car. The upper the stroll ranking, the extra handy it’s to stroll round the town to get to espresso retail outlets, groceries, laundromats, drug shops, faculties, and different identical facilities.

Thankfully, Mashvisor has get admission to to all the above knowledge and extra.

Mashvisor’s Actual Property Heatmap Research Instrument

Mashvisor is an actual property web site that does extra than simply supply correct marketplace knowledge to traders and actual property pros. It gives a number of making an investment gear that make making an investment a breeze even for beginner traders.

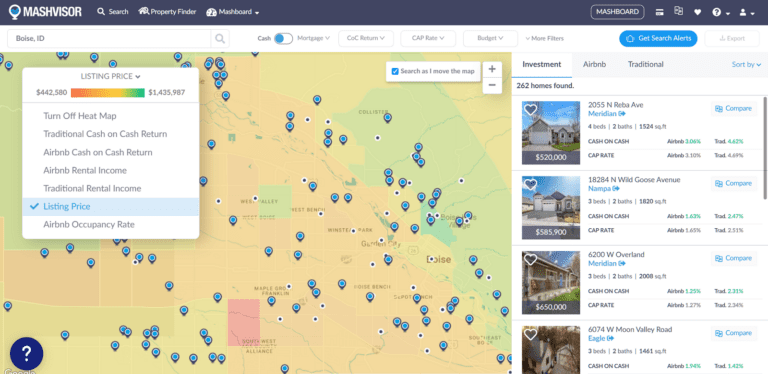

One in all its benefits over different actual property web sites is its actual property heatmap that displays customers the perfect condo markets to put money into. It comprises 4 primary filters that make assets searches quicker and extra environment friendly. The 4 filters, together with a couple of heatmap research guidelines, are the next:

Record Worth

One of the most first actual issues an investor appears out for is affordability. An investor is at all times searching for the perfect position to shop for condo assets that isn’t dear but in addition comes with an overly promising income-generating doable.

Mashvisor’s heatmap lets in customers to search for homes that have compatibility their standards, particularly their funds. Customers best want to choose the filter out from the dropdown menu, classified Warmth Map Dataset, situated on the higher left portion of the map. As soon as it’s decided on, the map will display other pricing zones starting from very inexpensive (reds) to very dear (vegetables).

Use Mashvisor’s heatmap device to search out homes that suit your funding standards, specifically your funds.

Conventional and Airbnb Apartment Source of revenue

Any other helpful filter out for traders is the Conventional and Airbnb Apartment Source of revenue filters. Since an investor’s objective is to make a benefit off in their funding, figuring out how a lot doable revenue a condo assets can generate will assist them get extra correct projections.

The 2 choices may also be present in the similar dropdown menu because the Record Worth. The superb factor in regards to the Conventional and Airbnb Apartment Source of revenue filters is that it displays which spaces are nice for normal or holiday condo assets investments. Additionally, it is going to make a side-by-side comparability to look which condo technique is extra winning ultimately.

The fairway spaces constitute the upper finish of the condo revenue spectrum, whilst the reds display which spaces have the bottom revenue charges.

Go back on Funding

To get an concept of what the ROI is like, customers can use this filter out to look what a specific group gives with regards to money on money go back. It’s the metric of option to decide ROI, basically as it takes under consideration the financing possibility that can be used to buy the valuables.

Buyers can take a look at each conventional and Airbnb money on money go back charges the use of the heatmap. Very similar to the condo revenue filter out, the golf green portions spotlight spaces with the most efficient money on money go back charges, whilst the pink portions of the map display which spaces supply very deficient money on money returns.

Airbnb Occupancy Charge

Finally, the web site’s heatmap will level customers to neighborhoods with prime occupancy charges. As we already discussed previous, the per thirty days condo revenue for Airbnb homes will rely in large part on their occupancy/emptiness fee. The fairway spaces display customers which neighborhoods have prime occupancy/low emptiness charges, whilst the pink ones display the other.

On most sensible of the 4 filters above, Mashvisor additionally we could customers habits a extra thorough group research for the majority markets in the USA. Simply click on at the identify of any group and also you must be taken to the Group Analytics web page to achieve get admission to to the next knowledge:

- Collection of funding homes

- Historic condo revenue research

- Historic Airbnb occupancy fee

- Optimum condo technique

- Optimum condo assets sort

- Optimum collection of bedrooms

- Actual property comps

- Stroll ranking

Comparable: Actual Property Warmth Map: A Progressive Instrument for Group Research

What’s Subsequent?

After completing your analysis and acting the entire knowledge research wanted the use of Mashvisor’s heatmap research device, it’s now more straightforward so that you can make a well-informed funding determination.

Issues don’t get any higher than Mashvisor gives traders. You get a large number of onerous paintings executed in a fragment of the time it normally takes. It makes subscribing to Mashvisor’s services and products one of the vital perfect investments any actual property investor could make.

To get get admission to to our actual property funding gear, click on right here to join a 7-day unfastened trial of Mashvisor lately, adopted through 15% off for lifestyles.