Irvine, California – CoreLogic’s Unmarried Circle of relatives Hire Index (SFRI), which analyzes knowledge for unmarried family members hire value fluctuations in america, was once launched in March.

Unmarried Circle of relatives Condo Charges Achieve Document Prime Once more in January 2022

In line with the newest numbers, the 12 months 2022 began robust for standard leases as unmarried family members hire costs proceed to leap to listing prime ranges. January logged a 12.6% year-over-year build up, a a ways cry from the three.9% enlargement observed a 12 months sooner than.

CoreLogic’s newest SFRI liberate confirmed that all of the metropolitan spaces integrated of their protection recorded important year-over-year will increase. Solar Belt towns, like Miami and Orlando, registered the most important year-over-year positive factors in line with SFRI’s knowledge. The year-over-year value enlargement greater than tripled all positive factors from January 2021 and greater than quadrupled from January 2020.

Similar: Purchasing a Money Go with the flow Unmarried Circle of relatives Condo: 5 Steps

Provide vs Call for a Massive Issue within the Massive Spike in Hire Costs

Probably the most issues actual property business mavens and insiders agree on is how provide and insist play an integral position within the proceeding enlargement in unmarried family members hire value. It’s not information that there’s a scarcity of housing stock in all places america. Homebuyers and actual property traders are moderately acutely aware of that. Additionally they know that the nationwide scarcity can’t stay alongside of the expanding call for as extra people are securing houses for themselves for each private use and funding houses.

There’s additionally the small topic of inevitable house appreciation, which is usually anticipated for actual property investments. Handiest now, the rise was once upper than commonplace, with a 19% build up in January 2022.

Let’s take as an example the Miami 2022 actual property marketplace. In line with actual property site Mashvisor, the median estate price for a single-family house in sunny Miami again in January 2022 was once $795,968. Simply a few months later in March 2022, the median estate value for Miami rose to a whopping $1,059,287.

The skyrocketing house costs are making it more difficult for the typical American to possess a house. It is among the primary the reason why the call for for standard apartment houses has higher during the last 12 months.

After which, there are different elements outdoor the business which can be affecting the present marketplace prerequisites, equivalent to COVID-19, the Ukraine-Russia warfare, and their repercussions at the international economic system.

In line with CoreLogic’s most important economist, Molly Boesel, unmarried family members hire value enlargement reached a record-breaking 10-month streak in January. She additionally claims that the robust inhabitants enlargement is among the drivers for the spike in hire costs, specifically in towns alongside the Solar Belt.

To higher perceive what the full marketplace seems like, CoreLogic broke it down into 4 other tiers. The nationwide unmarried family members hire value enlargement and year-over-year will increase are as follows:

- Decrease (75% and beneath the regional median): 12%, a three% build up in comparison to January 2021

- Decrease Heart (75% to 100% of the regional median): 13.3%, a three.2% build up in comparison to January 2021

- Upper Heart (100% to 125% of the regional median): 13.4%, a three.6% build up in comparison to January 2021

- Upper (125% and above the regional median): 12.2%, a 4.5% build up in comparison to January 2021

Similar: Loan Charges Watch April 2022: Loan Charges Hit Best Since January 2019

Actual Property Traders Poised to Take Benefit of the Present Marketplace Development

Given the present estate value and loan charge will increase, proudly owning a house has change into extra elusive to the typical Joe. Many actual property traders beat them to inexpensive housing by way of providing all-cash purchases that bizarre people can’t beat.

Traders are searching for source of revenue houses on the market to provide as both conventional or holiday apartment houses. They determine that they may be able to lend a hand meet the call for for apartment houses and expectantly be offering transient housing possible choices to those that can’t manage to pay for to shop for a estate these days.

Because of this, actual property traders are on prime alert for houses that may lend a hand them be offering inexpensive apartment houses whilst making a tight go back on funding. And whilst in search of the suitable estate would possibly appear to be a large number of onerous paintings, a site like Mashvisor can help in making the property-hunting procedure sooner and extra environment friendly.

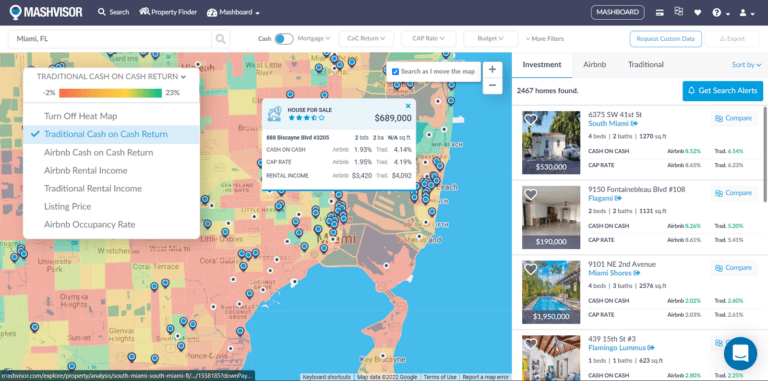

Its huge database covers numerous funding houses within the 2022 US housing marketplace. It additionally provides traders a number of actual property making an investment gear that make the seek for estate and research of marketplace knowledge so much more straightforward. Equipment just like the Belongings Finder, Actual Property Heatmap, and Funding Belongings Calculator can also be simply accessed by way of Mashvisor subscribers to hurry alongside the funding procedure with out compromising the standard of analysis and information research had to make smart funding selections.

To get get right of entry to to our actual property funding gear, click on right here to enroll in a 7-day unfastened trial of Mashvisor as of late, adopted by way of 15% off for existence.

Mashvisor provides a number of gear, such the Actual Property Heatmap, that let traders to hurry up their funding procedure with out compromising the standard of analysis and information research.

That being stated, listed below are the highest 20 metro spaces the CoreLogic indexed with probably the most spectacular year-over-year positive factors on unmarried family members hire value. They’re proven along Mashvisor’s up-to-date marketplace knowledge to offer traders an concept of every location’s funding attainable.

1. Miami, FL (38.6% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 11,271

- Per month Conventional Condo Source of revenue: $3,745

- Conventional Money on Money Go back: 1.87%

- Conventional Cap Charge: 1.91%

- Value to Hire Ratio: 24 (prime)

- Collection of Listings for Sale: 2,147

- Median Belongings Value: $1,059,287

- Moderate Value in line with Sq. Foot: $668

- Days on Marketplace: 91

- Stroll Ranking: 63

2. Orlando, FL (19.9% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 2,553

- Per month Conventional Condo Source of revenue: $1,733

- Conventional Money on Money Go back: 2.51%

- Conventional Cap Charge: 2.61%

- Value to Hire Ratio: 23 (prime)

- Collection of Listings for Sale: 295

- Median Belongings Value: $486,404

- Moderate Value in line with Sq. Foot: $282

- Days on Marketplace: 65

- Stroll Ranking: 40

3. Phoenix, AZ (18.9% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 5,580

- Per month Conventional Condo Source of revenue: $2,152

- Conventional Money on Money Go back: 2.04%

- Conventional Cap Charge: 2.08%

- Value to Hire Ratio: 27

- Collection of Listings for Sale: 923

- Median Belongings Value: $688,679

- Moderate Value in line with Sq. Foot: $356

- Days on Marketplace: 21

- Stroll Ranking: 28

4. Las Vegas, NV (16.6% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 10,579

- Per month Conventional Condo Source of revenue: $1,602

- Conventional Money on Money Go back: 1.12%

- Conventional Cap Charge: 1.15%

- Value to Hire Ratio: 33 (prime)

- Collection of Listings for Sale: 2,128

- Median Belongings Value: $625,200

- Moderate Value in line with Sq. Foot: $435

- Days on Marketplace: 73

- Stroll Ranking: 36

5. San Diego, CA (15.9% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 3,441

- Per month Conventional Condo Source of revenue: $3,167

- Conventional Money on Money Go back: 1.16%

- Conventional Cap Charge: 1.18%

- Value to Hire Ratio: 34 (prime)

- Collection of Listings for Sale: 857

- Median Belongings Value: $1,300,412

- Moderate Value in line with Sq. Foot: $813

- Days on Marketplace: 54

- Stroll Ranking: 52

6. Austin, TX (15.3% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 2,963

- Per month Conventional Condo Source of revenue: $2,114

- Conventional Money on Money Go back: 0.52%

- Conventional Cap Charge: 0.53%

- Value to Hire Ratio: 38

- Collection of Listings for Sale: 306

- Median Belongings Value: $959,017

- Moderate Value in line with Sq. Foot: $544

- Days on Marketplace: 57

- Stroll Ranking: 51

7. Boston, MA (13.7% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 5,675

- Per month Conventional Condo Source of revenue: $2,938

- Conventional Money on Money Go back: 0.81%

- Conventional Cap Charge: 0.83%

- Value to Hire Ratio: 33 (prime)

- Collection of Listings for Sale: 54

- Median Belongings Value: $1,155,675

- Moderate Value in line with Sq. Foot: $1,025

- Days on Marketplace: 70

- Stroll Ranking: 85

8. Dallas, TX (13.4% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 6,975

- Per month Conventional Condo Source of revenue: $2,362

- Conventional Money on Money Go back: 1.28%

- Conventional Cap Charge: 1.31%

- Value to Hire Ratio: 24 (prime)

- Collection of Listings for Sale: 1,424

- Median Belongings Value: $673,776

- Moderate Value in line with Sq. Foot: $330

- Days on Marketplace: 120

- Stroll Ranking: 46

9. Atlanta, GA (12.8% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 3,799

- Per month Conventional Condo Source of revenue: $2,425

- Conventional Money on Money Go back: 2.53%

- Conventional Cap Charge: 2.59%

- Value to Hire Ratio: 21 (prime)

- Collection of Listings for Sale: 2,626

- Median Belongings Value: $601,992

- Moderate Value in line with Sq. Foot: $465

- Days on Marketplace: 72

- Stroll Ranking: 44

10. Tucson, AZ (12.1% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 2,370

- Per month Conventional Condo Source of revenue: $1,339

- Conventional Money on Money Go back: 1.99%

- Conventional Cap Charge: 2.05%

- Value to Hire Ratio: 27 (prime)

- Collection of Listings for Sale: 737

- Median Belongings Value: $432,447

- Moderate Value in line with Sq. Foot: $251

- Days on Marketplace: 53

- Stroll Ranking: 40

11. Charlotte, NC (11.5% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 2,796

- Per month Conventional Condo Source of revenue: $2,090

- Conventional Money on Money Go back: 1.74%

- Conventional Cap Charge: 1.78%

- Value to Hire Ratio: 25 (prime)

- Collection of Listings for Sale: 1,051

- Median Belongings Value: $626,525

- Moderate Value in line with Sq. Foot: $335

- Days on Marketplace: 84

- Stroll Ranking: 36

12. Houston, TX (10.0% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 4,393

- Per month Conventional Condo Source of revenue: $2,163

- Conventional Money on Money Go back: 1.74%

- Conventional Cap Charge: 1.78%

- Value to Hire Ratio: 23 (prime)

- Collection of Listings for Sale: 723

- Median Belongings Value: $594,341

- Moderate Value in line with Sq. Foot: $258

- Days on Marketplace: 14

- Stroll Ranking: 44

13. Los Angeles, CA (9.2% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 15,142

- Per month Conventional Condo Source of revenue: $4,422

- Conventional Money on Money Go back: 1.49%

- Conventional Cap Charge: 1.50%

- Value to Hire Ratio: 28 (prime)

- Collection of Listings for Sale: 2,506

- Median Belongings Value: $1,491,827

- Moderate Value in line with Sq. Foot: $1,086

- Days on Marketplace: 68

- Stroll Ranking: 55

14. Seattle, WA (9.0% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 1,546

- Per month Conventional Condo Source of revenue: $2,738

- Conventional Money on Money Go back: 0.93%

- Conventional Cap Charge: 0.94%

- Value to Hire Ratio: 43 (prime)

- Collection of Listings for Sale: 395

- Median Belongings Value: $1,402,453

- Moderate Value in line with Sq. Foot: $688

- Days on Marketplace: 35

- Stroll Ranking: 64

15. Chicago, IL (8.8% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 29,196

- Per month Conventional Condo Source of revenue: $2,375

- Conventional Money on Money Go back: 1.00%

- Conventional Cap Charge: 1.04%

- Value to Hire Ratio: 20 (prime)

- Collection of Listings for Sale: 3,914

- Median Belongings Value: $576,887

- Moderate Value in line with Sq. Foot: $359

- Days on Marketplace: 48

- Stroll Ranking: 65

16. Honolulu, HI (8.7% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 3,683

- Per month Conventional Condo Source of revenue: $2,090

- Conventional Money on Money Go back: 2.26%

- Conventional Cap Charge: 2.30%

- Value to Hire Ratio: 31 (prime)

- Collection of Listings for Sale: 638

- Median Belongings Value: $784,575

- Moderate Value in line with Sq. Foot: $885

- Days on Marketplace: 86

- Stroll Ranking: 49

17. Philadelphia, PA (8.1% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 12,142

- Per month Conventional Condo Source of revenue: $1,838

- Conventional Money on Money Go back: 2.44%

- Conventional Cap Charge: 2.53%

- Value to Hire Ratio: 29 (prime)

- Collection of Listings for Sale: 1,858

- Median Belongings Value: $640,459

- Moderate Value in line with Sq. Foot: $406

- Days on Marketplace: 97

- Stroll Ranking: 64

18. New York, NY (6.5% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 54,518

- Per month Conventional Condo Source of revenue: $3,396

- Conventional Money on Money Go back: 0.85%

- Conventional Cap Charge: 0.86%

- Value to Hire Ratio: 36 (prime)

- Collection of Listings for Sale: 6,596

- Median Belongings Value: $1,464,804

- Moderate Value in line with Sq. Foot: $1,577

- Days on Marketplace: 141

- Stroll Ranking: 61

19. St. Louis, MO (6.0% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 1,264

- Per month Conventional Condo Source of revenue: $1,290

- Conventional Money on Money Go back: 1.28%

- Conventional Cap Charge: 1.33%

- Value to Hire Ratio: 24 (prime)

- Collection of Listings for Sale: 707

- Median Belongings Value: $371,171

- Moderate Value in line with Sq. Foot: $185

- Days on Marketplace: 72

- Stroll Ranking: 57

20. Washington, DC (5.6% year-over-year hire exchange, January 2022)

- Collection of Conventional Listings: 4,639

- Per month Conventional Condo Source of revenue: $2,489

- Conventional Money on Money Go back: 1.66%

- Conventional Cap Charge: 1.69%

- Value to Hire Ratio: 26 (prime)

- Collection of Listings for Sale: 1,596

- Median Belongings Value: $771,880

- Moderate Value in line with Sq. Foot: $632

- Days on Marketplace: 99

- Stroll Ranking: 62

Similar: The Most sensible 10 Quickest Rising Condo Markets in america 2022

Wrapping Up

The upward development within the unmarried family members hire value enlargement would possibly or would possibly not decelerate over the following few months. It is going to a great deal rely on how the marketplace as an entire can get well from the loss of housing stock and the worldwide inflation. The following CoreLogic SFRI shall be launched later in April with knowledge from February 2022. Till then, we will be able to handiest hope for costs to decelerate in order that inexpensive housing is inside achieve for the typical American.

To be informed extra about how Mashvisor let you make quicker and smarter actual property funding selections, click on right here.