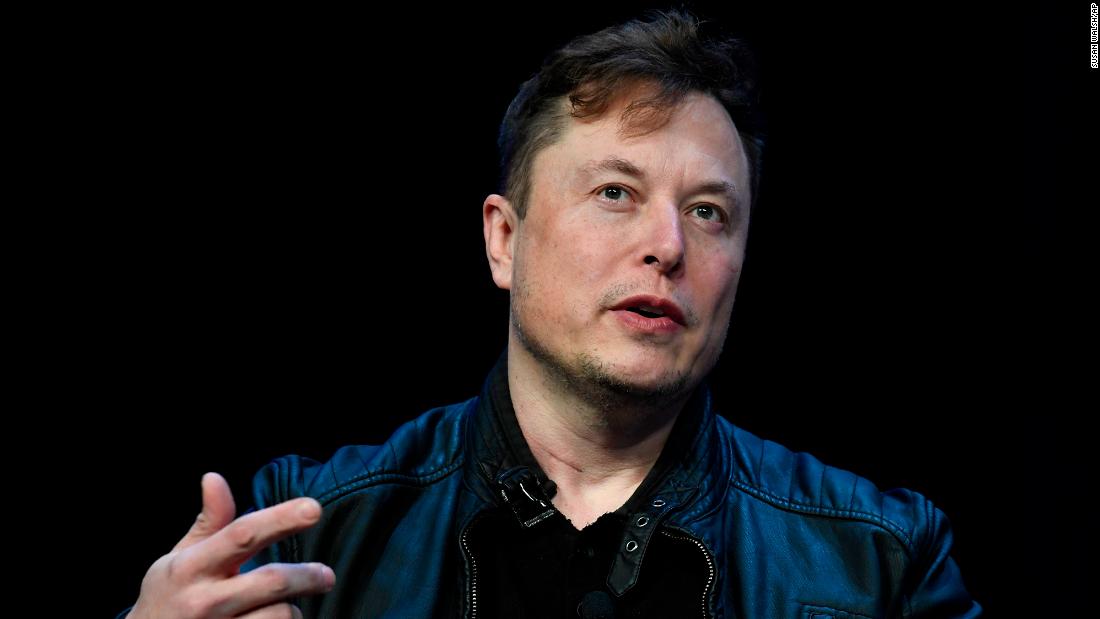

As a substitute of combating over Musk’s acquire of Twitter, we will have to use the talk over his $43 billion money be offering to invite how any individual with that a lot cash can fail to pay their fair proportion of taxes. That should finish. We’d like a compulsory tax at the ultra-wealthy that guarantees they can’t break out paying taxes the way in which the remainder of us do. If no longer, we’re at the trail to turning into an oligarchy. This factor is of significance, in particular as American citizens document their tax returns through the April 18 cut-off date.

For instance, in 2017, he reportedly paid handiest $65,000. And worse, in 2018, he paid 0 source of revenue taxes. That implies in case you paid $1 in source of revenue taxes in 2018, you paid extra in taxes than the billionaire. Does that sound truthful to you?

Other folks prefer the concept that Musk and different uber-rich will have to pay their fair proportion of taxes once a year — no longer simply when certainly one of them workout routines inventory choices.

I might wager, then again, that folks similar to Musk would like pitting left vs. proper in order that we argue over whether or not he will have to personal Twitter. As a substitute, we will have to be becoming a member of forces to call for that elected officers finish the loopholes and make sure the well off pay their fair proportion.