Earlier than purchasing a area, it’s essential to be well-informed on the advantages and disadvantages of an Airbnb funding. To extend your ROI, take a look at our information on making an investment in brief time period leases.

Desk of Contents

- What Is a Brief Time period Funding?

- What Is Airbnb?

- What Is the Highest Brief Time period Funding?

- The right way to Be triumphant at Operating an Airbnb

- Conclusion

Development a portfolio of Airbnb leases would possibly seem to be a suave method to build up your passive source of revenue. The reality applies to each new and skilled traders. It could actually herald doubtlessly excellent returns although you’ve simplest lately realized in regards to the winning alternatives of proudly owning a sought-after quick time period funding house,

The usage of the Airbnb platform—or another—to hire out properties could be a winning actual property funding means, but it surely additionally comes with some drawbacks. In different instances, it can be more effective and extra winning simply to hire out a house to a unmarried tenant or to keep away from actual property making an investment general.

On this article, we will be able to glance into Airbnb investments and the original advantages and disadvantages they are going to have. Proceed studying to determine extra.

What Is a Brief Time period Funding?

Brief time period funding alternatives are marketable belongings that may be simply transformed into money in about 5 years. Moreover, momentary investments are usually applied to retailer further investment for a restricted time. Buyers use them as a result of they’re extraordinarily liquid and can be utilized to fulfill expected coming near bills.

Lengthy-term investments are much less dangerous than momentary ones. It’s because such securities include longer tenure and supply predictable returns.

Prime-earning financial savings accounts, reoccurring deposits, debt budget, and govt securities are a couple of momentary making an investment chances. They’re the commonest momentary securities, with periods starting from a number of months to at least one to 2 years. Financial institution fastened deposits, nationwide financial savings certificate, and large-cap mutual fundings are every other momentary investments with funding phrases of as much as 5 years.

Alternatively, we’re that specialize in Airbnb, which is an instance of a brief time period funding.

What Is Airbnb?

An actual property funding is also a sensible selection to discover when you’re looking for passive source of revenue. However what precisely is the glory between a regular funding belongings and an Airbnb?

When a portion or all of a belongings is leased out on Airbnb after the purchase, it is known as an Airbnb funding. The leases are regularly momentary, permitting you to house a lot of visitors all over the yr. However, conventional funding houses are usually leased to long-term tenants.

Additionally, with the rising acclaim for Airbnb and different vacation apartment internet sites over time, belongings homeowners now have upper probabilities to create a circulate of passive source of revenue.

Even though it calls for complete dedication, momentary funding is a great technique that permits Airbnb hosts to amass wealth. The important thing to managing a lot of tasks is the use of equipment and instrument answers that assist automate maximum of your on a regular basis duties.

Comparable: The right way to Assessment an Airbnb Funding

Would Airbnb Be a Just right Brief Time period Funding?

Earlier than you select to put money into momentary leases, assessment all the advantages and disadvantages of the momentary apartment making an investment technique over conventional apartment making an investment.

Advantages of Making an investment in Airbnb

Listed here are a number of advantages of Airbnb making an investment:

1. It Can Be Extra Winning Than Conventional Renting

A well-booked Airbnb apartment is also extra profitable than leasing the similar belongings to at least one long-term tenant. It’s because you’ll be able to usually rate extra on a nightly foundation. In step with February 2022 statistics, the common condominium in Seattle rents $2,190 monthly if the tenant is of the same opinion on a 12-month hire, which equals $24,000 in annual income.

However what if you made a decision to make use of Airbnb? In step with our newest funding belongings information, the common day by day pricing for an Airbnb apartment in Seattle is round $153, with a 65% occupancy price. If you happen to hire out your Airbnb for $153 according to evening for a complete of 270 nights once a year, you could earn $41,300 in overall source of revenue from the apartment. It’s $17,000 greater than you’d make renting historically.

2. You’ll Have a Numerous Tenant Portfolio

Conventional renting comes to placing your whole items in a single field with a unmarried tenant. It could actually be triumphant if the tenant is financially accountable and remains for a longer duration. Alternatively, in the event that they ever fail to make hire bills or just disappear in the course of the evening, your source of revenue suffers speedy harm this is tough to revive.

With Airbnb being perhaps the best possible quick time period funding, you earn cash from quite a lot of tenants frequently while you hire out your Airbnb house. Each and every renter represents a fairly small a part of your general income. So, if one among them cancels on the ultimate second or refuses to pay, it would possibly not have a lot end result.

In San Francisco, as an example, you’ll be able to’t hire out any portion of a area except it’s your main place of abode, which is outlined as spending a minimum of 275 nights once a year there. Moreover, it’s forbidden to have greater than 90 nights of “unhosted” leases, this means that you don’t seem to be there when visitors are round.

In lots of eventualities, the laws have been installed position to care for a suitable housing provide for citizens. Nonetheless, they’re more likely to cut back the prospective go back on funding for any individual looking to make cash by way of Airbnb.

3. Better Keep watch over Over Your Space

Even though you must no longer permit your individual ideology to power your Airbnb trade, the likelihood to make use of your apartment homes as vacation houses continues to be an interesting further perk. It is possible for you to to make use of your Airbnb condominium as a 2nd house as an Airbnb host. All you want to do is mark explicit days for your Airbnb calendar.

Whilst quick time period funding wishes extra effort and prices extra, it can be more straightforward to care for repairs. Because you’ll be receiving new guests extra incessantly, you are going to be notified of any repairs issues faster, granting you extra regulate over your private home. As well as, while you set up an Airbnb belongings, you’ll be able to alternate your costs frequently and lift them all over top seasons or events. It additionally implies you might have extra flexibility over your pricing coverage.

Drawbacks of Making an investment in Airbnb

Along side the advantages, making an investment in Airbnb comes with a couple of drawbacks, together with:

1. Bills Can Be Better

If you happen to personal a house and hire it to a unmarried tenant, your participation in belongings control may also be minor. A accountable tenant pays expenses on time, blank the valuables, and mow the grass. You’ll simplest want to bounce in infrequently to do belongings maintenance or care for emergencies.

As one of the quick time period funding choices, an Airbnb condominium could be extra labor-intensive as a result of it is going to be as much as you, the owner, to stay it in very good situation always. You’ll additionally perhaps be required to supply stuff that you wouldn’t most often give to a unmarried tenant, reminiscent of:

- Fine quality furniture, ornament, and extra: If you wish to galvanize conceivable Airbnb tenants, you could want to spend some cash to be sure that the gap feels and appears refined. Airbnb visitors need to get the impact that they’re vacationing in a high-end belongings.

- Meals pieces: You don’t want to prepare dinner on your Airbnb guests, however offering some crucial meals merchandise will assist stay them happy. They are able to come with holding contemporary eggs, tea, or alcoholic beverages readily available. Some Airbnb hosts move out in their approach to supply snacks at other occasions of the day.

- Wi-Fi and extra: If you happen to hire to a unmarried tenant, they are going to usually be chargeable for connecting the cable tv and Wi-Fi. However, Airbnb visitors most often watch for those products and services to be provide all over their discuss with. Subsequently, the price of web connectivity—and its maintenance—falls on you.

Comparable: Airbnb Belongings Control Charges Breakdown – Are They Price It?

2. Growth Can Be Slow

It’s in doubt that you just’ll have the ability to reserve an Airbnb house virtually each and every evening right away. Bookings on Airbnb are made up our minds principally by means of your standing as an proprietor. The simpler your ranking from earlier tenants, the much more likely you are going to draw in new ones.

You might simplest get a couple of suggestions in the beginning, so you could want to care for hire relatively or be offering incentives to inspire other people to stick. Even though you be offering an implausible unit in a phenomenal location, don’t be expecting to begin incomes apartment income immediately.

Additionally, remember the quick time period funding tax. Any make the most of investments held for not up to twelve months will have to be incorporated for your taxable source of revenue for the stated yr.

3. Source of revenue Can Be Unpredictable

If you happen to personal a area and hire it to a continuing tenant, you might be able to care for that tenant on a long-term hire and obtain hire each and every month, giving you a constant source of revenue circulate.

Brief time period funding leases is also considerably extra unreliable. In principle, whilst you’ll be able to hire out a area twelve months yearly, you’re sure to peer many empty dates for your agenda. You’ll be able to even make a choice to set an afternoon or extra off between bookings to organize the home for the following customer.

You may be able to steadiness the vacant sessions as an proprietor by means of pricing greater than you may for a traditional apartment belongings, however there’s no simple task you’ll pop out on most sensible. On the whole, your occupancy price shall be made up our minds by means of quite a lot of components, reminiscent of climate, duration of the yr, and placement.

What Is the Highest Brief Time period Funding?

In step with our find out about and research, the high-yield financial savings account is these days some of the best possible quick time period funding choices with excessive returns to believe. Prime-yield financial savings account at a banking establishment is a better choice than holding cash in a bank account, which most often will pay fairly little hobby on deposits. A financial savings account will earn hobby frequently from the financial institution.

The right way to Be triumphant at Operating an Airbnb

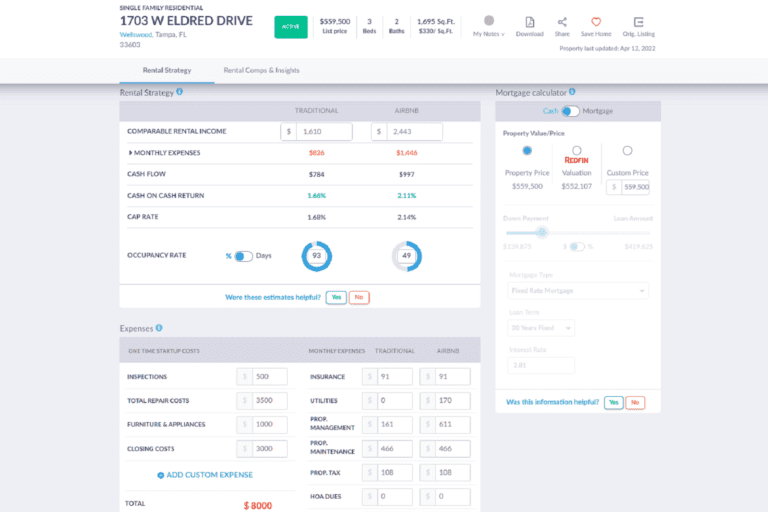

Except for operating the numbers, figuring out the native rules, and getting very good comments—use actual property equipment. Mashvisor and different an identical equipment could make all of the process significantly more straightforward. The platform, for instance, supplies a faithful Airbnb calculator that you’ll be able to use to calculate a very powerful ROI parameters, reminiscent of money float and cap price.

Here’s a listing of the Airbnb research and insights that our Airbnb funding calculator supplies:

- Occupancy Fee: The Airbnb occupancy price will have to be identified as a way to calculate the anticipated Airbnb apartment source of revenue of an funding belongings the use of an Airbnb calculator. The simpler your Airbnb occupancy price, the extra per thirty days Airbnb apartment cash you’ll have the ability to generate.

- Apartment Source of revenue: Buyers can use the apartment source of revenue information to estimate how a lot to invite for hire and calculate Airbnb’s money float and go back on funding. Apartment source of revenue estimates for normal homes also are equipped by way of our calculator. Our device makes it easy to research the profitability of the 2 apartment methods and pick out the most productive one in line with apartment source of revenue.

- Cap Fee: Capitalization price, often referred to as cap price, is a go back on funding indicator utilized by actual property traders to unexpectedly analyze the profitability of funding potentialities with out taking into consideration the financing supply. Calculating the Airbnb cap price may also be tough when you analyze a number of source of revenue homes on the market. Fortuitously, our apartment source of revenue calculator supplies fast cap price predictions.

- Apartment Bills: The Mashvisor calculator lists vital one-time startup bills related to proudly owning an Airbnb house, reminiscent of upkeep and inspections. You’ll be able to additionally absorb ordinary per thirty days prices like insurance coverage and HOA charges. You’ll be able to additionally come with custom designed bills for your calculation.

We will move on with the Mashvisor calculator options, however you’ll be able to be informed extra about it by means of clicking right here.

Comparable: What Airbnb Occupancy Fee Can You Be expecting in 2022?

Mashvisor’s Airbnb funding calculator lets in customers to calculate vital ROI parameters and analyze the profitability of Airbnb apartment homes, in line with occupancy price, apartment source of revenue, cap price, and apartment bills.

Conclusion

Think you’re occupied with quick time period investments. If that’s the case, you must consider all the benefits and downsides you could come across alongside the direction, from the potential of higher source of revenue to the lack of private time had to put it on the market and care for the house.

With the Airbnb trade nonetheless reeling from the have an effect on of the COVID-19 pandemic, it can be sensible to look forward to the location to stabilize prior to you make a decision. Alternatively, assume you believe buying a number one area to generate Airbnb income. In one of these case, the dangers is also minimum, so long as you’ll be able to find the money for your mortgage with out the additional source of revenue.

To position your self in a greater place to achieve your actual property making an investment adventure, be sure you use instrument answers from Mashvisor. To be informed extra about Mashvisor’s equipment, agenda a demo lately.