Not too long ago, there were many conversations surrounding the present inflation. What does it imply for actual property buyers in america?

Desk of Contents

- What Is Inflation?

- What Reasons Inflation?

- How Does Inflation Have an effect on Actual Property Buyers?

- How Does Inflation Have an effect on the Actual Property Costs?

- What Must Actual Property Buyers Do Throughout Inflation Classes?

- What’s Subsequent for Actual Property Buyers?

- Key Takeaways

For the longest time, actual property has been beneficial as a hedge towards inflation. If you happen to’ve invested in the actual property marketplace in recent times, you’ve most likely skilled the forces of inflation.

Since no person can say they’re moderately positive concerning the long run, it’s vital so that you can perceive inflation, the way it works, the way it impacts your actual property investments, and the most productive techniques to offer protection to your self.

In nowadays’s article, we search to have a look at the inflation definition and delve deeper into the subject.

What Is Inflation?

Inflation refers to the upward thrust in items and products and services costs in a undeniable financial system over a specific duration, most commonly over a 12 months. For example, the typical charge of inflation once a year is 1.8%. Assuming you purchased an electrical cooker final 12 months for $400, you’d wish to pay an extra $7.20 for a similar cooker nowadays.

It will now not appear to be some huge cash to be fearful about. Alternatively, while you upload your entire expenses, together with web, gasoline, groceries, telephone expenses, and different bills, you find yourself spending much more cash once a year.

A rustic feels a fair larger affect when it reports above-average inflation. For instance, prior to now decade, the inflation in Greece nearly hit 5%. It implies that the $400 cooker above would value an extra $20 nowadays.

You’ll additionally take a look at inflation because the lower within the buying energy of the forex over the years. For instance, since 1913, america buck’s buying energy has declined via more or less 96.5%. If you happen to had $1 a century in the past, it might best be price about 3.50 cents nowadays.

Since inflation reasons a buck to shop for much less over the years, you currently perceive why you want to pay extra to your milk, gasoline, or even hire than you probably did a couple of years in the past.

Some other folks confuse inflation with appreciation. The 2 are other. Appreciation in actual property refers back to the charge at which a assets’s worth is going up over the years. The rise in worth in appreciation isn’t because of inflation. The worth appreciates because of the upward thrust in call for.

It’s commonplace to look the price of assets expanding at the next charge than inflation. It may additionally depreciate because the financial system reports inflation.

What Reasons Inflation?

Whilst it’s no secret that the whole thing in this day and age is changing into pricey, what in fact reasons inflation?

- Lax financial coverage: That is sometimes called cash printing. It will increase the amount of cash in movement, which, in flip, ends up in the decline of the forex worth. For instance, america executive supplied a $5 trillion stimulus throughout the pandemic. It unleashed the most important flood of cash ever recorded in US inflation historical past. The volume was once 3 times greater than the authorized monetary support throughout the World Monetary Disaster in 2008.

- Provide Shocks: Provide shocks occur when there’s a upward push in costs because of an building up in call for however a low provide. It occurs when there are herbal screw ups or industry lockdowns.

- Call for Shocks: Call for shocks come with while you in finding actual property buyers enticing in bidding wars to buy funding homes with the prospective to yield apartment source of revenue.

- Anticipating costs to upward push: In step with the IMF, expectancies of emerging costs ultimately turn out to be self-fulfilling. When industry other folks be expecting the costs to upward push, they regulate their costs. In such occasions, you in finding hire costs expanding or buyers negotiating wages.

How Does Inflation Have an effect on Actual Property Buyers?

Whilst inflation can appear to be a damaging factor, it’s now not solely so. There are some positives to notice. Let’s wreck down this phase into what inflation manner for house owners, buyers, and potential buyers. We’ll take a look at each positives and negatives.

Inflation for House owners

The positives of inflation are principally loved via house owners. The obvious perk is that the price in their houses appreciates with the inflation charge. It may be tricky to get a loan throughout inflation. Because of the excessive loan prices, many of us proceed to hire, therefore using up the call for for housing.

With excessive housing call for but low provide, house owners can call for upper costs. It’s commonplace to look house owners obtain even upper provides than their asking costs. As you’ll inform, it makes inflationary sessions a very good time to promote however a troublesome time to shop for.

Similar: The place to In finding Home-owner Data for Making an investment

Inflation for Buyers

Buyers are some other team who generally tend to revel in some positives out of an inflationary marketplace. Say you search financing to put money into assets as a leveraged asset with charges as little as they’re now. You’ll in finding your self paying again the similar charge whilst your own home’s worth rises.

Within the present inflation, the financing charges aren’t emerging on the similar charge because the inflation. It implies that your go back on funding can jump.

Inflation for Potential Buyers

Potential buyers generally tend to endure the brunt of an inflationary marketplace. The instances are other from the ones for house owners and present buyers. Inflationary instances result in excessive prices of borrowing. Since banks and lenders don’t wish to lose their cash, they provide fewer loans at excessive rates of interest to scale back their possibility.

Inflationary instances additionally result in a excessive value of creating. Because of the excessive value of borrowing and construction fabrics, new structures throughout inflationary sessions is usually a tricky funding.

Whilst you might wish to put money into temporary leases throughout an inflationary duration, remember the fact that throughout such instances many of us generally tend to chop their go back and forth budgets. For the reason that holiday apartment industry is pushed via tourism, it won’t fare neatly in such instances.

How Does Inflation Have an effect on the Actual Property Costs?

Prior to now decade, the everyday value of a mean single-family house in america has risen via over 90%. In step with actual property mavens, we will be able to be expecting house costs to proceed emerging via 13.6% within the subsequent 12 months.

What reasons the rise in house costs throughout inflation sessions?

Call for in Source of revenue Producing Belongings

One of the most primary explanation why house costs building up throughout inflation instances is as a result of actual property buyers seek for belongings that can generate apartment source of revenue above the present inflation charge.

Condominium source of revenue is the cash accrued from the tenants and used to settle assets bills, similar to assets taxes and mortgages. Any cash that continues to be after settling the bills is the go back on funding. We specific the velocity of go back because the capitalization charge (cap charge).

Throughout inflationary sessions, buyers will search for homes that provide the next cap charge than different funding choices, similar to Treasury bonds or high-yield financial savings accounts.

Similar: How one can In finding Houses That Promise Top Condominium Source of revenue

Restricted Actual Property Stock

Actual property costs throughout inflationary sessions additionally move up as a result of the restricted quantity of actual property in comparison to fiat forex. You’ll in finding governments printing more cash throughout such sessions to extend the cash provide. It reasons actual property costs to upward push.

For example, let’s think {that a} nation has $1 million in movement and 100 houses are on sale. We’re assuming that there are not any different items or products and services on sale and that each one houses on sale are an identical. As such, each and every assets can be price $10,000.

Now, if the federal government prints an extra $1 million, there’s a complete of $2 million in movement. It manner the houses would now value $20,000. As you’ll see, the printing of cash is among the elements that motive the upward thrust in house costs and result in inflation.

Build up in House Building Prices

Inflation reasons all costs to extend, together with land, wages, construction fabrics, and provides. Because of this, house developers move the price of building to house patrons and buyers. It displays within the present actual property marketplace.

Prior to now one year, construction subject matter costs have risen via over 19%. House building fabrics come with lumber, ready-mix concrete, and gypsum forums used for completing ceilings and partitions.

So, what’s the treatment for actual property buyers throughout inflation?

What Must Actual Property Buyers Do Throughout Inflation Classes?

With these kind of elements in thoughts, a very powerful issue potential buyers should believe throughout inflationary sessions is timing. Ask your self one query; How lengthy do you plan to possess the potential funding assets?

If you wish to stay it in the long run, you’ll be expecting to experience the similar advantages as present homeowners, similar to assets worth appreciation. If you happen to’re having a look to put money into a shorter duration, most probably thru a repair and turn technique, we propose you to continue with numerous warning.

One primary risk of making an investment within the brief time period throughout inflation is that you simply possibility getting stuck within the actual property bubble. Last prices throughout such sessions might get up to six% of the house promoting value. As a brand new investor, for those who don’t have sufficient fairness to settle such prices, then you might lose some huge cash will have to the bubble burst.

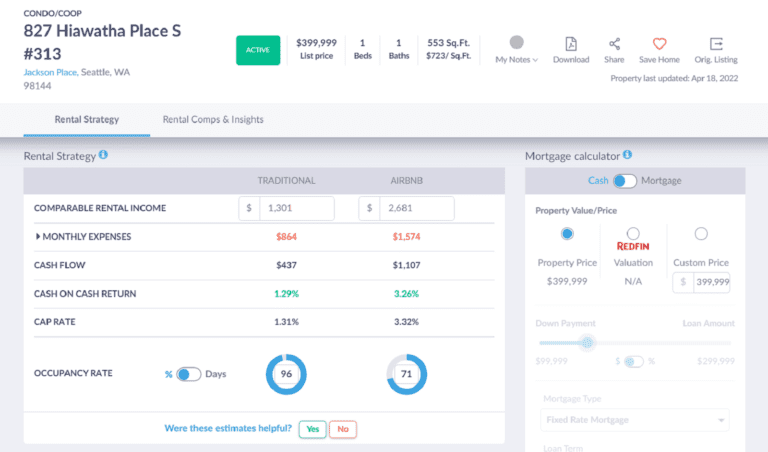

That is the place Mashvisor equipment are available. Whilst you’ll use an inflation calculator to calculate the inflation charge, you want our apartment assets calculator. The device lets you calculate a assets’s bills, in addition to per thirty days apartment source of revenue. Our apartment assets calculator additionally permits you to see the valuables’s go back on funding metrics, similar to cap charge and money on money go back, in addition to the money glide. E book your Mashvisor demo nowadays and spot how our equipment allow you to to your funding.

Not too long ago, assets costs have risen to ancient ranges. Whilst the rage won’t motive fear, it emphasizes the significance of figuring out your funding time horizon and making plans accordingly.

Mashvisor’s Condominium Assets Calculator lets in buyers to calculate a assets’s per thirty days apartment source of revenue and spot the related go back on funding metrics, similar to money glide, money on money go back, and cap charge.

How Can Buyers Use Funding Assets as an Inflation Hedge?

Making an investment in actual property throughout inflationary sessions all the time depends upon the site and the state of the marketplace. Alternatively, buyers might use the next techniques to realize a hedge towards inflation:

- Condominium homes: Since many of us can’t have enough money to construct their very own houses throughout inflation, apartment homes, together with industrial, residential, multi-family, and single-family gadgets, generally tend to have the next call for. As an actual property investor, you’ll then move the price of inflation on your tenants via charging upper apartment charges.

- Actual Property Funding Trusts (REITs): Making an investment in a REIT lets in buyers to diversify their funding portfolios and get right of entry to excessive dividend bills. Merely put, it’s an organization that owns, price range, and operates actual property. REITs typically observe marketplace calls for and recognize on the similar charge as bodily actual property. You’ll put money into REITs throughout inflation to unfold your investments throughout numerous belongings.

- Leverage reasonable cash: Loan rates of interest have reached ancient lows. The present common is 3.07% for a 30-year loan with mounted charges. An actual property investor can profit from the low-interest-rate setting to keep away from paying upper charges one day.

- Capitalize on emerging asset values: Historical past has demonstrated that actual property buyers take pleasure in proudly owning homes in the long run. For instance, since 1990, median house costs have risen via 345%. In a similar way, assets costs have greater via just about 20% since 2020. It’s one more reason to justify the use of actual property as a hedge towards inflation.

It’s very important so that you can have price range to be had so to take hold of any to be had alternatives. As we all the time advise, you should definitely perform your due diligence since making an investment throughout inflation sessions can move both manner.

Similar: Direct Actual Property Funding vs. REITs

What’s Subsequent for Actual Property Buyers?

The bursting of the 2008 housing bubble and consecutive financial recession nonetheless haunts buyers, patrons, and dealers so far. Please notice that whilst costs proceed to move up, it’s tricky to expect a marketplace decline. There’s nonetheless now not enough knowledge to signify {that a} recession is forthcoming.

For starters, the present marketplace inflation is moderately other from what we skilled simply sooner than the World Monetary Disaster. Even though there’s a brief provide of work, the financial system is rising at a gradual charge, and the velocity of unemployment is on a decline. We stay constructive that the post-pandemic financial system will totally reopen and develop to offer extra alternatives.

If you wish to make any primary monetary determination, all the time stay your guard up and do your due diligence. Sensible making plans and time control will assist you to arrange your financial possibility. Additionally, talk on your monetary consultant and actual property agent so you’ll in finding the absolute best position to shop for apartment assets.

Key Takeaways

Actual property costs generally tend to extend throughout sessions of inflation because of the surplus cash in movement within the financial system. Many buyers have used actual property as a hedge towards inflationary sessions. You’ll use actual property to generate source of revenue above the inflation charge and in addition capitalize at the attainable assets worth appreciation in the long run.

Most significantly, use Mashvisor equipment to your funding. Enroll nowadays and obtain 15% off your quarterly or annual subscription charge.