[ad_1]

Given the other actual property tool answers to be had to actual property buyers as of late, we’ve created this Roofstock vs Fundrise overview to come up with a deeper perception into the most productive tool to make a choice.

Desk of Contents

- What Is Roofstock?

- What Is Fundrise?

- Roofstock vs Fundrise: The Verdict

Actual property making an investment has, since time immemorial, been a surefire means of creating a constant circulation of revenue and developing long-term wealth that may remaining generations. Do you know that 90% of millionaires international were given their footing in actual property?

Historically, actual property making an investment used to be a keep of the elite. On the other hand, funding rules had been converting the scene as new tendencies, equivalent to generation, lend a hand decrease the barrier to access. Actual property making an investment is now to be had to the common investor who won’t have that a lot capital.

On this submit, we take a look at two of the preferred actual property making an investment platforms: Roofstock vs Fundrise.

What Is Roofstock?

Let’s start the Roofstock vs Fundrise overview by way of taking a look at Roofstock.

Roofstock is a web-based belongings market that’s best suited for buyers who need to achieve direct possession of residential condo houses. With Roofstock, you’ll be able to acquire an funding belongings and go away the valuables control duties to the Roofstock workforce. It’s why this platform is well-liked by buyers who need to personal condo houses outright however are hesitant to shoulder the obligations that include condo belongings control.

One distinctive factor concerning the houses indexed on Roofstock is they’re already occupied by way of tenants. It signifies that you right away generate money waft while you purchase the valuables. You buy the valuables on Roofstock Market without delay from the landlord, following the similar procedure you’d practice when purchasing some other condo belongings. Roofstock simplest acts because the facilitator.

Condominium houses indexed in Roofstock are all qualified and include a 30-day money-back ensure.

Roofstock does no longer require a minimal funding quantity. Your minimal funding quantity is solely the valuables’s asking worth. The houses indexed at the market vary from as little as $25,000 to as excessive as $one million+.

How Does Roofstock Paintings?

Roofstock doesn’t personal the houses indexed themselves; they supply condo properties for buyers. It merely acts as an middleman between impartial dealers and consumers. The platform acts as the vendor’s agent all the way through all the transaction.

As we discussed, houses on Roofstock are qualified. It signifies that they undergo a vetting procedure earlier than they’re indexed. The vetting procedure comprises:

- An skilled third-party inspector carries out a walkthrough inspection. On the other hand, some houses might include an inspection contingency that states that the inspection will happen after the vendor’s acceptance of an be offering.

- Roofstock’s workforce is going during the inspection file to establish that the restore prices gained’t be greater than 15% of the valuables’s asking worth. Additional, the funding belongings should meet positive requirements for the HVAC device, and not using a electric or well being problems, and doesn’t want in depth roof maintenance.

- After the wanted maintenance are recognized, Roofstock’s workforce notifies the prospective purchaser so that they issue within the prices earlier than making an be offering.

- The valuables vendor should supply an outstanding hire fee historical past.

- The vendor is needed to offer all of the data and information that Roofstock amassed at the list web page.

Every list web page on Roofstock comprises the asking worth, belongings footage, condo revenue, and estimated returns for various timeframes. It additionally lists essential funding metrics, together with money waft, cap price, annualized go back, gross yield, and price of appreciation.

When you’ve bought a belongings on Roofstock, the identify is transferred for your title and also you grow to be the condo belongings proprietor. You could make a choice to grow to be answerable for the valuables control, repairs, maintenance, and different landlord duties. On the other hand, if you need hands-free possession, Roofstock will counsel qualified belongings managers.

Roofstock Options

Roofstock provides extra options to incorporate different buyers who don’t need to purchase the condo belongings outright or lack the capability to take action. They come with:

Roofstock One

Roofstock One is a product for actual property buyers who won’t want to purchase a condo belongings outright. Right here, you’ll be able to purchase belongings stocks as a substitute of the entire belongings. On the other hand, you should be an approved investor so that you can spend money on Roofstock One.

The minimal funding quantity on Roofstock One is $5,000. As an investor, you’ll be able to acquire no less than 1/tenth of the valuables’s worth. You’ll be able to percentage the valuables possession with different buyers to be able to diversify on quite a lot of houses.

Traders are entitled to fairness possession within the belongings and revenue generated after eliminating belongings bills. Additionally they cling direct rights to the capital appreciation must they make a choice to promote the valuables.

Roofstock Academy

In Roofstock vs Fundrise, the latter might stand out because of its instructional program that seeks to teach buyers on making an investment in turnkey houses. This system is administered by way of skilled buyers who’ve been within the recreation for years and search to percentage their stories so more recent buyers can steer clear of the average pitfalls.

Roofstock Academy teaches buyers easy methods to spend money on actual property, funding methods, easy methods to analyze alternatives, and easy methods to put up a profitable be offering, amongst many others.

Self-Directed IRAs

With Roofstock, you’ll be able to spend money on houses inside an Particular person Retirement Account (IRA). you merely wish to open a self-directed IRA or solo 401(Ok) and start making an investment in Roofstock houses.

Is Roofstock a Just right Funding?

Now that we’ve noticed what Roofstock has to provide, you can be questioning whether or not it’s price your cash.

Roofstock Execs

Listed here are one of the most explanation why you might accept Roofstock within the Roofstock vs Fundrise comparability:

- Direct belongings possession: Probably the most primary advantages of Roofstock is that it means that you can spend money on a tangible asset that generates condo revenue. You’ll be able to additionally practice the purchase and cling technique the place you promote later as soon as the asset has liked.

- Quick money waft: Have in mind, Roofstock’s condo houses are already occupied by way of tenants. It signifies that you get an opportunity to earn sure money waft right away.

- Low charges: Roofstock is determined by generation. It permits them to rate considerably decrease commissions to the dealers, making actual property making an investment reasonably priced. You additionally simplest desire a 20% down fee to buy a belongings.

- Low barrier access: Rather then Roofstock One, the platform doesn’t require you to be an approved investor to spend money on the valuables.

- Diversify your portfolio: Roofstock means that you can spend money on single-family properties, small multi-family houses, and full portfolios of residential condo houses. The houses may also be in any housing marketplace in the United States.

To maximise Roofstock’s advantages, you wish to have to make use of Mashvisor’s Condominium Assets Calculator earlier than making an investment. It’s a web-based device that allows you to calculate an funding belongings’s benefit attainable. It’s easy to make use of because you’re simplest required to go into the valuables’s elementary main points, equivalent to purchasing worth, overall money funding, and financing possibility.

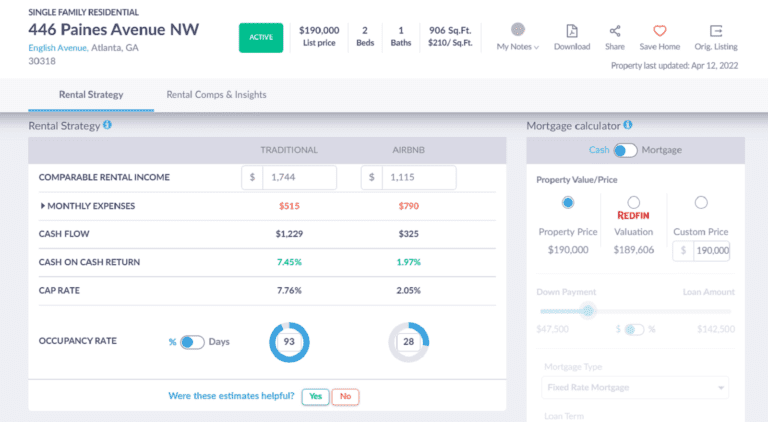

After coming into the above main points, the calculator generates essential go back on funding numbers, together with money waft, money on money go back, and cap price. The condo calculator generates the metrics for each conventional and momentary condo methods so you’ll be able to make a choice the optimum technique.

Guide a demo to be told extra about Mashvisor equipment and the way you’ll be able to use them to your funding.

Mashvisor’s Condominium Assets Calculator is a web-based device that shall we actual property buyers calculate an funding belongings’s benefit attainable, in accordance with money waft, money on money go back, and cap price.

Roofstock Cons

Each just right factor comes with a couple of downsides. Listed here are the primary cons of Roofstock:

- Illiquidity: Roofstock funding might not be the most productive funding possibility for you specifically should you foresee a good spot within the close to long term. Promoting the condo houses might take for much longer than anticipated, which might not be a just right revel in when you wish to have cash rapid.

- Landlord obligations: Except you need at hand over the valuables control duties to a belongings control company, you should be able to shoulder the owner obligations, equivalent to dealing with past due bills and irate tenants or scheduling repairs and maintenance.

The following a part of this Fundrise vs Roofstock overview is taking a look at one of the crucial fiercest Roofstock competition.

Similar: The Most sensible 3 Roofstock Competition Actual Property Traders May just Believe

What Is Fundrise?

Many of us will search for Roofstock vs Fundrise when on the lookout for actual property tool. Fundrise is likely one of the firms that spearheaded the actual property crowdfunding wave within the 2010s. Since then, many identical actual property crowdfunding platforms have emerged, however Fundrise stays a pace-setter on this area of interest.

Based in 2012, Fundrise is a superb possibility for actual property buyers who want to take the crowdfunding path of actual property making an investment. It’s a crowdfunded actual property platform that’s to be had to each approved and non-accredited actual property buyers.

Like different actual property partnerships or trusts, buyers in Fundrise pool their sources in combination to spend money on actual property belongings they won’t have get entry to to in my opinion. The belongings then develop relying at the foremost passion or generate revenue for the buyers.

As an investor on Fundrise, there are two primary funding choices:

- eREITs: When you spend money on the eREITs possibility, you purchase into fairness and debt actual property funding alternatives that fit the precise eREIT purpose. The targets is also long-term development or constant money waft.

- eFUNDs: The eFUNDSs possibility permits buyers to without delay spend money on a wide-range portfolio of indexed houses in high-growth neighborhoods. The neighborhoods are positioned in primary US metro spaces.

Similar: REIT vs Actual Property Condominium Assets Investments

Fundrise Minimal Funding

To start with, Fundrise’s minimal funding quantity used to be $500. On the other hand, they not too long ago decreased this quantity to $10 since they spotted extra younger buyers are on the lookout for techniques to spend money on the inventory marketplace.

That stated, Fundrise provides other account ranges that you simply spend money on relying for your funding targets and goals. The accounts are:

- Starter: The Starter account provides you with get entry to to Fundrise’s Starter portfolio whose minimal funding is $10. The account exposes you to quite a lot of funding houses around the nation.

- Fundamental: The Fundrise Fundamental account additionally means that you can spend money on the Starter portfolio with the addition of making an investment in an IRA. You’ll be able to additionally create and set up non-public funding targets. The minimal quantity for the account is $1,000.

- Core: Fundrise Core account provides you with get entry to to all same old portfolios, together with supplemental revenue, balanced making an investment, and long-term development. The minimal funding quantity is $5,000. The account provides you with get entry to to 40-80 other actual property initiatives.

- Complicated: The Advance account provides you with get entry to to the whole thing within the Core account plus alternatives to speculate out of doors same old portfolios. The alternatives are extra strategic and in addition matter to extra trade. The minimal funding quantity is $10,000.

- Top class: The Top class account offers buyers get entry to to all options within the Complicated and Core accounts. As well as, Top class buyers might spend money on initiatives out of doors the usual Fundrise fund. The initiatives are of longer periods and are much less liquid. The minimal funding quantity is $100,000. On the top rate degree, you’ll be able to e-book calls with the Fundrise workforce to speak about your funding technique and in addition search for recommendation for your investments.

Fundrise Portfolios

Traders should purchase stocks by way of making an investment in one in every of 4 portfolios:

- Starter Portfolio: The Starter portfolio is Fundrise’s elementary bundle created for those who need to check out a hand at making an investment. The minimal required funding quantity is $10. The portfolio is made up of fifty% revenue and 50% growth-oriented stocks. You’ll be able to improve to a complicated portfolio later at no cost.

- Supplemental Source of revenue: The Supplemental Source of revenue portfolio is composed of income-oriented holdings. Traders within the portfolio earn returns thru dividends from income-generating actual property. Dividends are earned thru passion and condo bills.

- Balanced Making an investment: Because the title suggests, the Balanced Making an investment portfolio accommodates 50% revenue and 50% growth-oriented investments. The portfolio accommodates each Fundrise eREITs and eFUNDs.

- Lengthy-Time period Expansion: The Lengthy-Time period Expansion portfolio’s primary purpose is to leverage asset appreciation and generate returns. The portfolio purchases actual property with excessive development attainable and generates returns from promoting underlying houses.

Is Fundrise a Just right Funding?

At this level, you can be questioning whether or not it is sensible to spend money on Fundrise. Let’s take a look at a few of its professionals and cons.

Fundrise Execs

Listed here are one of the most Fundrise benefits to believe in Roofstock vs Fundrise:

- Low funding requirement: You’ll be able to get began in Fundrise for as little as $10.

- Low barrier access: But even so the low funding quantity requirement, you don’t wish to be an approved investor to spend money on Fundrise.

- Passive revenue: Fundrise is likely one of the absolute best choices for buyers who want to make investments passively. You gained’t wish to take into consideration managing condo houses or scheduling repairs and maintenance.

- Transparency: Fundrise shall we all buyers know precisely what they’re making an investment in.

Similar: Passive Source of revenue vs Lively Source of revenue: Actual Property Methods

Fundrise Cons

Those are one of the most downsides of making an investment in Fundrise:

- Sophisticated charges: But even so the funding requirement quantities, you’ll be required to pay 0.15%-1% annual advisory charges and nil.85% every year asset control charges. Whilst the mentioned charges are somewhat low, there are different hidden charges. Such charges might make issues extra difficult for unexpecting buyers.

- Extremely illiquid: Traders should be keen to take a seat with their investments for roughly 5 years earlier than they may be able to understand important returns.

Roofstock vs Fundrise: The Verdict

After taking a look at this Roofstock vs Fundrise overview, we will now inform what each platforms are used for. Roofstock is perfect for buyers who need to personal condo houses outright. You’ll be able to additionally use the platform should you don’t intend to be without delay thinking about belongings control duties.

Fundrise, however, is healthier for actual property buyers who want to take the crowdfunding path. It’s a passive funding because the workforce takes over portfolio control.

Whichever platform you select to make use of to your investments, make sure to use Mashvisor equipment. Join to get entry to a 7-day unfastened trial of our equipment.

[ad_2]