Naomi Antonino/CNET

With mere days to record your taxes — the federal tax cut-off date is April 18 — it can be tempting to show to tried-and-true trade leaders TurboTax and H&R Block, and certainly, the ones merchandise most sensible our checklist of the perfect tax tool. In case you are assured about doing all of your taxes your self and do not want reside enhance, on the other hand, TaxAct supplies related carrier at a reduced value.

Whilst now not as polished as main tax tool, TaxAct combines an exhaustive question-and-answer procedure for finishing your tax go back blended with an outstanding Resolution Middle offering helpful knowledge for all types of tax eventualities.

TaxAct supplies 4 ranges of on-line tax preparation — Unfastened, Deluxe, Premier and Self-Hired. Each and every of the plans is outlined through the collection of integrated IRS paperwork. Easy returns can use the Unfastened plan, whilst the ones with loan curiosity or child-care deductions will wish to improve to Deluxe. Funding source of revenue calls for the Premier plan, and freelancers with a couple of 1099 paperwork will wish to shell out for the easiest degree, Self-Hired.

TaxAct covers virtually all tax eventualities and is less expensive than the main merchandise, however the trade-off is much less built-in enhance and no reside chat. Should you do not want reside assist throughout your tax go back, TaxAct is usually a excellent worth.

Like

- Thorough questions

- Deduction Maximizer device

- Bargains for early filers

Do not Like

- Repetitive clicking

- No record import or photograph seize

- No reside chat

TaxAct’s merchandise and costs

TaxAct supplies tax preparation tool on-line at 4 other value ranges: Unfastened ($0), Deluxe ($47), Premier ($70) and Self Hired ($95). Each and every calls for further charges for state returns — $40 in step with state go back within the Unfastened tier, and $55 in step with state go back in Deluxe, Premier and Self Hired.

TaxAct Unfastened

TaxAct Unfastened’s restrictions are reasonably beneficiant when compared with its competition. You’ll declare the earned source of revenue tax credit score, youngster tax credit score and restoration rebate. It additionally helps dependents, unemployment and retirement advantages and married submitting one at a time. You’ll simplest take the usual deduction, however you’ll be able to obtain schooling credit and take the aged and disabled credit to be had in Agenda R.

TaxAct Unfastened simplest allows you to record a unfastened federal tax go back. Your state go back will value $40.

Deluxe

The Deluxe tier of TaxAct provides a protracted checklist of IRS paperwork, together with itemized deductions (Agenda A), youngster and dependent care bills, casualty and robbery loss, well being financial savings accounts, house trade bills and different credit like loan curiosity, house power and electrical cars.

TaxAct Deluxe prices $47 for the federal go back and $55 for each and every state go back.

Premier

TaxAct Premier most commonly provides a spread of not unusual source of revenue sorts. If in case you have capital positive aspects from the sale of inventory or some other funding source of revenue, otherwise you earned cash from condominium belongings, you can wish to improve to TaxAct Premier. Filers who earned cash from the sale or bitcoin or different cryptocurrencies may also want TaxAct’s Premier tier, as will the ones with investments in overseas banks.

TaxAct Premier will recently run you $70, and any other $55 for each and every state go back.

Self-Hired

The highest tier of TaxAct is reserved for many who gained self-employed source of revenue (gig employees, freelancers and small trade homeowners) or farmers. If neither applies to you, you must transfer all the way down to Premier or decrease.

You’ll acquire TaxAct Self-Hired for $95, with any other $55 for each and every state go back.

TaxAct merchandise, when compared

| Absolute best for | Product | Federal | State* |

|---|---|---|---|

| Filers with usual deduction | Unfastened | $0 | $40 |

| The ones with itemized deductions like loan curiosity | Deluxe | $47 | $55 |

| The ones with belongings source of revenue, inventory gross sales or cryptocurrency | Top rate | $70 | $55 |

| Freelancers and gig employees | Self-Hired | $95 | $55 |

*Price is in step with state go back filed

TaxAct additionally provides downloadable variations of its tool at other costs. This assessment covers TaxAct’s on-line tool.

TaxAct’s options

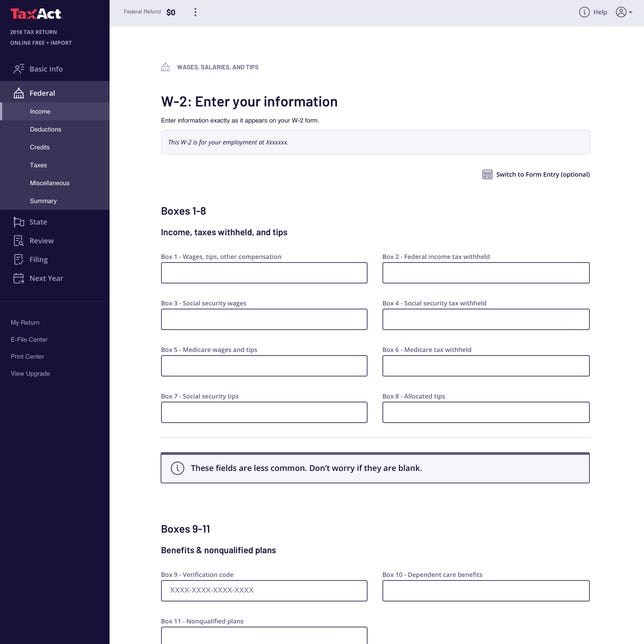

Like maximum different tax tool, TaxAct makes use of a tried-and-true process of getting you reply questions to finish your 2021 tax go back piece through piece. You’ll be able to input solutions through filling out clean packing containers, marking test packing containers or sure/no ideas and settling on from drop-down lists.

TaxAct

You’ll drop out of what TaxAct calls Step-by-Step Steering through clicking at the Federal or State hyperlinks within the left-hand navigation, the place you’ll be able to immediately get entry to explicit subsections reminiscent of Source of revenue, Deductions, Credit and Taxes.

Whilst the questionnaire procedure is exhaustive, additionally it is onerous. TaxAct is excellent at digging for deductions, however you could finally end up answering questions that do not follow in your state of affairs. Additionally, my step by step steerage was once incessantly thrown right into a loop, the place I used to be clicking Proceed via a number of pages I had already finished.

TaxAct does not permit record uploads as opposed to your prior 12 months’s tax go back from any other preparer. It features a partial W-2 import that labored tremendous for me, and 1099-INT lookups relying in your monetary establishment. If in case you have a couple of 1099-MISC or 1099-NEC paperwork, you can be coming into them manually.

TaxAct’s assist and enhance

TaxAct most commonly succeeds in offering a big database of useful resource pages for DIY tax filers, although it isn’t built-in into the tool itself — Resolution Middle entries spawn pop-up home windows. It is not as smartly arranged as TurboTax, nor does it have any neighborhood options reminiscent of message forums the place customers can put up questions.

When finishing your go back, you can discover a rotated “i” subsequent to a few variety packing containers. Clicking it provides contextual assist within the type of pop-ups, even though some explanations don’t seem to be very thorough and others simply be offering, “Do not fret, we will provide an explanation for it later.” Remaining those pop ups additionally sends you again to the highest of your present web page — a minor however most likely widespread annoyance.l

There are 3 further techniques to obtain enhance: during the Lend a hand button, by the use of Xpert Lend a hand or through screen-sharing with a enhance agent.

Lend a hand panel

TaxAct’s Lend a hand panel is simply too crowded — an Resolution Middle widget on the most sensible is essentially the most helpful. There, you’ll be able to temporarily seek for subjects or IRS paperwork, and contextual hyperlinks supply related enhance as you entire your tax go back. As an example, as you might be coming into dependents it’s going to display hyperlinks about newborns or Social Safety numbers to your youngsters.

The remainder of the busy Lend a hand panel comprises any other giant hyperlink to Xpert Lend a hand and 4 generic Resolution Middle hyperlinks.

Xpert Lend a hand

Xpert Lend a hand is TaxAct’s expert-help function with CPAs or EAs (IRS credentialed enrolled brokers). It is recently unfastened for all TaxAct customers (usually $60). Pricing might exchange because the April 18 tax cut-off date nears.

Whilst Xpert Lend a hand is unfastened, it simplest provides telephone and e mail assist — there is no reside chat choice. As soon as you might be hooked up to a professional through telephone, you’ll be able to percentage your display with the skilled the usage of a six-digit code supplied over the telephone.

Common hours for the “Xperts” are 5 a.m. to six p.m. PT weekdays, and six a.m. to a few pm. PT weekends. My wait time for a telephone name in past due February was once 155 mins, and after I ignored the decision I needed to reschedule for 4 days at some point.

I used to be ready to sooner or later reply my very own query of, “The place do I input car license charges?” however simplest through spending a number of mins researching tax-help assets outdoor of TaxAct. Compared, TurboTax temporarily spoke back a more difficult query — “What is the distinction between car registration and license charges and which quantity do I input on my taxes?” — or even confirmed me easy methods to to find my car license charges on the DMV web site. A reside chat function could be an overly welcome boost to TaxAct.

Who must use TaxAct?

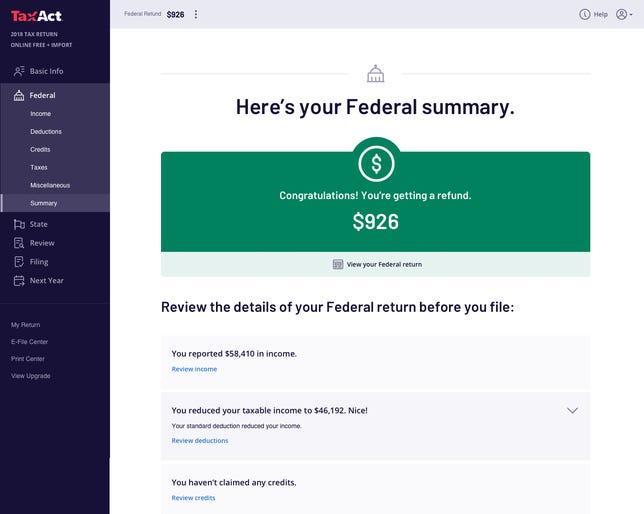

TaxAct

Assured tax filers who wish to maximize their refunds with deductions they may not have in the past thought to be must give TaxAct a glance. When reviewing your go back, TaxAct’s Deduction Maximizer device provides custom designed deduction ideas according to your own tax state of affairs. That mentioned, you can nonetheless want a excellent take hold of of tax laws to make vital adjustments.

The ones searching for a discount choice to TurboTax and H&R Block may just give TaxAct a take a look at, however TaxSlayer is a bit of less expensive and gives a an identical revel in with extra add-on assist ideas.

Who mustn’t use TaxAct?

Those that need absolutely unfastened tax tool must glance somewhere else — you can pay $40 for state returns — and the ones searching for reside chat enhance must take a look at TurboTax, H&R Block or Money App Taxes, which come with each unfastened federal and state returns.

Fanatics of complicated security measures must additionally cross on TaxAct. It helps two-factor authentication with Google Authenticator however none of the usual MFA login options like verifying a safety code together with your cell phone. TaxSlayer and Jackson Hewitt each be offering a lot more powerful security measures.

TaxAct’s different notable options

TaxAct features a Most Refund make sure that guarantees to pay the adaptation should you obtain a better tax refund from any other supplier. It additionally boasts a “$100K Accuracy Ensure,” promising to hide as much as $100,000 in IRS consequences, charges or “cheap, documented audit prices” associated with any calculation mistakes in its tool.

A welcome bookmarking function in TaxAct allows you to flag any a part of your tax go back for assessment or enhancing later. Merely click on the bookmark image on the most sensible of the web page so as to add a piece in your checklist of stored pages available beneath “My Go back” within the left-hand navigation.

TaxAct customers can obtain their tax refunds by the use of:

- Direct deposit in as much as 3 financial institution accounts

- Unfastened switch to an American Specific Carrier pay as you go debit card

- Paper test within the mail

TaxAct’s preparation charges can also be paid through shifting out of your anticipated tax refund, however that procedure will incur an extra charge from Republic Financial institution, TaxAct’s monetary spouse. TaxAct didn’t supply the cost of that charge on the time of this assessment. For reference, Republic Financial institution recently fees $22 as a usual charge for outgoing home cord transfers.

Abstract

TaxAct’s on-line tax submitting tool covers the entire vital bases and gives transparent path as you move via your tax go back. Whilst the press can appear never-ending from time to time, the thoroughness of the tool will assist maximize your tax refund. The bountiful assist variety comprises a variety of helpful knowledge that will help you record your taxes, however the loss of reside enhance method that you are most commonly by yourself.

Get the CNET Personal Finance newsletter

Save money with the best tips and products to make smart financial decisions. Delivered weekly.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.