[ad_1]

Should you’re questioning what an actual property fee calculator is, and find out how to use it, then you definately’ve come to the proper position.

Desk of Contents

- What Is a Actual Property Fee?

- How A lot Does It Value?

- What Is a Actual Property Fee Calculator?

- Backside Line: The usage of the Actual Property Fee Calculator

Any person who’s having a look to shop for or promote genuine property belongings should pay an actual property fee one day.

So, it is helping to pay attention to what this fee is, who you’re paying it to, how a lot it is going to value you, and what equipment allow you to plan for it.

Actual property buyers who need to increase their portfolio or get started an Airbnb trade will to find a couple of pointers on this information that will likely be particularly helpful to them.

With out additional ado, let’s speak about the true property fee calculator and the whole thing associated with it.

What Is a Actual Property Fee?

Because the title suggests, it is a fee that you just pay whilst you’re purchasing or promoting genuine property.

In different phrases, this can be a charge that prices a proportion of the transaction, and subsequently it’s a value that will increase as the cost of the valuables will get larger.

The most typical fee that you are going to come throughout in genuine property is the agent’s fee, even though you could use different services and products that experience commission-type costs as smartly.

Whilst maximum genuine property fee calculators on-line are essentially used to calculate the agent’s fee, they are able to most often be used for any percentage-based services and products.

Comparable: Actual Property Agent Charges Defined—A Breakdown for Traders

So, what are the several types of genuine property commissions that you’ll be able to be expecting to come back throughout?

Kinds of Actual Property Commissions

As discussed above, the commonest sort is the agent fee.

However this kind of fee comes to a number of events relating to who can pay it and who receives the cash.

In an actual property deal, each the consumer and the vendor will rent genuine property brokers.

Which means that each the consumer and the vendor should pay an agent fee.

Moreover, each and every agent will usually even have to separate the fee cash with the dealer whom they paintings for.

This, in flip, signifies that an ordinary genuine property transaction will contain a purchaser, their agent, and that agent’s dealer; and a dealer, their agent, and that agent’s dealer.

I can communicate concerning the prices and main points of the cost preparations in a bit of. However first, I wish to in brief speak about different forms of commissions that you could come throughout in genuine property.

Different Kinds of Commissions

As I mentioned previous, any percentage-based services and products that you are going to pay for in genuine property will also be integrated on this class.

But it surely’s vital right here to attract the glory between price-based commissions and income-based commissions.

Worth-based commissions are very similar to the agent fee in that they’re according to the cost of the valuables.

This may come with the attorney charges for remaining the deal, for instance.

Dealers too can be expecting to pay this fee when the use of some on-line platforms to checklist and promote it their belongings.

Source of revenue-based commissions, then again, are according to the condominium revenue of the valuables.

Those can come with many services and products like belongings control or HOA charges.

Source of revenue-based commissions are quite common when the use of one of the vital very best Airbnb pricing equipment, such because the dynamic pricing Airbnb device, which robotically manages your condominium charges in real-time.

When the use of an actual property fee calculator for a condominium belongings, it’s crucial to seek out one that permits you to consider income-based commissions in addition to price-based commissions for the most efficient long-term funding making plans.

How A lot Does It Value?

So, since an actual property agent fee is one thing that you are going to almost definitely need to pay, you for sure wish to understand how a lot it prices.

Whilst there isn’t a collection charge for this fee, it’s usually between 4–6% of the valuables’s fee in the USA.

However this fee is in most cases set by means of the agent or the dealer and will also be negotiated between the consumer, dealer, and their brokers.

In a later segment, I can give some tips about find out how to get decrease fee prices when purchasing or promoting a belongings.

For now, let’s think that you’re paying a 6% fee on a $500,000 belongings.

Should you’re the use of an actual property fee calculator, you’ll briefly to find that the fee for one of these belongings can be $30,000.

That may be a really extensive amount of cash that the brokers simply made.

It’s vital to believe, on the other hand, that this quantity will likely be break up between each brokers.

This implies each and every agent will handiest be getting $15,000.

Moreover, each and every agent may even have to present their agents their percentage of the fee, which will also be round 50% of that quantity, leaving them with $7,500 as their ultimate benefit.

All issues thought to be, this is nonetheless an excellent approach to make a residing.

Comparable: Actual Property Agent: Your Doable Long run Profession

However you could be questioning, who precisely paid that cash, initially? Used to be it the consumer or the vendor?

Who Will pay the Fee?

That is the phase the place lots of the confusion arises when speaking about the true property fee.

In actual fact, each the consumer and the vendor are come what may accountable for paying the fee, however in follow, handiest the consumer in truth can pay it.

It is because, as soon as the brokers agree on a fee charge, the quantity is in most cases added to the full belongings fee by means of the vendor.

As an example, if a dealer owns a belongings this is valued at $280,000, and the agent fee is 5%, the $14,000 fee can be added to the valuables’s record fee.

What this implies is that the associated fee which will likely be introduced to the consumer will in truth be $294,000.

So, in follow, the consumer should pay extra money to hide the brokers’ fee.

Then again, the confusion comes from the truth that the consumer can pay this cash to the vendor because it is a part of the valuables’s fee.

In flip, the vendor is the one that can pay the cash to their agent, who will then break up it with the consumer’s agent.

And whilst this makes a distinction for each the consumer and the vendor in the case of price range and tax functions, it’s what you may be expecting from an ordinary genuine property transaction.

It does no longer imply, on the other hand, that different forms of offers can’t be negotiated, as we will be able to see underneath.

But it surely does imply that, in the case of an ordinary genuine property fee calculator, nearly all of customers will likely be belongings dealers as they are trying to determine a right kind fee for his or her belongings.

It’s also crucial to incorporate the fee in every other genuine property calculators, similar to a holiday condominium pricing device, in an effort to get essentially the most correct effects and projections.

Negotiating a Decrease Fee

As I mentioned previous, it’s imaginable to barter several types of offers and fee charges.

This is applicable to all events eager about an actual property transaction.

Since each and every birthday party has a unique function, each and every birthday party will attempt to negotiate in opposition to the end result that favors them essentially the most.

Relating to patrons, for instance, they’re going to wish to pay the least amount of cash to buy a belongings, particularly if you wish to acquire a couple of ones.

Dealers, then again, received’t need to pay any more cash if the fee is upper.

Then again, dealers are affected negatively by means of upper commissions as a result of they must carry their record fee, which makes it harder to discover a purchaser.

The dynamic right here may be very other for each and every, as patrons are at once paying extra whilst dealers are gifting away a bigger pool of patrons in change for a extra environment friendly promoting procedure, which generally is value the associated fee.

At the different facet of the spectrum, each brokers and their agents will wish to take advantage of benefit.

Which means that it’s of their very best passion to have the next fee.

The Easiest Technique to Negotiate

With all of that during thoughts, negotiating a decrease fee is usually one thing {that a} purchaser will wish to do.

And the perfect and very best manner to take action can be to at once negotiate the costs with the vendor.

Consumers can occasionally persuade dealers to decrease the valuables fee to make up for the additional fee value that the consumer should pay.

Dealers could be prone to just accept such provides in the event that they’re made in excellent religion or in the event that they come with different incentives similar to a extra fluid cost agenda.

Moreover, if you happen to personal an Airbnb trade throughout a couple of markets, for instance, you’ll be able to choose in for the use of one brokerage that operates throughout those markets.

It will permit you to negotiate extra favorable phrases and set a set fee charge on your entire purchases.

By means of doing this, you’ll additionally to find it a lot more uncomplicated to make use of Airbnb dynamic pricing equipment as you received’t need to calculate a unique fee charge for each and every belongings you need to research.

What Is a Actual Property Fee Calculator?

I’ve discussed the true property fee calculator a number of instances already, however what precisely is it?

As I mentioned previous, an ordinary fee calculator would merely mean you can input a belongings’s fee, a fee charge as a proportion, and it is going to inform you how a lot fee you would need to pay.

Since maximum customers of such equipment are belongings dealers, the device will incessantly come with a box telling you what the overall fee of the valuables can be.

Then again, patrons too can get worth out of the device in the event that they mix it with different equipment to match Airbnb costs when making plans their funding.

That is very true when examining listings which might be for sale-by-owner, as those would possibly no longer have the fee charge added to them.

In most cases, on the other hand, it is important to use further equipment in an effort to belongings analyze an funding belongings.

Within the subsequent segment, I can speak about Mashvisor’s Airbnb research device and find out how to use it mixed with a fee calculator.

Easy methods to Use a Fee Calculator

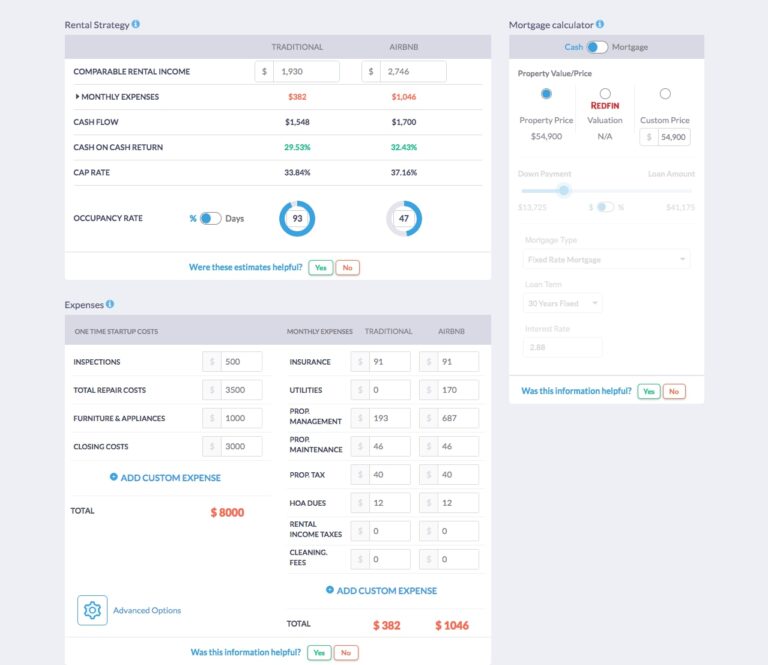

Mashvisor’s funding belongings calculator is an Airbnb research device that may be very helpful for patrons, particularly in the event that they wish to run an Airbnb trade.

This device will calculate the go back on funding {that a} condominium belongings is projected to have.

The calculator makes use of vital metrics such because the cap charge and the money on money go back.

It additionally calculates those values for normal or holiday condominium houses, and its knowledge comes from the MLS and Airbnb.

Integrated on this Airbnb research device are fields designated for all prices and bills associated with the valuables.

This lets you upload the true property fee to the remaining prices of any belongings that you just’re examining in an effort to get essentially the most correct long run projections of that belongings’s go back on funding.

Since Mashvisor’s database contains houses which might be indexed at the MLS, in addition to ones which might be on the market by means of proprietor, no longer all houses can have the true property fee added to their record fee.

This is the reason the use of an actual property fee calculator in an effort to upload the fee value to the remaining charges is one of the best ways to peer correct effects for the cap charge of the holiday condominium you’re examining.

Comparable: Mashvisor – The Easiest Airbnb Source of revenue Calculator

If you wish to get an entire image of a belongings’s benefit attainable, an actual property fee calculator isn’t sufficient. However you should use this device together with Mashvisor’s calculator to venture your money drift, money on money go back, and cap charge.

Backside Line: The usage of the Actual Property Fee Calculator

The true property fee is usually a really extensive fee that you are going to need to pay as a part of any genuine property deal, particularly if you happen to’re a purchaser.

It is important to to at all times account for this fee fee, and ask dealers whether or not the record fee contains this fee.

Should you’re the use of an actual property agent that will help you to find an funding belongings, then your agent will negotiate and take note of the fee charge, they usually will have to notify you of any adjustments in the amount of cash you’ll have to pay.

However if you happen to’re the use of an internet platform like Mashvisor to seek out houses on the market, then you definately will have to just be sure you’re acutely aware of all prices and bills similar on your acquire and come with them on your monetary making plans.

[ad_2]