Actual property marketplace traits can exchange hastily; traders can use some perception into the highest towns for winning momentary leases in 2022.

Desk of Contents

- What Is a Brief-Time period Apartment?

- Sorts of Brief-Time period Residential Houses

- Best 5 Towns for Winning Brief-Time period Leases

- Beginning Up a Apartment Industry: Guidelines for Buyers

- The Advantages and Drawbacks of Proudly owning Brief-Time period Leases

- Brief-Time period Leases: Summing Up

The USA actual property marketplace is an infinite one, and maintaining with present traits may also be reasonably difficult—particularly for any person who’s new to belongings investments.

Thankfully, researching the marketplace and finding winning funding houses are turning into somewhat more straightforward now. Long term traders and actual property brokers alike at the moment are ready to get entry to a variety of funding gear—permitting them get entry to to a very powerful knowledge inside mins.

What is clear when having a look on the present actual property marketplace traits is that the recognition of momentary trip leases is rising by way of the 12 months. And with the proper location, traders can briefly extend their portfolios and generate a gentle source of revenue.

So, if you have an interest in profitable places for getting an funding belongings with the aim of turning it into a holiday house, remember to stick round.

We’ll give you an in-depth evaluation of the most productive places—and a few pointers for turning your funding plans into fact.

What Is a Brief-Time period Apartment?

To begin with, let’s explain the that means at the back of “momentary leases,” making an allowance for that the time period could also be imprecise for other folks simply getting into the true property sport.

In a nutshell, a momentary condo is outlined as any form of residential belongings—or accent construction—that tenants occupy for a SHORT time period. And by way of “brief,” we imply not more than 30 days.

Who occupies those houses?

Neatly, just about someone and everybody.

In contrast to long-term leases, which might be the most popular selection of households and contract staff, momentary trip leases are appropriate for nearly someone in search of some “time-out” from their native land.

Whether or not it’s summer time trip, spring damage, or wintry weather vacations, momentary leases are very well liked by all age teams.

As an example, households who wish to spend their trip someplace will perhaps habits a radical Airbnb research to search out reasonably priced puts to stick as an alternative of paying for ten nights in a lodge. It’s frequently a question of budgeting for his or her upcoming trip.

However but even so the truth that trip condo houses are extra budget-friendly, they provide some other vital benefit. They’ve were given that “house setting” to them, in contrast to any lodge.

Along with the standard vacation-related causes, many of us come to a decision to stick in a holiday condo belongings whilst they’re getting their house renovated or looking ahead to the acquisition settlement to be finished.

Causes range, and, as you’re about to look, so do the kinds of those houses.

Sorts of Brief-Time period Residential Houses

A brief-term trip condo isn’t related to only one form of belongings.

To the contrary, because the housing marketplace advanced, so did the kinds of house leases. These days, the commonest kinds of momentary residential houses come with the next:

Seasonal Holiday Leases

Because the main belongings for funding amongst Millennials, seasonal trip houses have confirmed to be one of the crucial winning investments thus far.

A majority of these residential houses is not going to cross out of favor so briefly, just because their goal is exact—vacationing. When marketed and as it should be provided, they are going to all the time supply a extra tempting possibility than a lodge. It particularly is going for costlier towns and central vacationer places.

Along with bringing in seasonal earnings, they may be able to additionally function an possibility for the investor in the event that they come to a decision that they wish to spend vacations the place the valuables is situated.

It’s a win-win for everybody concerned.

Luxurious Houses

Whilst no longer as repeatedly booked as trip momentary leases, luxurious houses are nonetheless a sexy well-liked selection amongst amateur traders.

In 99% of instances, luxurious houses are meant to be momentary. Essentially for monetary causes, this belongings sort could also be more straightforward to find. Nonetheless, it’s a lot more tough to buy—you’re going to want a flawless credit score ranking or an entire life of financial savings.

Alternatively, this sort of funding will perhaps no longer be rented out for a longer length—once more, because of the prices. So, you most likely shouldn’t get your hopes up so far as your doable go back on funding is worried.

Alternatively, if you do hire it out, you’ll make some huge cash on it.

Getaway Houses

Because the title suggests, getaway houses are a kind of belongings situated in far flung spaces, even islands—some distance from the city way of life. Ahead of making a decision to embody or brush aside this selection, remember to stay a couple of issues in thoughts, together with:

Purchasing this sort of belongings is probably not tough, however you shouldn’t be expecting a prime benefit, both. Much more so, you’ll be freed from maximum criminal problems that essentially fear momentary leases in additional populated spaces.

However you’ll have to select your condo belongings properly.

Comparable: How you can Estimate Airbnb Source of revenue Ahead of Purchasing a Apartment Assets

Best 5 Towns for Winning Brief-Time period Leases

We’re slowly attending to the guts of the topic relating to house leases. And now that we’ve controlled to transparent up what kinds of houses fall beneath the umbrella of “momentary condo,” let’s take a look at some particular examples and places.

Listed below are the highest 5 momentary condo websites you will have to be having a look up in 2022, in step with Mashvisor’s newest knowledge, organized from perfect to lowest in the case of coins on cah go back:

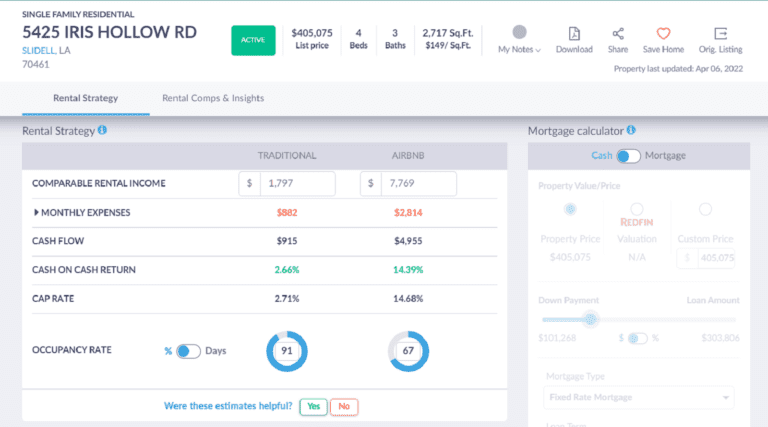

1. Slidell, LA

- Selection of Listings for Sale: 38

- Median Assets Worth: $406,906

- Reasonable Worth according to Sq. Foot: $187

- Days on Marketplace: 61

- Selection of Brief-Time period Apartment Listings: 68

- Per thirty days Brief-Time period Apartment Source of revenue: $4,441

- Brief-Time period Apartment Money on Money Go back: 7.62%

- Brief-Time period Apartment Cap Price: 7.82%

- Brief-Time period Apartment Day by day Price: $348

- Brief-Time period Apartment Occupancy Price: 54%

- Stroll Ranking: 69

2. North Charleston, SC

- Selection of Listings for Sale: 104

- Median Assets Worth: $327,792

- Reasonable Worth according to Sq. Foot: $202

- Days on Marketplace: 61

- Selection of Brief-Time period Apartment Listings: 287

- Per thirty days Brief-Time period Apartment Source of revenue: $3,028

- Brief-Time period Apartment Money on Money Go back: 6.18%

- Brief-Time period Apartment Cap Price: 6.36%

- Brief-Time period Apartment Day by day Price: $150

- Brief-Time period Apartment Occupancy Price: 64%

- Stroll Ranking: 77

3. Gulfport, MS

- Selection of Listings for Sale: 90

- Median Assets Worth: $354,462

- Reasonable Worth according to Sq. Foot: $163

- Days on Marketplace: 107

- Selection of Brief-Time period Apartment Listings: 198

- Per thirty days Brief-Time period Apartment Source of revenue: $2,982

- Brief-Time period Apartment Money on Money Go back: 6.07%

- Brief-Time period Apartment Cap Price: 6.26%

- Brief-Time period Apartment Day by day Price: $154

- Brief-Time period Apartment Occupancy Price: 58%

- Stroll Ranking: 61

4. Crystal River, FL

- Selection of Listings for Sale: 52

- Median Assets Worth: $469,242

- Reasonable Worth according to Sq. Foot: $256

- Days on Marketplace: 60

- Selection of Brief-Time period Apartment Listings: 148

- Per thirty days Brief-Time period Apartment Source of revenue: $3,447

- Brief-Time period Apartment Money on Money Go back: 4.91%

- Brief-Time period Apartment Cap Price: 5.05%

- Brief-Time period Apartment Day by day Price: $184

- Brief-Time period Apartment Occupancy Price: 57%

- Stroll Ranking: 51

5. Joshua Tree, CA

- Selection of Listings for Sale: 76

- Median Assets Worth: $581,776

- Reasonable Worth according to Sq. Foot: $473

- Days on Marketplace: 61

- Selection of Brief-Time period Apartment Listings: 388

- Per thirty days Brief-Time period Apartment Source of revenue: $3,792

- Brief-Time period Apartment Money on Money Go back: 4.69%

- Brief-Time period Apartment Cap Price: 4.77%

- Brief-Time period Apartment Day by day Price: $247

- Brief-Time period Apartment Occupancy Price: 58%

- Stroll Ranking: 53

One a very powerful issue for managing a a hit Airbnb industry is getting access to actual property knowledge at any given second.

Now, you’ll simply do this by way of the usage of our Apartment Assets Calculator—which objectives to help traders in researching and assessing the possible profitability of the specified belongings.

With trip condo methods, it’s essential to be versed in statistics and organize a considerable amount of knowledge coming your method, like cap price, cash-on-cash go back, occupancy price, and so forth.

Thankfully, our gear will let you achieve up-to-date knowledge and in depth wisdom of marketplace traits in a single position.

Comparable: What Is a Excellent Money on Money Go back?

Mashvisor’s Apartment Assets Calculator objectives to assist traders analysis and assess the profitability of a specific belongings, in response to coins glide, coins on coins go back, cap price, and occupancy price.

Beginning Up a Apartment Industry: Guidelines for Buyers

Entering into the true property industry isn’t one thing you will have to do blindly. You wish to have to equip your self with the data and gear to help you generate source of revenue and stay your momentary condo industry afloat.

Whether or not you’re an actual property amateur—or simply in search of some treasured data to refresh your reminiscence—the ideas defined underneath will turn out to be useful.

Outline Your Primary Function

Ahead of you even believe the speculation of striking up rooms for hire, you will have to outline your objectives obviously. Get started by way of asking of yourself questions equivalent to:

- Do I have already got a belongings that I will turn out to be right into a condo?

- Do I would like momentary or long-term visitors?

- Do I’ve the time to regulate the valuables?

- Can I collect the finances essential for making an investment on this belongings?

Be mindful, there’s a vital distinction between managing and anticipating source of revenue from long-term and momentary leases—and also you will have to overview your choices with excessive care sooner than taking the next move.

In the event you’re an investor leaning towards long-term plans, you will have to take a 2nd to head via our 2022 Investor’s Information to get your complete image and notice what it in point of fact takes.

Draft Your Technique and Monetary Plan

Making an investment in actual property belongings implies organising a powerful technique and monetary plan to help you organize your condo and get ready it for visitors.

Prior to now, it intended hiring a 3rd celebration that might will let you collect a very powerful knowledge and overview the profitability of doable momentary leases. Nowadays, alternatively, you have got the risk to do it your self by way of applying funding gear.

Your monetary functions additionally play an enormous section in making an investment and whether or not it’s going to be successful or no longer. You’ll wish to determine which investment manner fits you best possible to make sure the chance of falling into debt and having your own home taken clear of you is minimum.

Comparable: Best Courses About Actual Property Monetary Making plans to Be told Ahead of You Hit 30

Act on Comments

Now, this is a double-edged sword since tenants can impact the good fortune of trip leases.

How?

Because you’ll be record your momentary condo belongings, it routinely manner that there’s an open area for commenting and ranking your lodging. It, in flip, manner you’ll be coping with each just right and unhealthy critiques.

Right here’s one thing to bear in mind:

You should put in additional effort than you to begin with anticipated, concentrate in your tenants, and act on their comments—be it sure or destructive. It’s because a majority of your doable visitors are going to scroll via critiques previous to reserving your condo.

And you wish to have them to be proud of what they examine it—and also you, because the host.

The Advantages and Drawbacks of Proudly owning Brief-Time period Leases

Proudly owning and operating a momentary condo belongings isn’t all just right or all unhealthy. There’s a gentle steadiness between the 2 with regards to making sure you’re getting cash and no longer shedding it.

Let’s speak about some notable benefits—and downsides—of proudly owning a holiday condo sooner than we wrap up this information.

Advantages

- Flexibility: Because it’s no longer long-term, it permits you to resolve the precise dates when your own home will likely be to be had and whilst you might obtain visitors. It turns into much more really useful in the event you’re having a look to make the most of your own home and spend a while on it.

- Much less Put on and Tear: Having less-frequent visitors to your belongings manner spending much less on cleansing services and products and upkeep.

Drawbacks

- Inconsistent Source of revenue: Because you’re choosing momentary remains to your belongings, you will have to come to phrases with no longer receiving bills for months at a time. Your condo belongings might nonetheless carry out excellently—however best all over positive occasions of the 12 months.

- HOA Fees: Some neighborhoods is not going to take the speculation of traders renting out a belongings calmly—and will also press fees in opposition to you. That’s why community research is a a very powerful step in making plans your subsequent funding.

Talking of HOA laws and rules, right here’s a just right query:

How you can Get Round Brief-Time period Apartment Restrictions?

Many towns have positioned particular bans on momentary renting. With that stated, the principles and rules range by way of town.

What are you able to do to steer clear of pointless criminal motion? Neatly, it’s easy, in point of fact:

Get to understand the regulations of where you’re making plans to put money into previously.

One commonplace false impression revolves round subletting. You’ll be able to sublet your condominium or a part of the home to any person else—that means that they are going to be renting it out to a 3rd celebration. The regulation, alternatively, calls for such kinds of rentals to be momentary.

Know that you simply’ll more than likely wish to download a license to perform your momentary condo industry, too. So, take a look at the regulations—and re-read your hire a couple of occasions if wanted.

In the event you violate the regulations, you’ll finally end up paying a hefty positive or, even worse, going to prison.

Brief-Time period Leases: Summing Up

We’ve effectively long past via probably the most wealthy US towns to put money into momentary condo houses. Now, let’s in brief cross over probably the most vital issues.

Ahead of selecting making an investment, you will have to explain what momentary leases are and what are the commonest sorts. Amassing the essential data and data is part the fight.

As defined on this information, probably the most profitable places for these kind of funding houses recently come with Slidell, North Charleston, and Gulfport, to call a couple of.

The use of the proper funding gear all over your analysis and organising a forged technique will assist your own home keep in industry for a very long time—and be sure that you’re making prime returns.

Enroll for a 7-day unfastened trial of Mashvisor adopted by way of a fifteen% cut price to your quarterly or annual subscription.