Should you’re taking a look to spend money on a non permanent condo, the Airbnb cap fee is an important metric to concentrate on. However what’s it precisely? And the way do you employ it in genuine property making an investment?

Desk of Contents

- What Is Cap Price?

- Mashvisor: To find and Analyze Airbnb Markets

- Most sensible 10 Towns With the Very best Airbnb Cap Price

- Backside Line

Should you’re new to genuine property making an investment, you may’ve come around the time period cap fee, however you’re nonetheless undecided what it manner precisely. However to be able to maximize your income, you wish to have to concentrate on the stated metric. All the time understand that you will have to most effective put your cash in markets the place the condo houses’ cap charges are top sufficient to justify such an funding.

On this put up, I can let you know the whole thing you wish to have to learn about capitalization fee as a metric for measuring a condo belongings’s go back on funding.

Moreover, on the finish of this text, I can come up with a listing of the highest 10 towns for making an investment in non permanent leases in the US in response to every marketplace’s Airbnb cap fee.

What Is a Cap Price?

Cap fee, which is brief for capitalization fee, is probably the most usually used metric for measuring the possible luck of a condo belongings funding. This is a metric that tells you the share of your private home’s worth that will likely be generated out of your condo source of revenue every 12 months.

To calculate it, it is very important know the next:

- The valuables’s marketplace worth

- Per thirty days or annual condo source of revenue that the valuables is anticipated to generate

- All one-time and habitual bills that can incur

The usage of the above values, you’ll then calculate your web working source of revenue via subtracting the once a year bills from the once a year condo source of revenue and some other resources of benefit associated with the valuables.

In a while, you’ll use the method underneath to calculate the valuables’s cap fee:

Cap Price = (Web Running Source of revenue / Marketplace Price) x 100%

So, for instance, in case you’re inspecting a condo belongings this is valued at $500,000, and its anticipated annual NOI is $20,000, the calculation can be as follows:

Cap Price = (20,000 / 500,000) x 100% = 4%

What it manner is that the valuables will generate an annual benefit that is the same as 4% of its worth. It, in flip, implies that it is going to take 25 years for the valuables to pay for itself, in response to its present condo source of revenue and marketplace worth.

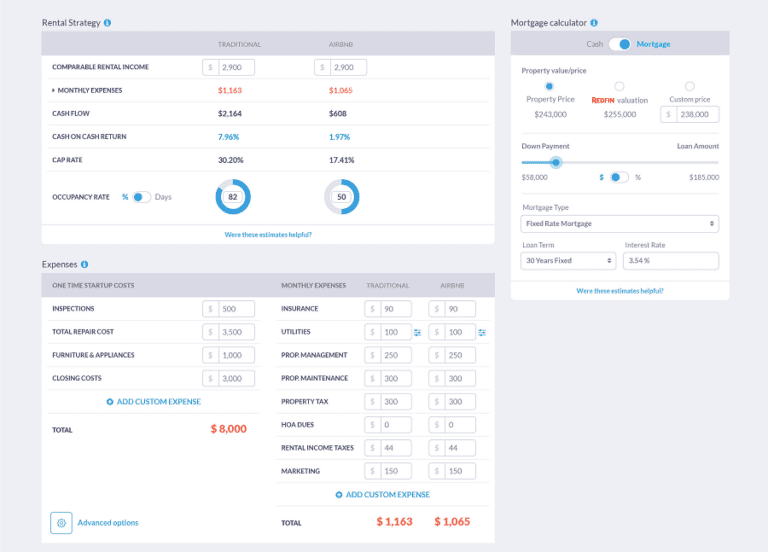

Happily, you’ll additionally use a cap fee calculator to make the method a lot more straightforward, particularly when looking to analyze a number of houses without delay. Should you’re in search of a super cap fee calculator to make use of, glance no additional than Mashvisor’s device, as it’s the best, particularly in terms of Airbnb leases.

Should you’re in search of a super cap fee calculator to make use of, glance no additional than Mashvisor’s device as it’s the best, particularly in terms of Airbnb leases.

However what’s the adaptation between cap fee and money on money go back?

Money on money (CoC) go back is every other standard metric used for inspecting the returns of a condo belongings. Then again, in contrast to the cap fee, the money on money go back metric depends on the amount of money you need to spend money on the valuables as an alternative of its marketplace worth. It makes CoC go back an invaluable metric to make use of when you need to make use of a loan to buy the valuables.

As an example, if you wish to calculate the CoC for a condo belongings that prices $100,000, however you need to make use of a loan to pay for 60% of its worth, you can most effective come with the $40,000 for your calculation.

Calculating the CoC is very similar to calculating the cap fee, aside from you are going to be the use of the money worth as said above. What it tells you is the speed of go back that your condo source of revenue will generate in comparison to the amount of money that you just’ve paid for the valuables.

What Is an Airbnb Cap Price?

Within the earlier phase, I mentioned cap fee basically, which is used for each conventional and non permanent condo houses.

However what’s the distinction between conventional and Airbnb cap fee? Neatly, the solution is they’re each calculated the similar, they usually contain equivalent steps.

The variation, then again, is within the effects that you’ll be expecting from every metric, which might be suffering from all of the same old variations between the 2 funding methods.

As an example, whilst conventional leases include a decrease attainable for annual benefit, their condo charges are extra strong and their emptiness charges are usually decrease. It leads to a decrease common cap fee however a a ways much less risky 5-year and 10-year forecast.

However, Airbnb cap fee can exchange greatly in response to the seasonality, and it’s a lot more difficult to expect its long-term worth because of the predicted volatility.

Every other factor to bear in mind when calculating the true property cap fee for an Airbnb condo is that your per thirty days cap fee can range a great deal out of your annual cap fee.

An instance can be a seashore area condo, which is able to see height occupancy all through the summer time, at which level the condo fee will also be adjusted and greater to compare the brand new call for. The Airbnb cap fee all through the stated duration will likely be greatly upper than the remainder of the 12 months.

Then again, because of the versatility of non permanent leases and your talent to simply hire them out all through height seasons, the decrease cap fee all through the remainder of the 12 months might not be as precious to you.

Similar: Easy methods to Review an Airbnb Funding

What Does Moderate Airbnb Cap Price Imply?

In relation to figuring out what a just right cap fee for Airbnb is in a selected marketplace, maximum genuine property traders will use Airbnb comps.

Airbnb comps comes to evaluating plenty of non permanent leases in a undeniable marketplace and determine the typical condo charges and median belongings worth to be able to calculate the typical cap fee of that marketplace. By way of the use of the stated method, you will have to have the ability to determine houses which might be appearing above or underneath common relating to their fee of go back on funding in comparison to different houses for your selected location.

Very similar to whilst you analyze a unmarried belongings, Airbnb comps are very depending on seasonality since non permanent leases most commonly draw in visitors who seek advice from spaces all through particular seasons of the 12 months.

Airbnb comps will let you know what the typical Airbnb cap fee is in a undeniable marketplace, which turns into very helpful when you need to match other markets with one every other or whilst you’re looking to diversify your portfolio. It brings us to our subsequent level relating to what makes for a just right cap fee for Airbnb in a marketplace.

What Is a Just right Cap Price for Airbnb?

In relation to figuring out what a just right cap fee is in any particular marketplace, the solution varies considerably relying in the marketplace in query.

There are a lot of sides that may impact a marketplace’s common cap fee. And usually, a just right cap fee can be the rest above common in comparison to its marketplace. It’s why it’s of maximum significance that you just do your marketplace analysis earlier than committing to any funding choices.

As an example, you may well be taking a look at a marketplace the place the typical cap fee is 3%, which turns out low to you. So, you have a look at a distinct marketplace and discover a belongings with a cap fee of 6%. You instantly think that it’s a just right cap fee for Airbnb in that marketplace.

However upon additional investigation, you may to find that the typical cap fee in that marketplace is in fact 6.5%, which means that that the valuables you idea had a just right cap fee was once, if truth be told, appearing underneath the marketplace’s common.

In relation to making an investment in Airbnb USA, you don’t wish to be taking a look on the national cap fee genuine property. As a substitute, you need to have a look at every condo marketplace on the town or community ranges to be able to get probably the most correct effects.

Happily, there are equipment that can assist you in numerous tactics.

Similar: Mashvisor – The Absolute best Airbnb Source of revenue Calculator

Mashvisor: To find and Analyze Airbnb Markets

Mashvisor is an actual property platform that was once designed to assist genuine property traders who wish to spend money on conventional and Airbnb condo houses. The platform contains a number of equipment that can assist you analyze every marketplace and to find the best-performing condo funding houses in any marketplace in the USA.

With a significant focal point on conventional and Airbnb cap fee analytics, Mashvisor removes the want to manually download information on every belongings earlier than the use of a spreadsheet to do comps and succeed in a conclusion. The Airbnb cap fee calculator that the platform provides is an easy-to-use dynamic device that permits for quite a lot of customization to be able to get probably the most correct calculations in real-time.

Should you’re in search of marketplace studies, you’ll request a spreadsheet file for any marketplace that you need to spend money on national.

Mashvisor’s cap fee calculator serves as an easy-to-use dynamic device that provides quite a lot of customization to get probably the most correct calculations in real-time.

Most sensible 10 Towns With the Very best Airbnb Cap Price

To show off the facility of Mashvisor’s information, I’ve compiled a listing of the highest 10 towns within the Airbnb USA marketplace relating to cap fee via town.

Along with having a top cap fee, the markets in this listing are thought to be reasonably priced and feature an above-average selection of listings on the market.

With out additional ado, listed below are the highest 10 towns in the USA for making an investment in Airbnb condo houses with top cap charges:

1. Seguin, TX

- Choice of Listings for Sale: 130

- Median Assets Worth: $388,064

- Moderate Worth in keeping with Sq. Foot: $207

- Days on Marketplace: 112

- Choice of Airbnb Listings: 96

- Per thirty days Airbnb Apartment Source of revenue: $4,585

- Airbnb Money on Money Go back: 7.71%

- Airbnb Cap Price: 7.91%

- Airbnb Day by day Price: $263

- Airbnb Occupancy Price: 52%

- Stroll Ranking: 67

2. Slidell, LA

- Choice of Listings for Sale: 38

- Median Assets Worth: $406,906

- Moderate Worth in keeping with Sq. Foot: $187

- Days on Marketplace: 61

- Choice of Airbnb Listings: 68

- Per thirty days Airbnb Apartment Source of revenue: $4,441

- Airbnb Money on Money Go back: 7.62%

- Airbnb Cap Price: 7.81%

- Airbnb Day by day Price: $348

- Airbnb Occupancy Price: 54

- Stroll Ranking: 69

3. Bristol, TN

- Choice of Listings for Sale: 51

- Median Assets Worth: $264,959

- Moderate Worth in keeping with Sq. Foot: $115

- Days on Marketplace: 46

- Choice of Airbnb Listings: 87

- Per thirty days Airbnb Apartment Source of revenue: $2,725

- Airbnb Money on Money Go back: 7.04%

- Airbnb Cap Price: 7.29%

- Airbnb Day by day Price: $173

- Airbnb Occupancy Price: 49%

- Stroll Ranking: 78

4. Redford, MI

- Choice of Listings for Sale: 45

- Median Assets Worth: $171,056

- Moderate Worth in keeping with Sq. Foot: $139

- Days on Marketplace: 69

- Choice of Airbnb Listings: 56

- Per thirty days Airbnb Apartment Source of revenue: $2,163

- Airbnb Money on Money Go back: 6.76%

- Airbnb Cap Price: 7.09%

- Airbnb Day by day Price: $155

- Airbnb Occupancy Price: 54%

- Stroll Ranking: 40

5. Stillwater, OK

- Choice of Listings for Sale: 52

- Median Assets Worth: $285,119

- Moderate Worth in keeping with Sq. Foot: $160

- Days on Marketplace: 72

- Choice of Airbnb Listings: 88

- Per thirty days Airbnb Apartment Source of revenue: $2,639

- Airbnb Money on Money Go back: 6.54%

- Airbnb Cap Price: 6.8%

- Airbnb Day by day Price: $177

- Airbnb Occupancy Price: 51%

- Stroll Ranking: 86

6. Huntington, WV

- Choice of Listings for Sale: 66

- Median Assets Worth: $281,090

- Moderate Worth in keeping with Sq. Foot: $119

- Days on Marketplace: 96

- Choice of Airbnb Listings: 57

- Per thirty days Airbnb Apartment Source of revenue: $2,491

- Airbnb Money on Money Go back: 6.51%

- Airbnb Cap Price: 6.8%

- Airbnb Day by day Price: $101

- Airbnb Occupancy Price: 60%

- Stroll Ranking: 48

7. Glendale, AZ

- Choice of Listings for Sale: 110

- Median Assets Worth: $538,900

- Moderate Worth in keeping with Sq. Foot: $275

- Days on Marketplace: 14

- Choice of Airbnb Listings: 211

- Per thirty days Airbnb Apartment Source of revenue: $4,618

- Airbnb Money on Money Go back: 6.61%

- Airbnb Cap Price: 6.74%

- Airbnb Day by day Price: $212

- Airbnb Occupancy Price: 76%

- Stroll Ranking: 89

8. East Stroudsburg, PA

- Choice of Listings for Sale: 43

- Median Assets Worth: $401,493

- Moderate Worth in keeping with Sq. Foot: $167

- Days on Marketplace: 96

- Choice of Airbnb Listings: 359

- Per thirty days Airbnb Apartment Source of revenue: $4,425

- Airbnb Money on Money Go back: 6.54%

- Airbnb Cap Price: 6.7%

- Airbnb Day by day Price: $303

- Airbnb Occupancy Price: 47%

- Stroll Ranking: 78

9. Laredo, TX

- Choice of Listings for Sale: 56

- Median Assets Worth: $261,434

- Moderate Worth in keeping with Sq. Foot: $141

- Days on Marketplace: 64

- Choice of Airbnb Listings: 64

- Per thirty days Airbnb Apartment Source of revenue: $2,904

- Airbnb Money on Money Go back: 6.44%

- Airbnb Cap Price: 6.67%

- Airbnb Day by day Price: $118

- Airbnb Occupancy Price: 62%

- Stroll Ranking: 55

10. Klamath Falls, OR

- Choice of Listings for Sale: 122

- Median Assets Worth: $435,534

- Moderate Worth in keeping with Sq. Foot: $218

- Days on Marketplace: 136

- Choice of Airbnb Listings: 116

- Per thirty days Airbnb Apartment Source of revenue: $3,858

- Airbnb Money on Money Go back: 6.47%

- Airbnb Cap Price: 6.64%

- Airbnb Day by day Price: $225

- Airbnb Occupancy Price: 52%

- Stroll Ranking: 66

Backside Line

If you wish to spend money on Airbnb and maximize your benefit, then the Airbnb cap fee is the metric that you need to be the use of. The cap fee tells you ways successful your condo belongings is relating to its annual condo source of revenue in comparison to its marketplace worth.

Mashvisor’s cap fee calculator will let you simply run the mathematics on any funding belongings this is indexed on the market. If you wish to to find your subsequent profitable funding in a non permanent condo, be sure to get started the use of Mashvisor these days to overcome your festival to the finest Airbnb leases for your marketplace of selection.

Join for a 7-day loose trial of Mashvisor adopted via a fifteen% bargain for your quarterly or annual subscription.