4 crucial monetary abilities that should be realized in existence are: opening a checking account, development and keeping up credit score, making an investment, and saving for retirement. The issue is that those crucial 4 are hardly ever being taught along STEM and different topics in colleges as a part of crucial abilities. However, this information can pave the way in which for monetary luck and inclusion later in existence.

Due – Due

Some children are uncovered to the occasional particular meeting revolving round topics like the way to save for varsity or why it’s now not a good suggestion to not spend the whole lot you earn out of your first activity. But well-liked monetary training isn’t taking place on a big scale — which is a huge downside. As identified in a Forbes article, handiest 20% of other folks have somebody of their existence they consider to proportion cash secrets and techniques. That’s a frightening statistic.

On the other hand, this isn’t to mention that monetary training isn’t at the radar of one of the crucial nation’s leaders and politicians. In keeping with a March 2022 survey via the Council for Financial Schooling, 23 states require highschool scholars to take a non-public finance path, and 25 states require highschool scholars to take an economics path. At the turn facet of the coin, 3 states plus the District of Columbia don’t come with non-public finance measures anyplace of their training requirements.

Long term Monetary Literacy

Issues could also be having a look up, regardless that. As famous in a 2021 piece in The New York Instances, greater than 20 states are making an allowance for mandating monetary literacy of their colleges. As well as, Congress is making development towards riding larger monetary training within the study rooms. For instance, consultant Matt Cartwright (D-PA) presented H.R. 1547—Adolescence Monetary Finding out Act, which objectives to award grants to combine monetary literacy training into public basic and secondary colleges.

Efforts also are being made on the state and native govt ranges. In keeping with the Nationwide Convention of State Legislatures, 38 states presented new monetary literacy regulation in 2021. Those are definitely steps in the fitting route. And those steps are confidently a favorable begin to a long term of economic inclusion for everybody.

Balanced Private Budgets: A Objective Price Pursuing

Lately, thousands and thousands of younger other folks learn to take care of their price range at the fly. Perhaps they see a dad or mum or grandparent write a take a look at at times. Much more likely, they don’t. Such a lot of other folks now behavior maximum or all in their banking on-line. This implies it’s clear of the eyes of youngsters. So, they don’t be informed the bits and bobs of those on a regular basis transactions with their ebank.

This wishes to switch. Some distance too many of us, specifically the ones from underserved communities, were disregarded of the mainstream monetary machine. It’ll handiest be tougher for his or her kids and grandchildren to construct a greater existence in the event that they don’t perceive managing a transaction account or developing the cheap.

Certainly, development a forged monetary literacy basis is important to compelling extra monetary inclusion. The extra individuals who change into conversant in the bits and bobs of the monetary machine and the sources to be had to them, the simpler situated they’re going to be to actively support their monetary well-being.

Take get entry to to honest and reasonably priced credit score, for example. Many of us need to purchase a automotive, personal a house, or have the capital to begin a trade. They are able to handiest make those huge concepts occur if they have got a minimum of a modicum of figuring out of what wealth is and the way to steward it correctly.

Demystifying Cash for the Just right of Present and Long term Generations

As a society, we have already got many important, daring targets that we are hoping to reach faster somewhat than later. Monetary literacy will have to rank proper up there, and the most efficient position to make it occur is within the colleges.

What’s the core advantage of weaving cash control into the Ok-12 curriculum? For one, bringing monetary training to the school room creates a existence cycle of economic literacy. Youngsters who find out about cash at an early age can construct on that elementary wisdom as they grow older and will perceive extra.

Some other merit is that educators change into smarter about their very own monetary selections. Educating our academics to effectively navigate the mainstream monetary machine and change into extra financially literate themselves will get them thinking about the subject and is helping them higher educate kids.

A last get advantages is the long-term results of demystifying cash on complete households or even buddy teams. Younger other folks can take the teachings they be informed in the school room to their folks and friends. This may permit everybody to be told and showcase more fit behavior in combination. It’s a series response that higher prepares our communities to support their monetary well being and well-being. This, in flip, would result in higher monetary inclusion at some point.

Once more, those sure results can temporarily start in the school room. It doesn’t should be difficult for any college to start to discuss cash in basic, heart college, or highschool, both. It doesn’t also have to price the rest—which is an ironic bonus.

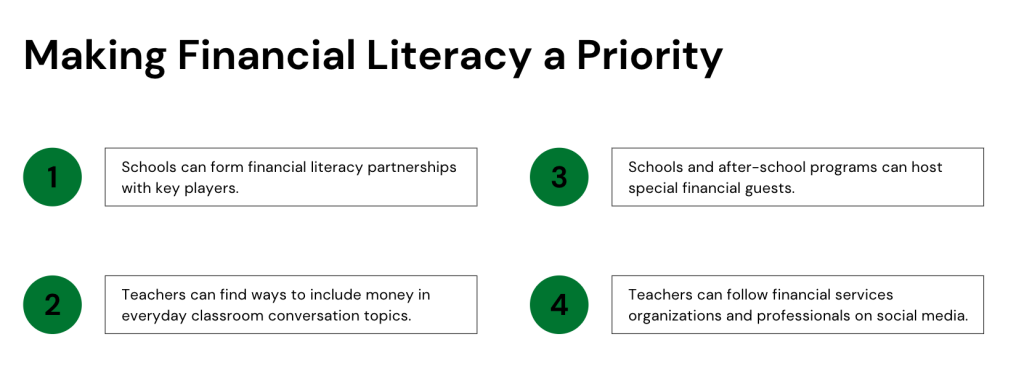

Beneath are a couple of strategic techniques for keen academics and directors to make monetary literacy a concern.

1. Faculties can shape monetary literacy partnerships with key avid gamers.

A faculty or college district doesn’t must “cross it on my own” on the subject of bringing cash issues into the school room. Numerous big-time avid gamers within the finance sector, reminiscent of banks and loan lenders, have techniques to proportion.

Take Experian and the Soar$tart Coalition for Private Monetary Literacy, as an example. The 2 entities have partnered for a few years. In combination, they acknowledge and rejoice the price of economic training to force larger monetary inclusion throughout communities. Their paintings has equipped academics with knowledge, gear, and sources to teach all scholars, particularly the ones traditionally excluded from the mainstream monetary machine.

2. Academics can to find techniques to incorporate cash in on a regular basis school room dialog subjects.

Some detractors of economic training in colleges may say it’s more uncomplicated mentioned than accomplished. They level to too many competing priorities, too few certified academics, and a loss of time and sources. In fact, those are all legitimate issues. But when most of the people care for cash day-to-day and depend on price range to navigate the daily, there’s no explanation why to relegate monetary training to the sidelines.

Indubitably, it could be laborious to think about every other college matter that would or could be condensed to a unmarried day or week. Academics will have to be inspired to speak about cash in numerous techniques. A historical past trainer may comment on how governments divide their budgets or accumulate taxes. A math task may contain a cash part. It’s more practical to convey cash into the school room than it could sound. There are on-line sources, such because the Soar$tart Clearinghouse, the place academics, folks, or even scholars can to find efficient, monetary training fabrics from more than a few assets.

3. Faculties and after-school techniques can host particular monetary visitors.

To their credit score, many faculties do invite monetary leaders from their communities into the school room. As nice as academics are, guests boost the varsity day, and the ones pros can discuss finance’s multifaceted, advanced sides. Plus, children can ask questions and get able solutions from other folks already operating within the box.

The issue is that a ways too regularly, colleges and person academics have to head thru slightly a couple of hoops to organize for visitor audio system and academics. Possibly a silver lining of the COVID pandemic is our larger convenience with digital communique, making it more uncomplicated for somebody from an area financial institution, credit score bureau, credit score union, funding company, or nonprofit to take half-hour each two weeks to speak to a category about pertinent cash problems and respond to questions. Those small touch-points would possibly not sound like so much however can upload up over the years, serving to other folks be extra financially literate and paving a long term pathway to monetary inclusion.

4. Academics can practice monetary services and products organizations and pros on social media.

For even probably the most certified non-public finance academics, it may be difficult seeking to stay alongside of the consistent trends within the monetary box. Sadly, many faculties lack enough finances for coaching techniques, and the restricted prep time that academics are given isn’t sufficient for self-directed studying. However, social media gives academics a very simple and reasonably priced technique to faucet into the experience and developments of the monetary fields.

By way of following monetary professionals on social media and techniques like Experian’s #CreditChat, academics acquire get entry to to insights, knowledge, bulletins, and sources. The trick, regardless that, is to you’ll want to practice respected organizations or permitted pros somewhat than self-proclaimed professionals and influencers.

A Global Filled with Brilliant, Assured Cash Managers

At this time, the baseline monetary wisdom of youngsters and adults around the nation may well be higher. Analysis from OppU means that now not handiest are greater than part of all adults frightened about their price range, however greater than three-quarters reside from one paycheck to the following.

It doesn’t should be this manner ceaselessly.

Ensuring younger other folks perceive price range on the earliest conceivable age will assist them assemble more fit wealth accumulation and spending behaviors. As probably the most main societies around the planet, American citizens should step up and shoulder the weight of serving to children and adults make wiser cash selections.

No doubt, the training machine has so much on its plate. Nonetheless, together with instructional tidbits about cash and the monetary machine will cross some distance towards higher monetary inclusion, converting every individual’s alternatives—and perhaps even converting the arena.

Authors:

The submit Dedication to Monetary Literacy Creates a Pathway to Larger Monetary Inclusion seemed first on Due.