Should you’re searching for new puts to put money into 2022, proceed studying to find the quickest rising condominium markets in the USA.

Desk of Contents

- The place Is Actual Property Booming? Right here Are the Best 10 Quickest Rising Apartment Markets

- Guidelines for Conventional Apartment Homes

- Conclusion

Making an investment in up-and-coming towns is a superb technique to build up your earnings in actual property. On this article, we can take a look at one of the most best possible places to seem into this yr for normal condominium houses.

The place Is Actual Property Booming? Right here Are the Best 10 Quickest Rising Apartment Markets

Conventional condominium houses supply a constant source of revenue flow for traders taking a look to earn money in actual property. Listed here are the highest 10 quickest rising condominium markets in the USA the place traders can profit from an actual property increase and amplify their portfolio.

1. Austin, Texas

- Collection of Listings for Sale: 250

- Median Assets Value: $808,163

- Moderate Value consistent with Sq. Foot: $467

- Collection of Conventional Listings: 2,964

- Per 30 days Conventional Apartment Source of revenue: $2,118

- Conventional Money on Money Go back: 0.84%

- Conventional Cap Fee: 0.86%

- Value to Hire Ratio: 32

- Days on Marketplace: 60

- Stroll Rating: 50

Austin, Texas is among the quickest rising actual property markets in 2022. Town can be a very good position to put money into a standard condominium belongings. Folks of every age are attracted to the town for the colleges, such because the College of Texas, and native trade alternatives. There are many issues to do downtown, together with buying groceries, eating places, and leisure.

Austin’s year-round heat climate draws other people taking a look to flee the wintry weather months at the East Coast. Town’s actual property information displays promising funding alternatives in the following few months. Discover the other neighborhoods within the space to search out essentially the most a hit conventional condominium belongings.

2. Raleigh-Durham, North Carolina

- Collection of Listings for Sale: 2,492

- Median Assets Value: $613,375

- Moderate Value consistent with Sq. Foot: $162

- Collection of Conventional Listings: 1,818

- Per 30 days Conventional Apartment Source of revenue: $1,866

- Conventional Money on Money Go back: 2.07%

- Conventional Cap Fee: 2.12%

- Value to Hire Ratio: 27

- Days on Marketplace: 63

- Stroll Rating: 32

Subsequent up on our quickest rising condominium markets in the USA is Raleigh-Durham, North Carolina. Raleigh-Durham is a emerging actual property marketplace as scholars are transferring to the realm to wait one of the crucial many universities within the town. North Carolina provides various alternatives for employment. One of the greatest firms within the space come with Amazon and Apple. The 2 companies mixed create 1000’s of activity alternatives within the space.

Raleigh-Durham can be a very good possibility for making an investment in a standard condominium belongings as persons are continuously searching for a long-term position to stick. Whether or not they’re scholars or other people relocating for paintings, it’s most probably your private home will draw in renters any time of the yr. In finding various conventional listings on the market so that you can start your funding adventure.

3. Orlando, Florida

- Collection of Listings for Sale: 658

- Median Assets Value: $499,170

- Moderate Value consistent with Sq. Foot: $273

- Collection of Conventional Listings: 2,553

- Per 30 days Conventional Apartment Source of revenue: $1,906

- Conventional Money on Money Go back: 2.41%

- Conventional Cap Fee: 2.49%

- Value to Hire Ratio: 22

- Days on Marketplace: 49

- Stroll Rating: 42

Some other one of the crucial best possible housing markets in the USA is Orlando, Florida. Orlando provides an never-ending quantity of sights, together with Disney Global, Sea Global, and Common Studios. Folks wish to transfer to the realm to be with regards to the entire motion year-round.

Orlando is one position to search for conventional condominium houses as a result of households are all the time taking a look to transport to the realm with their youngsters. Moreover, the amusement parks within the town be offering various activity alternatives to other people searching for a long-term position to stick.

Similar: Florida Actual Property Marketplace 2022 Outlook

4. Houston, Texas

- Collection of Listings for Sale: 1,833

- Median Assets Value: $485,246

- Moderate Value consistent with Sq. Foot: $240

- Collection of Conventional Listings: 4485

- Per 30 days Conventional Apartment Source of revenue: $2,205

- Conventional Money on Money Go back: 2.21%

- Conventional Cap Fee: 2.27%

- Value to Hire Ratio: 18

- Days on Marketplace: 48

- Stroll Rating: 43.29

Houston, Texas may be one of the crucial quickest rising condominium markets in the USA. Town provides a metropolitan really feel, with many neighborhoods identified for distinctive sights that give a contribution to its general draw.

Houston enjoys a thriving activity marketplace with various alternatives to be had to other people of every age. Greater than 30 other faculties are situated within the town, growing activity alternatives for each professors, scholars, and any person taking a look to lend a hand run the colleges. It’s why people and households are transferring to Houston’s neighborhoods. Imagine Houston on your subsequent conventional condominium funding belongings.

5. Charleston, South Carolina

- Collection of Listings for Sale: 421

- Median Assets Value: $1,517,504

- Moderate Value consistent with Sq. Foot: $604

- Collection of Conventional Listings: 538

- Per 30 days Conventional Apartment Source of revenue: $3,089

- Conventional Money on Money Go back: 1.11%

- Conventional Cap Fee: 1.13%

- Value to Hire Ratio: 41

- Days on Marketplace: 95

- Stroll Rating: 41.65

Charleston is among the quickest rising housing markets because of its location close to the sea. Town is situated with regards to the sea, making it a fascinating location for other people taking a look to survive the seaside. Citizens can partake in numerous actions downtown, comparable to buying groceries and eating out. The posh buying groceries facilities and stylish eating places create never-ending activity alternatives for other people relocating to are living nearer to the sea.

The normal condominium source of revenue may be somewhat prime in Charleston at round $3,089 per thirty days. It is going to lend a hand be sure that a successful go back on funding.

6. Sarasota-Bradenton, Florida

- Collection of Listings for Sale: 372

- Median Assets Value: $1,669,608

- Moderate Value consistent with Sq. Foot: $607

- Collection of Conventional Listings: 1,210

- Per 30 days Conventional Apartment Source of revenue: $1,210

- Conventional Money on Money Go back: 1.83%

- Conventional Cap Fee: 1.88%

- Value to Hire Ratio: 43

- Days on Marketplace: 51

- Stroll Rating: 50

The following town in our quickest rising condominium markets in the USA is Sarasota, Florida. The realm is situated proper at the beach, so citizens can pass to the seaside on every occasion they would like. Additionally it is a town identified for boating actions, which attracts other people taking a look to revel in the boating climate year-round.

Town’s faculty districts are one of the crucial best employers within the space. It may be a very good position for lecturers searching for a brand new activity alternative.

Sarasota is a brilliant location for a standard condominium belongings as persons are relocating to the realm for activity alternatives and to revel in the year-round stunning boating climate.

7. San Antonio, Texas

- Collection of Listings for Sale: 2182

- Median Assets Value: $350,990

- Moderate Value consistent with Sq. Foot: $215

- Collection of Conventional Listings: 6915

- Per 30 days Conventional Apartment Source of revenue: $1,543

- Conventional Money on Money Go back: 1.67%

- Conventional Cap Fee: 1.71%

- Value to Hire Ratio: 19

- Days on Marketplace: 54

- Stroll Rating: 37

San Antonio will also be the best possible position to shop for condominium belongings for traders. Town is house to one of the crucial biggest army bases in the USA. It manner households are continuously transferring to the town searching for a long-term position to stick. Moreover, the town’s 3 army bases supply a whole lot of activity alternatives for native citizens.

Moreover, San Antonio has various employment alternatives for other people within the healthcare and tourism trade. Imagine the town on your subsequent conventional condominium.

8. Dallas-Castle Value, Texas

- Collection of Listings for Sale: 6

- Median Assets Value: $710,983

- Moderate Value consistent with Sq. Foot: $461

- Collection of Conventional Listings: 0

- Per 30 days Conventional Apartment Source of revenue: $1,600

- Conventional Money on Money Go back: 0.48%

- Conventional Cap Fee: 0.50%

- Value to Hire Ratio: 37

- Days on Marketplace: 39

- Stroll Rating: 12

Subsequent on our checklist of quickest rising condominium markets in the USA is Dallas-Castle Value in Texas. It is among the biggest towns in the USA, providing a whole lot of facilities to its citizens. For recreational, there are buying groceries, leisure, and quite a lot of eating choices for the native inhabitants to profit from.

Town may be house to the headquarters of many huge firms. AT&T, American Airways, and Southwest Airways are headquartered in Dallas-Castle Value. Folks within the generation or air commute trade can get pleasure from the employment alternatives via the mentioned firms.

Folks wish to transfer to the town to discover the entire actions downtown, in addition to participate within the activity alternatives discovered within the town.

Similar: The Easiest Apartment Markets in Texas: The 2022 Information

9. Phoenix, Arizona

- Collection of Listings for Sale: 865

- Median Assets Value: $718,982

- Moderate Value consistent with Sq. Foot: $357

- Collection of Conventional Listings: 5706

- Per 30 days Conventional Apartment Source of revenue: $2,294

- Conventional Money on Money Go back: 2.13%

- Conventional Cap Fee: 2.16%

- Value to Hire Ratio: 26

- Days on Marketplace: 62

- Stroll Rating: 28

Phoenix is every other quickest rising condominium marketplace in the USA. Town accounts for a big portion of Arizona and is often known as the “Valley of the Solar.” Primary large banking firms like Wells Fargo and Financial institution of The usa are based totally in Phoenix, attracting other people of every age to the realm on the lookout for employment.

Moreover, Phoenix is understood for its heat climate all yr around. Folks taking a look to revel in summer time climate any time of the yr wish to transfer to a sunny town.

10. Charlotte, North Carolina

- Collection of Listings for Sale: 865

- Median Assets Value: $607,292

- Moderate Value consistent with Sq. Foot: $335

- Collection of Conventional Listings: 2826

- Per 30 days Conventional Apartment Source of revenue: $1,985

- Conventional Money on Money Go back: 1.69%

- Conventional Cap Fee: 1.73%

- Value to Hire Ratio: 26

- Days on Marketplace: 53

- Stroll Rating: 36

Ultimate on our quickest rising condominium markets in the USA is Charlotte, North Carolina. It may be a very good position for a standard condominium belongings as persons are transferring to the town for activity alternatives and are searching for a spot to stick. The per thirty days condominium source of revenue in Charleston will also be thought to be prime at $1,985, which guarantees you’ll generate a go back in your funding.

One of the best possible activity alternatives in Charlotte are at Financial institution of The usa. It is among the biggest employers within the town with over 15,000 workers.

Guidelines for Conventional Apartment Homes

Underneath are a couple of pointers that can assist you in making an investment in conventional condominium houses:

BRRRR Technique

If you have an interest in making an investment within the quickest appreciating actual property markets, you might have considered trying some pointers for normal leases. One tip pertains to the BRRRR technique. BRRRR necessarily stands for the “purchase, rehab, hire, refinance, repeat” technique.

Within the BRRRR technique, traders focal point at the important renovations to a condominium belongings they acquire. It manner they may be able to temporarily repair a belongings after which ask for more cash to hire it out every month. One of these technique is helping to create a handy guide a rough go back on funding.

Underneath are some benefits to the BRRRR technique:

- Purchasing a belongings faster

- Little downtime ahead of with the ability to hire it out

- Create fairness

- Develop condominium source of revenue

- Make investments with little money

- Obtain loans with now not the most productive credit score

The BRRRR technique is practiced amongst traders who wish to make a handy guide a rough benefit in conventional condominium houses. On the other hand, you will need to word there are some disadvantages to the method.

First, it’s imaginable renovations may just take for much longer than anticipated or price greater than first of all supposed. It might make producing a handy guide a rough benefit tougher. 2d, it’s imaginable you wouldn’t make sufficient cash to refinance the valuables. Failing to lift sufficient would make all the technique useless.

At all times pay attention to the advantages and negatives ahead of making an attempt the BRRRR technique when renovating a belongings in one of the crucial quickest rising condominium markets in the USA.

Similar: BRRRR Making an investment: 5 Tricks to Make sure that Luck

Funding Assets Calculator

Some other useful tip for making an investment in conventional leases is to test the knowledge in your belongings ahead of buying it. To take action, we suggest the use of our Funding Assets Calculator. The software displays you the way your private home is predicted to accomplish in accordance with up-to-date actual property information and developments. We handiest use information from dependable resources, such because the MLS, to run your private home research.

Mashvisor’s condominium belongings calculator gifts you with each metrics and a complete condominium technique, so you’ll be able to make the most productive actual property choices. Underneath are the metrics incorporated:

Moreover, the above information is when put next between conventional and Airbnb houses, so you’ll be able to get a hold of the most productive technique on your source of revenue belongings.

Actual Property Heatmap

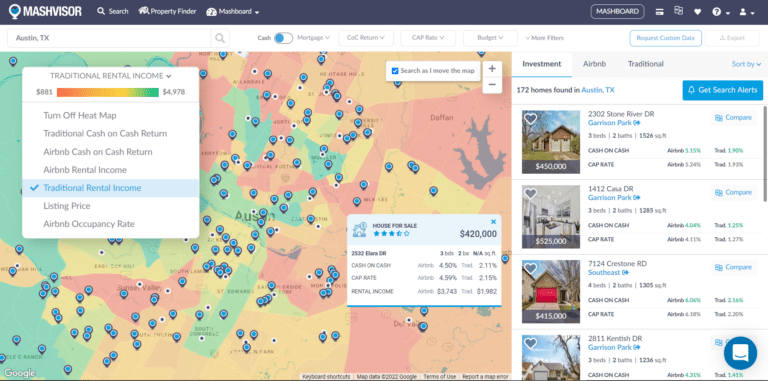

Mashvisor provides a very good software for finding the most productive spaces for a condominium belongings. Our Actual Property Heatmap software is helping to turn essentially the most successful neighborhoods in any town in the USA. You’ll be able to seek more than one places directly to search out your easiest funding space.

To resolve which neighborhoods will generate the most productive go back on funding, we use actual property metrics to match spaces. Underneath are one of the most information we believe:

- Apartment source of revenue

- Money on money go back

- Cap fee

- Occupancy fee

This software will without a doubt will let you in finding one of the most quickest rising condominium markets in the USA this 2022.

Mashvisor’s Actual Property Heatmap software is helping traders in finding essentially the most successful neighborhoods in any US town.

Conclusion

Above, we checked out one of the most quickest rising condominium markets in the USA. The places will also be thought to be promising places for normal condominium houses in 2022 because of a whole lot of activity alternatives and fascinating actions to participate in. Folks from all over the place are relocating to the mentioned towns and will likely be on the lookout for a spot to stick.

To start out searching for and inspecting the most productive funding houses for your town and community of selection, click on right here. To be told extra about Mashvisor’s gear, time table a demo quickly.