Citi

Citi is an promoting spouse.

The content material in this web page is correct as of the posting date; alternatively, one of the vital provides discussed will have expired.

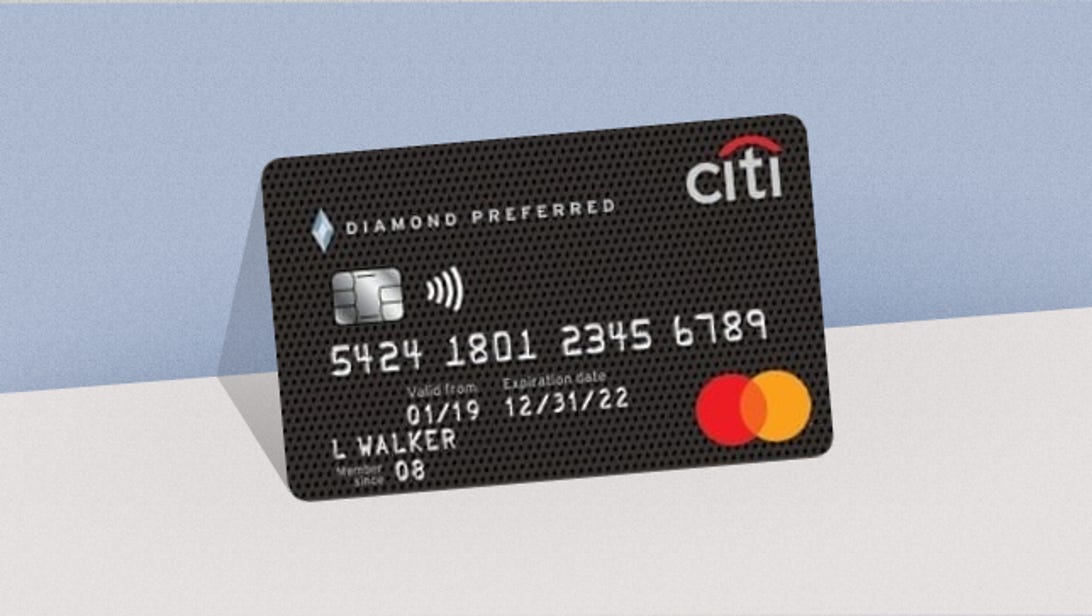

The Citi® Diamond Most well-liked® Card — predominantly recognized for its lengthy introductory APR length on stability transfers — is now providing a welcome bonus.

Welcome bonuses are exceptionally uncommon amongst stability switch bank cards. The Diamond Most well-liked card is providing a $150 remark credit score after you spend $500 in purchases throughout the first 3 months of account opening. Balances transferred to this card may not qualify towards the spending threshold.

In the event you plan to make use of this card on new purchases to qualify towards the welcome bonus threshold, you could possibly additionally get to profit from the 0% introductory APR on purchases for 365 days. This be offering is along with the 21 months of 0% introductory APR on stability transfers (stability transfers should be finished inside of 4 months of account opening). After each introductory sessions, the variable APR on purchases and stability transfers strikes to 13.99% to 23.99%.

In relation to welcome bonuses, this isn’t the most efficient one to be had available on the market. On the other hand, it is rather obtainable with a low spending threshold. The Chase Freedom Flex℠ has this card beat with a quite higher welcome bonus ($200) for a similar spending threshold ($500 within the first 3 months).

The editorial content material in this web page is primarily based only on purpose, impartial tests via our writers and isn’t influenced via promoting or partnerships. It has no longer been equipped or commissioned via any 3rd birthday party. On the other hand, we might obtain repayment while you click on on hyperlinks to merchandise or services and products presented via our companions.