Industry-minded people make funding choices to make a benefit. Because of this, the capitalization fee performs crucial position in any investor’s decision-making procedure, because it is likely one of the issues that can resolve the profitability of a mission.

Desk of Contents

- What Is Capitalization Price?

- How you can Calculate Capitalization Price in Actual Property

- 10 Places with the Best possible Cap Charges for Funding Assets Homeowners

- The Backside Line

Let’s take a more in-depth have a look at what a capitalization fee is and the position it performs in actual property making an investment.

What Is Capitalization Price?

Buyers move into trade with without equal objective of creating a benefit and getting a just right go back for the cash they spend. A capitalization fee actual property, or cap fee, is a metric used to measure the go back on funding of an funding belongings irrespective of technique, whether or not it’s a condo or BRRRR technique. Even if different metrics may also be used to resolve ROI, the cap fee is likely one of the maximum utilized in actual property making an investment.

Capitalization Price Definition

Cap fee, by means of definition, is the go back fee of an actual property funding belongings in accordance with the predicted source of revenue the stated belongings is anticipated to generate. Merely put, it determines how a lot an investor can earn from the valuables.

Why Is It Vital in Actual Property Making an investment?

Numerous people are all the time taking a look to reinforce their source of revenue and discovering tactics to generate a passive source of revenue supply this is financially rewarding however no longer too time-consuming. Veteran buyers and notable millionaires declare that actual property is likely one of the issues that meet each standards.

The item is, actual property investments are lovely large-scale and may also be slightly overwhelming, particularly to buyers who’re simply beginning out. Alternatively, the rewards may also be completely value it, bearing in mind the year-round source of revenue and money drift funding houses can generate. It may yield higher returns in comparison to shares and bonds. Plus, it’s extra solid since it isn’t correlated to the fluctuations of conventional―normally unstable―markets. It’s only a subject of understanding the place to place cash to get the most productive conceivable ROI.

In actual property, ROI is made up our minds by means of two key metrics: money on money go back and cap fee. Whilst the previous is utilized by extra buyers, the latter is similarly essential in making an investment.

The principle distinction between the 2 is that money on money go back represents a belongings’s doable annual profitability, assuming that it used to be bought with all money. It signifies that it takes into consideration the financing way utilized by the investor to obtain an actual property belongings. Nevertheless it’s a wholly other dialogue that’s highest stored for every other day.

Then again, the cap fee highlights the connection between the web running source of revenue (NOI) and the valuables’s marketplace price.

Comparable: The place to In finding Cap Price Knowledge for Residential Actual Property?

What Is a Just right Cap Price for Actual Property Investments?

For individuals who are questioning the way to spend money on actual property, you want to know how each and every funding metric is measured to provide you with an concept of what the ROI is like. The objective is, in spite of everything, to generate profits and no longer simply spoil even.

Cap charges are one among two primary ROI determiners in any actual property funding. However what precisely is a great capitalization fee? How a lot will have to it’s for an funding to be regarded as a good fortune?

Technically, the solution to such questions is it depends upon how it’s used. As an example, if you happen to’re making plans to promote a belongings, a decrease cap fee works highest as it signifies that the valuables price is upper. At the turn facet, a better cap fee is perfect for whilst you purchase a belongings as it approach you are going to desire a decrease preliminary funding.

When Must Buyers Use Cap Charges in Actual Property Making an investment?

There are 3 benefits to the usage of a cap fee. The primary one is one of the vital glaring. It’s simple to compute because the data wanted is instantly to be had. It makes evaluating returns on other funding sorts more practical for buyers.

2d, it supplies buyers with a greater perception into the valuables’s profitability. The ensuing share already provides them an concept of the way a lot they may be able to earn in the event that they purchase the valuables with money. Although a debt used to be used to buy the valuables, the go back can be considerably upper than the cap fee.

3rd, on account of the connection between threat and go back, the cap fee is helping buyers gauge belongings threat. It signifies that the upper the cap fee, the upper the danger, and the decrease the valuables acquire value. Then again, decrease threat approach a decrease cap fee, which additionally approach a better belongings acquire value.

That being stated, buyers normally use cap charges to display offers. As an example, if an investor is on the lookout for a belongings with an 8% cap fee or upper, any belongings represented by means of decrease cap charges may also be weeded out.

It’s also extraordinarily useful in assessing high-risk houses. A belongings with a 5% cap fee may also be simply when compared with one with a ten% cap fee to peer which one comes with a better threat top class in the similar community.

How you can Calculate Capitalization Price in Actual Property

Now let’s check out the way to compute the capitalization fee.

Capitalization Price Components

Computing the cap fee is moderately easy because the knowledge you are going to want is definitely obtainable. The essential main points to grasp are the web running source of revenue (NOI) and the valuables asset price. The cap fee is just the proportion of go back when you’re taking the NOI and divide it by means of the valuables’s marketplace price (assuming that the total quantity is paid in money).

Cap Price = Web Running Source of revenue / Assets Price

Computing for an Funding Assets’s Cap Price

Let’s say you propose to obtain a belongings that prices $100,000, inclusive of last prices and maintenance. Then, you’re taking that belongings and make a decision to hire it out as a conventional condo for $1,000 a month for one complete yr. It will herald a complete of $12,000 in annual source of revenue. Alternatively, you additionally want to pay for positive habitual bills that may price you about $200 per thirty days or $2,400 for all the yr. It signifies that your NOI (Overall Earnings – Running Bills) for that yr can be $9,600.

Given the entire numbers above, you are going to finally end up with a cap fee equation of:

- $12,000 – $2,400 (NOI) / $100,000 (Assets Price)

- $9,600 / $100,000 = 0.096

The use of the cap fee method, you are going to get a worth of 0.096 as your cap fee, or a 9.6% go back at the money funding.

The numbers, after all, will range in accordance with the valuables sort and advertise is in, however the primary is similar.

Mashvisor’s Cap Price Calculator

For the reason that numbers do alternate and sure different components want to be regarded as for computing essentially the most correct cap fee, buyers flip to funding calculators to assist them work out the maths.

Tens of 1000’s of actual property buyers accept as true with Mashvisor’s funding belongings calculator, serving to them no longer most effective get essentially the most correct cap charges but additionally in finding appropriate funding houses in accordance with their calculations.

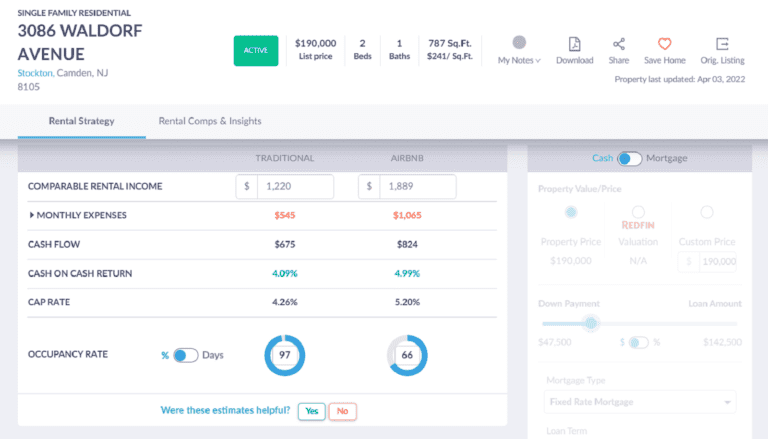

One in all Mashvisor’s benefits over the contest is that its funding belongings calculator additionally comes with a cap fee calculator, which truly sweetens the deal for its customers. It makes each conventional and Airbnb knowledge research swifter and so much easier.

Whilst the cap fee method is also easy to grasp and simple to compute, the usage of Mashvisor’s capitalization fee calculator provides buyers an edge because it permits them to additionally examine cap charges of an identical houses in the similar community. It provides customers a extra correct perception into the marketplace they’re taking a look at. The calculator is helping buyers analyze a number of condo houses, calculate the related metric, and make a well-informed resolution about which funding houses highest have compatibility their actual property portfolio.

To get get admission to to our actual property funding gear, click on right here to enroll in a 7-day unfastened trial, adopted by means of 15% off for existence.

Comparable: Mashvisor: The Most sensible Cap Price Calculator in 2022

Mashvisor’s Funding Assets Calculator comes with a Cap Price Calculator, which is helping buyers analyze a number of condo houses, calculate the related metric, and make a well-informed funding resolution.

10 Places with the Best possible Cap Charges for Funding Assets Homeowners

Now that we’ve already established the significance of cap charges and the way to spot just right offers the usage of the metric, buyers could be questioning which actual property markets in the United States have the most productive cap charges. We’ve made a listing of ten markets with one of the highest cap charges nowadays, consistent with Mashvisor’s huge and highly-accurate database.

Keep in mind, on the other hand, that each and every the true property marketplace regularly evolves and the numbers constantly alternate. The stats are in all probability to switch in a couple of weeks, so it’s nonetheless highest to accomplish due diligence when on the lookout for the most productive puts to spend money on. In mild of the stated inevitable marketplace adjustments, Mashvisor frequently updates its database to offer buyers essentially the most correct data and information they are going to want to analyze funding houses.

That being stated, listed here are ten markets nowadays with the most productive cap charges for each conventional and holiday leases:

Most sensible Markets with the Best possible Cap Charges for Conventional Condominium Houses

If you happen to’re questioning the place the highest position to shop for condo belongings is so far as conventional cap charges are involved, take a look at the next places:

1. Camden, NJ

- Median Assets Worth: $154,375

- Reasonable Worth consistent with Sq. Foot: $120

- Choice of Conventional Listings: 160

- Per 30 days Conventional Condominium Source of revenue: $1,321

- Conventional Money on Money Go back: 7.36%

- Conventional Cap Price: 7.86%

- Worth to Hire Ratio: 10 (low)

- Stroll Ranking: 63

2. Chester, PA

- Median Assets Worth: $141,939

- Reasonable Worth consistent with Sq. Foot: $102

- Choice of Conventional Listings: 201

- Per 30 days Conventional Condominium Source of revenue: $1,218

- Conventional Money on Money Go back: 7.00%

- Conventional Cap Price: 7.44%

- Worth to Hire Ratio: 10 (low)

- Stroll Ranking: 66

3. Lantana, FL

- Median Assets Worth: $322,460

- Reasonable Worth consistent with Sq. Foot: $333

- Choice of Conventional Listings: 118

- Per 30 days Conventional Condominium Source of revenue: $2,237

- Conventional Money on Money Go back: 4.77%

- Conventional Cap Price: 4.92%

- Worth to Hire Ratio: 12 (low)

- Stroll Ranking: 65

4. Dearborn Heights, MI

- Median Assets Worth: $215,617

- Reasonable Worth consistent with Sq. Foot: $165

- Choice of Conventional Listings: 250

- Per 30 days Conventional Condominium Source of revenue: $1,372

- Conventional Money on Money Go back: 4.54%

- Conventional Cap Price: 4.78%

- Worth to Hire Ratio: 13 (low)

- Stroll Ranking: 60

5. Odessa, TX

- Median Assets Worth: $302,945

- Reasonable Worth consistent with Sq. Foot: $147

- Choice of Conventional Listings: 419

- Per 30 days Conventional Condominium Source of revenue: $1,695

- Conventional Money on Money Go back: 4.09%

- Conventional Cap Price: 4.25%

- Worth to Hire Ratio: 15 (low)

- Stroll Ranking: 53

Most sensible Markets with the Best possible Cap Charges for Holiday Condominium Houses

For individuals who are leaning towards momentary condo houses for Airbnb and different an identical platforms, the next puts are the highest Airbnb markets with nice cap charges:

1. State Faculty, PA

- Median Assets Worth: $437,828

- Reasonable Worth consistent with Sq. Foot: $223

- Choice of Airbnb Listings: 268

- Per 30 days Airbnb Condominium Source of revenue: $5,728

- Airbnb Money on Money Go back: 8.02%

- Airbnb Cap Price: 8.22%

- Airbnb Day by day Price: $497

- Airbnb Occupancy Price: 52%

- Stroll Ranking: 94

2. Sheboygan, WI

- Median Assets Worth: $202,600

- Reasonable Worth consistent with Sq. Foot: $141

- Choice of Airbnb Listings: 127

- Per 30 days Airbnb Condominium Source of revenue: $2,592

- Airbnb Money on Money Go back: 7.48%

- Airbnb Cap Price: 7.81%

- Airbnb Day by day Price: $315

- Airbnb Occupancy Price: 45%

- Stroll Ranking: 88

3. Bushkill, PA

- Median Assets Worth: $331,909

- Reasonable Worth consistent with Sq. Foot: $157

- Choice of Airbnb Listings: 105

- Per 30 days Airbnb Condominium Source of revenue: $4,131

- Airbnb Money on Money Go back: 7.57%

- Airbnb Cap Price: 7.77%

- Airbnb Day by day Price: $323

- Airbnb Occupancy Price: 50%

- Stroll Ranking: 0

4. Galena, IL

- Median Assets Worth: $445,852

- Reasonable Worth consistent with Sq. Foot: $229

- Choice of Airbnb Listings: 216

- Per 30 days Airbnb Condominium Source of revenue: $4,781

- Airbnb Money on Money Go back: 7.41%

- Airbnb Cap Price: 7.60%

- Airbnb Day by day Price: $269

- Airbnb Occupancy Price: 63%

- Stroll Ranking: 76

5. Berkeley Springs, WV

- Median Assets Worth: $426,810

- Reasonable Worth consistent with Sq. Foot: $202

- Choice of Airbnb Listings: 143

- Per 30 days Airbnb Condominium Source of revenue: $4,261

- Airbnb Money on Money Go back: 7.39%

- Airbnb Cap Price: 7.55%

- Airbnb Day by day Price: $216

- Airbnb Occupancy Price: 67%

- Stroll Ranking: 5

Comparable: What Is a Just right Cap Price for Condominium Assets: Conventional vs Airbnb?

The Backside Line

Capitalization fee is crucial metric used to resolve how successful an funding belongings may also be. Relying on their objectives, it might probably assist buyers resolve which houses are value taking a look into and which of them can be a whole waste in their time. It is helping accelerate the due diligence procedure since you’ll be able to simply take out numerous different houses that don’t meet your standards.

With the assistance of a website online like Mashvisor and its cap fee calculator, buyers may have an more uncomplicated time making instructed choices within the shortest period of time. To be informed extra about how Mashvisor mean you can in finding successful funding houses, agenda a demo.