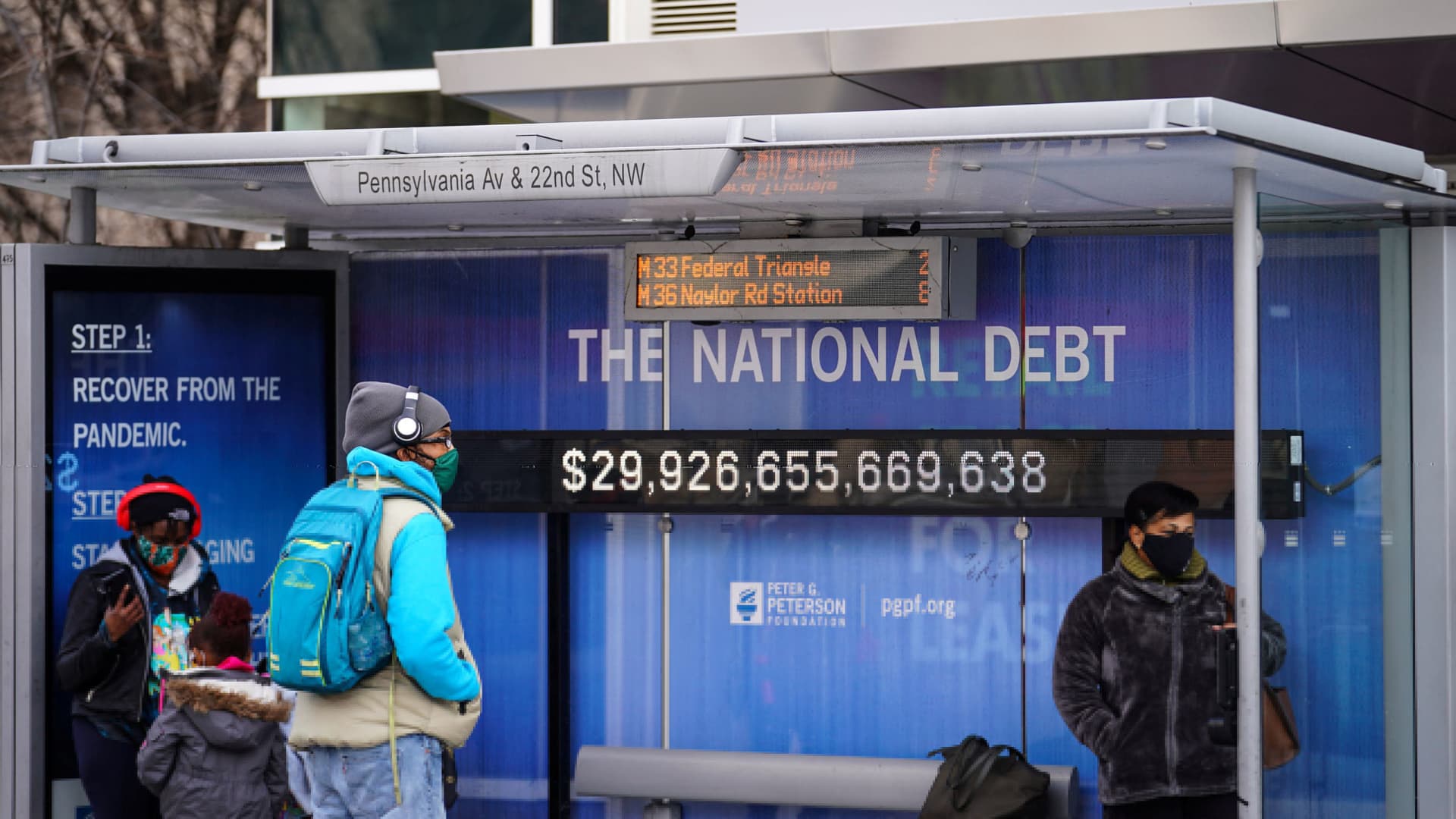

Other people dressed in protecting face mask wait at a bus prevent with a show of the present nationwide debt amid the coronavirus illness (COVID-19) pandemic in Washington, January 31, 2022.

Sarah Silbiger | Reuters

LONDON — International sovereign debt is anticipated to climb by means of 9.5% to a report $71.6 trillion in 2022, in step with a brand new record, whilst recent borrowing could also be extensively set to stay increased.

In its 2d annual Sovereign Debt Index, printed Wednesday, British asset supervisor Janus Henderson projected a 9.5% upward push in world executive debt, pushed basically by means of the U.S., Japan and China however with nearly all of nations anticipated to extend borrowing.

International executive debt jumped 7.8% in 2021 to $65.4 trillion as each nation assessed noticed borrowing building up, whilst debt servicing prices dropped to a report low of $1.01 trillion, an efficient rate of interest of simply 1.6%, the record mentioned.

Alternatively, debt servicing prices are set to upward push considerably in 2022, mountaineering round 14.5% on a constant-currency foundation to $1.16 trillion.

The U.Ok. will really feel the sharpest impact at the again of emerging rates of interest and the affect of surging inflation at the considerable amounts of U.Ok. index-linked debt, in conjunction with the prices related to unwinding the Financial institution of England’s quantitative easing program.

“The pandemic has had an enormous affect on executive borrowing – and the after-effects are set to proceed for a while but. The tragedy unfolding in Ukraine could also be prone to drive Western governments to borrow extra to fund higher protection spending,” mentioned Bethany Payne, portfolio supervisor for world bonds at Janus Henderson.

Germany has already vowed to ramp up its protection spending to greater than 2% of GDP in a pointy coverage shift since Russia’s invasion of Ukraine, in conjunction with committing 100 billion euros ($110 billion) to a fund for its armed products and services.

New sovereign borrowing is anticipated to achieve $10.4 trillion in 2022, virtually a 3rd above the common previous to the Covid-19 pandemic, in step with the most recent world borrowing record from S&P International Rankings printed on Tuesday.

“We predict borrowing to stick increased, owing to top debt-rollover wishes, in addition to fiscal coverage normalization demanding situations posed by means of the pandemic, top inflation, and polarized social and political landscapes,” mentioned S&P International Rankings credit score analyst Karen Vartapetov.

The continuing warfare’s world macroeconomic repercussions are anticipated to exert additional upward drive on executive investment wishes, whilst tighter financial stipulations will building up executive investment prices, the record highlighted.

This poses an additional headache for sovereigns that experience up to now struggled to reignite expansion and minimize reliance on foreign currencies financing, and whose pastime expenses are already considerable.

In complicated economies, borrowing prices are anticipated to upward push however most probably stay at a degree that may permit governments time for funds consolidation, S&P mentioned, providing governments time for funds consolidation and concentrate on expansion stimulating reforms.

Alternatives for traders

Convergence of financial coverage emerged as a theme all through the primary couple of years of the pandemic, as central banks minimize rates of interest to historical lows to assist improve unwell economies.

Alternatively, Janus Henderson famous that divergence is now rising as a key theme, as central banks within the U.S., U.Ok., Europe, Canada and Australia glance to tighten the coverage strings to include inflation, whilst China continues to take a look at to stimulate the financial system with a extra accommodative coverage stance.

This divergence provides alternatives for traders in short-dated bonds which are much less prone to marketplace stipulations, Payne prompt, highlighting two places specifically.

“One is China, which is actively enticing in loosening financial coverage, and Switzerland, which has extra coverage from inflationary drive as power takes up a way smaller share of its inflationary basket and their coverage is tied, however lagging, to the ECB,” she mentioned.

Janus Henderson additionally believes shorter-dated bonds glance horny at this time relative to riskier long-term ones.

“When inflation and rates of interest are emerging, it’s simple to brush aside mounted source of revenue as an asset elegance, in particular since bond valuations are fairly top by means of historic requirements,” Payne mentioned.

“However the valuation of many different asset categories is even upper and investor weightings to executive bonds are fairly low, so there’s a receive advantages in diversifying.”

What is extra, she argued, the markets have most commonly priced in upper inflation expectancies, so bonds purchased these days take pleasure in upper yields than they’d have a couple of months in the past.

Correction: The headline in this tale has been up to date with the proper determine for world executive debt.