The capitalization fee, or cap fee, illustrates the expected fee of go back on an source of revenue assets. If you wish to know what is a superb actual property cap fee for 2022, stay studying.

Desk of Contents

- What Is Cap Price in Actual Property?

- Estimating Actual Property Cap Price

- Cap Price Utilization and Drawbacks

- What Is Thought to be a Just right Cap Price?

- What Elements Impact the Cap Price?

- Most sensible 8 Towns With the Best Conventional Cap Price

- Most sensible 8 Towns With the Best Airbnb Cap Price

- How Can Mashvisor Lend a hand?

- Conclusion

It can be intimidating to pursue a large-scale acquire, particularly for the primary time. The problems of what, when, and methods to fund your long term are important. Following actual property’s restoration during the last decade, it’s now most likely the one best possible approach for marketers to offer protection to their financial long term.

Actual property would possibly supply higher and extra consistent returns than shares and bonds, from year-round earnings to stable money flows. Prior to beginning to put money into actual property, analyze your alternatives to be sure you’re choosing probably the most rational and skilled choice. The cap fee is a superb start line in relation to actual property.

What Is Cap Price in Actual Property?

The capitalization fee is a time period utilized in actual property building to explain the estimated fee of go back on an actual property assets. The metric is generated primarily based on the web source of revenue that the valuables is anticipated to earn and is represented as a proportion by way of splitting web running source of revenue by way of assets web property. It calculates the possible go back on an investor’s funding in the true property trade.

The actual property cap fee is in a position to temporarily evaluating the relative value of similar actual property investments. Alternatively, it shouldn’t be observed as the principle predictor of an funding’s energy because it ignores leverage, the time price, and incoming money flows from assets enhancements. There are not any set laws for what makes a excellent or dangerous cap fee, and it’s closely influenced by way of the valuables’s and marketplace’s cases.

Similar: Learn how to Carry out a Actual Property Marketplace Research

Estimating Actual Property Cap Price

The cap fee actual property is probably the most incessantly used metric for comparing the profitability of actual property property. The metric necessarily presentations a assets’s go back over a one-year time scale, supposing the valuables is paid for in money slightly than funded. The capitalization actual property fee represents the elemental, natural, and unleveraged fee of go back on funding.

Components for Capitalization Price

There are a number of strategies for calculating the capitalization fee. The cap fee of assets funding is decided the usage of the most typical system by way of dividing the construction’s web running source of revenue (NOI) by way of the existing marketplace price.

If we do it mathematically, the cap fee system looks as if the next:

Internet Working Source of revenue / Present Marketplace Price = Cap Price

The online running source of revenue is the (anticipated) every year source of revenue earned by way of the valuables (akin to leases) after deducting all expenditures required for assets control. The expenditures come with the price of regimen facility repairs, in addition to actual property taxes.

The funding’s present marketplace value is the valuables’s present marketplace price in response to present marketplace charges. The quantity is calculated the usage of the valuables’s preliminary capital or acquire price in some other shape.

Internet Working Source of revenue / Acquire Value = Cap Price

Then again, the second one approach isn’t specifically in style for 2 major causes. Basically, it produces false effects for outdated houses got at low costs a few years in the past. Then, it can’t be used for inherited houses as a result of their general price is 0, making department unfeasible.

As a result of assets values alternate such a lot, the primary actual property cap fee system, which makes use of the present marketplace value, is a extra practical image than the second one, which employs the set price preliminary acquire value.

Capitalization Price Examples

Think you need to shop for a multi-family condo to make use of as a condominium assets. Assets A is positioned within the middle, whilst Assets B is positioned at the town’s edge. You expect that Assets A will make $30,000 in hire every 12 months, however you’ll want to pay $8,000 in actual property taxes and upkeep, leaving you with a web source of revenue of $22,000. Since the present assets price is $300,000, your cap fee could be 7.3%.

($22,000 / $300,000) x 100% = 7.3%

At the different facet, Assets B generates a $40,000 web running source of revenue and springs with a $200,000 present marketplace price. Your cap fee at the asset could be 20%.

Upper actual property cap charges seem to be higher in idea as a result of they constitute upper charges of go back, however purchasing a assets at the fringe of the town with little call for would possibly move improper. Inspecting issues as opposed to cap charges is important when comparing funding choices.

Cap Price Utilization and Drawbacks

Traders use the capitalization fee to decide an asset’s long term go back on funding or profitability. When making an investment in actual property, you need to maximise your possibilities of benefit whilst ultimate inside your protection zone.

Actual property cap fee can lend a hand you decide between marketplaces, assets varieties, and different funding choices. As an example, to estimate conceivable benefit, examine a assets’s cap fee to the once a year rate of interest on government-issued T-bills.

Those two funding choices, regardless that, aren’t absolutely related. T-bills supply a safety measure by way of making sure a collection go back if held till adulthood. There are dangers in funding assets, which may also be influenced by way of the valuables’s promoting price, the true property marketplace, vacancies or dangerous tenants, or unfavorable money waft.

Assets investments are dangerous since cap charges are primarily based only on predicted web source of revenue and transferring marketplace values.

What Is Thought to be a Just right Cap Price?

Cap charges are set by way of anticipated long term earnings, which may also be risky and alter vastly. A excellent cap fee for condominium assets is decided by way of what you need to earn from an asset and what sort of you are prepared to possibility.

A better cap fee suggests better possibility, while a decrease cap fee implies decrease possibility. The actual property cap fee additionally presentations an inverse reference to the valuables’s price. A better cap fee is related to a extra pricey assets, while a decrease cap fee is related to a more cost effective house.

Similar: Moderate Go back on Funding: The entirety You Wish to Know

What Elements Impact the Cap Price?

Prior to the usage of a cap fee to purchase funding houses, it’s important to grasp the weather that affect the speed. Incapacity to take action would possibly lead to a deficient – and dear – industry selection. Listed here are the 3 maximum crucial facets that have an effect on the capitalization fee.

1. Assets Kind

In line with B&B Friends LLP, there are six classes of assets: commercial, residential, industrial, commercial, mixed-use, agricultural, and particular goal, which can be additional subdivided by way of assets options.

Industrial assets, as an example, comprises, amongst different issues, workspaces, retail shops, and accommodations. The hazards, expenditures, and conceivable returns are decided by way of the kind of assets, which influences the cap fee.

2. Assets Price

The actual property cap fee for actual property property varies relying on how they tie into {the marketplace}. On a national foundation, town actual property incessantly supplies upper cap charges than related houses in smaller puts or villages.

As a result of metropolitan economies are extra various, full of life, and strong, such funding chances are much less problematic than their rural equivalents. Alternatively, that’s no longer at all times the case.

Imagine a massive town condo block. The advanced could be pricey, however the possible earnings could be better as a result of main towns draw in new tenants. With much less threat, one would be expecting a decrease cap fee by way of town than if it have been in a much less closely visited state house.

On a extra native scale, related houses in the community are closely influenced by way of cap charges. A village’s or town’s property are categorised into 3 varieties: Elegance A, Elegance B, and Elegance C.

The classification gadget used to be designed by way of traders, debtors, and agents to higher successfully and safely give an explanation for the standard of a assets. As an example, Elegance A amenities are the most productive on the subject of location and well being. Elegance A structures include a decrease cap fee since they’re extra precious.

3. Apartment Attainable

The traits and situation of a assets affect its general price and the way interesting it’s to possible renters. With out renters, assets funding will supply little to no money, in all probability making it a monetary burden slightly than a income.

Along with options and stipulations, condominium possible considers a large number of facets, akin to the provision and insist for actual property within the area and the stableness of the condominium settlement. All of the mentioned variables affect a assets’s leasing chances and, in consequence, the cap fee.

Now that we’ve lined the entirety there’s about actual property cap fee, let’s see the best possible position to shop for condominium assets taking into account the cap fee.

Similar: Learn how to Review a Apartment Assets Temporarily

Most sensible 8 Towns With the Best Conventional Cap Price

Let’s check out one of the vital towns in the USA with the absolute best cap charges for normal condominium houses. The record is in response to Mashvisor’s most up-to-date cap fee statistics consistent with town.

- Greenwood, MS: 10.18 %

- Spruce Pine, NC: 9.98%

- Suwannee, FL: 9.97%

- Presidio, TX: 9.79%

- Saxonburg, PA: 9.67%

- Alturas, CA: 9.14%

- Sylacauga, AL: 8.98%

- Waterville Valley, NH: 8.70%

Most sensible 8 Towns With the Best Airbnb Cap Price

Let’s check out among the US towns with the absolute best cap charges for Airbnb condominium properties. The next record is in response to the newest cap fee knowledge consistent with town from Mashvisor.

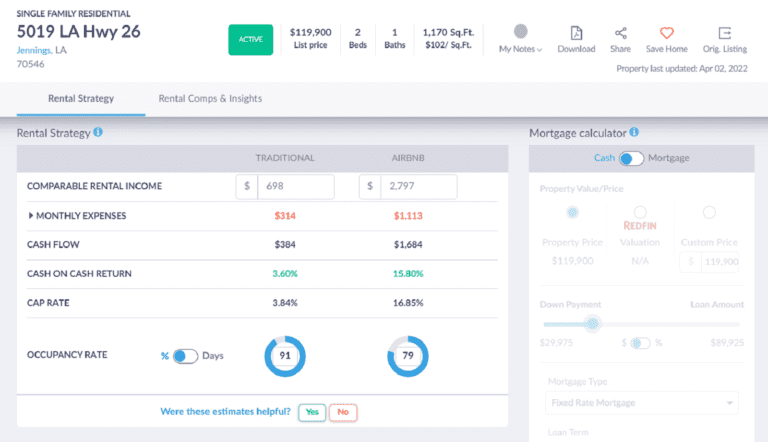

- Jennings, LA: 9.95%

- Dunmore, PA: 9.74%

- Marmora, NJ: 9.55%

- Wolverine Lake, MI: 9.12%

- Matamoras, PA: 9.11%

- Horn Lake, MS: 9.08%

- Centerville, OH: 9.03%

- Centereach, NY: 8.99%

How Can Mashvisor Lend a hand?

Since that actual property funding calls for an important quantity of study and research, the place will have to traders search for probably the most dependable knowledge and among the finest knowledge research equipment? Learn how to put money into actual property? Let’s see how our software can lend a hand.

Mashvisor is a web based actual property platform that objectives to make actual property funding more uncomplicated by way of providing traders probably the most up-to-date knowledge from numerous markets round the USA. It additionally contains various precious actual property making an investment equipment to lend a hand customers find funding houses and doing Airbnb funding analysis. Amongst its maximum essential equipment are:

- Assets Finder: All you want to do is input where you’re enthusiastic about (town, house, or zip code) within the seek box, and also you’ll be offered with an inventory of to be had houses at the MLS.

- Actual Property Heatmap: The heatmap software supplies traders with a extra correct image of marketplace stipulations on the native degree. It’s color-coded to turn whether or not neighborhoods are the most productive acting, poorly acting, or someplace in between.

- Apartment Assets Calculator: Considered one of Mashvisor’s strengths is that our funding assets calculator is greater than a calculator. It additionally allows consumers to search out the most productive houses, learn about the information, and make a decision on the most productive funding plan.

Mashvisor’s Apartment Assets Calculator allows traders to seek for probably profitable houses, analyze knowledge akin to money on money go back and cap fee, and make a decision on the most productive funding technique.

Mashvisor is a superb software for finding the best funding assets that aligns with the objectives of every investor. In finding details about our product right here.

Conclusion

Since each and every investor’s scenarios are distinctive, a favorable cap fee will have to no longer be the one issue to believe. Prior to investing selection, there are a plethora of different elements to take into accounts. As an example, your money waft imaginative and prescient on a specific assets is also considerably other from that of some other investor at the identical asset. What’s a a success assets for one investor is also the other for some other.

An actual property cap fee may also be helpful in figuring out the opportunity of an actual property funding. Nonetheless, its scope is restricted, as a result of they just take into accounts two elements—the valuables’s web running source of revenue and the property’s present marketplace price.

Remember the fact that cap charges are estimations, no longer promises, and they’re at risk of alternate. You will have to bring to mind this fee as a guiding principle on how, when, and the place to put money into assets slightly than as a ensure of financial luck when the usage of it in your corporation lifestyles.

To get get admission to to our actual property funding equipment, click on right here to enroll in a 7-day loose trial of Mashvisor lately, adopted by way of 15% off for lifestyles.