Are professionals seeing indicators of a housing marketplace crash 2022? If it is true or no longer, buyers must understand how to arrange in case a crash occurs.

Up to now couple of years, the United States housing marketplace demonstrated a phenomenal efficiency amid the pandemic. In 2022, homebuyers around the nation proceed to stand difficulties find a assets to shop for as house costs skyrocket and inventories drop. Homebuyers and actual property buyers have interaction in bidding wars, and the United States actual property is no doubt a sizzling supplier’s marketplace. Many are questioning if the rage will proceed or a possible US housing marketplace crash is drawing close in 2022.

Desk of Contents

- What Is a Housing Marketplace Crash?

- Will the United States Housing Marketplace Crash in 2022?

- Conceivable Reasons of a Housing Marketplace Crash 2022

- How Can Buyers Get ready for a Attainable Housing Marketplace Crash?

- Are You In a position for a Housing Marketplace Crash?

What Is a Housing Marketplace Crash?

A housing marketplace crash occurs when there’s an surprising and demanding plunge in house costs. Steadily, an actual property marketplace crash begins with a housing bubble. A housing bubble starts when there’s a surprising surge in call for for residential houses in spite of a restricted quantity of delivery. The imbalance between delivery and insist reasons actual property costs to upward push, typically at an alarmingly top charge.

When speculators input the marketplace, the call for for housing will additional escalate and this may occasionally inflate the bubble extra. The brand new call for and loss of delivery will purpose an extra upsurge in house costs. Then again, in spite of the rise in costs, consumers are nonetheless willing to shop for a house, and a few are even prepared to pay most sensible buck simply to protected a assets. Additional, since stock may just no longer stay alongside of the regularly expanding call for, actual property firms will profit from this via development new homes. Buyers may also attempt to make a benefit via getting their fingers on fixer-upper flips.

All over an actual property bubble, homebuyers generally acquire their houses at very top costs. This implies they’ve to borrow more cash to fund their acquire and even use their financial savings and retirement price range for a down fee. When occasions all of sudden get tricky, folks will to find it tricky to stay alongside of their loan bills, and this regularly leads to foreclosure.

When Does a Housing Marketplace Crash Occur?

So when will the housing marketplace crash? After a undeniable duration, extra housing stock turns into to be had as a reaction to the former call for spike. Then again, by the point the availability will increase, the call for for housing starts to shrink, inflicting the bubble to burst. When the bubble in spite of everything pops, a housing marketplace crash occurs. House values will abruptly decline because the call for for housing drops whilst delivery nonetheless will increase.

In step with Michael Jones, a dealer and actual property marketing consultant, all of the economic system will endure when the true property marketplace crashes. A housing marketplace crash can lead to task losses and diminished client spending, in the end resulting in a recession.

A crash in actual property is regularly led to via a lower in call for for housing whilst stock assists in keeping rising. The rise in housing delivery is most commonly led to via an building up of newly constructed houses from actual property buyers and firms who wish to profit from the prior call for. Prime debt ranges too can purpose a housing marketplace crash 2022. As a result of some debtors can not pay their loan, it can lead to foreclosure, including as much as the housing stock. Regulatory adjustments, greater loan charges, and different international components too can purpose an actual property marketplace crash.

Will the United States Housing Marketplace Crash in 2022?

In step with an article from Fox29, actual property professionals consider that the United States actual property marketplace isn’t appearing indicators of slowing down. House costs aren’t going to say no in 2022—actually, professionals are expecting secure worth beneficial properties starting from 4% to six% this 12 months. Then again, the double-digit building up in house costs and the top collection of a couple of provides for a assets all through the previous couple of years will move down a little bit.

Every other article from AZ Giant Media states that whilst the marketplace isn’t going to stay unchanged, a significant crash isn’t looming at the horizon. We will be able to be expecting a settling of house costs as buyers take a step again, opening extra alternatives for normal homebuyers to discover a assets to shop for.

Whilst it’s not likely to peer a US housing marketplace crash 2022, not anything is about in stone and it’s unattainable to are expecting with simple task. In step with dealer and actual property marketing consultant Michael Jones, some professionals say there’s a chance of a recession in 2022 as a result of a number of signs.

Just lately, the rustic skilled a lower in client spending and an financial slowdown because of a chain of youth inventory marketplace crashes. We’ve additionally noticed international instability because of the pandemic and international disaster introduced via the stress between Ukraine and Russia. They’re 3 of the criteria that stipulate the likelihood {that a} nation might be headed towards a possible 2022 housing marketplace crash. As a actual property investor, it’s crucial to understand how to give protection to your self in case a housing marketplace crash 2022 occurs.

Similar: 2022 Actual Property Marketplace Forecast: Most sensible 10 Predictions

Conceivable Reasons of a Housing Marketplace Crash 2022

We’ve established that an actual property marketplace crash is not likely to occur in 2022 in spite of the expected decline within the appreciation charges of house costs. Then again, the mentioned prediction isn’t utterly in black and white. As discussed, the rustic is seeing a number of trends that point out a conceivable housing marketplace crash 2022, together with international instability and an financial slowdown.

Listed here are the opposite conceivable reasons of a US housing marketplace crash in 2022:

1. Emerging Passion Charges

Professionals are expecting that the Federal Reserve will get started elevating rates of interest all through the primary part of the 12 months. An building up in loan charges can have an effect on the 2022 US housing marketplace. Whilst rates of interest exhibit no direct correlation with house costs, they may be able to impact the call for for housing.

Usually, low loan charges can spike purchaser call for, main to better assets costs. As loan charges are anticipated to head up, we will watch for a slowing down in call for from homebuyers and buyers. It signifies that house costs is not going to develop exponentially as previously couple of years.

2. Build up in Building and Development

Some of the causes for regularly emerging house costs final 12 months is the vastly low housing delivery in lots of US actual property markets. Then again, professionals say we will be expecting a reprieve from the low stock factor as developers are operating double-time to handle the supply-and-demand downside.

With new houses being constructed and new subdivisions being evolved, it could possibly transfer the home actual property marketplace to a extra balanced situation. If the brand new buildings lead to an oversupply, it could possibly most probably result in a housing marketplace crash 2022.

3. International Disaster Can Result in a Recession

With the present international disaster because of the stress between Russia and Ukraine, economists consider that the percentages of a recession in 2022 may just building up. The world sanctions on Russia’s oil exports are riding oil and gasoline costs as much as a harshly top charge. It can lead to a lower in client spending and an building up in inflation.

Then again, the United States economic system stays frequently sturdy, and we’re slowly convalescing from the COVID-19 pandemic. There’s a sturdy task marketplace, and the tourism business is now again on its ft, opening extra doorways of alternatives for quick time period condominium marketplace buyers.

How Can Buyers Get ready for a Attainable Housing Marketplace Crash?

Whilst the percentages of a housing marketplace crash 2022 are low, no person is in point of fact positive about it and not anything in actual property is assured. As actual property buyers, it’s crucial to be ready for such unlucky instances whilst they aren’t but taking place. Getting ready for a possible recession or actual property crash let you safeguard your investments and funds.

Listed here are some sensible guidelines buyers can do to give protection to themselves from a housing marketplace crash:

1. Steer clear of the Concern of Lacking Out

When there’s a actual property bubble and the call for for housing considerably exceeds the to be had delivery, it’s simple to get stuck up in a purchasing frenzy. Buyers and homebuyers are ready for bidding wars, and a few are prepared to pay a considerably upper worth than a assets is price.

The concern of lacking out and no longer with the ability to purchase a house whilst costs stay emerging will most probably drown you when there’s a correction in marketplace costs. When making an investment, it’s necessary to make knowledgeable and prudent choices. Perceive the actual property marketplace research to make certain that you’re no longer purchasing an overpriced assets simply to enroll in the bandwagon.

2. Keep on with Your Finances

Don’t acquire greater than you’ll be able to come up with the money for to pay. Actual property professional Michael Jones instructed buyers to study their price range and make adjustments every time vital. Handiest put money into houses that meet your reasonable price range so you’ll be able to nonetheless pay on your loan in case the economic system takes a plunge.

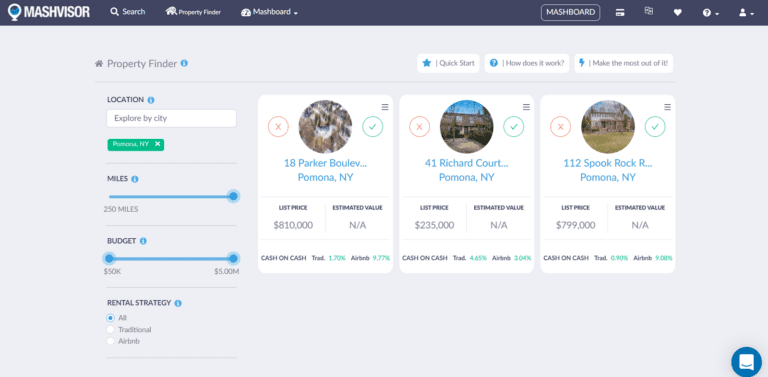

Thankfully, Mashvisor let you seek for an funding assets in response to your particular price range requirement. You’ll be able to use the price range clear out whilst in search of a assets and set your most well-liked minimal and most costs. Mashvisor will handiest display the houses on the market to your decided on house that meet your price range specs.

Mashvisor allows actual property buyers to seek for an funding assets in response to their set standards, similar to distance and minimal and most price range.

3. Construct Your House Fairness via Creating a Massive Down Cost

House fairness refers back to the price of your own home that you simply personal outright in comparison to how a lot you owe on a loan. A bigger house fairness manner you personal a larger portion of your own home. You’ll be able to building up your own home fairness via making a big down fee that you’ll be able to come up with the money for. While you personal extra fairness, it could possibly assist save you foreclosures in case issues take a flip for the more serious.

Then again, you must no longer spend your entire cash on a down fee. As buyers, it’s very the most important so that you can keep liquid and stay sufficient money reserves that let you get thru tricky occasions. In step with Michael Jones, you’ll want get admission to to money so you’ll be able to profit from different alternatives as they get up. Protecting sufficient money reserves too can let you together with your money float all through an financial downturn.

4. Construct an Emergency Fund

Development an emergency fund is very important to arrange for surprising instances. You should definitely save sufficient price range to hide a minimum of 3 to 6 months of bills in case of emergencies. A larger emergency fund is also vital relying for your way of life, price of residing, and the quantity of people who rely on you.

An emergency fund could also be necessary although there is not any upcoming recession or housing marketplace crash 2022. Emergency price range let you all through the off-season, particularly if you’re making an investment in holiday leases. It will probably additionally let you in case of private emergencies, similar to task loss and illness.

5. Diversify Your Investments

Every other efficient manner to give protection to your self from a possible housing marketplace crash 2022 is to make certain that you don’t position your entire eggs in a single basket. For those who handiest put money into actual property, you’ll chance dropping your entire cash in case the United States housing marketplace plummets. To attenuate your chance, it’s necessary to diversify your investments amongst other funding cars, together with shares, bonds, actual property, cryptocurrency, and commodities.

To successfully diversify your price range, it’s the most important to hunt skilled recommendation, particularly should you’re no longer positive what to do or the place to position your cash. In step with Michael Jones, looking for monetary recommendation from a professional skilled let you make knowledgeable funding choices. It will probably additionally offer protection to you from taking needless dangers.

6. Purchase the Proper Funding Assets

Actual property buyers who put money into the correct funding assets are much less prone to get affected in case of a housing marketplace crash. A house continues to be a need. While you put money into the correct location the place there’s a secure call for for housing in spite of an financial downturn, you’ll no longer really feel the have an effect on of a crash that a lot. Then again, when you select to put money into spaces the place call for is prone to get scarce, you’ll be probably the most first to really feel the antagonistic results when the bubble bursts.

To stop it from taking place, it’s necessary to know the true property marketplace traits in a selected location prior to making any funding choice. Fortunately, Mashvisor makes this simple for you via offering complete and up-to-date actual property marketplace information and actual property comps while you seek for a assets.

Similar: What Is the Absolute best Position to Purchase Funding Assets in 2022?

7. Be Proactive in Making a Backup Plan

Every other piece of recommendation from actual property marketing consultant Michael Jones is to devise your funds proactively and watch for a housing marketplace crash 2022, although it’s not likely to occur. Don’t tackle further debt, particularly while you aren’t positive if you’ll be able to come up with the money for to pay it again.

Additionally, construct extra facet hustles and further source of revenue streams to have extra assets of price range to assist quilt your per thirty days loan. Most significantly, keep calm and steer clear of making rash choices. Panicking all through a recession or a housing marketplace crash may cause you to take irrational movements that may price you extra.

Are You In a position for a Housing Marketplace Crash?

After the drastic building up in house costs previously couple of years, the United States housing marketplace is in spite of everything appearing indicators of stabilization in 2022. Actual property professionals are expecting the upward thrust in assets costs will decelerate amid the secure transaction numbers and extra housing stock coming into the marketplace. Then again, actual property buyers don’t wish to panic since the odds are low {that a} housing marketplace crash 2022 will occur. The mentioned forecast is in response to concrete actual property information and traits.

However, whilst professionals consider {that a} housing marketplace crash isn’t anticipated any time quickly, buyers nonetheless wish to be ready. In the end, there are indicators of any other conceivable financial slowdown. As the true property marketplace is continuously converting, it’ll proceed to differ every so often. The easiest way to give protection to buyers from a recession or an unexpected construction is to be ready.