The appearance of algorithms has made technical research much more necessary in these days’s marketplace setting. That is very true on shorter-term trades. Basics are necessary ultimately, however technicals are necessary for the close to time period. I talk about this idea under and find out how to practice this necessary principle to persistently discover profitable choices trades. Learn on for extra.

shutterstock.com – StockNews

Benjamin Graham, the Godfather of Price Making an investment, summed up the perception of technical as opposed to basics together with his quote:

“Within the quick run the marketplace is a balloting device. Ultimately this can be a weighing device.”

The multi-year soften up in shares is beginning to melt. Endured out-sized annual returns will likely be harder to return by means of. That is very true now that the Fed has begun to withdraw liquidity and lift rates of interest.

Staying nimble and choosing the right shares on the proper time will raise ever extra significance within the coming months. The POWR Scores will without a doubt mean you can pick out the correct shares. Technical research will mean you can pick out the correct time to each input and go out positions.

A handy guide a rough stroll via of the hot trades in ArcelorMittal (MT) for the POWR Choices portfolio will lend a hand to turn how I exploit technical research to spot value spaces to imagine hanging on and starting up positions.

My manner is solely one of the. It’s, then again, a easy technique that has stood the check of time. So let’s leap in.

The chart under is a one-year value chart for MT inventory. There’s horizontal reinforce on the $28 house. I love to time period it “eyeball reinforce.” MT has bounced off this degree seven instances prior to now one year. Obviously a forged reinforce house:

As soon as a space of hobby is known, just a bit extra paintings must be performed. My manner makes use of handiest 4 major elements:

- 9-day RSI (Relative Energy Index)

- MACD (Transferring Moderate Convergence Divergence) Histogram

- Bollinger P.c B

- 20-day transferring reasonable

RSI signifies when a inventory is getting overbought (above 70) or oversold (below 30). MACD compares the 12-day transferring reasonable to an extended 26-day transferring reasonable to lend a hand discover divergences in momentum.

Bollinger P.c B is a volatility-based indicator that identifies the place the remaining value of a inventory is relative to the higher and decrease bands. 100 is the higher band and zero is the decrease band.

The 20-day transferring reasonable is extensively adopted, particularly by means of the algo machines that dominate buying and selling these days.

When all 4 signs align on the identical time, it’s generally a competent indication that issues have got overdone both to the upside or problem. Time to take a counter-trend place.

Taking a look on the chart once more displays the 3 times POWR Choices took a protracted place in MT calls in accordance with oversold readings (gentle inexperienced).

9-day RSI used to be below 30, MACD used to be deeply within the pink, Bollinger P.c B used to be nearing 0 and stocks have been buying and selling at a large cut price to the 20-day transferring reasonable.

The chart additionally displays how POWR Choices used the similar option to go out the ones positions in accordance with overbought readings (crimson).

The process is discreet. Purchase when issues get oversold and promote when issues get overbought. To cite Warren Buffett, “Be Grasping When Others Are Worried and Be Worried When Others Are Grasping.”

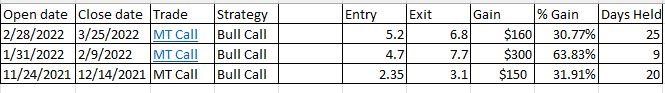

The result of the 3 trades are proven under:

Under no circumstances all effects will likely be this efficient. Buying and selling is ready likelihood, now not walk in the park. The usage of a easy technical technique at the side of the POWR scores can lend a hand supply a forged one-two-punch to place the chances on your choose when swing buying and selling choices.

What To Do Subsequent?

Whilst the ideas in the back of choices buying and selling are more effective than the general public understand, making use of the ones ideas to persistently make profitable choices trades is not any simple job.

The answer is to let me do the exhausting give you the results you want, by means of beginning a 30 day to my POWR Choices e-newsletter.

I’ve been uncovering the most efficient choices trades for over 30 years and with the quantitative muscle of the POWR Scores as my start line I’ve completed an 87% win fee over my closing 15 closed trades!

All the way through your trial you’ll get complete get entry to to the present portfolio, weekly marketplace observation and each and every business alert by means of textual content & e-mail.

I’ll be including the following 2 thrilling choices trades (1 name and 1 put) when the marketplace opens this Monday morning, so get started your trial these days so that you don’t leave out out.

There’s no legal responsibility past the 30 day trial, so there may be completely no chance in getting began these days.

About POWR Choices & 30 Day Trial >>

Right here’s to excellent buying and selling!

Tim Biggam

Editor, POWR Choices E-newsletter

SPY stocks rose $0.01 (0.00%) in after-hours buying and selling Friday. Yr-to-date, SPY has declined -4.34%, as opposed to a % upward push within the benchmark S&P 500 index all the way through the similar length.

In regards to the Creator: Tim Biggam

Tim spent 13 years as Leader Choices Strategist at Guy Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Marketplace Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Business Reside”. His overriding hobby is to make the advanced global of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices e-newsletter. Be informed extra about Tim’s background, at the side of hyperlinks to his most up-to-date articles.

The submit Technical Research Doesn’t Wish to Be Overly Technical to Be Efficient gave the impression first on StockNews.com