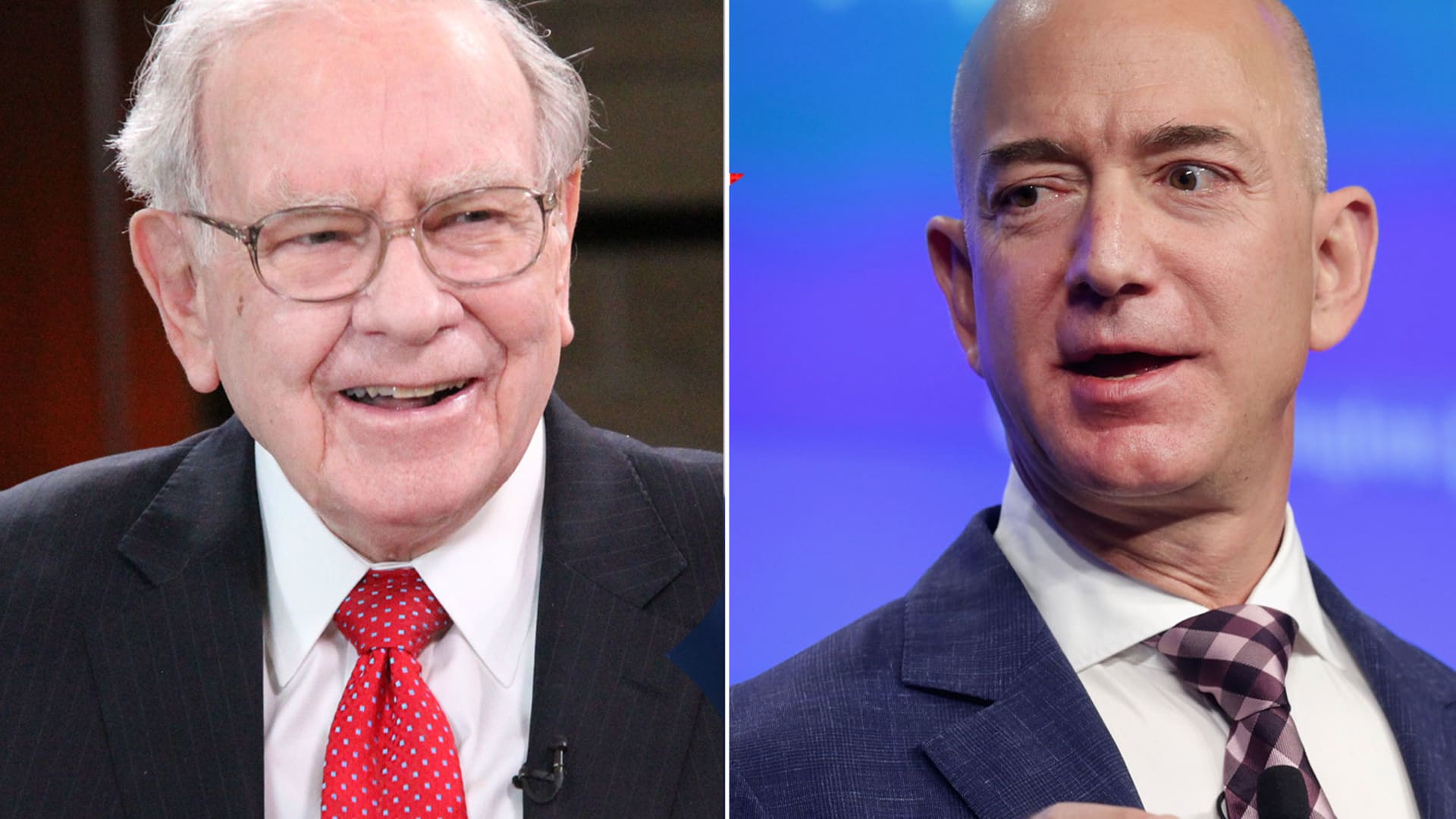

Warren Buffett and Jeff Bezos

Lacy O’ Toole | CNBC; Getty Pictures

The wealth of The usa’s wealthiest other folks, comparable to Warren Buffett and Jeff Bezos, larger through a complete of $6.5 trillion closing 12 months, principally pushed through hovering inventory costs and monetary markets, in line with the Federal Reserve.

The entire wealth of the 1% reached a document $45.9 trillion on the finish of the fourth quarter of 2021, mentioned the Federal Reserve’s newest document on family wealth. Their fortunes larger through greater than $12 trillion, or greater than a 3rd, right through the process the pandemic.

“The numbers are astounding,” mentioned Edward Wolff, professor of economics at New York College. “The pandemic wealth increase indubitably ranks at or close to the highest of all of the wealth booms over the past 40 years.”

The highest 1% owned a document 32.3% of the country’s wealth as of the top of 2021, knowledge display. The proportion of wealth held through the ground 90% of American citizens, likewise, has declined relatively since earlier than the pandemic, from 30.5% to 30.2%.

The wealth expansion on the best has doubtlessly stalled or declined relatively up to now this 12 months because of inventory declines.

The primary drivers for the richest American citizens closing 12 months had been shares and personal companies. About $4.3 trillion of the entire features for the 1% closing 12 months got here from company equities and mutual fund stocks, in line with the Fed knowledge. The inventory portfolios of the highest 1% are actually value $23 trillion, and so they personal a document 53.9% of in my opinion held stocks, in line with the central financial institution.

Regardless of claims of a democratization of the inventory marketplace, with thousands and thousands of latest retail traders opening buying and selling accounts on Robinhood and different platforms, inventory possession in The usa has if truth be told change into extra concentrated than earlier than the pandemic. The highest 10% owned a document 89% of in my opinion held company equities and mutual fund stocks on the finish of 2021.

A Gallup in 2021 discovered that 56% of American citizens owned no less than some inventory — relatively above the common of 55% in 2019 and 2020, however nonetheless down from the 62% prime earlier than the 2008 monetary disaster.

Extra wealth inequality

Hovering inventory costs have created a “comments cycle” for wealth and inequality, mentioned Wolff, the NYU professor. As a result of inventory possession is tilted towards the highest of the wealth ranks, emerging inventory costs shift extra money to richer American citizens. For the reason that rich can manage to pay for to save lots of and make investments a bigger proportion in their added wealth, extra of the country’s wealth features go with the flow to the inventory marketplace. That raises inventory costs even additional.

“Emerging wealth inequality drives the inventory marketplace, which then drives extra wealth inequality,” Wolff mentioned.

Personal companies have additionally been a formidable engine of wealth for the ones on the very best. The 1% personal 57% of personal firms, in line with the Federal Reserve. The price of personal companies held through the wealthiest larger through 36%, or $2.2 trillion, closing 12 months.

“Small trade is truly key whilst you communicate concerning the resources in their wealth,” Wolff mentioned.

The 1% have additionally benefited modestly from emerging real-estate values. Their real-estate holdings larger through just below $1 trillion right through the pandemic, to achieve a prime of $5.27 trillion.

However their proportion of the country’s genuine property if truth be told fell relatively right through the pandemic, as house costs and residential possession additionally larger for remainder of the rustic. Actual property is way more extensively owned than shares, so the emerging in house costs has helped the center magnificence relatively greater than the rich. The highest 1% owned 14% of the country’s genuine property on the finish of 2021, down from 14.5% earlier than the pandemic on the finish of 2019.

The ground 90% of American citizens added $2.89 trillion to their wealth closing 12 months from genuine property.

“The housing increase has benefited the center magnificence,” Wolff mentioned. “If it hadn’t been for that, wealth inequality would have grown much more than it did.”