For those who’re in search of actual property tool that will help you with making an investment, Roofstock critiques allow you to make a smart move.

Since time immemorial, making an investment in actual property has been a surefire manner of producing certain money drift and development wealth. For a very long time, actual property used to be a keep of the rich and well-connected folks.

On the other hand, the emergence of recent era has revolutionized the way in which we do maximum issues in our lives. Generation has additionally made actual property making an investment to be had to the average investor who might not be well-connected. Additionally, you’ll be able to now get began even with out a large number of capital.

Roofstock is without doubt one of the tool answers streamlining industry operations for actual property buyers. The tool is for you if making an investment in actual property with as low as $5,000 turns out like a good chance for you.

On this article, we have a look at Roofstock critiques, how you’ll be able to have the benefit of the platform, and some other answer that compliments it.

Desk of Contents

- What Is Roofstock?

- Roofstock Critiques: How Does the Platform Paintings?

- Different Key Options and Services and products

- How Does Roofstock Evaluate

- What Is Mashvisor

- Is Roofstock Price It?

In finding out what Roofstock is and the way the platform can assist actual property buyers such as you.

What Is Roofstock?

Roofstock is basically a web-based actual property market that specializes in single-family apartment houses. For houses to be indexed at the platform, they should be occupied by way of tenants who meet Roofstock’s tenant-screening necessities.

Roofstock’s primary audience is busy pros who’re searching for extremely successful and a success houses for hire however don’t have the time to completely decide to landlord duties or don’t seem to be in a position to position within the paintings themselves.

Consistent with the 3 founders, specifically Wealthy Ford, Gary Beasley, and Gregor Watson, their primary purpose used to be to construct a web-based actual property market that used to be cost-effective, radically available, and easy.

In contrast to different on-line actual property funding marketplaces, Roofstock doesn’t personal any of the indexed houses. As an alternative, they center of attention on comparing, negotiating, and shutting actual property transactions.

Roofstock Critiques: How Does the Platform Paintings?

As a first-time actual property investor, Roofstock will make it more uncomplicated so that you can make your first funding. Whilst buyers too can promote their houses at the platform, it makes it more uncomplicated to start out making an investment in turnkey houses.

So, how does it if truth be told paintings?

Roofstock critiques the houses on its platform, with every assets going thru a certification procedure sooner than it’s authorized for record. The method comes to a house inspection the place the Roofstock crew will get a valuation document and conducts a housing marketplace research. In addition they test the tenants’ apartment fee historical past, disclosure experiences, and rent phrases. If the valuables calls for any primary maintenance, additionally they estimate the bills.

Whilst Roofstock’s crew does play their phase to provide you with some peace of thoughts, don’t fail to remember to hold out some due diligence your self sooner than making an investment.

If you’re at the Roofstock web page, click on “Purchase” and also you’ll be directed to {the marketplace}. Right here, you’ll be able to view listings beneath the next classes:

- Houses: For getting funding houses outright

- Portfolios: For getting more than one houses concurrently

- Assets stocks: For getting fractions of a assets

For the reason that 3 processes are moderately an identical, we’ll undergo one to come up with a glimpse of ways all of them paintings. For those who’re simply getting began in actual property making an investment, purchasing fractional assets stocks could also be extra appropriate. Right here’s how you buy fractional stocks on Roofstock:

1. Discover a Assets

Roofstock critiques display that the net market supplies a very good person interface that permits you to flick thru to be had apartment assets funding alternatives. You’ll be able to clear out the hunt effects in step with other standards, reminiscent of markets (location), community ranking, minimal funding quantity, assets situation, and so on.

Roofstock is recently found in 25 actual property markets, together with Florida, Alabama, Texas, Arizona, Georgia, and California. Whilst pricing is in line with many components, you’ll be able to be expecting to peer costs starting from $100,000 to $900,000.

For those who see a assets that arouses your pastime, merely click on on it, and also you’ll get an in depth assessment of the valuables. The rundown comprises assets pictures (each external and internal), assets inspection document, identify document, overall house value, valuation document, and proportion value.

Moreover, the platform additionally offers you an estimate of the go back on funding, which is proven as the objective annual distribution. The mentioned quantity is calculated in line with the anticipated income, minus the estimated assets bills, loan bills, and reserve bills.

It additionally features a calculator that permits you to see how a lot you’ll be able to spend at the ultimate prices and the way your money funding would possibly have an effect on the anticipated returns.

Have in mind, all investments are dangerous. As such, the estimations equipped don’t seem to be a ensure.

2. Choose Stocks and Reserve

For those who’ve made up your thoughts to put money into the valuables, it’s now time to make a choice what number of assets stocks you need to shop for. To the appropriate of the valuables pictures, you’ll to find a space the place you’ll be able to reserve the stocks.

For starters, a reservation is solely a declare to the choice of stocks you select to put money into from what’s to be had. To finish a reservation, you should pay a refundable price inside of 24 hours.

For those who see “All Stocks Bought,” it implies that there aren’t any to be had stocks. In a different way, make a choice the choice of stocks you need to acquire and upload them to the cart.

3. Signal and Make investments

You’ll be able to view your cart and continue to checkout. Right here, you’ll wish to undergo a couple of steps to finish your reservation and buy the stocks. For those who’re investment your funding, you’ve gotten an solution to add a pre-approval letter. You should additionally enter your bank card knowledge to facilitate Roofstock’s 0.5% market price.

If you’ve paid the associated fee, Roofstock critiques your utility by way of verifying your identification and authentic investor standing the use of the documentation you’ve uploaded. In a while, chances are you’ll now signal the subscription settlement and perform an ACH switch to fund your funding.

4. Obtain Passive Source of revenue

If you’ve finished your funding, chances are you’ll now take a seat again and benefit from the apartment revenue coming in from tenants dwelling for your assets funding. Roofstock’s assets stocks loose you from the difficulty of being a landlord and assets supervisor. A qualified in-house crew looks after assets control.

For those who’re taking a look to put money into all of the assets, chances are you’ll make a choice to head the true property agent direction. On the other hand, Roofstock critiques display that the platform beats them in relation to costs. An agent’s fee price is usually 6%, whilst Roofstock simplest fees $500 or 0.5% of the acquisition value. Additionally, in case you’re taking a look to promote assets on Roofstock, the expense is $2,500 or 3% of the sale value (whichever is upper).

The most efficient phase about it’s that you’ll be able to put money into houses across the nation, without reference to the place you are living. It opens you as much as many funding alternatives.

Different Key Options and Services and products

Right here’s a breakdown of different important services and products that Roofstock gives:

Roofstock One

Principally, Roofstock One is the platform’s assets stocks phase. It’s moderately other from the Roofstock market. On the other hand, you want to be an authorised investor to get entry to it. Authorised buyers can put money into single-family properties portfolios, very similar to different actual property crowdfunding platforms.

You want to put a minimal funding of $5,000 to get began on Roofstock One. In a while, Roofstock’s crew takes over the whole lot, together with the valuables control of all properties incorporated within the Roofstock One portfolios. It is a wonderful choice for buyers who need publicity to a much broader number of houses but in addition want a hands-off assets funding means.

On the other hand, you should observe that Roofstock One houses are extremely illiquid. Additionally, buyers should have an funding background of 5 years, and recently, there’s no third-party marketplace to promote Roofstock assets stocks.

Roofstock’s remained quiet on how a lot it prices to make use of Roofstock One. On the other hand, from on-line Roofstock critiques, we’ve been ready to collect that assets proportion buyers are charged an asset control price beginning at 0.50% of the house value. The speed is adjusted on the identical charge because the gross charge adjustments.

Roofstock Academy

The path your actual property funding takes relies on who you understand and what you understand. Roofstock Academy is certainly one of Roofstock’s newest merchandise. This can be a actual property route that teaches buyers the right way to grasp turnkey funding houses. This system is created by way of a crew of seasoned actual property buyers who’ve noticed all of it and are glad to proportion their reviews with amateur buyers.

Rather than studying the right way to put money into actual property, you additionally be told the next:

- Actual property funding methods you will have to find out about

- Methods to analyze funding offers

- The professionals and cons of making an investment in native markets and long-distance

- Methods to construct $100,000 in passive revenue

- Kinds of dangers in actual property funding and the right way to organize them

- Methods to negotiate and publish a profitable be offering

- How to make a choice a excellent lender and assets supervisor

One advantage of Roofstock Academy is that it combines on-line studying with one-on-one training periods. You additionally get get entry to to a personal community of different achieved actual property buyers.

Roofstock Academy programs are as follows:

- Self-Learn about: Th Self-Learn about package deal offers you get entry to to 50+ hours of unique lectures for a $399 price or 12 per thirty days bills of $39.

- Workshop: The Workshop package deal supplies buyers with unique lectures, get entry to to the non-public investor group, workforce training, and one-on-one training, and a Roofstock Market price credit score of $1,000. The fees are $999 or 12 per thirty days bills of $99.

- Mastermind: The Mastermind package deal comprises the whole lot within the Workshop and Self-Learn about programs with a Roofstock Market price credit score of $2,500. You’ll need to phase with $5,000 or 12 per thirty days bills of $499 to get entry to this package deal.

How Does Roofstock Evaluate?

We’ve checked out Roofstock critiques and feature noticed what it does for actual property buyers. Now, let’s have a look at the way it compares to some other platform of its sort.

There are few firms on-line that may fit what Roofstock gives actual property buyers. Whilst there are lots of crowdfunding platforms that can permit you to put money into non-traded REITs, maximum don’t provide you with a person apartment house to put money into.

Of the few firms that may fit, Mashvisor sticks out.

Let’s have a look at what Mashvisor is and a breakdown of what it gives.

What Is Mashvisor?

Based in 2014, Mashvisor is a web-based actual property platform that goals to supply buyers with correct, dependable, and up-to-date assets knowledge that will help you to find conventional and Airbnb leases all the way through the USA housing marketplace. The web page will get its knowledge from dependable resources, reminiscent of Airbnb, Public sale.com, Zillow, and Roofstock itself.

It then makes use of system studying and AI algorithms to show that knowledge into useful knowledge. It saves you a large number of time and effort when in search of and examining apartment houses on the market.

Listed here are some funding assets seek and research gear that you just’ll to find at Mashvisor:

Assets Finder

The Mashvisor Assets Finder software makes use of predictive analytics that will help you seek and to find profitable conventional and momentary apartment houses in only a topic of mins. You’ll be able to use more than a few standards, reminiscent of assets record value, assets kind, choice of bedrooms and loos, and excellent apartment technique, to clear out in the course of the effects.

The Assets Finder is particular because it is helping you to find houses in line with monetary patterns, behavioral patterns, and social patterns.

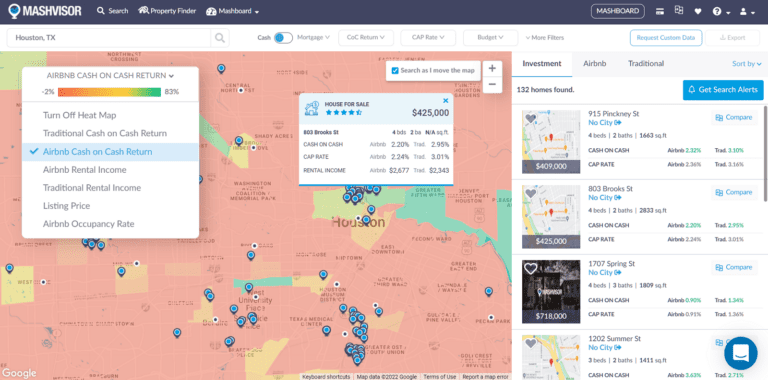

Actual Property Heatmap

Mashvisor’s Heatmap software is a housing research software that makes use of colours and visible cues to turn you top-performing neighborhoods in a definite space. The map makes use of inexperienced to turn energetic neighborhoods and purple to constitute dormant ones. With the heatmap software, you’ll be able to additionally use more than a few metrics, reminiscent of cap charge, money on money go back, apartment revenue, and Airbnb occupancy charge, to research the neighborhoods.

Mashvisor’s Heatmap software supplies a color-coded map of the best-performing neighborhoods in a definite location.

Funding Assets Calculator

Mashvisor’s Funding Assets Calculator, additionally known as the Condo Assets Calculator, comes in handy for each conventional and Airbnb assets analyses. You merely enter your monetary prices and the software displays you what to anticipate in the case of apartment revenue, assets bills, cap charge, occupancy charge, money drift, and money on money go back. This software additionally offers you get entry to to apartment comps for all listings.

Is Roofstock Price It?

Roofstock critiques have proven us that it really works out properly for actual property buyers, particularly freshmen, for the reason that equipped knowledge is simple to grasp. Whilst you would possibly wish to do a little paintings when researching the houses, it’s a doubtlessly profitable funding alternative for you.

Assets dealers additionally stand to have the benefit of Roofstock for the reason that platform supplies a connection to homebuyers in search of income-generating alternatives. If a supplier needs to promote a single-family house that’s already occupied, they don’t have to take away the tenants sooner than promoting the house.

Mashvisor is a wonderful on-line platform that you’ll be able to additionally use. It used to be evolved with the primary goal of serving to actual property buyers make good funding choices. Ebook a demo with us to be told extra about how you’ll be able to use Mashvisor gear in your investments.