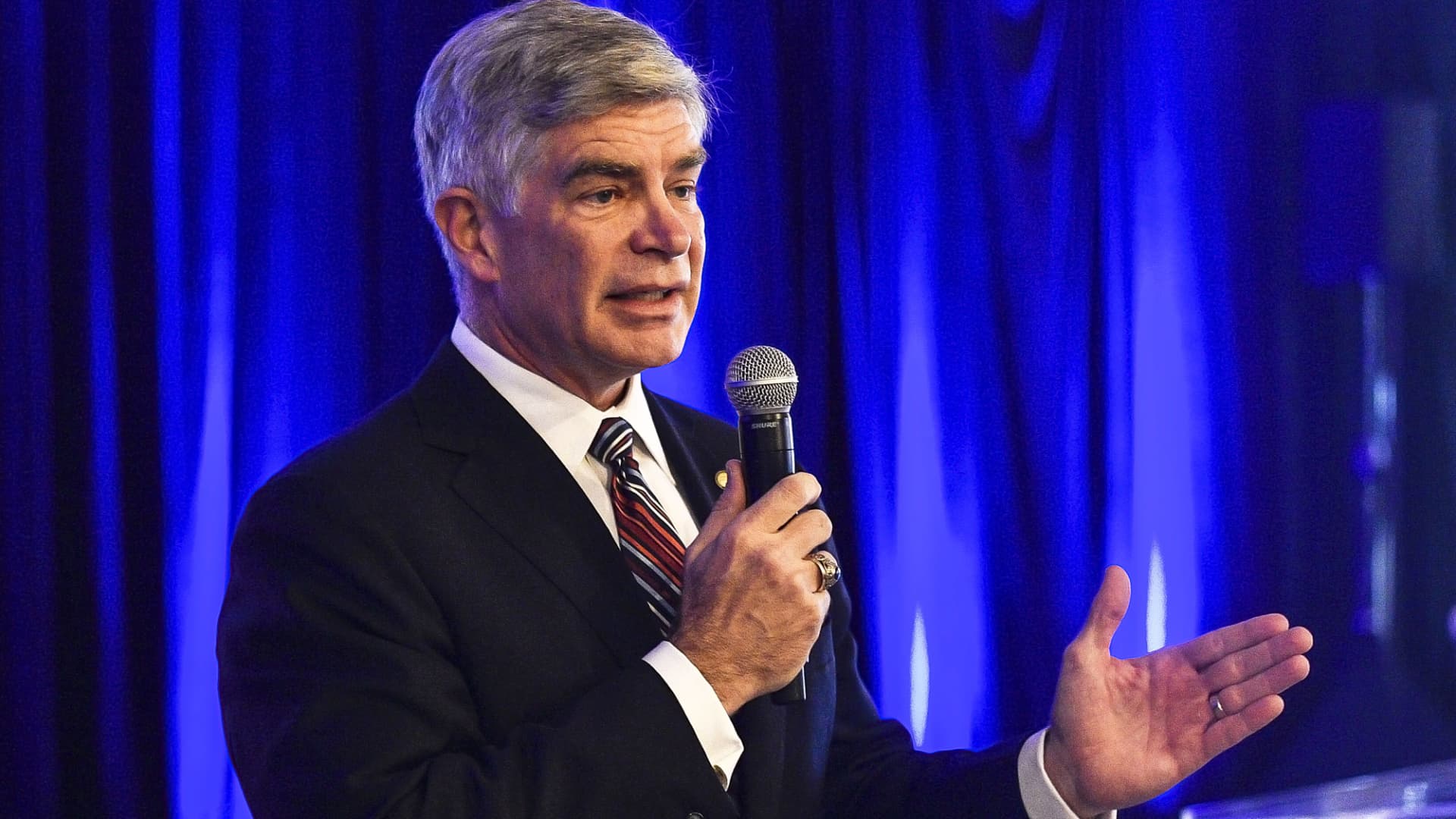

In spite of on ominous indicator putting over the economic system and better rates of interest at the manner, Philadelphia Federal Reserve President Patrick Harker stated Tuesday that he does not suppose the U.S. is heading for recession.

That view, expressed in a CNBC interview, comes within the face of a looming inversion of the 10- and 2-year Treasury yields and marketplace expectancies that the Fed is set to embark on a considerable rate-hiking cycle aimed toward curtailing inflation.

Harker stated he thinks the present state of the economic system is powerful sufficient to resist each tighter financial coverage and bond marketplace fears of what that can imply to expansion.

“What I am on the lookout for is a secure touchdown,” he advised CNBC’s Sara Eisen all the way through a “Energy Lunch” interview. “It can be bumpy alongside the best way. It was once bumpy going up, it’ll be bumpy coming down. We have all been on the ones planes. We land safely, however it might be a little of a thrill experience. I are not looking for that. In order that’s why we are being wary and cautious about how we enforce coverage.”

The feedback got here with the curve about flat between the benchmark 10-year and its 2-year counterpart. The curve has inverted, with the 2-year yield above the 10-year, in most up-to-date U.S. recessions, regardless that it has now not been a ensure.

Harker cautioned towards depending an excessive amount of on one courting when seeking to are expecting the long run.

“The proof is blended. In the event you take a look at the knowledge, it obviously correlates with recessions. However causation isn’t very transparent,” he stated. “So we want to ensure that we are having a look at a lot of other knowledge.”

Yield curve inversions are thought to be a very powerful signal as they replicate investor concern that the Fed will tighten prerequisites an excessive amount of in order that they prohibit additional expansion. In addition they generally tend to inhibit lending from banks who fear that long term returns can be decrease.

Alternatively, U.S. unemployment is again to close the place it was once pre-pandemic, when the jobless price hit a 50-year low. Shoppers stay flush with money and assets values proceed to upward push.

However the Fed has been wrestling with inflation ranges working at a 40-year prime, prompting Harker and his colleagues to embark on a rate-hiking cycle through which markets be expecting will increase at every of the rest six conferences this yr, with most likely as prime as part a share level.

Harker stated he thinks the Fed at its Might assembly must building up its benchmark price by means of just a quarter-percentage level, or 25 foundation issues. Markets, regardless that, expect a hike of fifty foundation issues, and Harker stated he stays open to the theory relying at the knowledge.

“I would not take it off the desk,” he stated of the upper transfer.

Even with the possibility of a lot upper charges, he stated he thinks the Fed can engineer its manner throughout the present scenario, with a focal point on bringing down inflation first.

“That is task one,” he stated. “I do not need to overdo it, regardless that, and take a look at to simply stomp the brakes onerous and feature expansion finish.”

“I feel it’s going to be a bumpy experience, and there could also be some issues the place we get right into a duration of below-trend expansion for some time,” he added. “However I feel we will pull this off.”