For each and every actual property investor, the cap charge actual property is without doubt one of the an important metrics to practice.

By means of calculating the valuables cap charge, you’ll be able to make certain that you’re securing the most efficient funding belongings deal in your cases. With a view to higher perceive the cap charge in actual property, stay on studying.

What Is Cap Charge in Actual Property?

A cap charge in actual property, additionally known as capitalization charge, is the ratio of web running source of revenue (NOI) to the worth of the valuables asset. In that sense, the cap charge components would appear to be this: NOI/acquire value = cap charge.

NOI presentations the prospective source of revenue earned from the valuables in query inside a length of 1 yr, minus all of the running prices and bills. In relation to renting a complete condominium development, the NOI would come with the source of revenue from the tenants’ hire bills minus all of the bills associated with taxes, development repairs, and so forth.

The cap charge components in actual property isn’t just helpful for checking a selected belongings, but in addition relating to all the marketplace when you’re taking a look to put money into a bunch of houses. On the other hand, it’s vital to say that loan bills don’t seem to be integrated within the cap charge components.

The economic cap charge in actual property additionally differs from the residential one. The worth of the primary is in large part according to the prospective go back on funding whilst the latter is decided through the associated fee in line with sq. foot with reference to an identical houses. Additionally, the cap charge in actual property isn’t fastened; slightly the opposite, it is going to range according to the valuables elegance, rates of interest, and product availability.

Learn how to Calculate the Cap Charge in Actual Property

Traders be able to buy houses both with loans or money. The cap charge routinely considers money as the principle buying method as a way to provide the baseline charge of go back, and not using a regard to rates of interest or mortgage repayments.

We already discussed the cap charge components, particularly NOI/acquire value = cap charge. That is the “conventional” technique to calculate it. To make this clearer, we’ll use an instance. For example, if the valuables you’re concerned with is indexed at $500,000 and its NOI is $75,000, the components would position the cap charge at 15%, i.e. 75K/500K = 0.15.

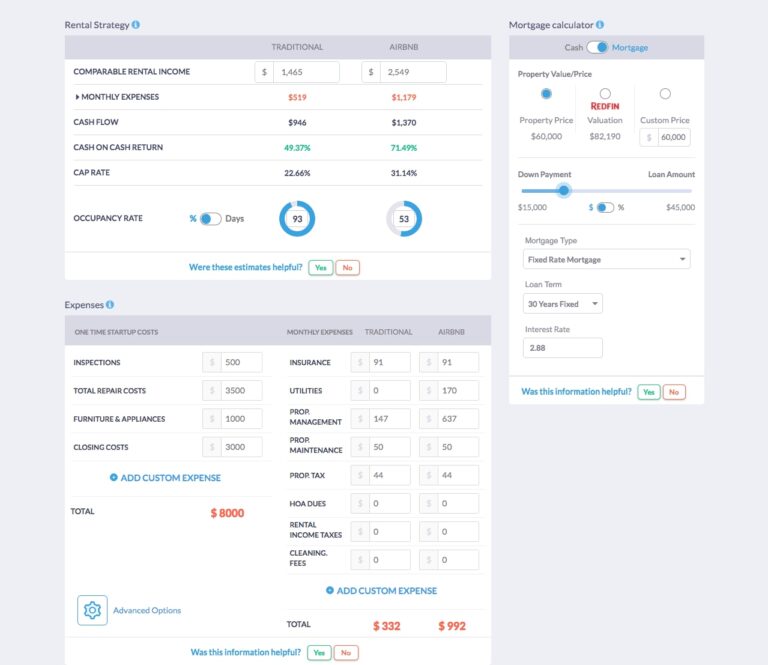

In fact, there’s a significantly extra environment friendly technique to calculate the cap charge in actual property. Mashvisor’s cap charge calculator is a fairly nifty instrument that may significantly reduce the demanding situations and dangers of your funding research.

What’s extra, the instrument is created to make issues simple for each rookies and mavens alike when making an investment in actual property is worried. It best takes a few mins to get detailed information on the true property cap charge and extra. That means, you’ll be able to be 100% positive that you just’re making the most efficient imaginable resolution and keeping up authority within the aggressive marketplace.

Mashvisor’s calculator can also be present in each and every list web page. This is helping traders resolve the profitability of the for-sale belongings that they’re viewing sooner than selecting whether or not to shop for it.

Why Use a Cap Charge in Actual Property Making an investment

To place it merely, calculating the valuables’s cap charge provides you with an perception into the true belongings alternative and its worth. For example, if the cap charge suggests 15%, it’s cheap to suppose that the go back can be round 15%.

If you happen to’ve been questioning learn how to put money into actual property, remember the advantages of other cap charges. According to their chance tolerance, maximum traders will choose to head with cap charges in numerous levels. That mentioned, when a cap charge is decrease, the valuables is most probably stabilized inside an already confirmed marketplace. However, when a cap charge is upper, likelihood is that that the valuables in query can have some problems reminiscent of desirability and upkeep, however it may additionally include upper upside attainable.

A distinct cap charge in actual property making an investment additionally comes with other strategies of acquisition. The commonest choices come with gentle debt, heavy debt, and all money. Irrespective of the process, the money go with the flow is sure to switch whilst the throw-off of the valuables’s annual earnings will stay the similar.

That mentioned, the use of a cap charge in actual property is a good technique to briefly calculate attainable money flows of various houses of pastime, permitting the traders to check them with essentially the most profitable alternatives in thoughts.

When to Use a Cap Charge in Actual Property

As discussed, cap charges can also be fairly helpful for actual property traders who wish to evaluation attainable worth and dangers with reference to a number of other houses they have got their eye on. In the case of different selections with reference to actual property making an investment, cap charges might not be essentially the most useful metric to be had. In fact, except cap charges, there are different metrics that may additionally supply some perception into the prospective dangers and returns of an funding belongings.

If you happen to’re taking a look to put money into business houses, don’t hesitate to take advantage of out of cap charges. On the other hand, this actual components isn’t preferrred relating to comparing houses you intend to turn, ones with an abnormal circulate of source of revenue, or single-family houses.

Comparable: Learn how to Evaluation an Airbnb Funding

What Is a Excellent Cap Charge in Actual Property?

It’s crucial to needless to say we can not discuss a universally just right cap charge, and a definite cap charge quantity gained’t be preferrred for all types of belongings. Traders most commonly use the cap charge in actual property to peer whether or not a definite belongings suits into their very own convenience ranges.

Usually, a better cap charge signifies upper NOI and decrease valuation of a belongings, whilst a decrease cap charge signifies decrease NOI and better valuation. Houses with decrease cap charges are normally related to decrease chance, however this additionally means that it could take longer to get the preliminary funding again.

That is why it’s an important to not rush and punctiliously analyze the most efficient cap charge in your funding portfolio. If in case you have a host in thoughts that fits your specific circumstance, it is going to be simple to pick out and make a choice amongst other houses according to that, and if truth be told have a “just right” cap charge for you in my opinion.

10 Absolute best Cap Charge Towns for Conventional Apartment Houses

It’s no secret that conventional apartment houses are essentially the most successful trail to take when easing your means into actual property making an investment. Necessarily, those supply worth each short- and long-term, particularly via apartment source of revenue and actual property appreciation. Additionally, it’s all the time imaginable to get a qualified belongings supervisor and get started incomes a passive source of revenue this fashion.

With a view to protected your self the most efficient imaginable deal when making an investment in actual property, the go-to follow must be to find essentially the most profitable places for the subject. If you happen to’re questioning what’s the easiest position to shop for apartment belongings, we at Mashvisor have get a hold of a best 10 record of the towns with the perfect conventional cap charge in 2022. We’ve used the true property and apartment information in the USA residential property marketplace as a way to have our algorithms calculate the by-city cap charges and give you the ten perfect ranked places relating to essentially the most precious long-term apartment alternatives.

1. Spruce Pine, NC

- Per 30 days Conventional Apartment Source of revenue: $4,451

- Conventional Money on Money Go back: 9.78%

- Conventional Cap Charge: 9.98%

- Worth to Hire Ratio: 8

- Selection of Listings for Sale: 16

- Median Belongings Worth: $448,018

- Stroll Rating: 47

2. Suwannee, FL

- Per 30 days Conventional Apartment Source of revenue: $1,373

- Conventional Money on Money Go back: 9.32%

- Conventional Cap Charge: 9.97%

- Worth to Hire Ratio: 21

- Selection of Listings for Sale: 8

- Median Belongings Worth: $350,938

- Stroll Rating: 18

Comparable: 20 Highest Puts to Put money into Actual Property in Florida in 2022

3. Presidio, TX

- Per 30 days Conventional Apartment Source of revenue: $1,365

- Conventional Money on Money Go back: 9.20%

- Conventional Cap Charge: 9.79%

- Worth to Hire Ratio: 15

- Selection of Listings for Sale: 6

- Median Belongings Worth: $240,000

- Stroll Rating: 53

4. Saxonburg, PA

- Per 30 days Conventional Apartment Source of revenue: $720

- Conventional Money on Money Go back: 8.55%

- Conventional Cap Charge: 9.67%

- Worth to Hire Ratio: 7

- Selection of Listings for Sale: 9

- Median Belongings Worth: $62,344

- Stroll Rating: 38

5. Alturas, CA

- Per 30 days Conventional Apartment Source of revenue: $3,152

- Conventional Money on Money Go back: 8.90%

- Conventional Cap Charge: 9.14%

- Worth to Hire Ratio: 7

- Selection of Listings for Sale: 13

- Median Belongings Worth: $271,954

- Stroll Rating: 53

6. Sylacauga, AL

- Per 30 days Conventional Apartment Source of revenue: $1,414

- Conventional Money on Money Go back: 8.47%

- Conventional Cap Charge: 8.98%

- Worth to Hire Ratio: 19

- Selection of Listings for Sale: 8

- Median Belongings Worth: $319,975

- Stroll Rating: 60

7. Waterville Valley, NH

- Per 30 days Conventional Apartment Source of revenue: $9,810

- Conventional Money on Money Go back: 8.62%

- Conventional Cap Charge: 8.70%

- Worth to Hire Ratio: 7

- Selection of Listings for Sale: 6

- Median Belongings Worth: $869,900

- Stroll Rating: 21

8. Hillsville, VA

- Per 30 days Conventional Apartment Source of revenue: $1,150

- Conventional Money on Money Go back: 7.81%

- Conventional Cap Charge: 8.35%

- Worth to Hire Ratio: 24

- Selection of Listings for Sale: 12

- Median Belongings Worth: $328,600

- Stroll Rating: 59

9. Hibbing, MN

- Per 30 days Conventional Apartment Source of revenue: $1,314

- Conventional Money on Money Go back: 7.60%

- Conventional Cap Charge: 8.17%

- Worth to Hire Ratio: 9

- Selection of Listings for Sale: 10

- Median Belongings Worth: $135,100

- Stroll Rating: 60

10. Gallipolis, OH

- Per 30 days Conventional Apartment Source of revenue: $1,459

- Conventional Money on Money Go back: 7.72%

- Conventional Cap Charge: 8.17%

- Worth to Hire Ratio: 10

- Selection of Listings for Sale: 8

- Median Belongings Worth: $166,638

- Stroll Rating: 59

10 Absolute best Cap Charge Towns for Airbnb Apartment Houses

Apart from conventional apartment houses, buying a holiday apartment may be a just right begin to your funding adventure in 2022. That mentioned, Mashvisor additionally ready a listing of the highest 10 towns with the perfect Airbnb cap charges.

Observe: The next record is according to Mashvisor’s research, which is according to information accumulated from Airbnb and different number one assets. We didn’t come with legalities surrounding momentary leases in our attention, so please you’ll want to name the native government to make sure that Airbnbs are allowed within the house.

1. Jennings, LA

- Selection of Airbnb Listings: 9

- Per 30 days Airbnb Apartment Source of revenue: $3,363

- Airbnb Money on Money Go back: 9.62%

- Airbnb Cap Charge: 9.95%

- Airbnb Day by day Charge: $80

- Airbnb Occupancy Charge: 55%

- Selection of Listings for Sale: 16

- Median Belongings Worth: $255,081

- Stroll Rating: 63

2. Dunmore, PA

- Selection of Airbnb Listings: 15

- Per 30 days Airbnb Apartment Source of revenue: $2,404

- Airbnb Money on Money Go back: 9.28%

- Airbnb Cap Charge: 9.74%

- Airbnb Day by day Charge: $162

- Airbnb Occupancy Charge: 65%

- Selection of Listings for Sale: 6

- Median Belongings Worth: $197,300

- Stroll Rating: 79

3. Marmora, NJ

- Selection of Airbnb Listings: 8

- Per 30 days Airbnb Apartment Source of revenue: $6,408

- Airbnb Money on Money Go back: 9.39%

- Airbnb Cap Charge: 9.55%

- Airbnb Day by day Charge: $235

- Airbnb Occupancy Charge: 64%

- Selection of Listings for Sale: 8

- Median Belongings Worth: $468,138

- Stroll Rating: 48

4. Wolverine Lake, MI

- Selection of Airbnb Listings: 5

- Per 30 days Airbnb Apartment Source of revenue: $4,142

- Airbnb Money on Money Go back: 8.89%

- Airbnb Cap Charge: 9.12%

- Airbnb Day by day Charge: $122

- Airbnb Occupancy Charge: 65%

- Selection of Listings for Sale: 6

- Median Belongings Worth: $581,367

- Stroll Rating: 2

Comparable: Michigan Housing Marketplace Forecast 2022

5. Matamoras, PA

- Selection of Airbnb Listings: 6

- Per 30 days Airbnb Apartment Source of revenue: $5,981

- Airbnb Money on Money Go back: 8.94%

- Airbnb Cap Charge: 9.11%

- Airbnb Day by day Charge: $879

- Airbnb Occupancy Charge: 63%

- Selection of Listings for Sale: 34

- Median Belongings Worth: $382,632

- Stroll Rating: 57

6. Horn Lake, MS

- Selection of Airbnb Listings: 11

- Per 30 days Airbnb Apartment Source of revenue: $3,172

- Airbnb Money on Money Go back: 8.79%

- Airbnb Cap Charge: 9.08%

- Airbnb Day by day Charge: $149

- Airbnb Occupancy Charge: 64%

- Selection of Listings for Sale: 10

- Median Belongings Worth: $267,744

- Stroll Rating: 44

7. Centerville, OH

- Selection of Airbnb Listings: 21

- Per 30 days Airbnb Apartment Source of revenue: $6,215

- Airbnb Money on Money Go back: 8.87%

- Airbnb Cap Charge: 9.03%

- Airbnb Day by day Charge: $204

- Airbnb Occupancy Charge: 61%

- Selection of Listings for Sale: 5

- Median Belongings Worth: $456,032

- Stroll Rating: 59

8. Winneconne, WI

- Selection of Airbnb Listings: 6

- Per 30 days Airbnb Apartment Source of revenue: $2,770

- Airbnb Money on Money Go back: 8.68%

- Airbnb Cap Charge: 9.03%

- Airbnb Day by day Charge: $391

- Airbnb Occupancy Charge: 46%

- Selection of Listings for Sale: 7

- Median Belongings Worth: $431,929

- Stroll Rating: 32

9. Centereach, NY

- Selection of Airbnb Listings: 9

- Per 30 days Airbnb Apartment Source of revenue: $7,059

- Airbnb Money on Money Go back: 8.84%

- Airbnb Cap Charge: 8.99%

- Airbnb Day by day Charge: $139

- Airbnb Occupancy Charge: 64%

- Selection of Listings for Sale: 15

- Median Belongings Worth: $548,640

- Stroll Rating: 59

10. Kingsburg, CA

- Selection of Airbnb Listings: 8

- Per 30 days Airbnb Apartment Source of revenue: $9,443

- Airbnb Money on Money Go back: 8.88%

- Airbnb Cap Charge: 8.98%

- Airbnb Day by day Charge: $165

- Airbnb Occupancy Charge: 62%

- Selection of Listings for Sale: 10

- Median Belongings Worth: $760,939

- Stroll Rating: 87

Conclusion

Now you’ve got the information and the figuring out of the easiest apartment markets and perfect cap charge actual property markets in the USA in 2022. All that’s left for you is to head throughout the to be had houses and imagine them in your funding portfolio. In fact, in case you join Mashvisor, you’ll be able to simply flip 3 months value of actual property analysis into an effective 15-minute research.