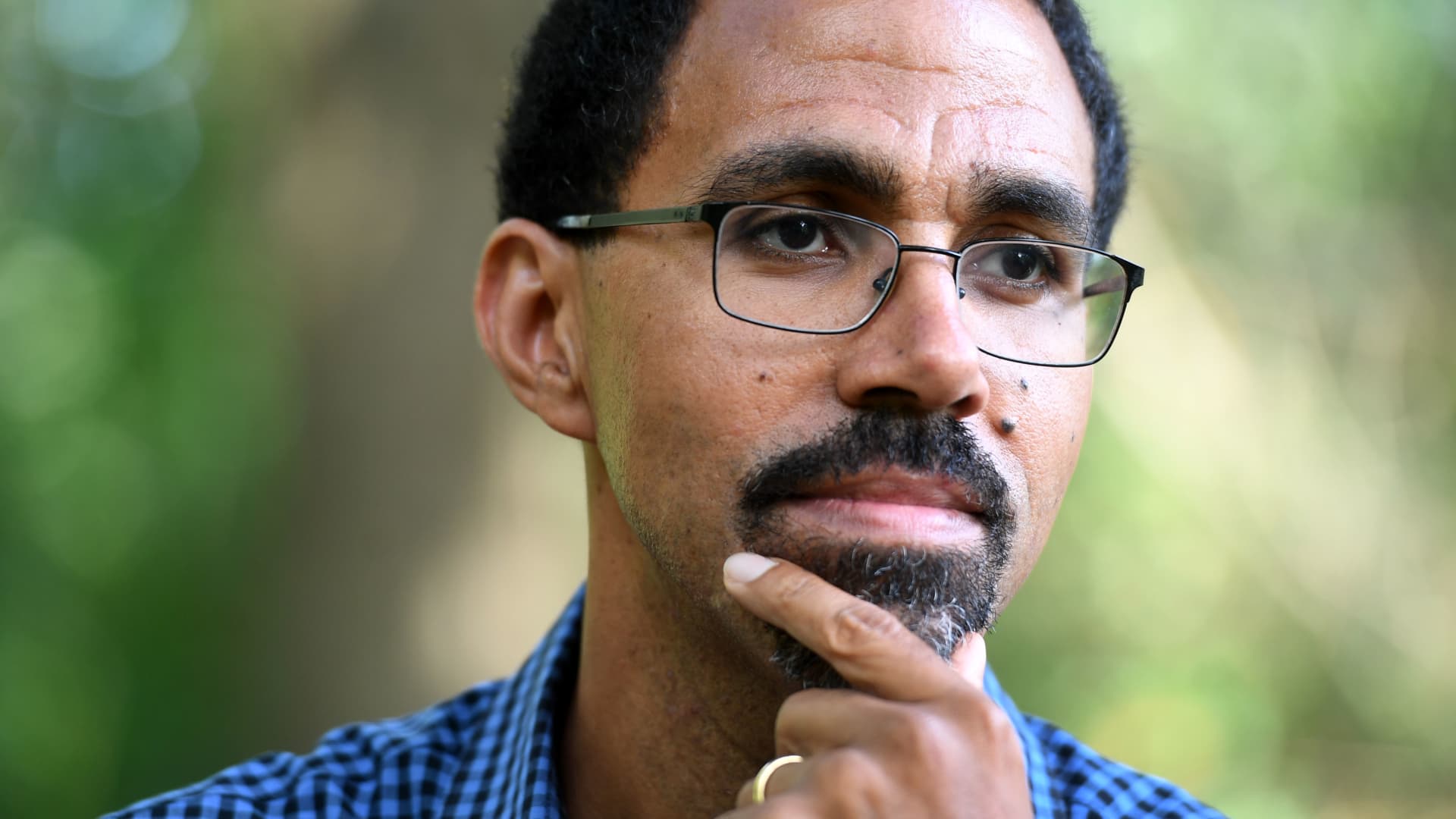

John King.

Katherine Frey | The Washington Publish | Getty Photographs

It used to be most effective after John King left workplace as Schooling secretary below then-President Barack Obama that he completed off paying his personal pupil loans.

“I’ve spent numerous my grownup lifestyles paying it down,” mentioned King, who studied executive at Harvard and regulation at Yale. He would not disclose how a lot he owed, however, he mentioned, “It used to be moderately a little bit, many tens of 1000’s of greenbacks.”

King, 47, who is lately operating for governor of Maryland as a Democrat, has now change into one of the crucial many of us calling on President Joe Biden to cancel pupil debt via govt motion. “We have now a possibility on this second to boost this burden for folks, and I feel in point of fact assist boost up our financial restoration from Covid,” King mentioned.

He additionally had warnings about what is going to occur if Biden does not act. A spokesperson for the White Area says the management continues to imagine the choices for mortgage forgiveness.

The interview has been edited and condensed for readability.

Annie Nova: What used to be it about your time as Schooling secretary that makes you presently improve pupil mortgage forgiveness?

JK: All over the Obama management, we have been very concerned with addressing the load on scholars who’d been taken good thing about by way of predatory, for-profit faculties. We additionally installed position income-based reimbursement methods. Taking a look again, the ones plans were not sufficient. And on this second, given the Covid disaster and the commercial disaster that got here together with the pandemic, we’ve a possibility to make this a New Deal second, the place we cancel debt for all.

AN: Do you imagine President Biden has the facility to forgive pupil debt on his personal, with out Congress?

JK: Sure. We have been in a position to position in position within the Obama management a procedure for debt cancellation. And the majority of attorneys who have checked out this query imagine there may be the manager authority for huge forgiveness.

AN: Have you ever had any conversations with the present Schooling secretary, Miguel Cardona, about debt cancellation?

JK: I’ve talked with him. This determination will come all the way down to the president.

AN: Greater than 40 million American citizens raise pupil debt. The common burden is greater than $30,000. 1 / 4 of debtors are in the back of on their bills. How did we get right here?

JK: This pupil debt disaster is the made from a 40-year coverage mistake. The buying energy of the Pell Grant has been allowed to decrease. In 1980, Pell Grants accounted for just about 80% of the price of a public upper schooling stage; now it is lower than a 3rd. As a rustic, we’ve got shifted from seeing upper schooling as a public excellent to hanging a big percentage of the load on scholars and households.

AN: If pupil loans get canceled, how do you keep away from the debt from simply spiraling out of keep an eye on once more?

JK: Fixing the issue going ahead calls for doing the issues which can be important to make public upper schooling to be had to all scholars with out debt. And that’s achievable. It in point of fact comes all the way down to this concept that debt-free school is a public excellent, and simply as we take into consideration Okay-12 schooling as serving the general public hobby, the well being of our financial system and the well being of our democracy, so, too, will have to we take into consideration upper schooling.

AN: What do you assume will occur if Biden does not forgive pupil debt?

JK: There could be super disillusionment from key constituents who’re a very powerful for the well being of the Democratic Birthday party.

Extra from Non-public Finance:

7 issues to grasp concerning the SEC local weather rule

Here is the common tax refund thus far this 12 months

The way to keep away from a 6-figure tax penalty on overseas financial institution accounts