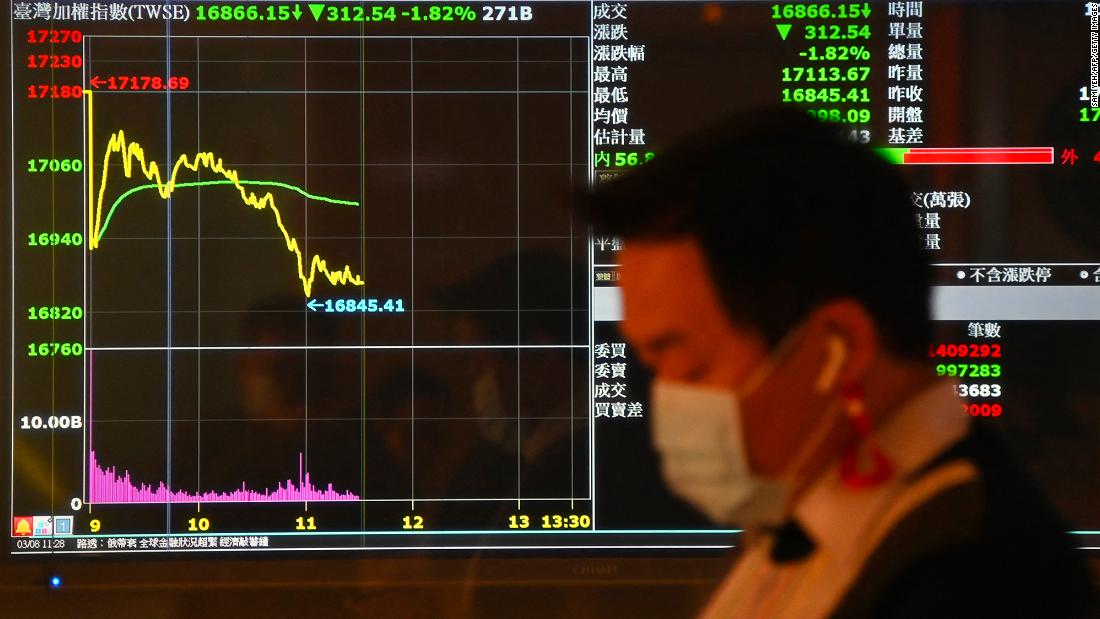

Within the 3 weeks following the invasion, overseas buyers dumped stocks price about 480 billion Taiwanese greenbacks ($16.9 billion), in keeping with Alex Huang, director at Mega World Funding Services and products, a Taipei-based company.

That outflow is the largest on document, he stated, exceeding the worth of Taiwanese stocks offered through overseas buyers in the entire of 2021, which Financial institution of The united states analysts have estimated at $15.6 billion. Goldman Sachs analysts venture that Taiwan has observed an outflow of $15.6 billion over the last month, topping remaining 12 months’s tally of $15.3 billion.

It is “the largest [rout] on document thus far,” Huang advised CNN Trade. “That is even larger than the worldwide monetary disaster in 2008.”

However Russia’s assault on Ukraine has renewed fears that China may well be emboldened to advance its personal army aggression towards Taiwan, a self-governed democratic island that the Communist management in Beijing has lengthy claimed as a part of its territory, regardless of having by no means dominated over it.

Hypothesis has grown that China may act, “both to milk Western distraction or to advance a brand new global order,” Eurasia Staff mavens wrote in a March file. “However those comparisons fail to remember key variations and forget about political indicators from Beijing and Taipei.”

Hovering outflows

Each Beijing and Taiwan have brushed aside the comparability, albeit for extraordinarily other causes. And regardless of the outpouring of money, Taiwan’s general inventory marketplace hasn’t suffered catastrophic losses.

Huang stated that was once as a result of a number of government-backed Taiwanese banks just lately went on a purchasing spree, serving to mitigate the loss.

He stated that buyers founded in Taiwan were not struggling the similar lack of self assurance, partly as a result of many believed the 2 scenarios had been dissimilar, and as a result of a consensus that the USA would step in to assist protect the island within the tournament of a significant assault.

Even sooner than the Ukraine invasion began, international buyers were anxious as a result of a lot of elements, similar to emerging costs of oil and uncooked fabrics and anticipated fee hikes in the United States.

Then the struggle started, developing “an ideal typhoon,” Huang stated.

Small however mighty

Amongst locals, TSMC is even dubbed the “sacred mountain that protects nationwide safety.”

However since past due February, its stocks have slipped greater than 3% each in Taipei and New York. Taiwan’s tech shares have additionally lagged the wider marketplace, with the island’s tech index down 2% over the similar length, in keeping with Refinitiv knowledge.

On account of its “stranglehold” at the global of pc chips, “lots of the Taiwan-related worries have a tendency to be mirrored in semiconductor shares,” stated Phelix Lee, an fairness analyst at Morningstar.

In a report back to purchasers, he stated that buyers had two considerations: fears of a Chinese language invasion, and nervousness over the provision of uncooked fabrics, together with neon.

But when the rest had been to occur to Taiwan, there may be extra at stake for the worldwide economic system than chips. The island may be the most important producer of top of the range bicycles and sports wear, together with factories for international manufacturers, Huang added.

Status guard

Taiwan’s forex has additionally suffered. It has long past from serving as a “regional secure haven to geopolitical possibility proxy” in contemporary weeks, in keeping with Financial institution of The united states.

“Geopolitical uncertainties over Taiwan are the largest drivers of portfolio outflows,” analysts there wrote in a word to purchasers previous this month.

They stated that the Taiwanese buck was once “starting to lag after a stellar 12 months in 2021,” after being hit through “a pointy build up in possibility aversion” following the Russian invasion.

However regardless of the stress, many mavens consider that Taiwan is secure for now.

“Russia’s invasion of Ukraine does no longer up the near-term odds that China invades Taiwan,” Eurasia Staff analysts wrote of their file previous this month.

They famous that “each Beijing and Taiwanese President Tsai Ing-wen have performed down the relationship between Ukraine and Taiwan,” and that there looked to be “no arrangements in Beijing and no panic in Taipei.”

China’s ruling Communist Birthday party has again and again vowed to “reunify” with the island — the usage of power if essential.

“Those are completely various things.”

As for investor jitters, “we expect the concern in regards to Russia has peaked already, and can fade away to grow to be a secondary attention,” stated Huang.

— Wayne Chang and Eric Cheung contributed to this file.