Making an investment in a condo belongings on the market is a superb nice option to create a constant source of revenue circulate and construct wealth in the longer term.

In keeping with contemporary statistics, there are about 43.3 million families renting in the USA. The stated determine is up from 34.6 million earlier than the Nice Recession. Between 2016 and 2021, the USA condo marketplace grew by way of simply 0.2%. As well as, as much as $485 billion is going to hire once a year.

Buying a condo belongings is likely one of the largest choices most of the people make of their lifetime. Despite the fact that it could take a little bit little bit of effort and time, it’s additionally a little intimidating whilst beginning. Additionally, it calls for you to commit an important quantity of your effort and time. You want to know vital actual property fundamentals akin to tips on how to put money into actual property, find the perfect funding belongings, get admission to financing, and in finding excellent tenants.

Observe that “funding belongings” right here method a belongings supposed to hire out to generate condo source of revenue. Whilst buying your first funding belongings is nearly very similar to purchasing your number one place of abode, there are a couple of elements that you just will have to imagine.

In lately’s article, we have a look at such elements and different insider tricks to assist in making the method reasonably problem-free.

Desk of Contents

- Is Purchasing an Funding Assets the Proper Selection?

- Pointers for Purchasing a Condominium Assets for Sale

- Backside Line

Be informed concerning the most sensible 10 pointers for purchasing a condo belongings beneath.

Is Purchasing an Funding Assets the Proper Selection?

Sooner than we get to the criteria that you just will have to imagine when pondering of shopping for a condo belongings on the market, you will have to first solution the above query. You want to grasp whether or not it’s the proper funding for you. Finally, there are lots of tactics of making a living in actual property.

At the beginning, are you in a position to embody the volume of labor and energy had to perform landlord actions? Whilst most of the people classify condo funding source of revenue as “passive,” there’s relatively an lively involvement wanted. Although making a decision to outsource the duties and duties to a belongings control company, you’ll nonetheless be required to supervise your funding.

As an example, you’re required to approve sure maintenance, repairs duties, and belongings enhancements and renovations. Additionally, you will have to ceaselessly undergo per thirty days and annual monetary statements, such because the source of revenue remark and internet benefit document.

Secondly, are you in a position to maintain the tenants? Tenants could make or smash your funding. When you stick to dangerous tenants who don’t pay the hire on time, your condo source of revenue turns into nearly non-existent. It proves that an funding belongings might include the next chance than different investments, say the inventory marketplace.

Despite the fact that you can provide your all all over the tenant screening procedure, you continue to chance finishing up with a foul tenant. Take into account that if making a decision to evict the tenant, the eviction procedure and prices concerned might utterly devour up your possible returns and total earnings. The eviction procedure is time-consuming, too.

It isn’t to color condo investments in a foul gentle. We simply sought after to polish a focus at the dangers concerned. Alternatively, the gamble you are taking by way of making an investment in condo belongings comes with massive returns. The upsides, akin to belongings price appreciation and tax advantages, are unrivaled.

Pointers for Purchasing a Condominium Assets for Sale

When you’ve determined that being a landlord is in truth value it, it’s now time to seek out condo belongings on the market close to me and make investments your cash. The next 10 pointers will kickstart your funding at the proper notice.

1. Compile a Staff to Paintings With

“If you wish to stroll rapid, stroll by myself. If you wish to stroll a ways, stroll in combination.”

Whether or not you’re a brand new or skilled actual property investor, you wish to have to paintings with a workforce. Encompass your self with seasoned execs who will stroll with you to your making an investment adventure. Why is it vital?

Making an investment in a condo belongings is fully other from purchasing a number one house. You wish to have to stroll with individuals who will allow you to with the method concerned whilst securing financing, discovering your preferrred condo belongings on the market, and shutting the deal. Make certain that the folk you select to paintings with know what they’re doing.

Actual property execs to paintings with come with a neighborhood actual property agent, dealer, actual property lawyer, house inspector, insurance coverage agent, appraiser, and plenty of others. Necessarily, your actual property agent can also be the supply of all different execs on account of their in depth community.

Mashvisor Actual Property Agent Listing is a superb position to start out your seek for an actual property agent. At the platform, you’ll in finding crucial agent main points, akin to license quantity, actual property revel in, agent’s specialties, and evaluations from different shoppers who’ve labored with them earlier than.

As an actual property investor, you’re handiest as excellent because the workforce you encompass your self with.

Similar: Promoting Your House? Learn how to Discover a Actual Property Agent

Seasoned execs can also be very useful to your making an investment adventure, whether or not you’re a brand new or an skilled actual property investor.

2. Pay off Your Private Money owed

Many skilled actual property traders use debt as a part of their condo funding technique. Then again, in case you’re simply beginning out with little to no revel in, we propose you keep away from it. If you were given any unpaid clinical expenses or pupil loans, or dependents becoming a member of school quickly, you may wish to rethink your funding technique.

Are you able to nonetheless put money into condos on the market in case you nonetheless face unpaid money owed? The solution is sure. Simply calculate whether or not the go back on funding you’ll get out of your condo belongings is upper than the price of debt. If it’s better, then chances are you’ll continue with the funding. (When you’re questioning tips on how to calculate the go back on funding, we’ll get to that during a couple of).

The important thing this is to keep away from striking your self in a difficult place the place you’re not able to make bills in your money owed.

3. Come to a decision What You Wish to Purchase

Sooner than going additional down the condo belongings funding procedure, it’s crucial that you just nail down your funding objectives. They’ll lend a hand information your making an investment procedure.

You’ll ask your self a couple of questions to lead you. Do you wish to have to shop for a single-family house or a multi-family belongings? Is discovering a condominium or a duplex on the market extra of what you’re on the lookout for?

Sooner than deciding what you must purchase, there are a couple of elements to imagine. As an example, whilst multi-family homes can generate extra money float, single-family houses, particularly the ones in sizzling markets, generally tend to supply extra appreciation possible.

Observe that once we communicate of multi-family residential houses, we imply homes with two to 4 devices. Houses with greater than 5 devices might require you to get business financing, which we don’t suggest for newcomers.

4. Safe the Down Fee

Financing a condo belongings on the market works otherwise than that for a number one place of abode. For starters, you wish to have a bigger down cost. The rates of interest and lender charges also are upper. In a similar fashion, the approval procedure is extra stringent.

As an example, you’ll want to protected a 20% down cost when buying a condo belongings. You’ll handiest want 3% when purchasing your number one place of abode. This is because there’s no loan insurance coverage for condo homes. Then again, you’ll gain the down cost via financial institution financing, akin to taking a non-public mortgage.

5. Purchasing With Money vs. Financing

So, must you purchase your condo belongings with money or get financing? Once more, it is dependent upon your financing objectives. There’s no one-size-fits-all solution.

Paying for the valuables the use of money let you generate certain per thirty days earnings. Let’s say you purchase the valuables for $100,000. When you take away the valuables bills, akin to taxes, and belongings depreciation, it’s good to be expecting annual earnings of $9,500. It’s an identical to an annual go back of 9.5% on an preliminary funding of $100,000.

Financing, alternatively, will get you a better go back. Let’s say you place 20% because the downpayment and get a loan with a 4% compounding charge. If you are taking out the valuables bills and running prices, the income could be about $5,580 every year. Whilst the money float is decrease, the yearly go back is 27.9% at the preliminary funding of $20,000. It’s a lot upper than the 9.5% the money purchaser will get.

Whilst financing will get you the next go back, take into account we discussed that the necessities are extra stringent. Right here’s a normal breakdown of a few of these necessities:

- Whilst it’s imaginable to buy condo constructions on the market with decrease credit score, chances are you’ll want a credit score rating of 720 if you wish to get the most efficient mortgage phrases.

- You’ll want to supply borrower paperwork, akin to evidence of source of revenue, financial institution statements, and copies of tax returns.

- If the periodic source of revenue is much less or belongings bills are upper than projected, lenders might require you to offer a reserve account protecting as much as six months of loan bills.

Despite the fact that you wish to have to leap via many hoops whilst securing financing in your condo belongings funding, the excellent news is that there are lots of choices to be had for you to choose between. Learn our information at the easiest sorts of loans for condo belongings traders.

Similar: A Information to Ingenious Financing for Actual Property Buyers

6. Come to a decision The place You Wish to Purchase

Your condo belongings’s geographical location may be vital. No investor desires to be left with an funding belongings that’s caught in a declining community slightly than one who’s solid or rising rapid.

Spaces or neighborhoods whose populations are rising provide very good funding alternatives. You might also need to take a look at spaces with revitalization plans. Basically, you’ll search for the next location options:

- A super college district

- Low belongings taxes

- Facilities, akin to eating places, strolling trails, parks, buying groceries amenities, and occasional stores

But even so, don’t put out of your mind fundamentals akin to get admission to to public transportation, low crime charges, and a rising task marketplace. The stated elements guarantee you of a big pool of renters to choose between.

If it kind of feels like a difficult nut to crack, concern now not since Mashvisor additionally supplies a complete information at the subject.

7. Calculate the Money Drift

As an actual property investor taking a look to buy a condo belongings on the market, one of the vital easiest ideas you’ll perceive is money float. Why? As a result of some traders purchase into what turns out like a excellent deal for a condo belongings. Then again, they quickly understand that their running prices and possession bills are upper than their condo source of revenue. In one of these case, your checking account is tired to unfavourable.

You wish to have to know whether or not the valuables you’re interested by can realistically generate certain money float whilst you purchase it. We use realistically right here because it doesn’t merely imply subtracting your per thirty days loan cost out of your condo income and getting a favorable quantity. It will be unrealistic because it simply signifies that you just’ll generate a favorable money float when issues are working completely.

In the actual international, your home will revel in vacancies once in a while, and also you’ll additionally want to settle repairs charges. They’re one of the crucial elements that you just will have to imagine when calculating your money float.

Listed here are the stairs you wish to have to practice when calculating your money float:

- Estimate your annual condo source of revenue.

- Estimate your annual running bills, together with belongings maintenance, control prices, taxes, and insurance coverage.

- Subtract bills out of your annual source of revenue.

- Calculate down cost plus different prematurely bills (akin to required maintenance).

- Divide annual money float by way of the overall amount of money invested.

As an example, let’s think that you wish to have to obtain an condo advanced on the market that may generate $2500 per thirty days. Your loan cost is $1,200, whilst your home control company levies a rate of 10% at the accumulated hire. When you put aside 15% of your condo source of revenue for vacancies and upkeep, the next is what your money float calculations will seem like:

Hire Accumulated = $2,500

Loan Fee = $1,200

Assets Control = $250

Emptiness and Upkeep Allowance = $300

Overall Bills = $1,750

Money Drift (Hire Accumulated – Overall Bills) = $750

Mashvisor Condominium Assets Calculator

If performed manually, wearing out the calculations we’ve described above can also be an uphill activity. But even so, sensible actual property traders use quite a lot of tool and on-line gear to lend a hand them with their day by day duties.

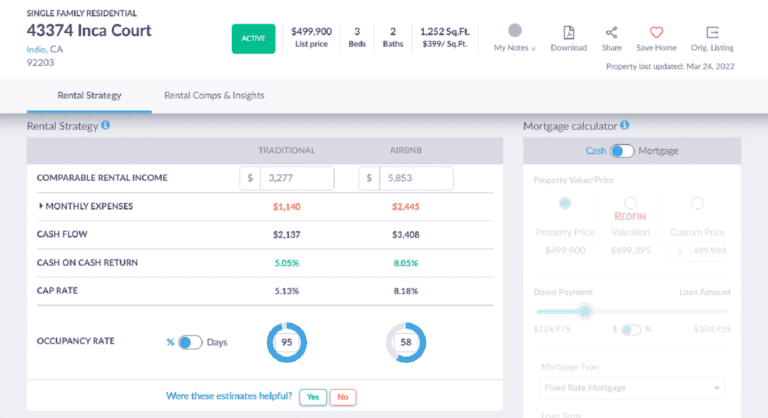

Mashvisor Condominium Assets Calculator is an internet actual property device the place traders enter fundamental belongings data, akin to acquire worth, money funding, and financing means. The device then calculates the an important numbers, akin to cap charge and money on money go back, so that you can make a decision whether or not making an investment within the belongings makes monetary sense or now not. Briefly, the device is helping you’re making sensible funding choices according to a belongings’s money float.

Our calculator provides comfort to the combination since you’ll perform all of the procedure in only a subject of mins. You don’t want to spend days upon days collecting hordes of information and organizing it on spreadsheets.

Actual property traders who’ve used Mashvisor’s calculator reward it for its accuracy. With such a very powerful calculation, you don’t wish to make fallacious funding choices just because you were given one quantity fallacious. Our device makes use of each conventional and predictive analytics at the side of comparative and historic information to give you correct effects.

Enroll for the Mashvisor trial now and get admission to the most efficient condo belongings calculator.

Similar: Learn how to Behavior a Thorough Airbnb Funding Research

Mashvisor’s Condominium Assets Calculator calculates vital metrics, akin to money float, money on money go back, and cap charge, serving to traders make a decision whether or not a belongings is value making an investment in or now not.

8. Come to a decision Whether or not to Rent a Assets Supervisor

Taking over landlord duties can also be extra time and energy-consuming than it’ll seem. Managing your condo belongings on your own method you wish to have to display tenants, accumulate condo bills, and agenda maintenance and upkeep. Then again, you’ll rent a belongings control company to hold out the stated duties for you.

Then again, understand that belongings managers price between 8% and 10% of the hire accumulated. The price is usually a primary drawback, particularly when your money float isn’t massive. It could actually devour up an important chew of your benefit margins.

It isn’t to mention that hiring a belongings supervisor isn’t value it. Finally, it permits you to have the benefit of their business experience and unlock the in-tray to your table. Your own home supervisor will allow you to:

- Perceive the native condo marketplace smartly

- Set the precise condo charges

- Marketplace your condo belongings to potential tenants

- Display the valuables to potential tenants

- Display tenants by way of wearing out background and credit score tests

- Gather hire

- Care for overdue bills

- Handle repairs problems and tenant lawsuits

- Time table maintenance

- Pay belongings bills, akin to taxes, insurance coverage, and utilities

How Can I Identify Whether or not to Rent a Assets Supervisor or No longer?

If you’re feeling caught on whether or not to rent a belongings supervisor or now not, listed below are a couple of questions that may information you:

- Am I in a position to control the valuables myself? When you paintings in a full-time task, it’s most likely that you just gained’t in finding the time and effort to absorb the valuables control duties, particularly in case you personal more than one homes.

- Can I maintain tenants? You could be excellent at screening possible tenants. Then again, you wish to have to understand that you just will have to additionally care for overdue hire bills, unreasonable tenants, or even evictions.

- Is the condo belongings just about my house? In case your condo is a substantial distance away out of your number one place of abode, it’ll be tougher to care for pressing and regimen problems.

- What’s my condo technique? When you’re pursuing the standard long-term condo technique, it could be more straightforward to self-manage because you’re handiest coping with one tenant in line with belongings at a time. Alternatively, you may want to rent a belongings supervisor in case you’re following the non permanent condo technique. This is because you’ll be coping with many various tenants, which means there could be many lawsuits and upkeep problems.

As you’ll already inform, hiring a belongings supervisor can utterly be value it. If you’re feeling you’ve got the time and effort to self-manage, simply give it a check out. Then again, we propose you get a belongings supervisor for the day by day control duties.

9. Spend money on Insurance coverage

There are some dangers that include being a condo belongings proprietor. One in every of them is injuries. To give protection to your funding, you wish to have to take each house owners’ insurance coverage and landlord insurance coverage insurance policies.

House owners and landlord insurance coverage are relatively identical as they supply protection for belongings harm all over unexpected occasions. Then again, house owners’ insurance coverage doesn’t simply duvet your house, but additionally your own belongings, and clinical and prison bills to handle other people injured in your house.

House owners’ insurance coverage might handiest be enough whilst you’re now not renting out the valuables. If you wish to hire out the valuables for a longer duration, a landlord’s insurance coverage will duvet you in tactics the house owners’ insurance coverage doesn’t. Briefly, we propose house owners’ insurance coverage if it’s your number one place of abode you’re insuring and landlord’s insurance coverage in case you’re renting out the valuables for a very long time.

Landlord insurance coverage provides extra coverage for condo belongings homeowners, together with lack of source of revenue protection in case a coated loss pushes your tenant to transport out. You gained’t in finding identical protection in house owners’ insurance coverage.

10. In finding the Condominium Assets for Sale

When you’ve adopted the entire steps we’ve described to the letter, you’ll be in a position to search for the condo belongings on the market close to me. There are a large number of on-line platforms that you’ll use in your belongings seek. Sadly, lots of the listings at the platforms are for traders on the lookout for number one flats.

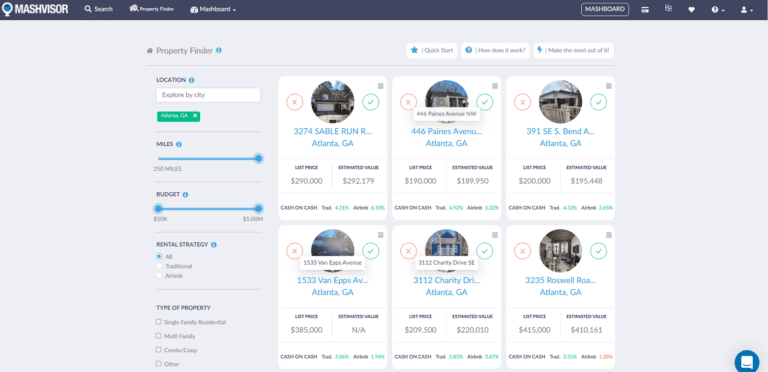

That’s why most present traders on the lookout for condo belongings on the market get started their seek on Mashvisor’s Assets Finder. The device makes use of AI and machine-learning algorithms that will help you in finding funding homes according to your earlier seek historical past and different customized elements. The most productive factor is that you’ll do all this in only a subject of mins.

You’ll use the next filters to seek out listings that fit your standards:

- Price range

- Location

- Condominium technique (Conventional or holiday condo technique)

- Choice of bedrooms and lavatories

While you’ve set the filters, the device presentations you essentially the most winning listings within the location of your selection. You’ll even seek for homes in a couple of housing marketplace concurrently. As an example, you’ll in finding condo belongings on the market in Florida and Georgia on the identical time.

Similar: The Absolute best Condominium Markets in Georgia: The 2022 Information

Many fashionable traders on the lookout for condo belongings on the market use Mashvisor’s Assets Finder of their seek.

Backside Line

Even on a small scale, actual property making an investment’s grew to become many traders into millionaires through the years. It stays a certain manner of establishing your own money float and wealth. Despite the fact that it can be thrilling to start with, you wish to have to be lifelike together with your expectancies. Don’t be expecting to make massive returns in a single day. Additionally, choosing the fallacious condo belongings on the market is a grave mistake that might price you your corporation.

One of the best ways to keep away from making trade errors is by way of the use of Mashvisor gear. Our gear have been advanced with the sensible actual property investor in thoughts and are supposed to empower you to your funding adventure. If you wish to be told extra about what our gear can do for your corporation, e-book a demo lately.