[ad_1]

Zillow’s estimated marketplace price instrument “Zestimate” has been puzzled via each actual property buyers and brokers for its accuracy.

Zillow is a web-based belongings seek web page that makes its cash via accumulating charges from its customers. They created Zestimate with the aim of assisting buyers in figuring out a belongings’s price.

Despite the fact that this turns out helpful, the accuracy of its knowledge has been put into query. It has come to the eye of customers that Zestimate does now not imagine critical facets that vary the price of a house. If it doesn’t account for those components, is it nonetheless a correct instrument?

On this article, we can overview Zestimate to decide how dependable this instrument is. We can imagine all the problems put into query via brokers and buyers to decide in the event that they must proceed the usage of it for funding choices. Finally, we can take a look at a substitute for this instrument that may give extra dependable knowledge to its customers.

What Is Zillow?

Earlier than one can say how correct Zestimate is, we must take a look at the supply of its introduction. Zillow is a web page that permits any individual to seek for to be had belongings listings at no cost. Because of this each homebuyers and dealers may take pleasure in the usage of Zillow’s products and services.

Comparable: Zillow—Dependable Assets Seek Instrument for Actual Property Buyers?

Zillow may be a platform for flipping homes. In reality, that is the place it makes cash. They rate a gross sales charge, together with pastime for house loans and charges for leads. Every now and then it’s unclear to the fundamental consumer as to how Zillow makes a benefit, however necessarily it’s via accumulating charges.

In particular for patrons, Zillow shall we customers purchase to be had houses all over the web page. If you want an agent, it’ll come up with one that particularly represents Zillow. They take a charge from any belongings bought via the usage of the web page.

For dealers, householders can record their houses proper at the web page. But when the house is bought thru a purchaser who accessed the Zillow platform, the corporate then takes a charge for that acquire.

Zillow additionally permits customers to find condominium houses in the event that they wish to trip or discover a position to stick. No longer most effective can customers glance thru to be had condominium listings, however they are able to additionally add knowledge like their credit score rating, a background take a look at, or any further verification pieces one would want for a condominium belongings. This shall we customers accelerate the method of discovering a condominium that works for them.

Renters the usage of Zillow will also select to pay on-line for his or her condominium belongings at some point of their keep slightly than going during the proprietor immediately or the usage of exams. If this happens, Zillow takes a charge of the condominium overall.

Some of the final key options that Zillow gives is mortgages. For customers, Zillow gives mortgages that come from different lenders they’re partnered with. That is in a different way Zillow is in a position to make a benefit.

Notice that Zillow additionally gives some gear corresponding to a loan condominium calculator, an affordability calculator, and hire Zestimate: a house price estimator.

What Is Zestimate?

Despite the fact that the general public who know anything else about actual property are conscious about Zillow, they will not be as accustomed to Zestimate.

Zestimate is a device created via Zillow this is used to lend a hand estimate the price of a house. It really works via the usage of a proprietary formulation created via statisticians that kind thru the actual property knowledge to create an estimated belongings price. This might be helpful to buyers who’re in search of an source of revenue belongings.

Despite the fact that Zestimate is a device described to estimate the price of a house or belongings, it does now not account for different specifics that pass into figuring out a belongings’s price. Zillow claims that its objective is solely to be a place to begin when figuring out the price of a belongings.

The one options Zestimate takes under consideration when figuring out house price are a belongings’s bodily attributes and tax information. Sometimes the tool will acknowledge different user-submitted knowledge and use that during its estimate.

Despite the fact that Zestimate would possibly appear love it might be helpful to buyers, how dependable is it?

Is Zestimate Correct?

Zestimate is Zillow’s model of a house price calculator. As actual property making an investment will also be difficult, the corporate tried to create this tool to lend a hand buyers pass judgement on the price of a possible funding belongings. If the calculator is incorrect, regardless that, then it’s prone to result in dangerous funding instructions.

Comparable: The number one Actual Property Funding Calculator in 2022

Zestimate Most effective Appears to be like at Taxes and Bodily Attributes

Buyers and brokers alike have complained that Zestimate’s knowledge and the instrument general is just now not useful for actual property funding methods, as the information produced via the tool isn’t dependable. One key function that makes it questionable is the truth it does now not imagine a very powerful options that may decide the price of a house. Despite the fact that the valuables takes under consideration taxes and bodily facets, it does now not imagine location, particular options or facilities, and the situation of the valuables.

There Is a Prime Error Charge

If you’re an investor the usage of actual property funding gear, you should ensure that you’ll be able to rely at the knowledge you might be given, or else your funding belongings will fail. Zestimate does now not take into accounts one of the key facets that give price to a house. How are you able to consider it?

Briefly, customers in point of fact can’t. Zestimate studies the nationwide error charge is round 4.6%. This could imply in the case of Zestimate, part of the checklist costs noticed on Zestimate have an error charge of four.6% already, and the opposite part has a good upper error charge. If you’re making an investment in actual property, then this information is some distance from correct.

The function of making an investment is to generate a passive source of revenue. If your whole knowledge is off, it’ll throw off how a lot source of revenue you expect to make from the funding belongings. A 4.6% error charge would possibly now not appear to be so much, however that’s 4.6% extra you’ll have to pay to your belongings. That may be hundreds of bucks after all, particularly if your own home is an condominium construction or apartment advanced.

They Depend on Consumer Data

Apart from the huge error charge, Zestimate depends upon consumer knowledge to create its estimated house price worth. Despite the fact that this turns out like an ideal concept, if the tips the consumer entered was once misguided, then the Zestimate will probably be incorrect.

Customers can repair this knowledge proper at the authentic Zillow checklist, however Zillow does now not ensure it’ll even exchange the Zestimate. It’s because it takes some time for the adjustments to be to be had to the Zestimate tool, they usually even say that on occasion the adjustments don’t seem to be considered in any respect.

This implies customers gained’t know if the Zestimate estimate they’re having a look at for a belongings is correct, and there’s in point of fact no means of telling. This is able to purpose critical issues for buyers when making funding choices corresponding to budgets and remodels.

Zestimate Does No longer Imagine Upgrades & Remodels

When in search of an funding belongings, if you don’t want to mend and turn a house, it’s most likely you might be in search of a belongings that wishes the least quantity of upkeep. A newly made over house could have a better price than the similar taste house that has had no upgrades in two decades. Zestimate does now not take house remodels under consideration when figuring out their estimated house price.

For instance, if you happen to and your neighbor have the very same options in your house, however you latterly rework and upgraded all the bogs whilst your neighbor has now not, Zestimate will nonetheless price each houses similarly. It will make it tough for buyers to remember that new adjustments have even been made to the valuables.

General, Zestimate has some key problems with their tool that in the end makes it tough for actual property buyers. How can any person decide if an source of revenue belongings on the market is price making an investment in if all the knowledge is incorrect?

What Is Mashvisor?

If you’re an investor in search of dependable actual property knowledge, imagine the usage of Mashvisor. We’re an actual property web page that is helping buyers in finding profitable houses to develop into leases. We have now all kinds of gear and products and services which might be to be had to our customers to lend a hand information them thru their funding choices and techniques. All of Mashvisor’s knowledge is from dependable resources corresponding to Airbnb and the MLS. This knowledge is put thru our particular set of rules to supply our customers with predictive estimates and different helpful knowledge.

Mashvisor’s Assets Price Instrument

We provide many alternative gear and products and services you can want inside your making an investment occupation. Very similar to Zestimate, we now have a belongings price instrument known as Funding Assets Calculator. However in contrast to Zestimate, our knowledge is extra dependable and can information you against winning funding choices.

Our funding belongings research instrument is helping you fine-tune your funding prices and create an concept of estimated returns. This is very important when looking to calculate your price range to your general funding. You wish to have to rely at the knowledge you might be supplied with as a result of, after all, it’ll be a a very powerful side whether or not you’ll make a benefit or now not. You’ll be able to rely on Mashvisor for correct actual property knowledge.

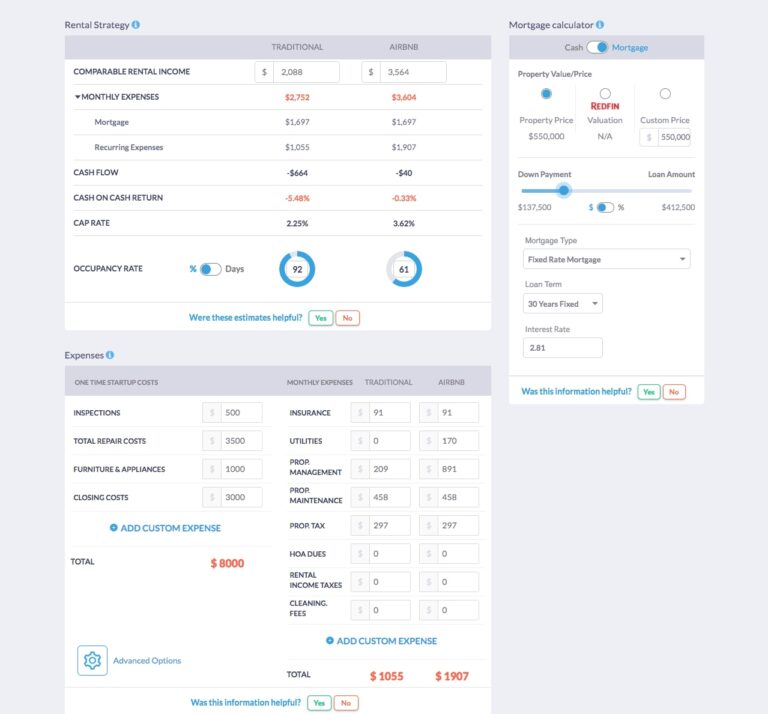

Our Funding Assets Calculator instrument supplies buyers with the predictive knowledge:

- Loan Hobby Charge

- Assets Tax

- Repairs Prices

- Money on Money Go back

- Cap Charge

- Airbnb Condominium Source of revenue

- Money Drift

- Airbnb Occupancy Charge

Masvhisor needs to come up with all the metrics had to make sensible actual property choices.

Comparable: The way to To find Cap Charge for a Actual Property Marketplace

Present in each and every checklist revealed at the Mashvisor platform is the Funding Assets Calculator, which estimates the valuables’s money waft and returns in response to the condominium technique, condominium source of revenue, bills, and occupancy charge.

What Different Gear Does Mashvisor Be offering?

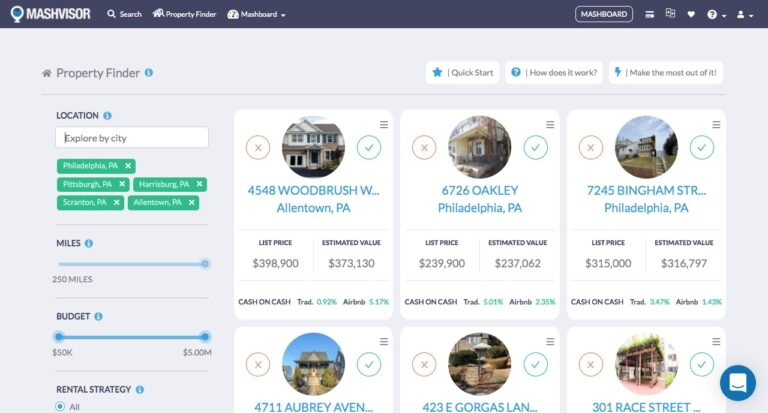

Mashvisor gives many gear but even so a house price calculator. Earlier than you’ll be able to even decide how winning an funding belongings will also be, you want to discover a area. We provide buyers a Assets Finder instrument that allows you to seek thru to be had houses in any town around the U.S. Mashvisor shall we our customers clear out thru those listings so they’re most effective viewing those that very best have compatibility their needs and wants. Under are one of the filters presented:

- Price range

- Location ( you’ll be able to seek more than one towns without delay)

- Condominium Technique ( Airbnb or Conventional)

- Collection of Bedrooms / Bogs

- Form of Assets

This knowledge is used to compare you along with your absolute best funding belongings.

We additionally be offering an ideal Actual Property Heatmap instrument. That is absolute best for buyers having a look to habits an area research to find a winning funding location. Our map displays you the listings with the most efficient costs, that may be offering the absolute best Airbnb condominium source of revenue and money on money go back. Location is a a very powerful side of making an investment as it could actually utterly adjust how winning funding will also be.

The usage of Mashvisor’s Assets Finder, you must seek as much as 5 other towns on the similar time. This may occasionally can help you in finding the valuables with the absolute best benefit attainable even if you end up nonetheless taking into consideration other places.

Must Actual Property Buyers Use Zestimate?

Despite the fact that this query is as much as the investor themselves, Zillow’s house price estimator turns out to have moderately a couple of issues.

First, Zestimate acknowledges taxes and bodily attributes in its calculations however fails to imagine many different components corresponding to location, form of belongings, and the way not too long ago the house has been made over. Mashvisor’s Funding Assets Calculator, alternatively, takes all of those components under consideration to supply buyers with probably the most correct house price prediction.

Moreover, depending on customers to enter knowledge creates a better probability of errors, which throws off the information fully. Mashvisor does now not depend on user-generated knowledge for our knowledge. We use knowledge from dependable resources corresponding to Airbnb and the MLS to make certain that the tips we’re presenting to our customers is correct. We additionally provide the medians slightly than the averages to our customers. This guarantees no outliers will skew our metrics.

Mashvisor’s primary center of attention is offering probably the most correct actual property knowledge to our customers. We all know making an investment in actual property will also be tough, so we provide all of our gear and products and services to lend a hand information you thru your funding choices.

To Recap

Zestimate is a device created via Zillow to are expecting house price. Sadly, it has raised questions inside the actual property neighborhood as it’s mentioned to supply misguided knowledge with a prime error charge. The usage of this instrument would possibly create issues of calculating your funding belongings for the reason that knowledge will all be off when you in fact try to acquire a belongings.

For those causes, we propose Mashvisor as a correct selection to your condominium marketplace research. Mashvisor most effective makes use of dependable knowledge to verify our customers make the most efficient funding choices. To get get right of entry to to our actual property funding gear, click on right here to enroll in a 7-day unfastened trial of Mashvisor as of late, adopted via 15% off for lifestyles.

[ad_2]