Now that 2021 has handed, it’s time to start out having a look ahead. What elements will affect the Philadelphia actual property marketplace in 2022?

Listed here are some issues that business insiders consider will considerably have an effect on the marketplace’s route within the following months.

Shoppers who’ve retreated from the marketplace might make a choice to reconsider their positions, with lesser completed and ongoing gross sales in addition to declining call for. Philadelphia and its surrounding spaces are nonetheless vendor’s markets. The median gross sales worth of single-family homes within the Philadelphia housing marketplace used to be $304,000, with the fee expanding 8% 12 months on 12 months.

Whilst the indications are favorable, one worry lingers on each investor’s thoughts: What does this 12 months have in retailer for the Philadelphia housing marketplace? Will house costs fall? Will there be an build up in house stock this 12 months? That’s what this submit will move into element about. However ahead of that, let’s check out Philadelphia as an total funding vacation spot.

Evaluation of the Philadelphia Actual Property Marketplace 2022

Philadelphia is the sixth-most populous town in the US, with over 1.5 million other folks dwelling there. Philadelphia has a powerful financial system with sturdy ties to the meals, schooling, and healthcare industries. Its wealthy historic monuments and places make it a well-known migration vacation spot and an ideal tourism vacation spot for plenty of American citizens.

The range of the Philadelphia actual property marketplace makes it a profitable location for actual property buyers. It attracts other folks from all backgrounds, together with scholars from all over the nation. The plethora of faculties and universities within the the city, such because the College of Pennsylvania, Indiana College of Pennsylvania, Temple, Vilanova, and others, is evidence of this.

Some of the Freshest Actual Property Markets in 2021

Closing 12 months, Philadelphia used to be one among the freshest actual property markets within the nation, and its marketplace recognition stays prime. It implies that purchaser call for exceeds the present provide of to be had houses on the market. With low stock and coffee mortgage charges for customers, Philadelphia and its neighboring towns are recently in a vendor’s marketplace.

The Philadelphia actual property marketplace can be virtually the similar—aggressive regardless of the place you purchase. House costs are emerging larger within the new degree, making it extra interesting to dealers. The depth of pageant, however, can range from county to county or town to town. Necessarily, the Philadelphia metro area’s house costs will upward push because of a loss of provide and rising calls for.

Philadelphia Housing Call for

Purchaser call for for houses within the Philadelphia metro house remained consistent in October of 2021. The house call for index stayed at 111, suggesting reasonable purchaser hobby. Regardless of being secure month-over-month, the index used to be virtually 13% less than closing 12 months. For a couple of months, purchaser hobby has been smallest for lower-priced single-family homes and biggest for higher-priced single-family houses.

Passion for higher-priced single-family homes declined 5% month-over-month, beating simplest the already small hobby for lower-priced single-family houses. Different varieties of housing call for remained consistent. The months’ value of house stock ranged from 1.3 for mid-priced single-family homes to five.8 for higher-priced condominiums. Months’ value of provide for each and every assets class usually stayed constant all over the month, aside from higher-priced condos, which climbed from 4.9 to five.8 months.

Forecast for the Philadelphia Actual Property Marketplace in 2022

The Philadelphia housing marketplace is anticipated to care for its contemporary development of being one among the freshest markets. Philadelphia’s maximum widespread housing devices are 3 and four-bedroom row apartments and connected homes. Giant condo complexes, single-family indifferent houses, duplexes, and apartments remodeled into residences are different commonplace housing varieties in Philadelphia.

Imagine the fee patterns reported via Zillow over the previous couple of years. Since November 2011, the common assets price within the Philadelphia metro house has higher via roughly 48%. For almost 3 years, from 2013 to 2016, assets costs remained solid with out a expansion. Housing costs had been incessantly emerging since mid-2016, with a 16% build up within the closing 12 months.

First-time house patrons will proceed to be a formidable drive within the housing marketplace, however more youthful Gen-Z patrons also are expected to play an expanding position. Each Technology Z homebuyers and New Yorkers in search of extra price for his or her cash will stay Philadelphia actual property transferring.

The true query is, must you spend money on the Philadelphia actual property marketplace? Neatly, the solution is sure. Let’s smash down why.

Philadelphia Actual Property Is Slightly Priced

Philadelphia actual property has a mean promoting worth of kind of $208,000. Those charges range a great deal according to the community’s total safety and enchantment. The reality is that there are single-family homes to be had within the $40,000–$60,000 vary that may be rented out to unmarried ladies with out a youngsters preferring privateness. There are condos and older houses that may well be repaired and flipped for a small benefit. Greater than 10% of actual property transactions in lots of zip spaces within the Philadelphia housing marketplace are “flipped gross sales.”

Do you need to get extra perception into the promoting costs, see if it’s well worth the funding, and be informed learn how to spend money on actual property? Mashvisor is right here to assist.

Looking for Homes

When in search of houses to spend money on, Mashvisor has many gear and contours that make the method faster and more uncomplicated than ever ahead of.

Similar: The Final Funding Assets Seek Device

Funding Assets Seek and Heatmap

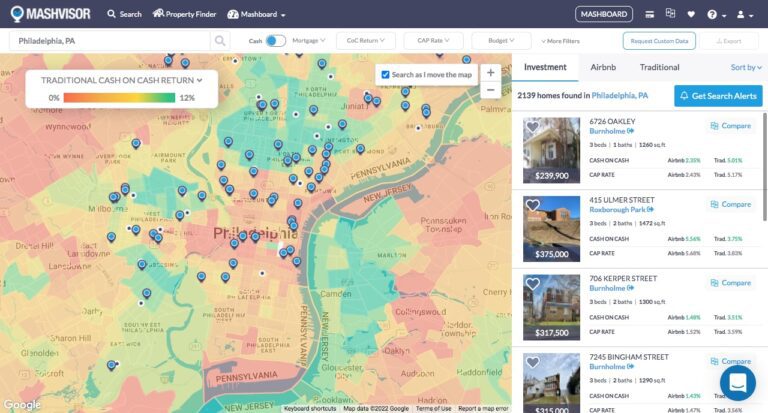

The Funding Assets Seek is the primary characteristic you’ll realize when the usage of Mashvisor. This web page features a map serve as and quite a lot of filters and adjustment gear that will help you slim down your seek and find the best funding assets that meets your standards. The Warmth Map device is but some other device introduced on Mashvisor’s Funding Assets Seek.

This actual property heatmap supplies a color-coded overlay of the map that presentations how each and every phase of the marketplace is behaving for the factors that you’ve decided on. This lets you temporarily make a choice the most efficient spaces in a marketplace according to parameters such because the Cap Fee, Money on Money Go back, Occupancy Fee, Condo Source of revenue, or Record Worth.

That is Mashvisor’s Funding Assets Seek appearing effects at the Philadelphia actual property marketplace. The true property heatmap could also be set to spotlight the bottom to very best conventional money on money go back.

Condo Assets Analytics Web page

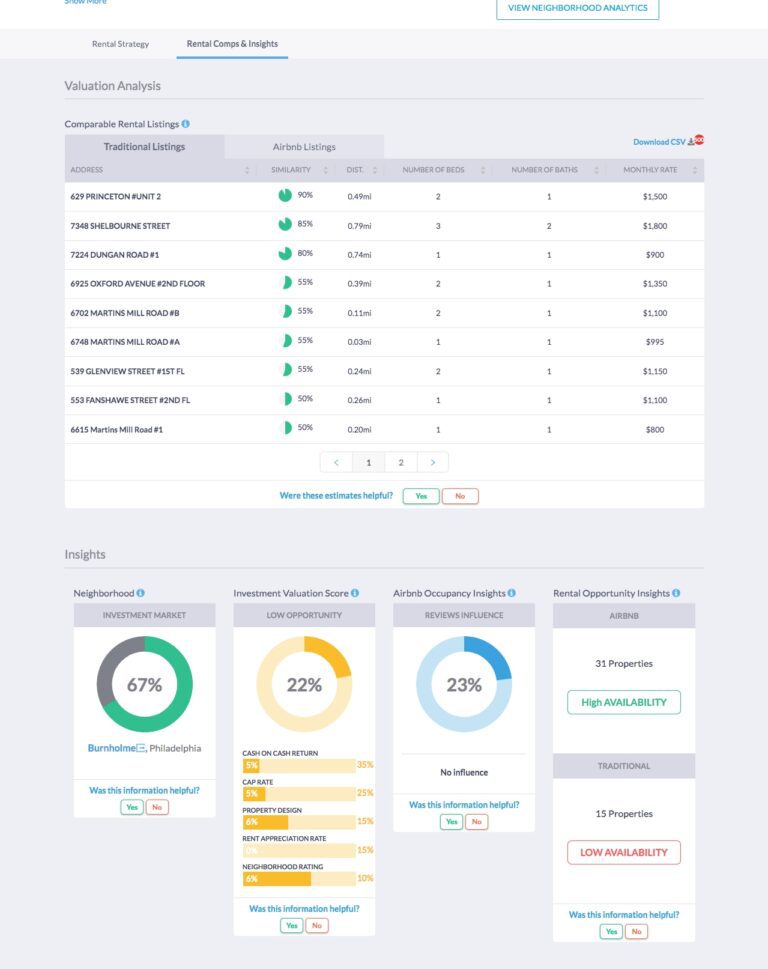

Further analytics for managing your funding can also be discovered on the second one tab of each list web page uploaded on our web page. Related Condo Homes and Insights are examples of those. And when you’ve questioned learn how to in finding condo comps, you’ll do it simply with those analytics.

Similar: The Highest Comparative Marketplace Research Equipment for Novice Buyers

There are masses extra Mashvisor gear, but when those sound attention-grabbing and of assist for you, take a look at them out via clicking right here.

Now transferring on with Philadelphia actual property.

Each and every list web page incorporates a bit that includes Condo Comps & Insights. It lists conventional condo and Airbnb houses very similar to the indexed assets and their metrics in addition to our AI’s insights at the community, Airbnb occupancy, and total funding valuation, amongst others.

Philadelphia Has In depth Actual Property Price

By means of now, the conceivable go back on funding you’d enjoy as a landlord. The opposite aspect of the equation is the emerging price of the asset, which you’d get well if and whilst you promote it. In line with Zillow, Philadelphia actual property marketplace costs higher via about 11% within the closing 12 months, and it estimates that costs will upward push once more in 2022. Philadelphia’s appreciation charges stay a few of the very best within the nation, together with the bigger metropolitan house, the place the months’ value of provide has fallen to at least one.1 months.

Some of the best possible funding alternatives within the Philadelphia actual property marketplace is in places the place everybody needs to reside. The Graduate Health facility community, as an example, is very talked-about. The zip codes 19118 and 19106 have the very best assets checks and worth rises.

Strangely, there are zip codes within sight that experience witnessed flat or lowering values; when you gain homes within the flat or falling price zip codes of 19132 or 19125 and draw in people having a look to reside in 19121 or 19133, you must see excellent money on money go back. This means you don’t must habits intensive research or make trained guesses to earn from the Philadelphia actual property marketplace.

Highest Neighborhoods for Conventional Leases in Philadelphia in 2022

Listed here are one of the crucial most sensible places for standard leases within the Philadelphia actual property marketplace this 12 months, in keeping with the newest Mashvisor’s Philadelphia actual property information analysis, which is according to the luck of tangible condo comps within the house.

Dickinson Narrows

- Median Assets Worth: $381,971

- Worth in step with Sq. Foot: $288

- Per month Conventional Condo Source of revenue: $2,015

- Conventional Money on Money Go back: 3.86%

- Worth to Hire Ratio: 16

- Stroll Rating: 95

West Passyunk

- Median Assets Worth: $283,649

- Worth in step with Sq. Foot: $258

- Worth to Hire Ratio: 16

- Per month Conventional Condo Source of revenue: $1,454

- Conventional Money on Money Go back: 3.78%

- Stroll Rating: 92

Previous Kensington

- Median Assets Worth: $443,912

- Worth in step with Sq. Foot: $290

- Per month Conventional Condo Source of revenue: $2,140

- Conventional Money on Money Go back: 3.74%

- Worth to Hire Ratio: 17

- Stroll Rating: 93

Graduate Health facility

- Median Assets Worth: $567,888

- Worth in step with Sq. Foot: $330

- Per month Conventional Condo Source of revenue: $2,138

- Conventional Money on Money Go back: 2.87%

- Worth to Hire Ratio: 22

- Stroll Rating: 94

Washington Sq.

- Median Assets Worth: $899,291

- Worth in step with Sq. Foot: $599

- Per month Conventional Condo Source of revenue: $1,641

- Conventional Money on Money Go back: 2.67%

- Worth to Hire Ratio: 46

- Stroll Rating: 99

Highest Philadelphia Neighborhoods for Airbnb Leases in 2022

If you wish to spend money on temporary leases like Airbnb within the Pennsylvania actual property marketplace, we’ve performed our Philadelphia actual property marketplace learn about and seemed on the MLS database and verified Airbnb listings, amongst others, to assemble essentially the most profitable neighborhoods for Airbnb funding.

West Passyunk

- Median Assets Worth: $283,649

- Worth in step with Sq. Foot: $258

- Per month Airbnb Condo Source of revenue: $2,764

- Airbnb Money on Money Go back: 6.26%

- Airbnb Day-to-day Fee: $155

- Airbnb Occupancy Fee: 64%

- Stroll Rating: 92

Sharswood

- Median Assets Worth: $302,145

- Worth in step with Sq. Foot: $222

- Per month Airbnb Condo Source of revenue: $2,395

- Airbnb Money on Money Go back: 6.04%

- Airbnb Day-to-day Fee: $133

- Airbnb Occupancy Fee: 53%

- Stroll Rating: 82

Newbold

- Median Assets Worth: $360,682

- Worth in step with Sq. Foot: $256

- Per month Airbnb Condo Source of revenue: $2,967

- Airbnb Money on Money Go back: 5.70%

- Airbnb Day-to-day Fee: $149

- Airbnb Occupancy Fee: 64%

- Stroll Rating: 97

Dickinson Narrows

- Median Assets Worth: $381,971

- Worth in step with Sq. Foot: $288

- Per month Airbnb Condo Source of revenue: $3,157

- Airbnb Money on Money Go back: 5.04%

- Airbnb Day-to-day Fee: $133

- Airbnb Occupancy Fee: 64%

- Stroll Rating: 95

Previous Kensington

- Median Assets Worth: $443,912

- Worth in step with Sq. Foot: $290

- Per month Airbnb Condo Source of revenue: $3,099

- Airbnb Money on Money Go back: 4.28%

- Airbnb Day-to-day Fee: $137

- Airbnb Occupancy Fee: 53%

- Stroll Rating: 93

Philadelphia Is Most often Landlord-Pleasant

A lot of actual property buyers need to know if an area is landlord- or tenant-friendly. The Pennsylvania housing marketplace is in most cases favorable to landlords. Philadelphia, however, is slightly stricter. In 2018, the Town Council debated law that may prohibit evictions to instances of affordable motive. Failing to pay hire, disruptive conduct, and violation of the rent are all examples of motive.

Alternatively, it’s merely no longer conceivable to evict anyone to fix the valuables. When extending the rent, the tenant will have to be introduced to simply accept a brand new rent or pay a better hire moderately than being evicted.

Explicit regulations are considerably extra favorable to landlords. As an example, whilst there is not any such factor as a fee point in time, overdue charges haven’t any higher restrict. There are not any puppy regulations in position, both. Whilst the state of Pennsylvania does no longer require a license to rent out a house, any person buying a house within the Philadelphia housing marketplace will have to download a business task license in addition to a housing condo allow.

Conclusion

What’s subsequent now that what’s coming within the Philadelphia actual property marketplace for an funding assets in 2022? The usage of actual property making an investment gear, like Mashvisor’s condo assets calculator, will permit you to in finding essentially the most profitable houses on the market in Philadelphia is likely one of the first steps.

Keep in mind, buying or promoting actual property is likely one of the maximum the most important selections for plenty of buyers. Selecting an actual property skilled/counselor continues to be an very important component of the entire procedure. They’re well-versed in the most important marketplace parts affecting your marketplace sectors, reminiscent of marketplace adjustments, projections, buyer belief, optimum puts, timing, and rates of interest.

To achieve get right of entry to to our actual property funding gear, join for a 7-day loose trial of Mashvisor these days, adopted via an entire life bargain of 15%.