The Zillow condominium estimate device is widespread amongst actual property traders having a look to estimate the condominium charges in their funding assets. On the other hand, because of its reputation, novice traders ceaselessly depend too closely on Zillow’s information with out knowing that the smallest inaccuracies would possibly price them monetary losses.

With a lot of possible choices – like Mashvisor – which can be to be had to any investor, how does the Zillow condominium estimate device examine to different an identical gear?

On this article, let’s take a deeper have a look at the hire estimate device that Zillow provides, how correct it’s, and what different options it provides in comparison to its competition.

Prior to delving into Zillow condominium estimate device, let’s first discuss what an investor must be expecting from a condominium assets calculator device basically.

In most cases, when a condominium actual property investor needs to shop for a space to hire it out for benefit, they’re going to wish to understand how a lot hire they may be able to set at the assets to take advantage of benefit. And not using a get right of entry to to ancient information at the assets, the one manner for traders to grasp that data is via operating a condominium comp.

A condominium comp is while you accumulate information on an identical homes in the similar marketplace and examine their condominium charges to get an concept of the volume of hire you’ll be able to fee. So, the way to to find condominium comps? Gear like Zillow and Mashvisor simply spring to mind.

Each platforms acquire huge quantities of knowledge from a lot of assets as a way to supply their customers with condominium comp information. At their core, each gear give you the identical major function of evaluating condominium homes available in the market to come up with a hire estimate for the valuables you’re all for.

Whilst it’s the fundamental stage of what a condominium calculator just like the Zillow condominium estimate device can do – the functions of this kind of device can range considerably relying at the quantity and form of information that the device is using. So, let’s communicate in regards to the gear intimately and the way they make the most of their information in several tactics to supply other ranges of insights and accuracy to the person.

Comparable: Need an Correct Hire Estimate? Landlords Use This Device

Mashvisor vs Zillow Condo Estimate Gear

As discussed in the past, each Zillow and Mashvisor be offering an identical gear for estimating the condominium source of revenue of a assets. On the other hand, each and every platform is other in the way it makes use of the knowledge it collects, along with its distinctive options.

Since we’re reviewing the Zillow condominium estimate right here, we’ll get started with having a look on the major options of that device earlier than speaking in regards to the professionals and cons in comparison to Mashvisor.

Condo Source of revenue Calculator

Zillow’s device, which is known as Hire Zestimate, estimates a assets’s per thirty days condominium fee the use of algorithms that considers the next components:

- The house’s bodily traits and facilities, together with its sq. pictures, collection of rooms, and heating/conditioning programs

- Condo comps within the house

- Any more information supplied via the house owner or public assets

The usage of the above information, Zillow will then resolve a hire vary and provides the center of the variation between the 2 numbers. As an example, if a assets’s hire vary is between $1,000 and $1,600, Zillow’s insights will give a hire estimate of $1,300.

On the other hand, a significant problem when the use of the Zillow condominium calculator is that the accuracy of the knowledge can range considerably in accordance with the volume of knowledge the platform collects on each and every marketplace. So, in spaces the place Zillow doesn’t accumulate a lot information, the hire vary hole may also be a lot better, leading to a bigger margin of error.

Any other problem that Zillow faces is that it does now not correctly assess the alternate within the worth of a house after positive adjustments or renovations have been made to it.

Many space adjustments will naturally require a allow, which is able to ceaselessly lead to that knowledge being handed down alongside to the valuables tax government and entered into the general public document. On the other hand, because the condominium assets calculator can handiest replace its listings information when new knowledge turns into to be had, two problems stand up because of this:

Originally, some adjustments would possibly not want a allow, because of this that the ideas is probably not handed to the general public information that Zillow can get right of entry to. In this kind of case, Zillow will depend on the valuables proprietor to record the adjustments to the platform in order that the list may also be up to date.

It’s the place the second one factor seems, alternatively, as Zillow’s estimate of the alternate within the worth of the valuables is probably not correct as it’ll lack knowledge at the identical form of alternate and its impact on different homes within the house.

Whilst you have a look at the larger image and imagine that almost all of Zillow’s information is interconnected with such imaginable mistakes, you’ll notice that the Zillow condominium estimate device can give various levels of inaccuracies.

Comparable: Condo Comps: What Are They and The place Can I To find Them?

In comparison to Mashvisor

The Zillow condominium estimate device comes with two main disadvantages in comparison to Mashvisor, akin to:

- Zillow doesn’t use a cap fee or money on money go back calculator.

- Zillow handiest supplies its condominium comps information in keeping with cope with, so you’ll be able to’t depend on it when on the lookout for an funding assets to shop for.

With regards to the condominium assets calculator, Mashvisor’s money on money go back calculator is some distance awesome with regards to the insights it offers to the person. No longer handiest does Mashvisor supply an identical information with regards to the valuables’s main points, hire estimate, and value – but it surely additionally tells you what the possible go back on funding will probably be.

For the reason that cap fee and money on money go back are such key metrics for any condominium assets investor, Mashvisor supplies the ease of pre-calculated cap charges for each and every assets the place there may be to be had information.

As well as, Mashvisor gathers its information from an identical assets, but it surely additionally contains information from depended on and up-to-date MLS assets, in addition to from Airbnb. It implies that Mashvisor possesses a lot more information that can be utilized in its complicated algorithms to estimate condominium charges with better accuracy.

Moreover, when the use of Mashvisor, you’ll be able to base your whole go searching discovering homes with a just right money on money go back. This is because you don’t wish to request condominium comps as a way to get effects for each and every assets one after the other, like with the Zillow condominium estimate device.

As a substitute, via visiting any assets’s web page, you’ll to find all information about it integrated within the condominium source of revenue calculator, in addition to condominium comps for that assets and an identical homes round it.

Funding Assets Finder

Along with the Zillow condominium estimate device, the platform provides gear and lines that can assist you checklist or to find indexed homes on the market on their web page. It is without doubt one of the most well liked makes use of of Zillow as an entire, and it’s common for folks to make use of the platform’s worth estimates as an ordinary when on the lookout for funding assets. On the other hand, as discussed in the past, Zillow’s information isn’t at all times correct, which makes depending only on its information problematic.

Since Zillow is predicated closely at the information supplied via its customers, akin to when updating their assets’s data and public main points, there may also be a large number of room for error with regards to the indexed costs. In consequence, customers will probably be forced to seek the advice of an actual property agent or rent an appraiser earlier than committing to a unmarried assets to keep away from making an be offering this is manner off the true worth of the residing.

All issues thought to be, Zillow provides all of the fundamental and same old options that you’d be expecting in a assets finder device, together with filters to seek for homes in accordance with:

- Their list worth

- Their kind

- Their measurement

- Selection of rooms

- Their situation

Coupled with a easy map function, any investor must be capable to use the device to search out homes on the market simply.

In comparison to Mashvisor

Like Zillow, Mashvisor permits house owners and dealers to checklist their dwellings on the market at the platform.

The merit, alternatively, is that Mashvisor supplies superb gear to lend a hand consumers and traders seek for homes to buy. Actually, the platform provides two other gear that you’ll be able to use to search out listings on the market:

- Funding Assets Seek

- Funding Assets Finder / Market

Mashvisor’s seek device is an overly subtle but easy-to-use map device that incorporates quite a lot of filters that can assist you slim down your seek, together with:

- Value vary (as much as $5 million)

- Projected money on money go back

- Assets kind (single-family, multifamily, apartment/townhouse)

- Sq. pictures

- Yr constructed

- Selection of bedrooms

- Selection of bogs

- Standing (together with foreclosed)

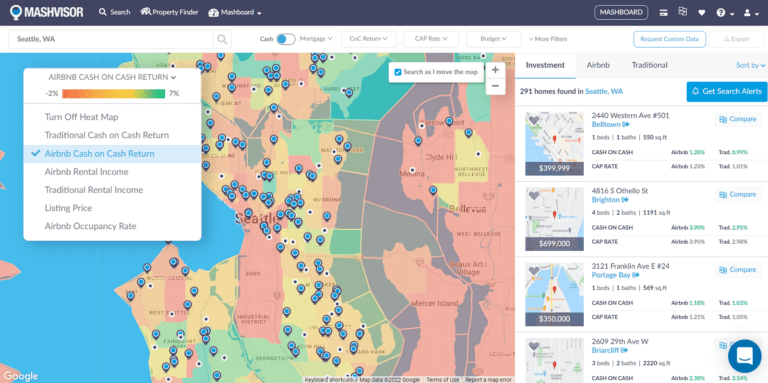

Moreover, the device comes with an actual property heatmap function that allows you to analyze markets in accordance with their:

- Conventional money on money go back

- Airbnb money on money go back

- Conventional condominium source of revenue

- Airbnb condominium source of revenue

- Airbnb occupancy fee

- List worth

Comparable: Airbnb Leases: Discovering Source of revenue Houses The usage of a Heatmap

Mashvisor’s Heatmap device permit actual property traders to research particular places in accordance with a number of standards.

Verdict: Which Device Will have to I Use?

The solution is it is dependent upon what you wish to have to succeed in. Each gear include a national assets seek function and inform you the way to estimate your condominium source of revenue. On the other hand, each and every device gifts its information in some way that appeals to various kinds of assets consumers and house owners.

Mashvisor’s multitude of condominium analytics options and deep insights attraction extra to traders and pros who need to use each element of the marketplace to maximise their earnings. On the other hand, it may additionally imply that ordinary house consumers will to find the volume of to be had information overwhelming in comparison to their explicit wishes. Such consumers would possibly to find Zillow’s easy information enough to fulfill their function of shopping for an inexpensive house to make use of as a number one place of dwelling.

However in case you’re handiest having a look on the Mashvisor and Zillow condominium estimate gear, the previous is just the awesome possibility because it supplies analytics this is a lot wanted via any investor. Having the ability to carry out a national assets seek in accordance with cap fee or money on money go back may also be immensely useful and will considerably scale back the volume of effort and time wanted for funding analysis.

Any other crucial factor to emphasise is that Mashvisor additionally supplies information on momentary leases. It implies that customers will be capable to see information on each condominium methods for each and every funding assets and condominium comp at the platform. It offers traders extra choices since they may be able to get right of entry to information at the related condominium technique.

What In regards to the Value?

With regards to Zillow’s most evident merit over Mashvisor, it’s that any one can use Zillow free of charge. Whether or not you’re within the Zillow condominium estimate device or seek engine platforms, homebuyers and traders can get right of entry to such options with out the wish to pay a per thirty days charge. On the other hand, the disadvantage, as we’ve discussed above, is that Zillow doesn’t be offering a lot with regards to complicated research gear.

So, in case you’re the use of Zillow and also you’re prepared to pay further to get get right of entry to to analytics in accordance with their information, they don’t be offering such an possibility. However, Mashvisor’s model of the analytics device does now not come unfastened.

Buyers who need get right of entry to to Mashvisor’s condominium comps and assets research should subscribe to one of the most to be had plans, which range relying at the stage of get right of entry to that they want. On the other hand, the platform does be offering a seven-day unfastened trial length to mean you can check out the gear and be informed the interface earlier than committing to a complete subscription.

In spite of everything, traders who use Mashvisor to find that it does now not disappoint. Many traders pay for get right of entry to to one of the most platform’s gear, handiest to be pleasantly stunned after discovering that they may be able to get right of entry to further gear which can be extraordinarily helpful to them.

So, sign up for the rising collection of Mashvisor consumers and enroll for a week-long unfastened trial, adopted via a fifteen% bargain to your quarterly or annual subscription. You might also agenda a demo for extra help.