Why purchasing crushed down shares like ERIC and promoting dear name choices in a coated name commerce will outperform with much less chance.

shutterstock.com – StockNews

The inside track from February 16 that Ericcson could have paid bribes to Isis in Iraq despatched the inventory plunging. Stocks dropped 40% from the $12.50 degree ahead of in any case bottoming out across the $7.50 house.

The drop took stocks to ranges final noticed originally of the Covid Disaster. The drop additionally took ERIC to extraordinarily oversold readings from a technical standpoint. 14-day RSI used to be slammed to beneath 20. MACD reached probably the most bearish ranges prior to now two years. Momentum just about fell off the chart. Stocks had been at an enormous bargain to the 20-day transferring moderate. The technicals, then again, have advanced very much over the last few weeks.

Ericsson (ERIC – Rated “B”- Purchase) has since recovered a few of the ones large losses and closed Friday at a couple of greenback off the lows at $8.52. Some big-time participant is pondering that ERIC inventory has more space to run if the choices marketplace is any indication.

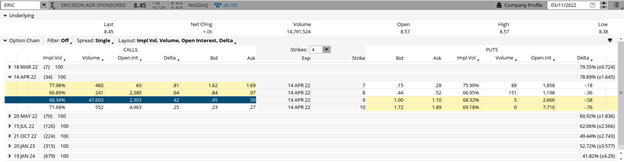

Friday noticed very heavy bizarre name purchasing within the ERIC April $9 calls. Ordinary name purchasing is characterised via a lot better than commonplace quantity that dwarfs the open passion and spikes the implied volatility (or IV). Implied volatility is solely differently to mention the cost of the choice.

Over 47,000 contracts traded Friday within the April $9 calls. Evaluate that to quantity on Thursday of simply 90 contracts. Unquestionably, bizarre quantity.

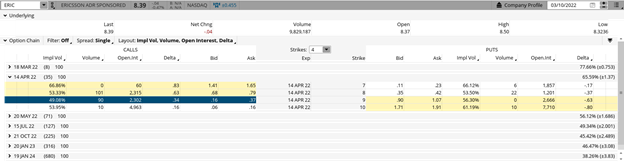

Thursday Possibility Montage

Friday Possibility Montage

Those 47,000 contracts had been as opposed to simply 2,303 open passion. Open passion signifies the whole collection of choice contracts that also open, or nonetheless ready to be closed out. The truth that the amount used to be over 16 instances the scale of the open passion is a transparent indication it used to be recent, new purchasing.

Extra importantly, the implied volatility (IV) of the choice jumped from beneath 50 on Thursday ahead of the huge name purchasing to over 68 after the big-time name purchaser stepped in. Because of this the cost of the choice exploded. Actually, IV now stands on the 100th percentile. Possibility costs have now not been this dear prior to now yr.

The April $9 calls had been up 20 cents although the inventory rose simplest 6 cents on Friday. It makes no intuitive sense for the calls to upward push greater than the inventory. This units up preferably for a coated name commerce to lean bullishly with the large name purchasing whilst shooting some very dear choice top class.

A coated name commerce is performed via purchasing ERIC inventory after which concurrently promoting 1 of the April $9 requires every 100 stocks of inventory bought.

The April $9 calls had a delta of 42 in keeping with Friday’s shut. Because of this the April $9 calls had been an identical to 42 stocks of ERIC inventory. Purchasing 100 stocks of ERIC inventory after which promoting 1 of the April $9 calls makes the entire internet delta place 58 deltas internet lengthy (100 minus 42) or the similar as proudly owning 58 percentage of ERIC inventory.

The price of the commerce is the cost of the inventory purchased minus the cost of the choice offered. ERIC inventory closed at $8.45 on Friday and the April $9 calls had been buying and selling round 47 cents. The whole price of the commerce would were $8.45 – $0.47 or simply beneath $8.00.

Evaluate that to the price of the commerce ahead of the large name purchasing. The price of the commerce in keeping with Thursday’s last costs would were $8.39 for the inventory and more or less 27 cents for the choices. This equals $8.12 for the coated name commerce.

So, the bullish coated name commerce in reality become about 14 cents inexpensive although ERIC inventory rose 6 cents. This used to be since the large name purchasing made the choices costs far more dear.

The large name purchaser needed to overpay to position on that gigantic of a commerce. We will take merit via promoting the ones dear choices after which hedging with the inventory.

Shares are usually decrease to begin the yr. The VIX, a measure of S&P 500 implied volatility, is upper at the yr. The combo of decrease shares and better choices is a twin receive advantages to a coated name technique.

Promoting name choices as opposed to lengthy inventory positions can convey in more cash within the type of richer choice premiums. The trade-off is that you just give away one of the most large upside in trade for cushioning the disadvantage and decreasing your chance.

2022 is shaping as much as be a yr the place total marketplace positive aspects will most likely are available a lot less than the last few years. Including coated name methods can lend a hand climate the typhoon and supply for out-performance although shares underperform.

POWR Choices

What To Do Subsequent?

If you are in search of the most productive choices trades for lately’s marketplace, you must take a look at our newest presentation Tips on how to Industry Choices with the POWR Scores. Right here we display you the best way to constantly in finding the highest choices trades, whilst minimizing chance.

If that appeals to you, and you need to be told extra about this robust new choices technique, then click on under to get get entry to to this well timed funding presentation now:

Tips on how to Industry Choices with the POWR Scores

All of the Perfect!

Tim Biggam

Editor, POWR Choices Publication

ERIC stocks closed at $8.45 on Friday, up $0.06 (+0.72%). 12 months-to-date, ERIC has declined -22.26%, as opposed to a -11.56% upward push within the benchmark S&P 500 index all over the similar length.

In regards to the Writer: Tim Biggam

Tim spent 13 years as Leader Choices Strategist at Guy Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Marketplace Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Industry Are living”. His overriding pastime is to make the advanced international of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices publication. Be informed extra about Tim’s background, in conjunction with hyperlinks to his most up-to-date articles.

The put up An Ordinary Lined Name Alternative in ERIC Inventory seemed first on StockNews.com