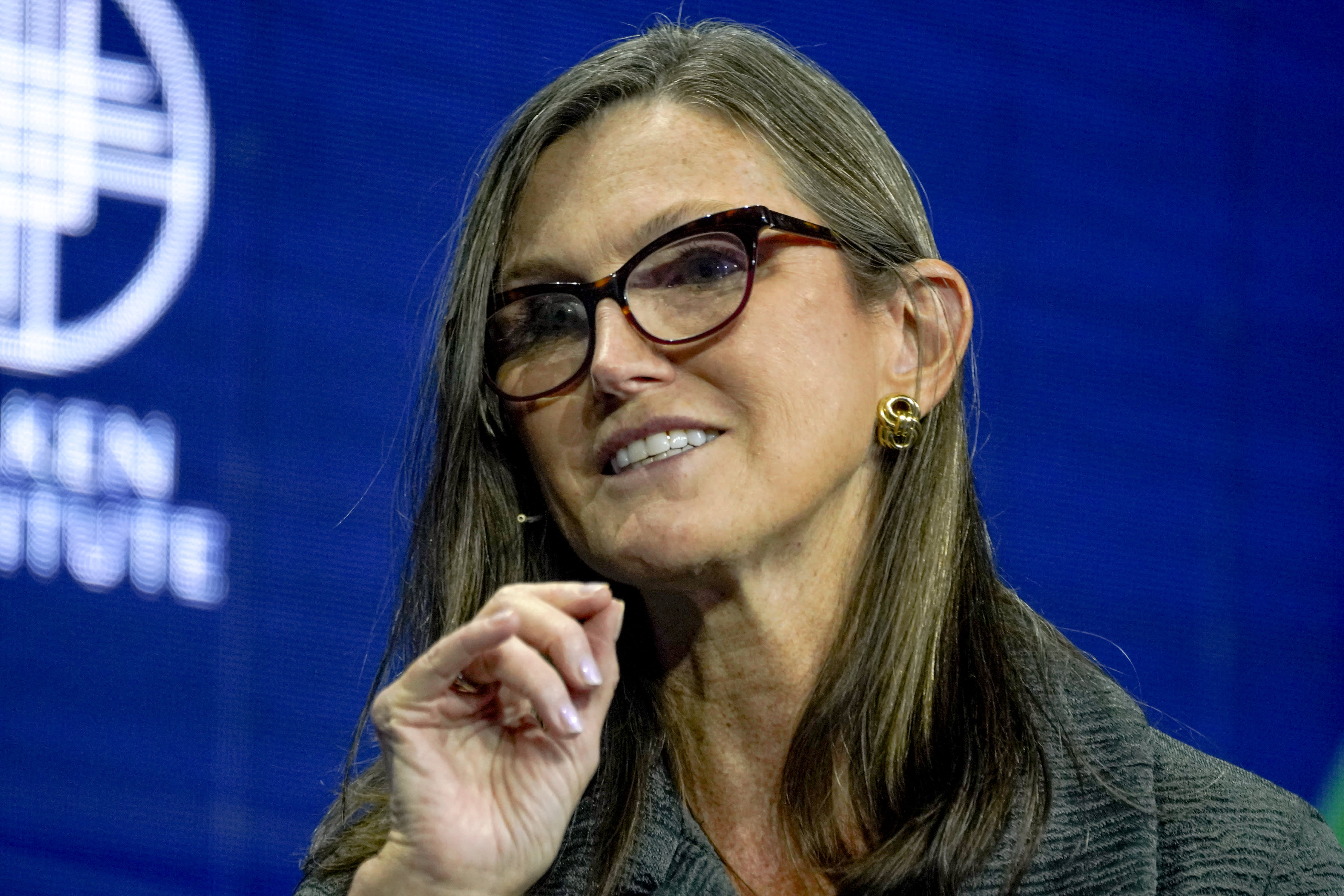

Cathie Wooden defended her company’s innovation-focused portfolio, announcing she sees “impressive returns” for Ark Make investments over the following 5 years.

“Given our expectancies for enlargement in those new applied sciences, I believe we are going to see some impressive returns,” the Ark Make investments CEO instructed CNBC’s “Capital Connection.”

Her feedback come after her company’s flagship fund has been stuck within the contemporary tech-led sell-off. The Ark Innovation ETF has just about halved prior to now three hundred and sixty five days. When compared, the benchmark S&P 500 is up just about 15% in the similar period of time.

“We have now been in a horrible endure marketplace for innovation,” she admitted. “Alternatively, when you glance from the ground of the coronavirus to that top [of the Ark Innovation ETF] in February of ’21, we have been up 358%.”

Wooden stated, on the other hand, the company has observed “important inflows” since Jan. 17.

“I believe numerous our investor base is averaging down,” she stated. Averaging down refers back to the funding technique of shopping for extra gadgets of an asset when its value drops.

“You would be amazed when you reasonable down over the years, how briefly a technique can come again above that reasonable. And if we are proper, considerably above that reasonable over the following 5 years,” Wooden stated.

Wooden stated the sector is these days going through “a wide variety of issues” and innovation is about be the solution.

She pointed to the continued conflict in Ukraine, which has has brought on a surge within the costs for some commodities like oil. Wooden stated the struggle is about to result in “numerous call for destruction and substitution into innovation” comparable to a transfer towards electrical automobiles clear of the ones which can be gas-powered.

She described her company as the nearest factor to a project capital fund within the public markets, which worth those frontier generation corporations otherwise than personal markets.

“In case you examine what is going on within the public fairness markets to the non-public fairness markets, with regards to innovation, we’ve got observed a 60% drawdown within the remaining yr. The non-public markets have observed a 20% building up … as we have now analyzed it via Crunchbase,” Wooden stated.

She attributed this to public markets being “full of traders who’re benchmark delicate,” versus personal markets traders who see the “explosive enlargement alternatives” in main innovation platforms.

Whilst generation is already a heavyweight within the S&P 500, accounting for 28% of the index, Wooden stated the ones shares are “a part of the luck prior to now.”

“Our generation shares are going to be the long run successes and they’re going to finally end up within the indexes,” she stated.