The cap charge calculator is among the must-use equipment for somebody who’s making an allowance for making an investment in actual property. In finding out why right here.

The cap charge (brief for capitalization charge) is among the metrics that actual property buyers maximum continuously use when inspecting the possible go back on funding on a apartment belongings.

So, whether or not you’re making an allowance for purchasing an funding belongings to transform a apartment gold mine or already personal a apartment belongings and you wish to have to look what its monetary long run seems like, Mashvisor’s cap charge calculator is the instrument that you wish to have to make use of.

So, nowadays I sought after to write down concerning the cap charge metric in actual property to lend a hand novice actual property buyers get started the usage of it after they plan the way forward for their funding and steer clear of making errors when purchasing new funding homes.

What Is the Cap Price Formulation in Actual Property?

To begin with, let’s get started with the fundamentals: what’s the capitalization charge in actual property?

The cap charge is a metric this is utilized by actual property buyers when inspecting a apartment belongings’s go back on funding in comparison to the valuables’s worth.

Because of this the cap charge method is not going to consider the process of financing that you just’re the usage of, however slightly it could take a look at the worth of the valuables as a complete.

This turns into related for those who’re fascinated by the usage of a loan to pay for the valuables, however you’re nonetheless within the degree of making an allowance for your financing choices however nonetheless wish to analyze apartment homes for his or her possible returns.

Notice: If you wish to have a metric that calculates the speed of go back according to the amount of money that you wish to have to speculate from your pocket, the Money on Money Go back is the metric you’re in search of, and fortuitously this metric may be incorporated in Mashvisor’s Cap Price calculator.

So, what precisely is the cap charge method? Let’s see:

Cap Price = (Annual Web Running Source of revenue / Assets’s Value) x 100

As you’ll be able to see, the method itself is rather easy in case you have get entry to to this details about the valuables. However what precisely does the cap charge let you know a few belongings?

The cap charge is a percentage-based metric (therefore the x100) which tells you the share of a belongings’s worth that shall be generated via the valuables as apartment source of revenue on an annual foundation.

As an example, if a belongings has a cap charge of 6%, it signifies that the yearly benefit that the valuables is producing quantities to six% of the valuables’s worth in this day and age of its acquire.

And whilst calculating the cap charge for a unmarried belongings may not be a problem, oftentimes when you wish to have to make use of this metric, it would be best to use it to habits a apartment marketplace research.

This implies that you are going to wish to analyze tens and even loads of homes in a marketplace with the intention to needless to say marketplace’s efficiency and be capable to distinguish homes which might be projected to accomplish above or under reasonable.

Historically, this might be accomplished the usage of spreadsheets the place you may enter each and every belongings’s main points and calculate each and every belongings’s cap charge for my part earlier than working the maths on all the report to spot the averages and the outliers…in brief, it used to be a big bother.

In this day and age although, all you wish to have to do to get entry to a cap charge actual property calculator that has the entire equipment and contours that every one actual property buyers want is to make use of a web-based platform like Mashvisor.

So, what precisely units Mashvisor’s actual property cap calculator except different cap charge calculators on the web? Let’s to find out.

Comparable: Find out how to In finding Cap Price for a Actual Property Marketplace

Mashvisor’s Actual Property Cap Price Calculator

Mashvisor is an actual property investor’s platform that used to be designed to lend a hand novice actual property buyers like your self via offering them a package of the entire other equipment that they’re going to wish to be triumphant on their actual property funding adventure.

With the intention to discuss what it’s precisely that units Mashvisor’s actual property cap charge calculator aside, I’ve to say the opposite equipment that Mashvisor supplies and the way all of them hook up with the cap charge calculator.

At the start, for those who’re studying this weblog, you then’re already the usage of considered one of our best equipment on the web – wisdom.

Our weblog has hundreds of articles, novice and complicated guides, marketplace stories, and a plethora of data about actual property that you’ll be able to faucet into at any time, and this data is designed round our equipment to steer you thru the usage of our platform successfully and get the consequences that can assist you be triumphant.

Secondly, our most well liked instrument at the Mashvisor platform is the most productive, maximum obtainable, user-friendly, and intuitive of its type—and that’s our Funding Assets Seek.

This can be a fantastically environment friendly instrument that anybody can use to seek out funding homes round america which might be on the market, and spot how each and every belongings is appearing and the way it’s projected to accomplish one day according to its present and ancient apartment source of revenue and the valuables’s worth.

Principally, this presentations you a map of america the place you’ll be able to zoom in right down to group ranges and spot how each and every marketplace and each and every belongings is appearing in relation to its cap charge and money on money go back.

Thirdly, Mashvisor’s apartment marketplace research instrument lets in you to make a choice any marketplace and briefly get a document of the way apartment homes on this marketplace are appearing, together with apartment comps that examine homes which might be very similar to the only you’re involved in and examine them in combination.

Find out how to Use Mashvisor’s Platform

As I stated previous, Mashvisor’s equipment quilt the entire wishes that an actual property investor has relating to making an investment in apartment homes.

So, to be informed tips on how to spend money on actual property the usage of Mashvisor, you’ll first want fundamental wisdom about actual property making an investment and what your technique goes to be.

As an example, there are two sorts of apartment methods that you’ll be able to use—non permanent/Airbnb leases and long-term/conventional leases)—and maximum buyers favor the usage of one and now not the opposite. And because Mashvisor’s equipment supply information for each non permanent and long-term cap charges for each and every belongings, you’ll wish to know the variation between the 2 and what it could imply to you as the landlord earlier than selecting one as it has a better cap charge than the opposite.

In case you do know the fundamentals of actual property making an investment, then again, and you have already got a technique in thoughts; then, it’s time so that you can get started the usage of our platform and cap charge actual property calculator.

On the lookout for a Marketplace

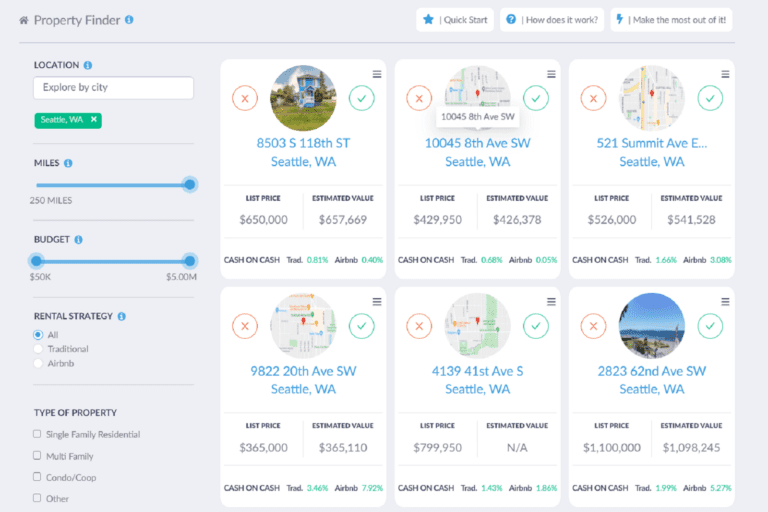

Our funding belongings finder instrument is an easy-to-use map seek instrument with a easy interface that allows you to slender down your seek the usage of filters, which additionally features a warmth map that highlights:

- Checklist worth vary (as much as $5 million)

- Airbnb money on money go back

- Conventional money on money go back

- Airbnb cap charge

- Conventional cap charge

- Airbnb apartment source of revenue

- Conventional apartment source of revenue

- Occupancy charge

Moreover, you’ll be able to use the valuables seek instrument to seek out funding homes in explicit markets and according to explicit standards:

- Location

- Miles from location

- Funds

- Condominium technique (conventional or Airbnb)

- Assets kind (single-family, multi-family, condominium/coop…and many others.)

- Selection of bedrooms

- Selection of bogs

Comparable: The Final Funding Assets Seek Device

Seek for your most well-liked funding homes the usage of Mashvisor’s Assets Finder instrument.

Doing a Condominium Marketplace Research

Now that you’ve a device that you’ll be able to use to seek out homes and measure their possible good fortune, it’s time to do a apartment marketplace research that lets you slender down your choices to a couple of that you’ll be able to have the funds for and that experience the possibility of making a living.

To do a apartment research for a marketplace it is important to first use the hunt instrument to slender down your seek and select the entire homes that fall inside of your price range vary and that fit your fundamental seek standards. You’ll be able to save each and every belongings that you just like for your assortment.

Now, you’ll be able to do the similar procedure in different markets that you just doubtlessly would possibly spend money on for those who haven’t set your thoughts on a selected marketplace but.

The next move is to decide the typical cap charge that you just will have to be expecting from homes inside of your price range vary and to look what homes have a better cap charge than the typical.

Happily, Mashvisor makes this straightforward in two alternative ways:

At the start, when the usage of the map characteristic, you’ll be able to zoom out the map to any degree, together with an area or a town, and the instrument will let you know what the typical cap charge is for apartment homes inside of this group or town for each conventional and non permanent leases.

Secondly, for those who like the usage of spreadsheets and taking a look at detailed numbers for each and every marketplace, you’ll be able to request a marketplace document from Mashvisor and we can ship you an excel sheet containing the information of the entire neighborhoods and homes in that marketplace.

Upon getting a handful of homes and also you’re able to pick out one, it’s time so that you can bounce to the cap charge method calculator.

Comparable: The Highest Comparative Marketplace Research Gear for Novice Buyers

The use of the Cap Price Formulation Calculator

That is the section the place the cap charge calculator actual property research instrument shines.

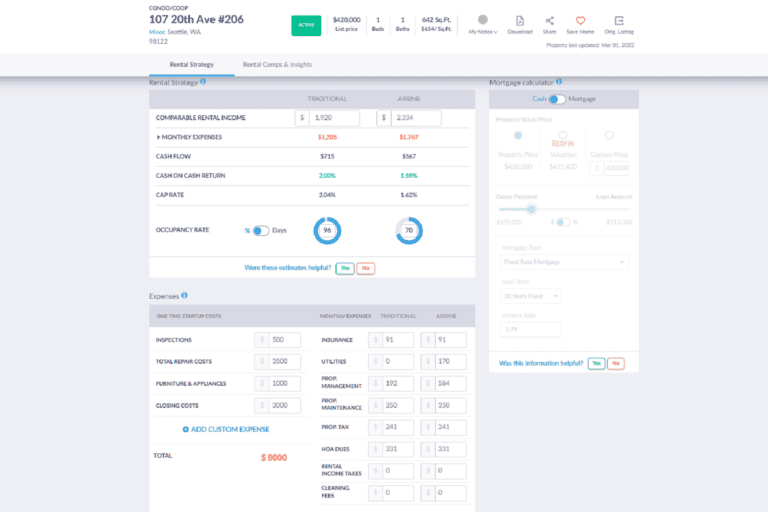

On Mashvisor, while you click on on any indexed belongings you’re going to be taken to that belongings’s apartment research web page.

This web page comprises the entire knowledge you wish to have to grasp concerning the belongings, together with information about its present proprietor and their touch information if it used to be equipped.

However you’re going to even have get entry to to the cap charge method calculator this is totally customizable however comes pre-filled with values founded in the marketplace’s averages.

Mashvisor’s cap charge method calculator seems like this:

Mashvisor’s cap charge method calculator is totally customizable, however comes pre-filled with values founded in the marketplace’s averages.

As you’ll be able to see, the instrument comprises 3 primary options:

- The principle calculator on most sensible, which presentations the consequences for each conventional and Airbnb leases the usage of the cap charge and the money on money go back metrics, in addition to the valuables’s occupancy charge which may be incorporated within the calculations.

- The bills segment at the backside, which is pre-filled founded in the marketplace’s reasonable related bills akin to belongings and apartment source of revenue taxes, HOA charges, belongings control, final prices…and many others. You’ll be able to additionally alter those values as you notice are compatible, or upload new ones if wanted.

- The loan calculator at the proper aspect, which contains the loan kind, period, quantity, and rate of interest.

Converting any worth within the bills or loan sections will right away be mirrored within the effects segment for each the cap charge and the money on money go back metrics.

This web page may even come with different information about the long-term projections comparable for your funding, such because the 10-year pay-back charge or comps of different identical homes, which is particularly helpful at this level.

Now, all you wish to have to do is to visit this web page for each and every belongings that you’ve decided on and alter the consequences to be extra correct and related for your explicit funding, such because the loan quantity and rates of interest, at which case you’ll be the usage of the money on money go back worth as smartly.

Backside Line

The Mashvisor cap charge calculator is the most productive of its type because of different distinctive options and equipment that Mashvisor provides which move hand in hand with our cap charge calculator instrument.

In case you’re involved in finding out about our different equipment, or possibly you wish to have to be informed extra concerning the complicated methods of actual property making an investment; without reference to what you’re taking a look to be informed, likelihood is that you’ll to find an editorial printed about it on our weblog!

So move take a look at Mashvisor’s weblog and subscribe to the platform to start out the usage of it nowadays and to find the very best funding belongings via the next day to come.