The S&P 500 (ASX: SPY) has been promoting off because it peaked at its all-time top of $479.98 on Jan. 3, 2022. Stocks fell as little as $410.64 sooner than staging a leap try. Because the pandemic lows of $218.26 set in March 2020, the “purchase the dip” technique has labored out neatly for essentially the most phase. Alternatively, there’s a key explanation why it’s not running and would possibly not paintings shifting ahead, upper rates of interest. The U.S. Federal Reserve has been extremely dovish with its quantitative easing (QE) pumping over $120 billion a month in asset purchases ballooning the stability sheet to almost $9 trillion. The “simple” cash has been a boon to traders, and a bane to savers as rates of interest actually non-existent and a bane to customers as this has allowed inflation to spike to the absolute best ranges in 40-years at 7.5%. It is a a ways cry from the two% inflation fee that the Fed has focused. The query is why has the Fed let inflation upward thrust so top?

Depositphotos.com contributor/Depositphotos.com – MarketBeat

Depositphotos.com contributor/Depositphotos.com – MarketBeat

Transitory or Sustained?

Because of the COVID-19 pandemic and self-inflicted financial stops from lockdowns, the drop in productiveness used to be anticipated to be brief. At the flipside, the snap-back restoration leap at the reopening used to be additionally anticipated to be brief because it overshoots. Substitute the phrase brief with the time period transitory and that’s what Fed Chairman Jerome Powell used to be preaching throughout 2021. The inflationary pressures are because of the spike in call for overwhelming the provide scarcity on account of the reopening from the pandemic. It’s all brief and can revert again to “commonplace”, proper? Alternatively, the issue is that shutting down factories and manufacturing after which getting them again on-line isn’t a very simple or affordable job. That is glaring through the worldwide chip scarcity and provide chain disruptions we’re seeing globally. Meals, gasoline, and salary inflation has run amok because the U.S. has observed the quickest spike in CPI in 4 many years. The Fed has modified its rhetoric and eradicated the phrase “transitory” from its vocabulary. Since unemployment is at report lows below 4%, the “coast is apparent” to begin financial tightening progressively.

Financial Tightening

Now we have been in a financial growth era for the reason that pandemic. Now it’s time to pay the piper (again). This implies tapering down the per thirty days bond buying (QE) program and just about getting rid of it in Q1 2022. It additionally way trimming the large Fed stability sheet down from just about $9 trillion. Maximum impactfully, it way elevating rates of interest to fight inflationary pressures. The combo of all 3 power the financial tightening procedure designed to hose down the tempo of monetary growth and inflationary pressures. Naturally, that is bearish for asset costs particularly shares. The inventory marketplace strikes on rumor and resolves on information. The anticipation of emerging charges and transition to a hawkish stance used to be evidenced through the December FOMC assembly mins. This set-off the inventory marketplace cliff dive in early January 2022 because the SPY fell just about 10% off its highs and Nasdaq fell 20% off its highs through the top of February, sooner than the new leap. There may be huge hypothesis that the Fed will carry rates of interest from three times as much as 6 or 7 instances as Jamie Dimon of JPMorgan Chase commented on its profits convention name. The key is upper rates of interest imply decrease markets as “chance off” stance takes impact. The Russian invasion of Ukraine is inflicting oil costs to spike and the following sanctions in opposition to Russia will affect costs for merchandise within the U.S. and globally. Whilst some speculate that the Fed would possibly ease up at the hawkishness because of the geopolitical occasions, if the result is the acceleration of inflationary pressures, then the Fed should react even tougher to offset the expectant surge. This yr could possibly be one in all enjoying protection as the entire marketplace local weather has reversed with the Federal Reserve’s stance on rates of interest. There shall be alternatives for traders and investors who administer self-discipline and persistence over panic and FOMO. Let’s check out the place essentially the most opportunistic spots shall be at the SPY.

SPY Value Trajectories

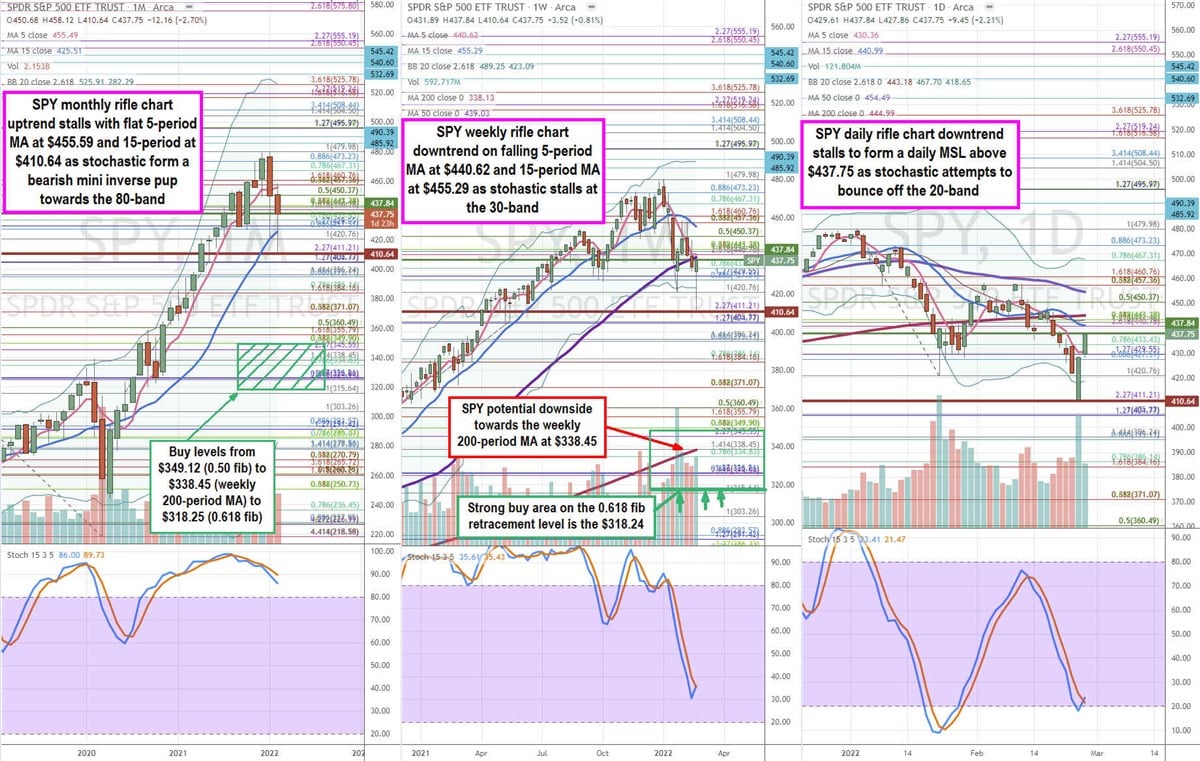

The usage of the rifle charts on per thirty days, weekly, and day-to-day time frames supplies a fowl’s eye view of the SPY. The SPY hit an epidemic low of $218.26 on March 24, 2020, from a top of $337.34 on Feb. 19, 2020. The SPY proceeded to rally off the lows to a top of $479.98 on Jan. 4, 2022. Stocks then proceeded to fall to a near-term low of $410.64 sooner than making an attempt a significant rally. Gazing key Fibonacci (fib) degrees the use of the pandemic low to the post-pandemic top (internet 261.72 issues) supplies a key 50% retracement degree at $349.12 and the 61.8% tough fib retracement space at $318.24, which is without equal purchase space for investors and traders. The per thirty days rifle chart is the widest period of time offering the broadest and arguably among the best view for long-term traders. For 2 years the per thirty days rifle chart breakout uptrend lasted sooner than in spite of everything forming a marketplace construction top (MSH) promote cause on a breakdown beneath $410.64. The per thirty days stochastic has stairstep mini inverse domestic dogs however remains to be above the 80-band. If the per thirty days stochastic falls below the 80-band, glance out beneath as a deeper oscillation may just in the end sell-off the marketplace against the 0.50 and zero.618 fib retracements at $349.12 and $318.24, respectively. This may herald a undergo marketplace. Those are each nice purchase/moderate ranges for traders to imagine scaling in lengthy positions. In the meantime, the weekly rifle chart has been in a complete oscillation down falling from the 80-band to the 30-band sooner than making an attempt to move up once more after the markets bottomed at the Russian invasion of Ukraine. The important thing resistance of the weekly 50-period shifting moderate (MA) is at $439.03 with the weekly 5-period MA resistance at $440.62. If the weekly stochastic manages to move up, then a channel tightening again to the weekly 15-period MA is conceivable at $455.29. Alternatively, if the weekly stochastic coil try turns in a mini inverse doggy, then an additional sell-off is conceivable against the 0.50 retracement space $349.12 and the tough weekly 200-period MA at $338.45, which coincidentally occurs to be just about the pre-pandemic highs (339.08) made in 2020. The day-to-day rifle chart illustrates the near-term day-to-day marketplace construction low (MSL) purchase cause above the $437.75 according to the sturdy reversal try as stochastic coils off the 20-band. Remember the fact that undergo markets have very sharp bounces, however the wider time frames want to be stored in point of view to gauge the overall marketplace downtrend. In abstract, be expecting the marketplace to bop first at the day-to-day MSL triggers however the wider period of time charts of the weekly and particularly per thirty days should be revered and used to gauge spaces to promote into the bounces. The best spaces to shop for is when the SPY falls all the way down to the $349.12 to $218.25 ranges, which represents a large number of helps together with the 0.50 fib to the 0.618 fib retracements and the weekly 200-period MA.