3 Penny Shares to Watch in March 2022

With any other month of buying and selling penny shares nearly right here, there’s a lot for buyers to imagine. Now, working out precisely what’s going on within the inventory marketplace will all the time be probably the most the most important issue to creating wealth with penny shares. And as February involves an finish, there are some things to bear in mind. For this reason, let’s destroy them down one at a time. On the most sensible of the record at this time, we’ve a war between Russia and Ukraine.

PennyStocks.com – PennyStocks

PennyStocks.com – PennyStocks

Whilst this has simplest been in play with penny shares previously few weeks, it has begun to have a significant impact at the inventory marketplace. And as February ends, we simplest be expecting this to proceed leading to main marketplace volatility. Subsequent at the record, we’ve the pandemic. Whilst Covid has taken a backseat momentarily, it’s nonetheless inflicting ups and downs within the inventory marketplace. Even supposing the upward thrust and next fall of Omicron has helped to carry us extra towards an epidemic state, it’s nonetheless round.

Finally, we need to imagine the results of the pandemic comparable to large inflation, and extra just lately, emerging rates of interest. Previous to the invasion of Ukraine, emerging rates of interest have been the principle subject of dialogue within the inventory marketplace. So, conserving all of this in thoughts concurrently is the most important to working out learn how to business penny shares and whether or not or no longer profitability is conceivable. So, with all of this in thoughts, let’s check out 3 penny shares to observe in March 2022.

3 Penny Shares For Your March 2022 Watchlist

- Camber Power Inc. (NYSE: CEI)

- Ambev ADR (NYSE: ABEV)

- Denison Mines Corp. (NYSE: DNN)

Camber Power Inc. (NYSE: CEI)

Camber Power is a penny inventory that we have got been overlaying considerably during the last few months. And on February twenty fourth, we witnessed stocks of the power corporate shoot up through over 25%.

This was once a considerable acquire and presentations each how bullish buyers are at the power business and the way unstable CEI inventory is as an entire. However, previously one month and 6 month classes, stocks of CEI inventory have shot up through over 18% and greater than 80% respectively. For this reason, it’s price taking a better take a look at the corporate.

The newest press liberate from Camber Power got here on February seventeenth. That is when it introduced that its subsidiary, Viking Power were identified as a pacesetter within the power sector. And extra just lately, the CEO of the corporate, James Dorris introduced an organization replace for shareholders. Within the replace, Dorris said that the subsidiary, Viking, has diminished its debt through over $100 million throughout the sale of divisions that have been subjected to high-interest loans.

As well as, Camber Power instituted a financing deal of most well-liked stocks price $100 million. All of this has helped to place CEI inventory in a greater place after submitting from round $4 to the place it these days sits at beneath $1 in step with percentage. Taking into account all of this, will CEI be for your record of penny shares to observe or no longer?

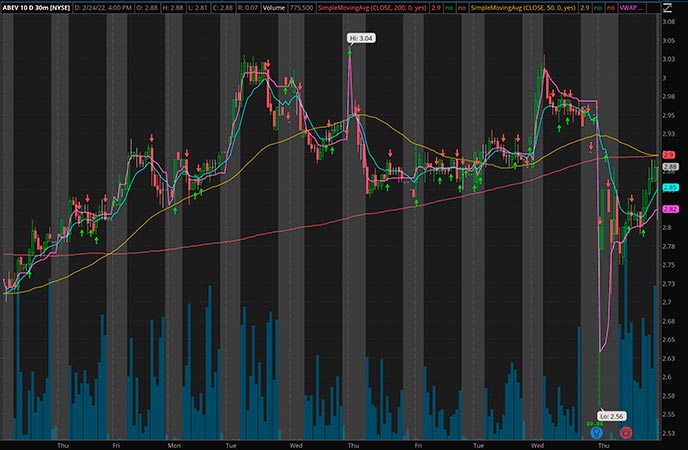

Ambev ADR (NYSE: ABEV)

Every other penny inventory that we have got mentioned steadily previously six months or so is Ambev. Over the past month, we’ve begun to peer a slight bullish turnaround for the Brazilian beverage producer. And, that is consistent with its fourth quarter 2021 monetary effects that have been launched only some days in the past.

The corporate introduced in its newest This fall effects that its internet source of revenue declined to a few.7 billion BRL or round $738 million. In spite of this, its internet income rose to 22 billion BRL from 18.6 billion BRL within the yr prior. Along with all of this, the corporate said that the overall price of products bought rose through nearly 30% from the fourth quarter of the former yr. The primary reason why in the back of all of that is the results of the pandemic.

And, the corporate states that it’s nonetheless feeling the results of Covid on its trade. However, as one of the most greatest vendors of alcoholic merchandise in South The united states, many buyers are fascinated by the way forward for the corporate. For now, ABEV inventory is slightly unstable, and buyers must imagine those effects wholly. With that during thoughts, will ABEV be for your penny shares watchlist subsequent month?

Denison Mines Corp. (NYSE: DNN)

Up to now few buying and selling days, we’ve noticed stocks of DNN inventory climb considerably. On February twenty fourth, DNN inventory shot up through over 6.4% to greater than $1.33 in step with percentage. And previously six months, DNN inventory has shot up through over 20%. The newest information from the corporate got here on February sixteenth when it introduced a number of intersections of high-grade uranium mineralization at its Phoenix Uranium deposit at its 95% owned Wheeler River mission.

“The grade and thickness of mineralization in holes GWR-045 and GWR-049 considerably exceeded what was once predicted through the Phoenix block style.

We imagine those effects will toughen a diffusion of the amount of the high-grade mineralized area in Segment 1 space of Zone A. The prospective exists to spot further perched mineralization alongside the northwest margin of the Deposit.”

The Director of Exploration at Denison Mines, Andy Yackulic

That is very thrilling information and presentations that Denison is operating exhausting to proceed increasing its uranium deposits. With all of that regarded as, do you assume DNN inventory is price including for your watchlist for subsequent month or no longer?

Which Penny Shares Are You Observing in March?

Discovering the most productive penny shares to shop for in March 2022 is difficult. However, with the fitting data readily available, it may be a lot more straightforward than prior to now imagined. As a result of there are such a large amount of choices to make a choice from, making a watchlist shall be your highest probability at profitability.

Along with this, buyers must have a radical working out of each learn how to business penny shares and a buying and selling technique readily available. All of this may increasingly assist to extend your possibilities of profiting and reduce your possibilities of doing the other. So, with all of that during thoughts, which penny shares are you observing in March 2022?

For those who loved this newsletter and also you’re fascinated by finding out learn how to business so you’ll be able to have the most productive probability to learn persistently then you want to checkout this YouTube channel.

CLICK HERE RIGHT NOW!!