Professional forma actual property is a technique to analyze a possible funding assets to make certain that it is going to generate prime returns.

There may be much more than simply purchasing apartment assets in terms of actual property making an investment. Whilst many would possibly recall to mind it as a beautiful simple funding, there are lots of calculations an actual property investor wishes to move thru ahead of even purchasing the valuables to verify its profitability.

From the assets value and loan to apartment source of revenue and money on money go back, they’re simply among the vital issues that want to be taken when making an investment in actual property. With out a right kind actual property assets research or funding research, there is not any actual technique to say {that a} unmarried assets will provide you with a first rate go back on funding. In different phrases, actual property buyers want to do a professional forma actual property research.

What Does Professional Forma Imply in Actual Property?

Prior to committing your acquire of an funding assets, it is very important carry out a professional forma actual property research to resolve if the unit is price making an investment in.

In industry, professional forma paperwork confer with the estimated predictions of your long run bills and source of revenue. Whilst the time period isn’t as widespread within the industry of marketing and renting homes, its definition in actual property is rather identical. Professional forma that means in actual property, in the most straightforward phrases, is a file that analyzes the profitability of a possible funding by means of evaluating the recognized consistent bills of shopping for and keeping up the valuables towards its possible source of revenue technology.

The use of historic information at the assets and house, professional forma actual property paperwork will evaluate projections and assess the conceivable framework referring to your own home’s long run monetary state. Whilst many bills include purchasing and proudly owning an funding assets, professional forma actual property calculations generally come with primary and habitual bills. Suppose alongside the traces of the way a lot maintenance will value and the way incessantly you’ll want to get them executed. Whilst professional forma actual property calculations are essential in comparing profitability and prices, they are going to incessantly miss one-time or unusual bills that aren’t more likely to happen.

A professional forma actual property funding assets research will focal point extra in your web working source of revenue (NOI), constant money glide, and habitual bills when undertaking actual property math. By means of taking into consideration the perhaps prices and source of revenue in response to previous information and developments, professional forma actual property calculations will have the ability to display you a carefully correct depiction of your own home’s efficiency available in the market. A professional forma actual property research may even have in mind of possible adjustments in computations, akin to will increase in hire, emptiness and occupancy charges, maintenance, and conceivable control charges, relying on the way you set up your own home.

Why Is Professional Forma Essential In Actual Property?

Making an investment in actual property is an overly profitable industry. Then again, whether or not or not it’s purchasing your first or your 5th assets, the preliminary value can take rather a toll in your funds. Whilst you’ll be buying a $one million assets hoping for a 2% go back on funding, even a 1% lower in benefit margins can deliver down your anticipated source of revenue by means of $10,000. It’s why a correct actual property professional forma is essential. You’re taking the danger of making an investment an excessive amount of cash, so that you will have to on the very least get some thought of the way a lot you are going to get in go back.

A professional forma actual property calculation in response to correct information and knowledge will lend a hand buyers resolve a assets’s possible to generate source of revenue and make a decision if it’s well worth the funding. A assets with an estimated apartment source of revenue of $2,000 on a $300,000 funding with just about no maintenance is also well worth the funding possibility to you. However a $2,500 apartment source of revenue on a $500,000 with a habitual want for maintenance might not be.

Whilst the luck of your investments is determined by your technique, seeing the estimates and projections will permit you to make a greater choice to succeed in your funding objectives. Acquiring a professional forma actual property estimate in response to marketplace analysis and historic monetary statistics is essential in any funding. It is helping buyers with initiatives and spot essentially the most correct image of the conceivable dangers and returns a assets can be offering. If you are making an error on your professional forma or select to forgo it altogether, you run the danger of overpaying for an underperforming piece of assets. It’ll in the end hurt your go back on funding or even doubtlessly reason monetary problems for your final analysis.

Calculate Professional Forma Actual Property?

In relation to actual property math, professional forma calculations come with a number of necessary variables that can appear difficult for brand spanking new and seasoned buyers. Whilst it’s admittedly no longer the most straightforward of computations, you want no longer fear as we’ve supplied you with an actual property professional forma template that incorporates the entire variables it is important to make a correct research.

1. Gross Condominium Source of revenue

In easy phrases, gross apartment source of revenue is the quantity your tenant will pay you in hire for occupying your own home. Gross apartment source of revenue refers back to the quantity of source of revenue your own home generates ahead of any deductibles and bills are accounted for. It’s purely what quantity of money you are making with out another prices.

For instance, if you’re renting out a two-bedroom rental in LA with one room costing $1,500 in hire and the opposite costing $2,000 in hire, your overall per 30 days gross source of revenue can be $3,500. When you’re not able to get admission to historic information with the former apartment value, you’ll forecast the homes’ gross apartment source of revenue by means of taking a coarse estimate of the once a year gross apartment source of revenue and multiplying the end result by means of 0.75. Moreover, if you’ll to find the gross hire multiplier within the homes’ location, you’ll use the next system to estimate the gross apartment source of revenue:

Gross Condominium Source of revenue = Belongings Value / Gross Hire Multiplier

Similar: The Very best Holiday Condominium Source of revenue Calculator

2. Emptiness Charge

Emptiness price refers back to the period of time your own home it is going to be available on the market and unoccupied. As you are going to simplest generate an source of revenue when it’s occupied, the emptiness price additionally performs a key function within the assets’s possible money glide and NOI.

Relying on the kind of funding homes you’re looking at, your calculations for its emptiness price would possibly vary moderately. When you intend to shop for a single-family house, it is important to calculate for a unmarried kin actual property professional forma. Alternatively, if you’re taking a look right into a multi-unit assets, it is important to calculate the emptiness price for a multi kin actual property professional forma. Unmarried kin homes are more uncomplicated to calculate as there is just one unit to inhabit. Then again, in terms of multi kin gadgets, it is important to account for the potential of one unit being occupied whilst the opposite is vacant.

The emptiness price is normally calculated by means of taking the choice of unoccupied gadgets and multiplying the determine by means of 100 after which dividing it by means of the choice of overall gadgets. For instance, you personal a multi-family assets with 10 gadgets with 3 gadgets recently unoccupied. To get the emptiness price, you are going to more than one the 3 gadgets occupied by means of 100 and divide it by means of 10, leaving you with a 30% emptiness price.

Emptiness Charge = Selection of Vacant Gadgets x 100 / Overall Quantity Of Gadgets

Similar: What Is Emptiness Charge and Stay It Low

3. Maintenance and Restore Bills

Maintenance and service bills confer with the estimated sum of money had to duvet your own home’s conceivable damages and maintenance each and every 12 months. Whilst it’s rather difficult to estimate how a lot injury and maintenance will likely be wanted each and every 12 months, you’ll put aside a definite sum of money out of your gross source of revenue to hide such contingency.

Actual property buyers normally apply the 1% rule for restore bills. The 1% rule signifies that regardless of the worth of your house for a specific 12 months, you will have to put aside 1% of its overall worth for maintenance. It implies that if your own home is valued at $500,000, you will have to put aside $5,000 for maintenance or more or less $417 monthly.

Similar: 11 Prices First Time Actual Property Traders Must Believe

4. Control Charges

If you’re a brand new actual property investor with just one assets, likelihood is that you are going to be the primary supervisor of the valuables. Then again, as you develop your actual property portfolio, you are going to perhaps rent a assets supervisor that will help you keep on most sensible of your other investments. At this level, it is important to believe their charges and prices each and every time you purchased new assets on your pro-Forma calculations. Moreover, without reference to whether or not it’s your first assets or tenth assets, relying at the assets, chances are you’ll want to pay a construction tremendous rate which is able to fall beneath control rate calculations.

5. Loan Bills and Mortgage Charges

Loan bills are beautiful simple. When you took out a mortgage to shop for the valuables, likelihood is that you have got a per 30 days loan to pay. Because the loan is a set per 30 days expense, it is important to take it into consideration when calculating your professional layout, as it is going to impact your go back on funding.

Extra incessantly than no longer, loan bills may even play a significant component within the apartment source of revenue as maximum buyers will come with loan bills of their checklist value for conceivable tenants. It implies that in case you pay a loan of $1,200 per 30 days, your apartment price will have to be any quantity above that. In case your loan is greater than the typical apartment price of the world, chances are you’ll need to search for different funding homes on the market that provide a extra profitable deal.

6. Different Actual Property Bills

Whilst incessantly lost sight of by means of many, taxes, HOA dues, insurance coverage, and different criminal charges also are wanted in a professional forma file. Whilst a few of them might not be per 30 days bills, they do take a vital sum of money out of your final analysis. Having such bills accounted for will permit you to get a greater image of the way a lot source of revenue your possible assets can generate.

Now that you’ve the entire vital estimated components and variables of your possible actual property funding assets, you’ll calculate your professional forma appropriately. To calculate your professional forma, here’s the overall system that actual property buyers use:

Professional Forma NOI = GRI – Emptiness Bills (Emptiness Charge x GRI) – All Different Bills

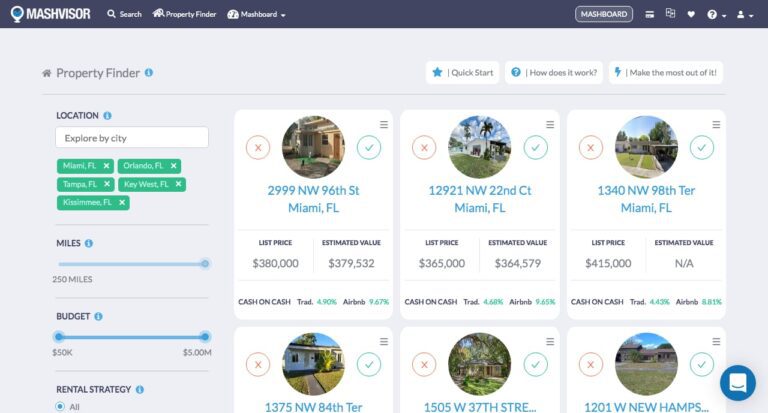

Mashvisor’s actual property funding equipment just like the Belongings Finder assist you to to find an funding assets and carry out a professional forma actual property research in mins.

You might imagine that calculating your professional forma for each and every funding assets is a frightening process, and we don’t blame you. The want to analysis and get admission to huge quantities of data to get one a part of the system is a time-consuming and tiring process for someone, to not point out could be very vulnerable to human error. It’s why many seasoned actual property buyers are turning to era and actual property funding equipment like Mashvisor to lend a hand them of their professional forma and complete actual property funding research.

Mashvisor provides many actual property equipment that will help you on your actual property funding adventure. From Mashvisor’s Belongings Finder to its funding actual property research equipment, you’ll simply discover a assets that meets your finances whilst additionally getting an estimate on its possible apartment source of revenue, money on money returns, occupancy charges, and lots of extra in response to historic and present information of neighboring homes within the house.

With no need the effort of manually calculating each and every issue in your professional forma, Mashvisor assist you to simply download the entire vital computation had to plug into the true property professional forma template. With this, you’ll leisure confident that you’re making data-based choices with correct computations with each and every actual property funding you are making from right here on out.

The Backside Line

Actual property math, particularly professional forma actual property research, is very important to any assets funding. With possible source of revenue and projected bills all accounted for, you might be positive to by no means overspend for an underperforming assets within the house. To ensure accuracy and straightforwardness of use, Mashvisor’s funding equipment collect and to find the entire information you want for a correct professional layout.

From the projected apartment source of revenue for your money on money go back, there is not any want so that you can shift thru a pile of knowledge simply to look the whole possible of 1 assets. Enroll and subscribe to Mashvisor and acquire get admission to to all our actual property information and funding equipment nowadays.