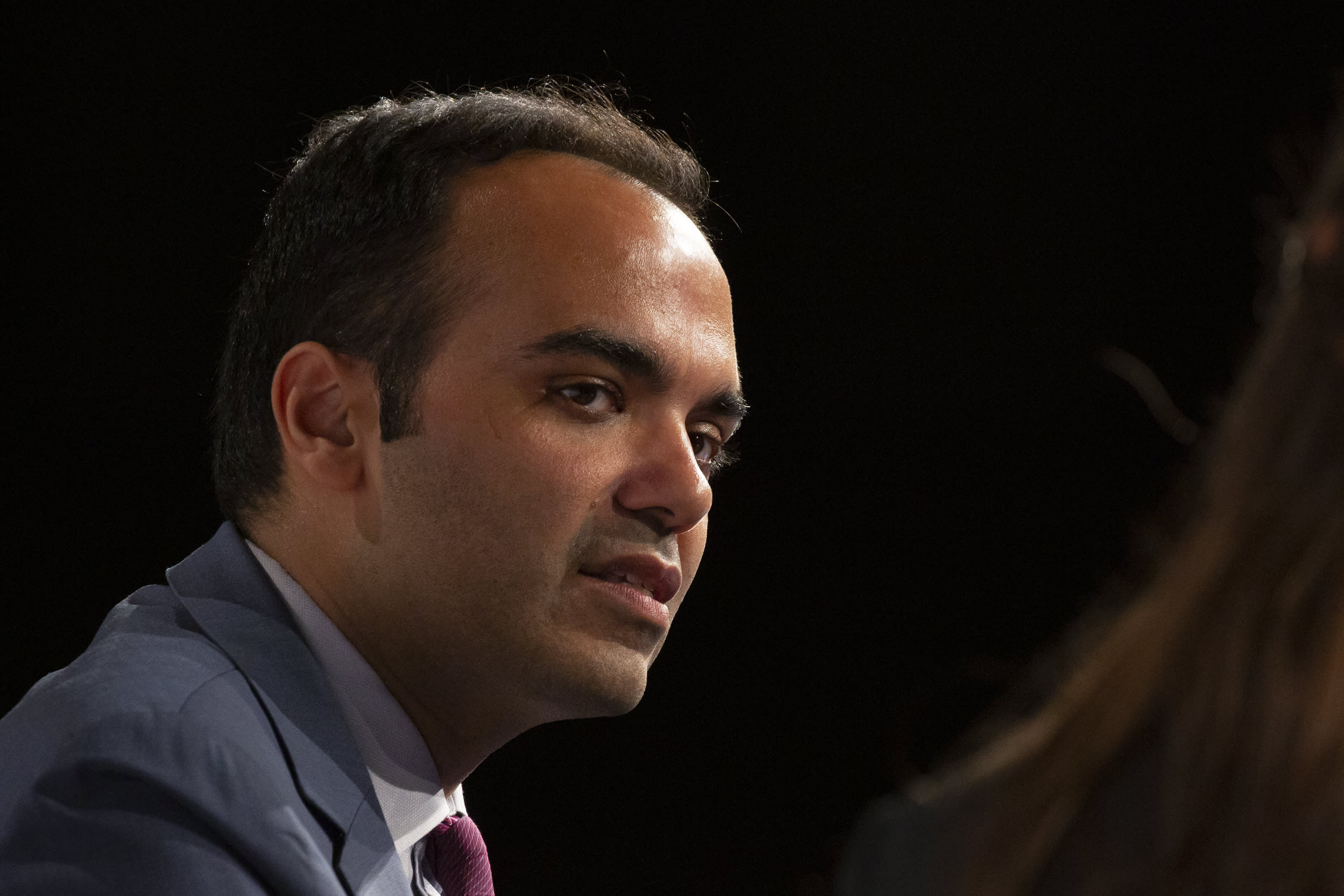

Rohit Chopra, director of the Client Monetary Coverage Bureau.

David Ryder/Bloomberg by the use of Getty Photographs

The Biden management is making an attempt to empower shoppers to assist rewrite the principles governing how banks, lenders and different monetary establishments can deal with consumers.

The Client Monetary Coverage Bureau — a federal company created within the wake of the 2008 monetary disaster — mentioned Wednesday it’s going to let the general public publish a rule-making petition without delay to the company.

The Dodd-Frank Act, signed in July 2010, established the watchdog to give protection to shoppers from unfair, abusive and misleading monetary practices — a reaction to the dangerous loans that tipped the U.S. right into a deep recession.

Extra from Private Finance:

82% of customers paying above decal worth for a brand new automotive

Biden management conserving a detailed eye on personal fairness

Training Division forgives $415 million in scholar debt

The bureau polices banking, mortgages, scholar loans, debt assortment, bank cards, credit score reporting and payday loans, amongst different spaces. This wide shopper oversight hadn’t up to now been the principle center of attention of any federal company.

Now, the general public can ask the bureau to pursue a brand new monetary rule, or exchange or repeal an current legislation.

The petitions will assist officers determine shopper coverage problems worthy of reform or wanting additional explanation, the bureau mentioned. They are additionally meant to restrict the facility of lobbyists, who’re “paid to persuade the company’s rulemaking time table at the back of the scenes,” it added.

“American citizens will have to have the ability to simply workout their Constitutional rights with out hiring a high-priced attorney or lobbyist,” mentioned CFPB Director Rohit Chopra, who used to be appointed via President Joe Biden and showed via the Senate in September. “Our new program will expand get entry to to the company’s rulemaking procedure.”

Petitions can be posted publicly and made to be had for extra remark from different contributors of the general public.

The company asks that petitioners come with “the factual and criminal causes for the proposed motion,” in addition to the “anticipated results” it’s going to have on related events like shoppers, the trade and enforcement government — duties that can turn out tough for some shoppers.

Earlier than the exchange, the general public have been in a position to sway company decision-making via filing public feedback on laws the company had proposed or via taking part in sure roundtable discussions. They might additionally publish proceedings about monetary services and products. (These kinds of avenues stay to be had.)

Client advocates anticipated the patron bureau to be extra competitive right through Biden’s tenure relative to his predecessor, President Donald Trump. Chopra, the brand new head of the bureau, had up to now overseen scholar loans on the company underneath President Barack Obama.