Producing a passive source of revenue isn’t precisely as passive as it kind of feels. The misunderstanding in the back of it lies in this one phrase: passive. Individuals who don’t know a lot about making an investment are below the influence that passive making an investment approach simply hanging cash in and now not doing anything else in any respect after that.

Any a hit investor is aware of that you just nonetheless must be up to the mark even though they’re passive investments. You continue to have to observe how your shares and mutual budget are doing; differently, you may omit on positive alternatives led to via marketplace fluctuations. That or it’s essential finally end up dropping cash for a similar reason why.

It’s just about the similar with actual property making an investment. There’s any such factor as palms off actual property making an investment. However it’s fully other from passive source of revenue. Let’s speak about it some extra.

Mashvisor’s Information to Fingers Off Actual Property Making an investment in 2022

Ahead of we truly take a dive into palms off actual property making an investment, we wish to first perceive what it’s and the way other it’s from different sorts of making an investment strategies. We’re all beautiful acquainted with each energetic and passive source of revenue and the way they may be able to be generated.

Lively and Passive Source of revenue Outlined

Lively source of revenue comes to actively acting explicit duties and offering products and services that experience to do with one’s process or profession. That is what most often takes up most of the people’s schedules. It comes to going to paintings and clocking in hours of carrier to generate source of revenue.

Passive source of revenue, alternatively, isn’t as time-consuming as an energetic source of revenue supply, however it doesn’t imply that you just’re totally palms off with it. To place it within the context of being profitable in actual property, let’s say an investor comes to a decision to shop for a belongings to lend a hand now not simply make a benefit but additionally increase their actual property portfolio. The investor has a couple of choices to choose between. She or he can select to move with the fix-and-flip way, microflipping, or condominium belongings technique.

Whilst all 3 strategies would possibly look like just right passive source of revenue alternatives, all 3 of them nonetheless require the investor to be actively concerned to a definite extent.

Space flipping usually comes to purchasing undervalued homes and rehabilitating them to promote them for a benefit. Scouting for the correct space takes time. So does house growth. And even though you’re running with an actual property agent, you continue to wish to be concerned within the gross sales procedure, particularly all through inspections and the ultimate. So necessarily, it isn’t as passive as one would suppose.

Microflipping is just about a scaled-down model of space flipping, with the primary distinction being that it does now not require any renovation or updates and may also be finished remotely with the assistance of era. Identical to the extra commonplace fix-and-flip manner, buyers search for and purchase homes which can be beneath marketplace worth and promote them to deal with consumers on-line. They now not wish to repair the valuables, which speeds the method up, with offers normally being closed in as low as per week or two. The one factor is, in contrast to standard space flipping, microflippers don’t earn as a lot.

Maximum other folks have this false impression that proudly owning condominium homes is as just right because it will get so far as passive source of revenue is anxious. In the end, whenever you in finding the correct tenant, you don’t need to do a lot apart from accumulate the hire on the finish of the month. On the other hand, any condominium belongings proprietor will inform you that it’s merely now not the case. Proudly owning a condominium belongings, whether or not it’s a conventional condominium or a holiday house, can absorb numerous your time, particularly if you happen to personal more than one condominium homes.

Similar: The Highest Method to In finding an Source of revenue Belongings for Sale

It’s important to ensure that the home is in just right situation and that the whole lot is operating smartly. On every occasion explicit problems stand up, landlords and belongings house owners wish to cope with them right away. The transition length between tenants will also be very time-consuming and expensive with all of the required maintenance and upkeep paintings. Hiring belongings managers can lend a hand ease the weight, however you continue to wish to be up to the mark. Simply because it says passive making an investment doesn’t imply you’ll be able to detach your self out of your funding as a result of different individuals are dealing with it. There’s a large global of distinction between being successfully sensible (or is it neatly environment friendly?) and being carelessly unaware.

So those 3 passive source of revenue resources aren’t precisely as palms off and palms unfastened as you may suppose.

What Does Fingers off Actual Property Making an investment In point of fact Imply?

True passive or palms off funding approach being able to earn source of revenue at the facet on autopilot. It approach now not having to be immediately or not directly provide to control the investments. A palms off investor thinks of how grow to be a belongings investor that 100% does now not absorb any in their time and dedication after the preliminary funding has been made.

Numerous individuals are searching for other ways to reinforce their source of revenue via having a look at other funding alternatives, particularly all through those attempting occasions. And whilst an funding might not be preferrred for instant returns (maximum are illiquid and require time to develop), they do lend a hand give protection to buyers towards the long-term results of inflation. Smartly, in fact, it’ll nonetheless rely on the kind of funding, however preferably, potential buyers will have to do their homework sooner than making any choice.

For example, the former examples discussed (fix-and-flips, microflipping, and condominium homes) all require other ranges of involvement and dedication. On the other hand, they all additionally require buyers to behavior their due diligence to offer protection to and develop their cash. They wish to collect the essential marketplace and community knowledge that may display them how successful a definite belongings is.

Irrespective of whether or not they intend to resell the unit or hire it out, buyers will take pleasure in acting thorough analysis and research on attainable funding homes. Doing so would require the correct investor equipment like those discovered on Mashvisor.

Mashvisor is a platform that makes a speciality of belongings location and profitability research to lend a hand buyers make the wisest and maximum assured choices, without reference to whether or not they cross with rehabilitating and reselling homes or 100% hand off actual property making an investment. It has other equipment that experience helped 1000’s of buyers find the correct homes.

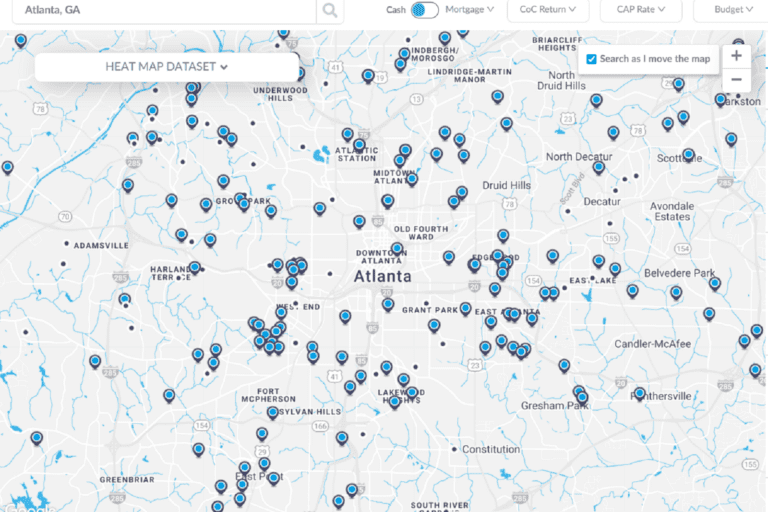

The website’s customers have get entry to to other equipment that let them to find a belongings just like the Belongings Finder and the Actual Property Warmth Map. Those equipment give buyers get entry to to up to date and correct knowledge they may be able to use to investigate whether or not a belongings is value making an investment in or now not. The Funding Belongings Calculator is utilized by buyers to look if the mathematics tests out in accordance with the information they collected from the website’s large database.

Similar: 5 Highest Actual Property Funding Gear

For more info about Mashvisor’s equipment and the way they may be able to lend a hand buyers, remember to seek advice from the web site right here.

An investor can get a hold of a good money waft with out being concerned within the funding if they have got the correct actual property funding technique. This now not best lets in the investor to get further source of revenue however increase their actual property portfolio as smartly. Fingers off actual property making an investment, due to this fact, is as regards to matching your funding wishes and objectives with suppliers and avenues that provide you with a way of convenience and safety.

Mashvisor’s Actual Property Warmth Map Provides Customers Get right of entry to Correct and Up to date Knowledge for Their Making an investment Wishes.

Advantages of Fingers Off Actual Property Making an investment

The next are probably the most the explanation why hand off actual property making an investment may give you the results you want:

Tax Advantages

Probably the most tactics an individual could make an actual property funding that’s totally passive is via hanging an in advance capital funding in an actual property syndication or non-public placement providing. This sort of funding most often comes with tax-deferred money returns permitting buyers to carry directly to extra in their profits for all of the length of the funding’s grasp length.

Leveraging Others’ Reviews and Experience

On the subject of actual property making an investment, potential buyers can both cross at all of it via themselves, comparable to purchasing their very own homes, or spouse with different extra certified and skilled professionals to lend a hand them navigate the funding procedure. Passive buyers are offered with a super merit after they sign up for forces with individuals who have in depth expertise and revel in on this trade.

No Coping with Banks

Following 2008’s Nice Recession, banks now require extra documentation from mortgage candidates, to not point out the strain of getting to stay up for all of the mortgage underwriting procedure to be finished. Fingers off buyers are relieved of those burdens principally as a result of their investments are treated via actual property corporations that have already got current relationships with banks and lenders.

No Hassles of Day-to-Day Control

Not like conventional or holiday condominium homes, palms off buyers don’t need to take care of the day by day hassles of managing operations. They don’t get late-night calls from tenants complaining a few clogged bathroom or damaged furnace. Neither do they have got to make sure that the valuables is totally stocked with toiletries and different necessities.

Make Cash Whilst You Sleep

Most likely the most efficient factor about passive making an investment is the way it offers buyers the posh of being profitable whilst they do not anything. In fact, it may well best be as energetic as one chooses to make it. Traders nonetheless wish to carry out their due diligence sooner than they put their cash into a definite funding. On the other hand, when they’re previous all the homework and forms and their investments had been processed, they routinely grow to be fairness house owners in an actual property belongings project, thus letting them develop their cash with out doing a lot.

Fingers Off Actual Property Making an investment Choices for Traders

Now that we’ve clarified what it truly approach to be a palms off actual property investor, the query we wish to cope with is what choices are there for buyers who wish to take this manner? If proudly owning an Airbnb condominium isn’t precisely as palms off as it kind of feels or if an investor isn’t fitted to condominium homes, what different possible choices do you have got?

Actual Property Funding Trusts (REITs)

Actual property funding trusts, or what’s repeatedly known as REITs, are an effective way for other people to get into passive making an investment with out in fact having to shop for and set up a belongings. REITs acquire and function several types of source of revenue homes, comparable to industrial structures, place of work areas, inns, condominiums, condominium structures, and different identical homes. They’re then purchased and offered, like different common shares, on primary inventory exchanges.

This offers buyers a possibility to increase their actual property portfolio with no need to take care of standard actual property transactions.

Actual Property Funding Teams (REIGs)

An actual property funding workforce (REIG), alternatively, supplies get entry to to source of revenue and appreciation with a extra palms off manner when put next to shopping for and managing a condominium belongings. Being concerned with one, alternatively, would require get entry to to financing and a better capital cushion.

REIGs most often spend money on condominium homes thru corporations that purchase or construct condominium properties. They then promote gadgets to buyers with out passing at the tasks of managing the valuables.

The commonest REIG buildings are partnerships and firms. On the other hand, actual property crowdfunding additionally falls below the REIG umbrella since it’s also structured as a type of partnership.

Actual Property Syndication

Finally, buyers too can select to move with actual property syndications. An actual property syndication is a kind of making an investment way the place teams pool their cash in combination to make use of as capital to shop for a big actual property belongings. It’s most often structured as a Restricted Partnership (LP) or a Restricted Legal responsibility Corporate (LLC) and isn’t traded publicly at the inventory marketplace. Merely put, actual property syndications be offering other people a possibility to grow to be actual property buyers with all the trappings of an funding belongings and none of a landlord’s complications.

Similar: Actual Property Making an investment: 5 Easy Techniques to Get Began

Is This Form of Funding Means the Proper One for You?

In the end is alleged and finished, the general choice is truly as much as you. Do you suppose this sort of funding manner is the correct one for you? Does it line up along with your funding objectives? What about your provide scenario? Those are some questions you want to invite your self to decide whether or not a palms off actual property making an investment manner is actually the correct selection.

If you want to be an actual passive investor in each and every sense of the phrase, you want to believe all of the choices to be had to you, now not simply actual property funding. On the other hand, actual property making an investment provides numerous nice advantages that different standard funding strategies can’t, particularly with condominium homes.

Communicate to an actual property agent or a extra skilled investor for steering. Get perception from them and take up to you’ll be able to that will help you get a hold of the correct funding choice. And whilst you do make a decision to spend money on actual property, you have got a chum in Mashvisor that will help you in finding funding homes that supply the most efficient conceivable returns.