The usage of places to take advantage of a plunge in a lower price decrease chance means.

shutterstock.com – StockNews

shutterstock.com – StockNews

All people are most probably very conversant in the unending hunt making an attempt to pick out what inventory would be the subsequent Amazon, Tesla or Apple. However now not just about as many are conversant in looking for which inventory would be the subsequent unhealthy apple.

The previous marketplace adage says that shares pass up the escalator and down the elevator. Which means rises in fairness costs have a tendency to be gradual and stable whilst drops have a tendency to be swift and violent. Without a doubt, the associated fee motion witnessed in January will attest to that.

2022 would possibly after all be the 12 months that inventory good points begin to flatten out, particularly given the large good points observed during the last few years. The tide that lifted all ships-the Federal Reserve-is set on elevating charges and getting rid of liquidity for the foreseeable long run. This will likely be a made up our minds headwind for shares.

This doesn’t imply that every one shares will pass nowhere in 2022. Slightly the opposite. In each and every marketplace there are giant winners and large losers. It simply implies that now you want to in point of fact do a little deeper digging to discover the ones hidden gems-and sift out the idiot’s gold.

You’ll be able to attempt to do the all of the quantity crunching and tough paintings your self. Or you’ll be able to do what I do and feature all of the paintings accomplished for me through the use of the POWR rankings. This is a time-tested and extra importantly fight examined approach to in finding the long run giant winners and large losers alike.

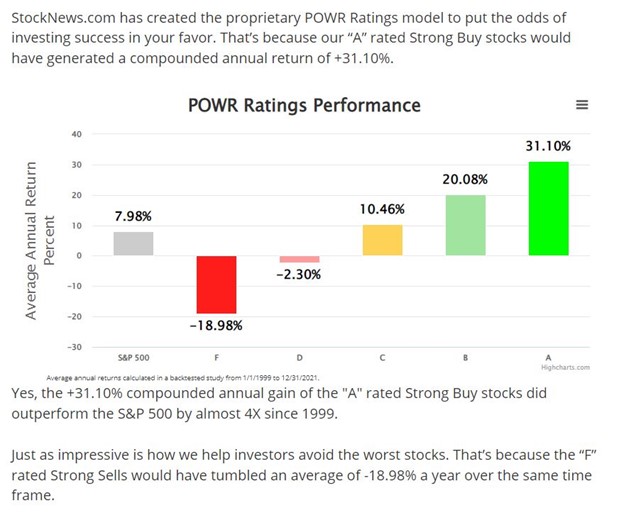

The ancient efficiency of the POWR rankings as opposed to the S&P 500 since 1999 is proven underneath.

When you do the maths, the A rated Robust Purchase shares outperformed the S&P 500 through an astounding 23.12% since 1999. The F rated Robust Promote shares underperformed through an excellent better stage, losing 26.94% in comparison to the S&P 500. This implies the ability of POWR shares is much more robust in selecting unhealthy shares.

As a substitute of shorting shares to take advantage of a drop, POWR Choices makes use of the rankings however buys places as a substitute. This decrease chance, upper doable benefit method reduces the angst and removes the upper margin necessities wanted for shorting a inventory.

A contemporary take a look at our newest business in Royal Carribean Cruises (RCL) on February 10 would possibly shed some gentle.

RCL is an F rated Robust Promote inventory in an F rated Business. It had rallied sharply off the new lows however was once drawing near resistance at $90. Stocks had been overbought on a technical foundation. RCL had simply reported profits that neglected on each the highest and backside line-yet the inventory moved upper.

Implied volatility (IV) was once reasonable at handiest the nineteenth percentile following profits. This arrange preferably for a bearish put business.

POWR Choices advisable purchasing the June $80 places for $4.00 according to contract-or $400 according to choice. Our bearish expectancies had been in an instant discovered day after today as RCL dropped 4.41% from $88.05 on Thursday’s as regards to $83.96 on Friday.

The June $80 places had been closed out at $5.00 on Friday for a pleasing one-day achieve of 25%-or over 5 instances greater than inventory drop of four.41%. This highlights the leverage impact that choices may give to propel income a lot upper than shares.

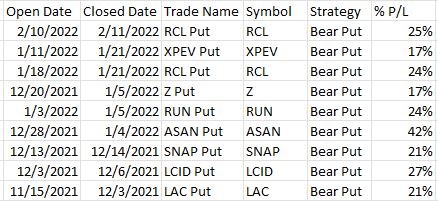

In fact, now not each and every business works out this temporarily, or this neatly. However because the POWR Choices program started remaining November, there were a complete of 9 bearish put trades. All 9 of those trades had been closed out for a achieve. The effects are proven underneath.

The typical conserving length was once slightly below 7 days with a mean achieve of 24.1%. No longer unhealthy for every week’s paintings. Plus, every business will have been accomplished with a mean value of slightly below $550. Very best for smaller accounts or as a efficiency booster for higher accounts.

Combining bearish positions in conjunction with bullish trades is much more essential now that shares appear to have after all discovered some resistance. Upper rates of interest in conjunction with traditionally stretched valuations make it extra of a inventory pickers marketplace. The usage of the POWR rankings to discover those winners and losers and POWR Choices to decrease the chance and build up the possible go back is extra necessary now than ever.

POWR Choices

What To Do Subsequent?

In case you are searching for the most efficient choices trades for nowadays’s marketplace, you will have to take a look at our newest presentation Industry Choices with the POWR Scores. Right here we display you the right way to persistently in finding the highest choices trades, whilst minimizing chance.

If that appeals to you, and you wish to have to be told extra about this robust new choices technique, then click on underneath to get get entry to to this well timed funding presentation now:

Industry Choices with the POWR Scores

All of the Best possible!

Tim Biggam

Editor, POWR Choices E-newsletter

RCL stocks closed at $83.96 on Friday, down $-3.87 (-4.41%). 12 months-to-date, RCL has won 9.18%, as opposed to a -7.26% upward thrust within the benchmark S&P 500 index all the way through the similar length.

In regards to the Writer: Tim Biggam

Tim spent 13 years as Leader Choices Strategist at Guy Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Marketplace Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Industry Reside”. His overriding hobby is to make the complicated international of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices e-newsletter. Be informed extra about Tim’s background, in conjunction with hyperlinks to his most up-to-date articles.

The publish How To Make Excellent Cash Choosing Dangerous Shares gave the impression first on StockNews.com