The money on money go back is an annual measure of source of revenue earned through an actual property investor on a belongings relative to the quantity the investor first of all spent to buy it and make it operational. The money on money go back through metropolis is frequently used when making any funding belongings research. The variation between the money on money go back and the capitalization fee is that with the money on money go back measure, the process of condo belongings financing could also be considered.

What’s a Just right Money on Money Go back for Funding Houses?

There’s no hard-and-fast rule in terms of deciding a particular determine that are meant to be thought to be as a excellent money on money go back. On the other hand, maximum buyers agree that projected money on money go back of 8% or upper is usually the best determine. On the other hand, others consider that even the ones markets with 3% to 7% money on money go back are nonetheless appropriate and might be value making an investment in.

For those who’re questioning tips on how to calculate the money on money go back for residential actual property condo houses, you’ll use the next money on money go back system:

Money on Money Go back = [Annual Cash Flow Before Tax / Total Cash Investment] x 100%

The money on money go back is calculated as the once a year money drift earlier than tax divided through the entire fairness invested and multiplied through 100% (to get the proportion). The determine for the money drift earlier than tax is calculated at the money drift projection in actual property. The determine for the entire money invested is the preliminary fairness funding (which is the entire acquire value of the valuables much less any mortgage proceeds and shutting prices) plus any further fairness required throughout the maintaining duration.

Similar: What’s a Just right Money on Money Go back? A Entire Information

How Can the Money on Money Go back through Town Lend a hand Buyers?

The money on money go back through metropolis is essential when comparing the prospective profitability of an funding belongings. The usage of this go back measure is a wonderful solution to resolve how an funding belongings in a selected house will carry out – serving to making a decision whether or not it’s profitable to put money into that metropolis or now not.

When discovering the finest location for actual property making an investment, it’s essential to take a look at the money on money go back through metropolis to assist maximize condo source of revenue. If you wish to know the proper spaces to shop for an funding belongings in 2022, we now have compiled the highest US housing markets with the finest money on money go back for each conventional leases and Airbnb funding houses.

Money through Money Go back through Town for Conventional Leases

To search out the finest towns for normal condo investments in 2022, we’ll check out the money on money go back through metropolis. The figures beneath had been computed through Mashvisor’s money on money go back calculator.

Listed below are the 60 maximum winning places for normal condo houses in 2022:

- Spruce Pine, NC: 9.1%

- Sylacauga, AL: 7.8%

- Espanola, NM: 7.6%

- Owatonna, MN: 7.3%

- Winslow, AZ: 7.2%

- Greenwood, MS: 6.9%

- Emporia, VA: 6.9%

- Mimbres, NM: 6.8%

- Lakeview, OR: 6.8%

- 8 Mile, AL: 6.8%

- Wooded area Hills, KY: 6.7%

- New Ringgold, PA: 6.7%

- Rotonda West, FL: 6.6%

- Woodburn, IN: 6.5%

- Hobbs, NM: 6.5%

- Dunkirk, IN: 6.5%

- Elkview, WV: 6.4%

- Kansas, OK: 6.4%

- Greers Ferry, AR: 6.4%

- St Gabriel, LA: 6.4%

- Gallipolis, OH: 6.3%

- Castle Madison, IA: 6.2%

- Las Vegas, NM: 6.1%

- Brooksville, KY: 6.1%

- Alma, MI: 6.1%

- Damascus, AR: 6%

- Cushing, OK: 5.9%

- Narrows, VA: 5.9%

- Adelphi, MD: 5.9%

- North Huntingdon, PA: 5.9%

- Stamford, TX: 5.9%

- Newberry, SC: 5.9%

- Doyline, LA: 5.9%

- Spring Valley, MN: 5.8%

- Marietta, OH: 5.8%

- Wolcottville, IN: 5.7%

- Maysville, KY: 5.7%

- Summit, NY: 5.5%

- Princeton, WV: 5.4%

- Pine Hill, NJ: 5.4%

- Suwannee, FL: 5.4%

- Afton, TN: 5.4%

- Duanesburg, NY: 5.3%

- Hinton, OK: 5.2%

- Snowflake, AZ: 5.2%

- Mammoth Spring, AR: 5.1%

- Jacksboro, TX: 5.1%

- Outdated Forge, PA: 5%

- Godfrey, IL: 5%

- Thermal, CA: 4.9%

- DeQuincy, LA: 4.9%

- Olney, TX: 4.9%

- Los angeles Position, LA: 4.9%

- Brackettville, TX: 4.8%

- Rome Town, IN: 4.8%

- Richmond, MO: 4.8%

- Pleasantville, NJ: 4.8%

- White Springs, FL: 4.8%

- Durand, MI: 4.8%

- Inexperienced Lake, WI: 4.7%

To find the Money through Money Go back through Town The usage of Mashvisor’s Money on Money Go back Calculator

Money on Money Go back through Town for Airbnb Leases

Some actual property buyers are earning money in actual property through making an investment in Airbnb leases. Quick time period condo belongings investments have turn into a viable supply of passive source of revenue for lots of buyers. To turn into a hit in quick time period condo investments, it’s essential to test the best-performing markets through examining the money on money go back through metropolis.

Listed below are the 60 preferrred places for Airbnb in 2022:

- Winslow, AZ: 10%

- Milan, IL: 9.6%

- Huntingdon Valley, PA: 9.6%

- Salem, AL: 9.6%

- Vinton, VA: 9.4%

- Westover, WV: 9.4%

- Parkersburg, WV: 9.3%

- Feasterville Trevose, PA: 9.2%

- Plymouth, NH: 9.2%

- Creve Coeur, IL: 9.1%

- Meadville, PA: 9.1%

- Black River, NY: 9%

- Cuba, MO: 9%

- Florida, NY: 9%

- Owings, MD: 9%

- Springfield, LA: 8.7%

- Watauga, TX: 8.8%

- Bel Aire, KS: 8.8%

- Lancaster, OH: 8.8%

- Fulks Run, VA: 8.8%

- Caledonia, MI:S 8.8%

- Sparks, MD: 8.7%

- Collingswood, NJ: 8.7%

- Cottage Grove, MN: 8.7%

- Orangevale, CA: 8.7%

- Madison Heights, MI: 8.7%

- Dover, OH: 8.7%

- Hillsboro, TX: 8.6%

- Santa Claus, IN: 8.6%

- Berkeley, NJ: 8.6%

- Ridgeland, SC: 8.6%

- Hainesville, LA: 8.6%

- Lake Wylie, SC: 8.6%

- St Robert, MO: 8.5%

- Cave Town, KY: 8.5%

- Garfield Heights, OH: 8.5%

- Chittenango, NY: 8.4%

- Tunkhannock, PA: 8.4%

- Merrillville, IN: 8.4%

- Wooded area Hill, TX: 8.4%

- Newton, NJ: 8.4%

- Ravenna, OH: 8.4%

- Coventry, CT: 8.4%

- Hamtramck, MI: 8.4%

- Value, IL: 8.3%

- Marysville, WA: 8.2%

- Oak Grove, KY: 8.2%

- Corunna, MI: 8.2%

- Reidville, SC: 8.2%

- West Fargo, ND: 8.2%

- Ledyard, CT: 8.1%

- Pulaski, VA: 8.1%

- Port Wentworth, GA: 8.1%

- Coolidge, AZ: 8.1%

- Wethersfield, CT: 8%

- Lincoln, RI: 7.9%

- Browns Summit, NC: 7.9%

- Parachute, CO: 7.9%

- Greenwood, DE: 7.9%

- Clearlake Oaks, CA: 7.8%

When making an investment in Airbnb leases, it’s essential to investigate the quick time period condo laws for a selected state and/or metropolis. Understanding the limitations according to state and/or metropolis is very important in serving to you undertake the proper funding technique.

For example, holiday leases in positive spaces don’t permit remains for lower than 30 days. It method you must imagine making an investment in Airbnb long-term leases as a substitute. In some markets, quick time period leases are accredited simplest in number one flats. With this type of restriction, you’ll decide to both purchase a duplex or any other small multi-family house, are living in a single housing unit, or hire out the remaining on holiday condo platforms equivalent to Airbnb, HomeAway, or Vrbo.

Similar: Airbnb Condominium Source of revenue in 2021: The 100 Perfect US Towns

Research of the 2022 Money on Money Go back through Town

- The most productive 2022 money on money go back through metropolis for normal leases levels from 4.7% (Inexperienced Lake, WI) to 9.1% (Spruce Pine, NC), with a mean worth of 6% in Damascus, AR.

- In keeping with the information introduced above, the finest location for getting a long-term condo belongings in 2022 is the Inexperienced Lake housing marketplace, with a money on money go back of 9.1%.

- The states with the biggest choice of best US housing markets for making an investment in conventional condo houses in 2022 come with Texas, New Mexico, Louisiana, and Ohio.

- The most productive 2022 Airbnb money on money go back through metropolis covers between 7.8% (Clearlake Oaks, CA) and 10% (Winslow, AZ). The median worth is 8.6% in Ridgeland, SC.

- In line with Mashvisor knowledge, as of January 2022, probably the most winning marketplace for making an investment in an Airbnb condo belongings is the Winslow actual property marketplace, with a metropolis moderate money on money go back of 10%.

- The states with the biggest choice of best US housing markets for making an investment in brief time period condo houses in 2022 come with Michigan, New York, Texas, and Pennsylvania.

- If we take a look at the low to medium vary money on money go back values of each the standard and Airbnb leases, we will be able to say that quick time period leases be offering upper yields in comparison to long-term leases. That is because of the prime day-to-day charges and occupancy charges. Since the United States tourism business is slowly beginning to open once more after the onset of the pandemic, we will be able to be expecting to peer stepped forward call for for holiday leases.

- For the prime vary money on money go back values, there’s no important distinction between conventional and Airbnb leases, regardless that the latter remains to be reasonably upper.

The Perfect Money on Money Go back Calculator in 2022

To calculate the money on money go back correctly, you want to assemble the essential actual property knowledge to determine the prospective profitability of the houses that passion you. Listed below are the essential knowledge and estimates that you are going to want:

- Belongings’s promoting value

- Money down cost

- Ultimate charges

- Actual property appraisal

- House inspection

- Preliminary upkeep

- Per 30 days loan bills

- Belongings tax

- Belongings insurance coverage

- Belongings control

- HOA dues (if acceptable)

- Cleansing charges (for Airbnb funding houses)

- Utilities

Calculating the money on money go back of an funding belongings comes to a large number of paintings, and it may be tedious, particularly for brand new actual property buyers. The excellent news is there are lots of tool gear to be had that may assist actual property buyers make the proper resolution. One of the vital essential making an investment gear is the money on money go back calculator.

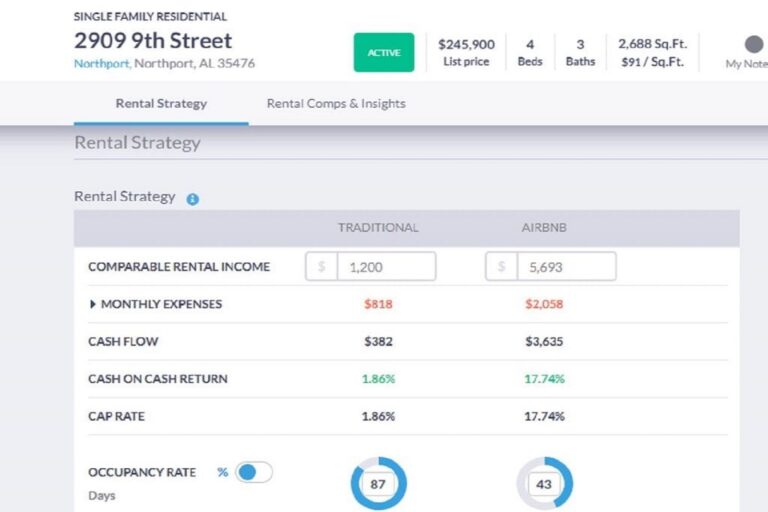

Thankfully, Mashvisor gives an funding belongings calculator that particularly supplies very important knowledge, together with the valuables value, one-time startups prices, routine per month bills, condo source of revenue, occupancy fee, money drift, money on money go back, and cap fee.

Necessary Reminder

The money on money go back through metropolis permit you to have a normal assessment of the way winning a conventional condo funding or Airbnb funding belongings in a definite location shall be. It could possibly assist making a decision which marketplace to put money into, particularly if you happen to imagine out of state making an investment. Whilst this go back measure can also be very useful when making funding choices, you must additionally imagine different essential components, equivalent to the cost to hire ratio, Airbnb day-to-day fee, moderate per month leases, and the occupancy fee.

Whilst one of the vital towns incorporated in those lists have money on money go back charges beneath the beneficial fee of 8% or upper, buyers must know that those are simply city-level averages, and those numbers must now not discourage them from making an investment. The most productive neighborhoods for actual property making an investment in every of those spaces be offering considerably upper charges of go back. Use our Mashvisor heatmap research instrument to briefly establish the neighborhoods with the best money on money go back for normal and Airbnb leases.

Similar: The usage of a Heatmap to Come to a decision The place to Spend money on Actual Property

Get started Making an investment in Condominium Houses with the Lend a hand of Mashvisor

For those who’re in a position to put money into condo houses however aren’t positive which spaces to put money into, we will be able to permit you to make an educated resolution in line with our in-depth actual property marketplace knowledge research. Mashvisor’s database accommodates masses of hundreds of houses, in addition to whole actual property analytics that can assist you get began along with your condo funding.

To seek for the proper funding belongings, simply kind in a metropolis or your most popular community to get a handy guide a rough assessment of the homes on the market in that house. Click on at the belongings that pursuits you in finding a extra detailed research of the moderate condo source of revenue, money on money go back, median house value, money drift, value to hire ratio, occupancy fee, and extra. Those main points are essential to be sure that you’ll get a good money drift and excellent go back funding.

Use our Mashvisor gear that can assist you to find the proper belongings in your funding objectives. Our gear additionally supply predictive analytics, related condo listings, and insights. We will additionally permit you to resolve which actual property funding technique would paintings preferrred in a selected location. Click on right here to begin in search of the finest funding houses to your selected metropolis and community.