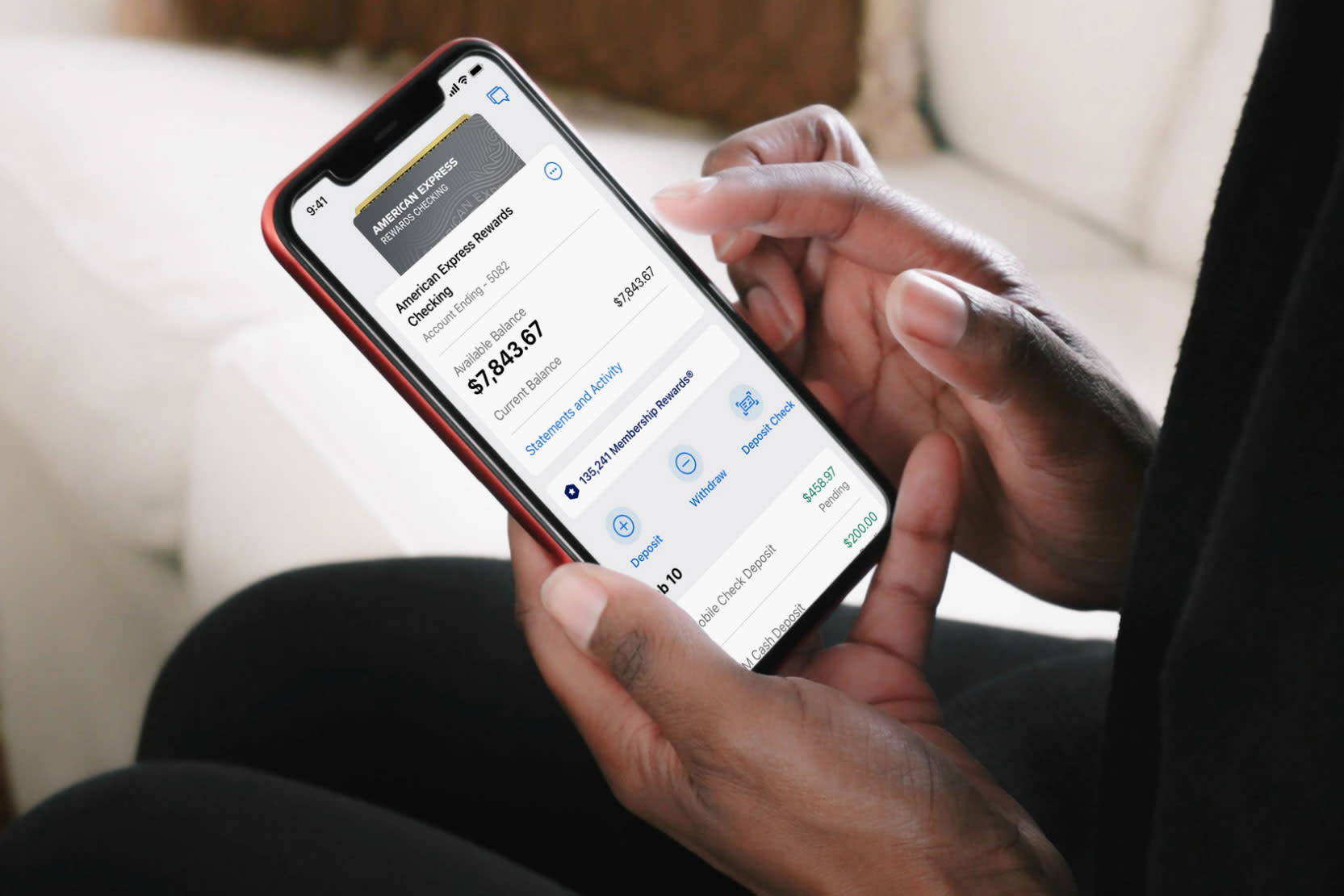

American Specific Rewards Checking

Supply: American Specific

American Specific, identified for its array of perks-laden playing cards, is leaping into the extremely aggressive enviornment of virtual checking accounts.

The corporate on Tuesday introduced Amex Rewards Checking to its U.S. shoppers. Any non-business card member in just right status is eligible for the no-fee, no minimal stability account, in step with Eva Reda, Amex common supervisor for shopper banking.

Whilst there’s no scarcity of choices for American citizens in quest of a bank account, from fintech disruptors to special banks, Amex thinks their card contributors will in finding the be offering engaging. That is as a result of shoppers who revel in racking up issues on transactions can use the account’s debit card to earn one praise level for each and every $2 spent, in addition to a nil.50% annual yield on balances.

“The rationale we’re striking in combination this truly great APY and the rewards is to utterly maximize the loyalty we will get from the ones shoppers,” Reda mentioned. “The time simply feels proper in keeping with the place shoppers’ heads are, who is the usage of the product and the way mass this type of an answer is instantly changing into.”

American Specific referred to as it the corporate’s first bank account for customers. Remaining 12 months, the company rolled out an account for small enterprise homeowners referred to as Kabbage Checking. (The financial institution has introduced on-line financial savings accounts since 2008, in step with Reda). The corporate had greater than 56 million U.S. playing cards in circulate remaining 12 months, although it does not give a breakdown between shopper and enterprise customers.

The accounts might be built-in into the Amex app and supply perks together with acquire coverage on debit purchases and round the clock customer support, mentioned Reda. Of explicit passion for the cardboard corporate is luring millennial and Gen Z customers to undertake the account, she mentioned.

“There is not any query in my thoughts that some portion of our buyer base are going to come to a decision that is their number one account, and others who’re going to take a look at it out and get started out with this as their 2nd or their 3rd account,” Reda mentioned.