It’s been attention-grabbing to peer the level to which the 5 greatest Tech shares – Amazon AMZN, Alphabet GOOGL, Apple AAPL, Fb (FB) and Microsoft MSFT – have moved based on their quarterly releases in fresh days. Whilst Alphabet and Amazon actually added loads of billions of greenbacks to their marketplace capitalizations in the next day’s buying and selling consultation, Fb misplaced that a lot after disappointing buyers.

– Zacks

– Zacks

Those shares have nearly behaved like coiled springs, with the profits stories serving to free up them. You’ll see this within the chart beneath that presentations the inventory marketplace efficiency during the last 3 months of the Zacks Generation sector (inexperienced line), the S&P 500 index (purple line), Alphabet (red line), Amazon (blue line) and Fb (orange line).

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

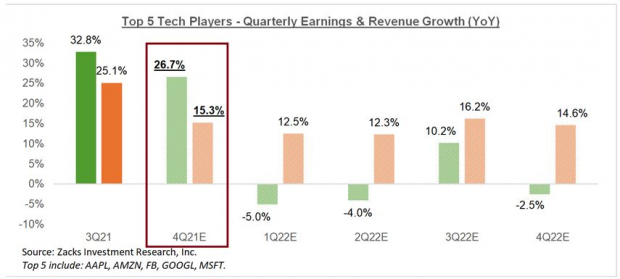

Those 5 corporations are greatly vital to the marketplace as an entire, each in the case of their weight within the indexes in addition to their profits contribution. They mixed account for 22.5% of the S&P 500 index’s marketplace capitalization and are contributing 20% of the index’s general 2021 This fall profits. For the quarter, those 5 massive corporations mixed earned $98.6 billion in profits on $408.6 billion in revenues, representing year-over-year enlargement charges of +26.7% and +15.3%, respectively.

Check out the chart beneath that presentations present consensus expectancies for this staff for the approaching sessions within the context of what they had been ready to succeed in in 2021 This fall and the previous duration.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

What we see here’s that profits enlargement is decelerating in a significant manner, even though we account for some upward revisions estimates within the coming days.

However realize how revenues proceed to stay robust; it’s the price pressures which might be weighing on profits expectancies. That is if truth be told the massive takeaway from the present profits image; corporations seem to be suffering to satisfy a traditionally high-demand atmosphere.

The resources of combat are logistical bottlenecks that stopped Apple from promoting extra iPads and Levi’s from promoting extra denims because of enter shortages, logistical bottlenecks and emerging prices. All of that is appearing up in compressed margins.

Microsoft, Alphabet and Fb aren’t as liable to logistical bottlenecks as Apple and Amazon are, however all of them need to pay up for the ones brainy engineers.

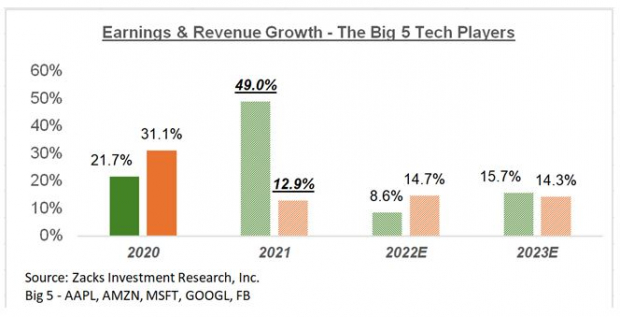

The chart beneath that presentations the crowd’s profits and income enlargement on an annual foundation.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Have a look at the chart and word the expansion pattern from 2022 to 2023. In different phrases, whether or not the expansion pattern for those corporations is decelerating or no longer is a serve as of your maintaining horizon. Those corporations are spectacular enlargement engines ultimately.

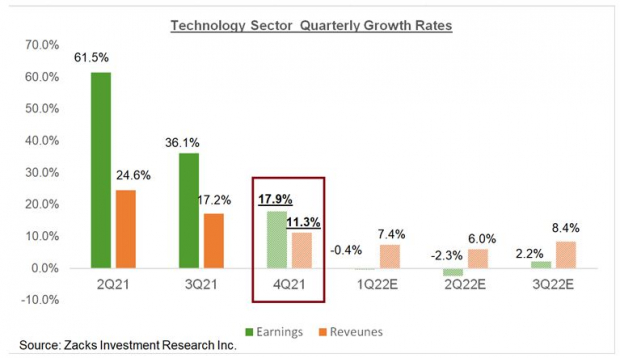

Past the Giant 5 Tech gamers, general Q5 profits for the Generation sector as an entire are anticipated to be up +17.9% from the similar duration remaining 12 months on +11.3% upper revenues.

The dramatic-looking chart beneath presentations the sphere’s This fall profits and income enlargement expectancies within the context of the place enlargement has been in fresh quarters and what’s anticipated within the coming 4 sessions.

Please word that the This fall profits and income enlargement charges are the ‘combined’ enlargement charges, which means that mixes the true effects that experience pop out already with estimates for the still-to-come corporations. The chart would glance much less dramatic in its decelerating enlargement pattern if we excluded the 2021 Q2 duration from it.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

This giant image view of the ‘Giant 5’ gamers in addition to the sphere as an entire presentations a decelerating enlargement pattern.

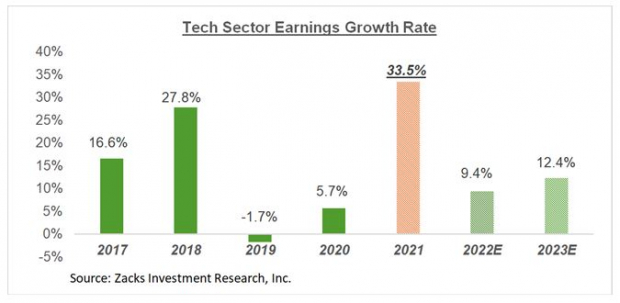

That mentioned, in contrast to this ‘quarterly view’, the yearly image presentations much more steadiness, because the chart beneath presentations.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

This Week’s Reporting Docket

We now have greater than 450 corporations on deck to record effects this week, together with 81 S&P 500 contributors. Notable corporations reporting this week come with Coke (KO), Pepsi (PEP), Disney (DIS), Pfizer (PFE), Twitter (TWTR) and others.

This fall Profits Season Scorecard

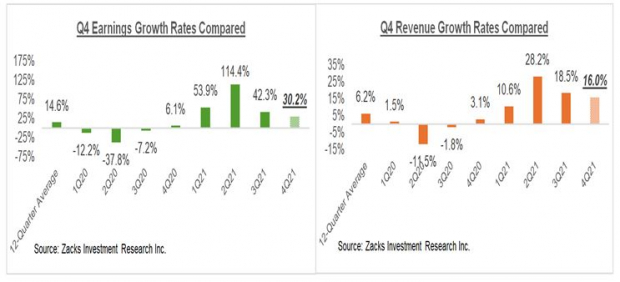

Together with all of the effects that got here out thru Friday, February 4th, we’ve This fall effects from 278 S&P 500 contributors or 55.6% of the index’s general club. General profits (or mixture web source of revenue) for those 278 corporations are up +30.2% from the similar duration remaining 12 months on +16% decrease revenues, with 78.4% beating EPS estimates and the similar share beating income estimates.

The 2 units of comparability charts beneath put the This fall effects from those 278 index contributors in a historic context, which will have to give us a way how the This fall profits season is monitoring at this degree relative to different fresh sessions.

The primary set of comparability charts evaluate the profits and income enlargement charges for those 278 index contributors.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

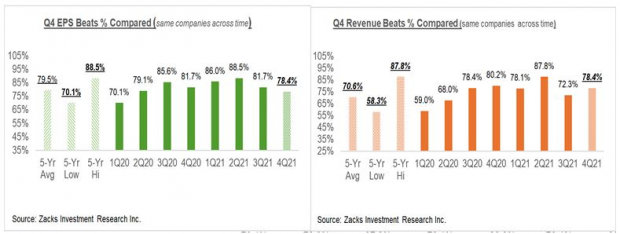

The second one set of charts evaluate the percentage of those 278 index contributors beating EPS and income estimates.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

As you’ll see from the above comparability charts, the This fall numbers no longer most effective constitute a enlargement deceleration from the tempo of the primary 3 quarters of the 12 months, but in addition in the case of the beats percentages, in particular EPS beats percentages.

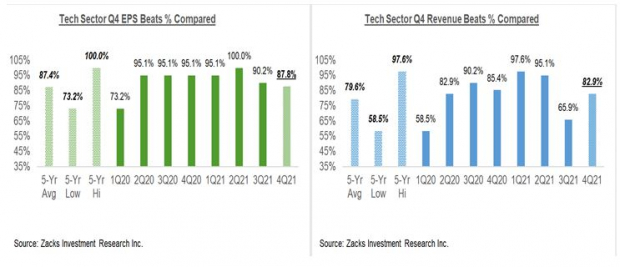

For the Generation sector, we’ve This fall effects from 81.6% of the sphere’s marketplace capitalization within the S&P 500 index. General This fall profits for those Tech corporations are up +18.6% from the similar duration remaining 12 months on +10.7% upper revenues, with 87.8% beating EPS estimates and 82.9% beating income estimates.

The comparability charts beneath put the sphere’s This fall EPS and income beats percentages in a historic context.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Expectancies for This fall & Past

Having a look on the quarter as an entire, combining the true effects that experience pop out with estimates for the still-to-come corporations, general This fall profits for the S&P 500 index are anticipated to be up +30.1% from the similar duration remaining 12 months on +14.6% upper revenues.

The chart beneath gifts the profits and income enlargement image on a quarterly foundation, with expectancies for 2021 This fall contrasted with the true enlargement completed over the previous 4 quarters and estimates for the next 3.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

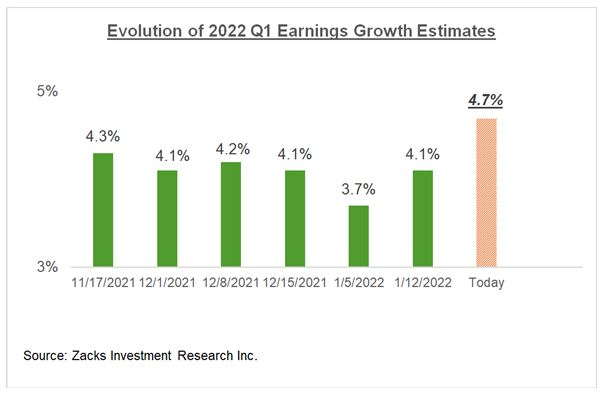

For the present duration, general S&P 500 profits are anticipated to extend +4.4% from the similar duration remaining 12 months on +8.4% upper revenues. The chart beneath presentations the revisions pattern for the present duration.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

The chart beneath presentations the related image on an annual foundation.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

For an in depth have a look at the entire profits image, together with expectancies for the approaching sessions, please take a look at our weekly Profits Developments record >>>> A Robust and Resilient Profits Image Stays Amid Marketplace Volatility

Zacks’ Best Alternatives to Money in on Synthetic Intelligence

In 2021, this world-changing era is projected to generate $327.5 billion in income. Now Shark Tank big name and billionaire investor Mark Cuban says AI will create “the sector’s first trillionaires.” Zacks’ pressing particular record finds 3 AI selections buyers want to learn about as of late.

See 3 Synthetic Intelligence Shares With Excessive Upside Attainable>>

Need the most recent suggestions from Zacks Funding Analysis? Nowadays, you’ll obtain 7 Very best Shares for the Subsequent 30 Days. Click on to get this loose record

Amazon.com, Inc. (AMZN): Loose Inventory Research File

Apple Inc. (AAPL): Loose Inventory Research File

Microsoft Company (MSFT): Loose Inventory Research File

Meta Platforms, Inc. (FB): Loose Inventory Research File

Alphabet Inc. (GOOGL): Loose Inventory Research File

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis