The country’s biggest financial institution JPMorgan Chase & Co. (NYSE: JPM) inventory has been main the financials down as benchmark indexes get ready for rate of interest hikes. The U.S. Federal Reserve has made it transparent {that a} financial tightening coverage is taking impact. Historically, inventory markets upward push all over financial growth and low-interest charges and therefore fall all over financial tightening and emerging rates of interest. The banks and financials are one sector that advantages from emerging charges however could have issues swimming upstream in a falling marketplace. However, JPMorgan continues to ramp up its era and virtual functions because it hit file earnings in fiscal 2021. The Corporate introduced it might be expanding its bills in 2022 via 8% to fund new investments in era. Funding banking revenues are anticipated to fall with emerging charges, however the Corporate seems to reinforce its fintech choices to offset this. Prudent traders in the hunt for publicity in a emerging price surroundings can look ahead to opportunistic pullbacks in JPMorgan.

Depositphotos.com contributor/Depositphotos.com – MarketBeat

Depositphotos.com contributor/Depositphotos.com – MarketBeat

This autumn Fiscal 2021 Income Free up

On Jan. 14, 2021, JPMorgan launched its fiscal fourth-quarter 2021 effects for the quarter finishing December 2021. The Corporate reported profits in line with percentage (EPS) earnings of $3.36 as opposed to $3.04 consensus analyst estimates, a $0.32 beat. Revenues fell (-0.3%) year-over-year (YoY) to $29.26 billion, in comparison to $29.78 billion. Credit score prices web receive advantages $1.3 billion after $550 million web charge-offs. JPMorgan CEO Jamie Dimon commented, “JPMorgan Chase reported forged effects throughout our companies profiting from increased capital markets job and a pick-up in lending job as firmwide reasonable loans have been up 6%. The economic system continues to do fairly smartly regardless of headwinds associated with the Omicron variant, inflation, and provide chain bottlenecks. Credit score remains to be wholesome with exceptionally low web charge-offs, and we stay positive on U.S. financial expansion as trade sentiment is upbeat and customers are profiting from activity and salary expansion.”

Convention Name Takeaways

JPMorgan CFO Jeremy Barnum coated the financials immediately off the slide presentation and the outlook transferring ahead, “As you’ll take into accout from Daniel’s feedback in December, the 17% that we have got mentioned as a medium-term ROTCE goal isn’t reasonable for 2022. We do be expecting to look some tailwinds to NII, together with the good thing about the newest implied and the expectancy that card revolve charges will build up. However the headwinds most probably exceed the tailwinds as capital markets normalize off an increased pockets, and we proceed to make further investments in addition to the have an effect on of inflationary pressures. Alternatively, regardless of those doable demanding situations for the near-term outlook, we do proceed to consider in 17% ROTCE as our central case for the medium time period as charges proceed to transport upper and we discovered trade expansion, pushed via our investments. So, allow us to attempt to provide you with extra element round forward-looking drivers which may be headwinds or tailwinds. So first, the velocity curve. Our central case does no longer require a go back to a 2.5% Fed price range goal price as the present ahead curve best costs in 625 basis-point hikes over the following 3 years. Assuming we notice the ahead curve, from there, we see the results as being fairly symmetric with plus or minus 175 foundation issues of ROTCE have an effect on as an inexpensive vary relative to our central case. And naturally, there are patently any collection of price paths to get there, which might produce other results over the close to time period. On this representation, the drawback assumes that charges keep fairly consistent to present spot charges while upside can be pushed via a mix of a steeper yield curve, extra hikes in conjunction with a extra favorable deposit reprice revel in. And naturally, what we’re comparing here’s the have an effect on of charges in isolation on NII, however for the efficiency of the Corporate as an entire, credit score issues so much. And the explanation why charges are upper can have an have an effect on on that. In markets and banking, we be ok with the percentage we’ve taken, and there are explanation why the start of a price mountain climbing cycle might be fairly wholesome for fastened source of revenue revenues specifically, a minimum of within the sense that it would supply a partial offset to what we might differently be expecting relating to post-COVID earnings normalization. In our central case, markets and banking normalized reasonably in 2022 relative to their respective file years in 2020 and 2021 and resume modest expansion thereafter. The disadvantage case assumes a go back to 2019 pattern line ranges with sub-GDP expansion charges, while the upside case assumes persevered expansion from present increased ranges.”

He persevered, “Having a look on the key drivers of that for 2022, there are a couple of main components. Charges, with the market-implied suggesting roughly 3 hikes later this 12 months and the explanation steepening of the yield curve, we might be expecting to look about $2.5 billion extra NII from that impact. You’ll be able to see on the backside proper, we’ve proven you the third-quarter profits in danger and an estimate of what we might be expecting to reveal within the 10-Ok, reflecting the year-end price curve and adjustments within the portfolio composition.”

JPM Opportunistic Pullback Ranges

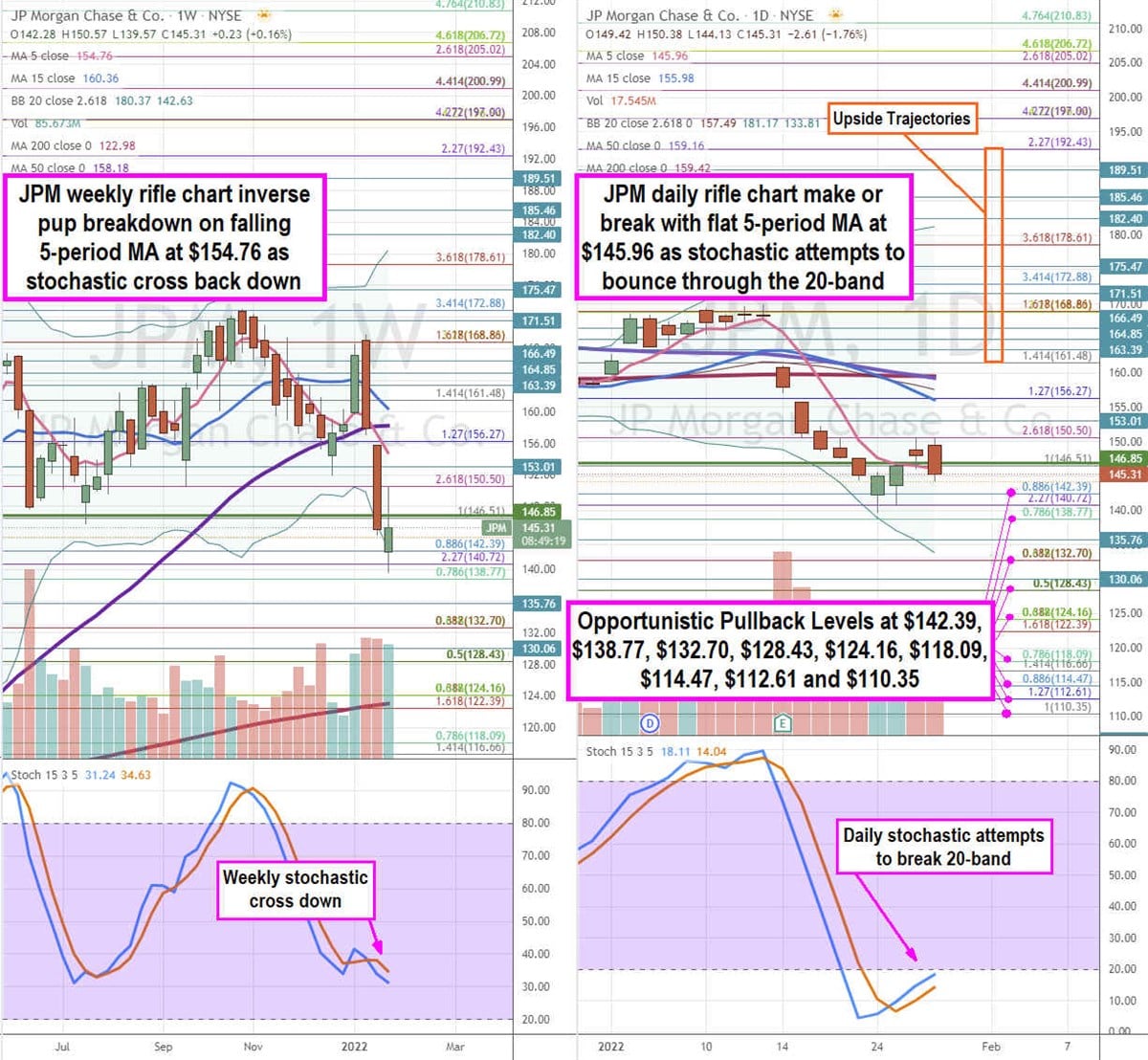

The use of the rifle charts at the weekly and day by day time frames supply an actual view of the fee motion enjoying box for JPM inventory. The weekly rifle chart peaked close to the $172.88 Fibonacci (fib) stage earlier than falling in opposition to the $138.77 fib house. The weekly rifle chart shaped an inverse doggy breakdown falling during the 50-period transferring reasonable (MA) at $158.18. The weekly 5-period MA is falling at $154.76 adopted via the 15-period MA at $160.36. The weekly decrease Bollinger Bands (BBs) at $142.63. The day by day rifle chart has a make or smash because the 5-period MA flattens at $145.96 and 15-period continues to tighten the channel at $155.98. The day by day stochastic has move up however trying out the 20-band to both smash or reject. The day by day marketplace construction low (MSL) purchase triggers on a breakout above $146.85 with day by day higher BBs at $181.17. Prudent traders can look ahead to opportunistic pullbacks on the $142.39 fib, $138.77 fib, $132.70 fib, $128.43 fib, $124.16 fib, $118.09 fib, $114.47 fib, $112.61 fib, and the $110.65 fib stage. The upside trajectories vary from the $161.48 fib up