The AMC Burbank 16 and the Batman bronze statue in Downtown Burbank.

AaronP/Bauer-Griffin | GC Pictures | Getty Pictures

After a 12 months of big inventory good points, AMC Leisure stocks are beginning to cool off.

The film theater chain, which narrowly have shyed away from chapter ultimate January, was once the beneficiary of a flurry of recent retail buyers who helped the corporate protected a lot wanted capital. Those ardent lovers led a marketing campaign that reinforced AMC’s stocks to an all-time prime of $72.62 ultimate June.

Even supposing stocks closed Tuesday at $16.02, AMC is in a greater place in 2022 on account of the reinforce this new wave of buyers and the opportunistic movements of its CEO Adam Aron.

“Of all of the meme shares, AMC appears to be the neatest company to take merit and acknowledge the chance there,” mentioned Eric Wold, senior analyst at B. Riley Securities.

As retail buyers hoisted the corporate’s stocks to new highs, Aron made strategic inventory gross sales and accumulated a $2 billion “battle chest” that may be used to spend money on theater upgrades and new cinema rentals.

“Adam Aron were given an enormous present with those retail buyers,” mentioned Eric Handler, media and leisure analyst at MKM Companions. “He may then promote sufficient inventory to present AMC sufficient money to live on.”

With extra protected footing, AMC can center of attention on shoring up its stability sheet, decreasing its debt load and hobby bills and increasing its content material and concession choices. AMC is dealing with a lot of demanding situations. The film theater trade has but to completely get well from the ongoing world pandemic. In the meantime, its new investor base is also fracturing, with some shareholders having unrealistic expectancies for AMC’s enlargement, whilst others depart it at the back of.

Accumulating a ‘battle chest’

At first of 2021, AMC was once in determined want of a money infusion. With out budget, analysts mentioned it was once most probably going to need to report for Bankruptcy 11 chapter coverage with the intention to restructure greater than $5 billion in debt it had accumulated previous to the pandemic. It was once at the moment that the corporate’s inventory hit an rock bottom of $1.91.

Alternatively, on Jan. 25, 2021, AMC was once ready to boost round $500 million through issuing new not unusual inventory and $411 million of incremental debt from upsizing and refinancing its Eu revolving credit score facility. Stocks of the corporate jumped to round $5 a percentage in this information.

This, coupled with a $100 million shot within the arm in past due 2020 from Mudrick Capital Control intended that “any communicate of approaching chapter for AMC is totally off the desk,” Aron mentioned on the time.

Two days later, AMC’s inventory started its wild journey in earnest. Stocks surged 300% to $20 as buyers within the Reddit neighborhood brought on a brief squeeze.

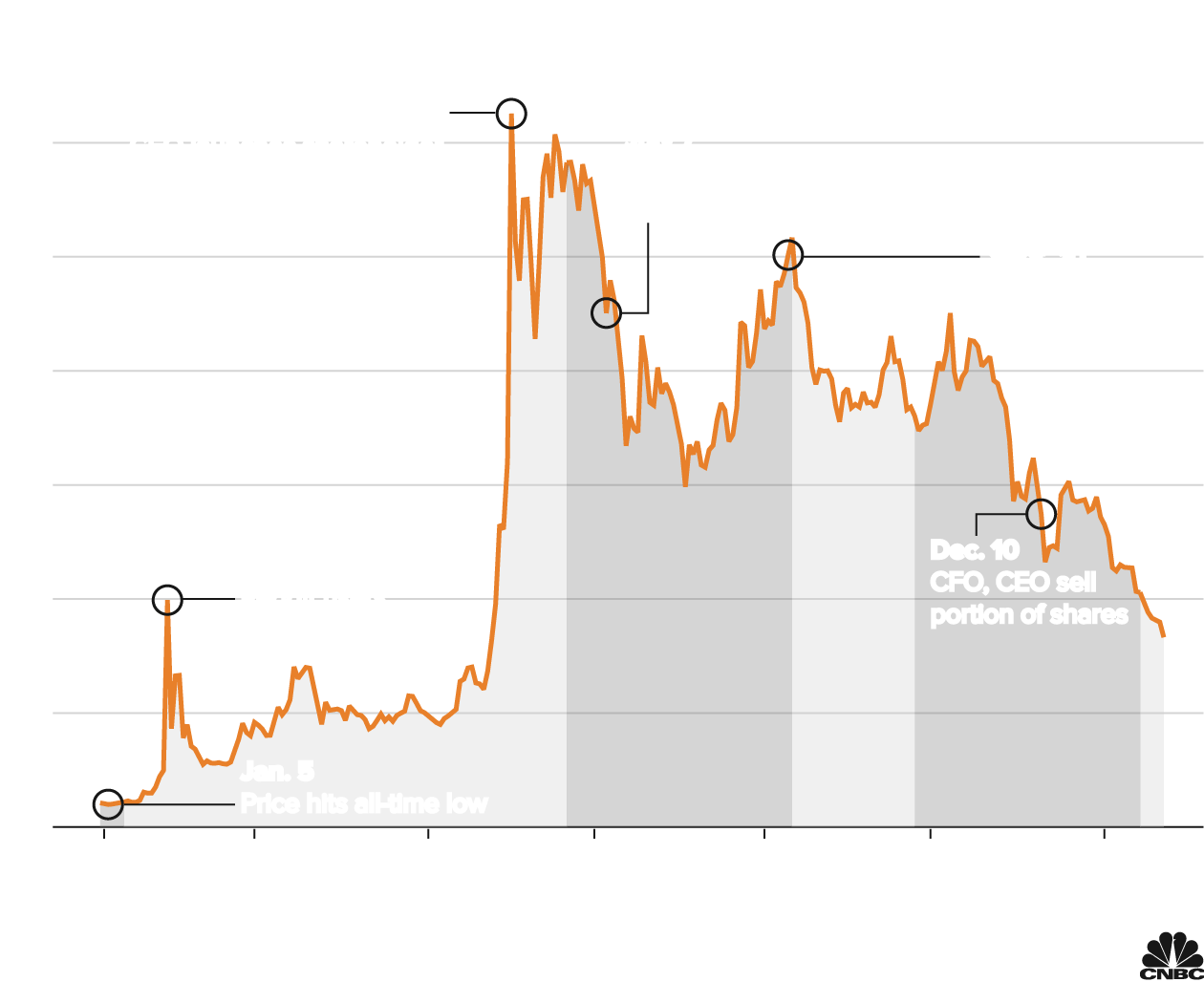

June 2

CEO launches shareholder

perks, together with loose popcorn

July 7

AMC says it would possibly not search shareholder

approval to factor new stocks

Sept. 10

Sturdy field place of work

for “Shang Chi”

Dec. 10

CFO, CEO promote

portion of stocks

Dec. 10

CFO, CEO promote

portion of stocks

Jan. 27

Reddit customers

pile into inventory

Jan. 5

Worth hits rock bottom

Chart: Nate Rattner / CNBC

Supply: FactSet. As of Jan. 24, 2022.

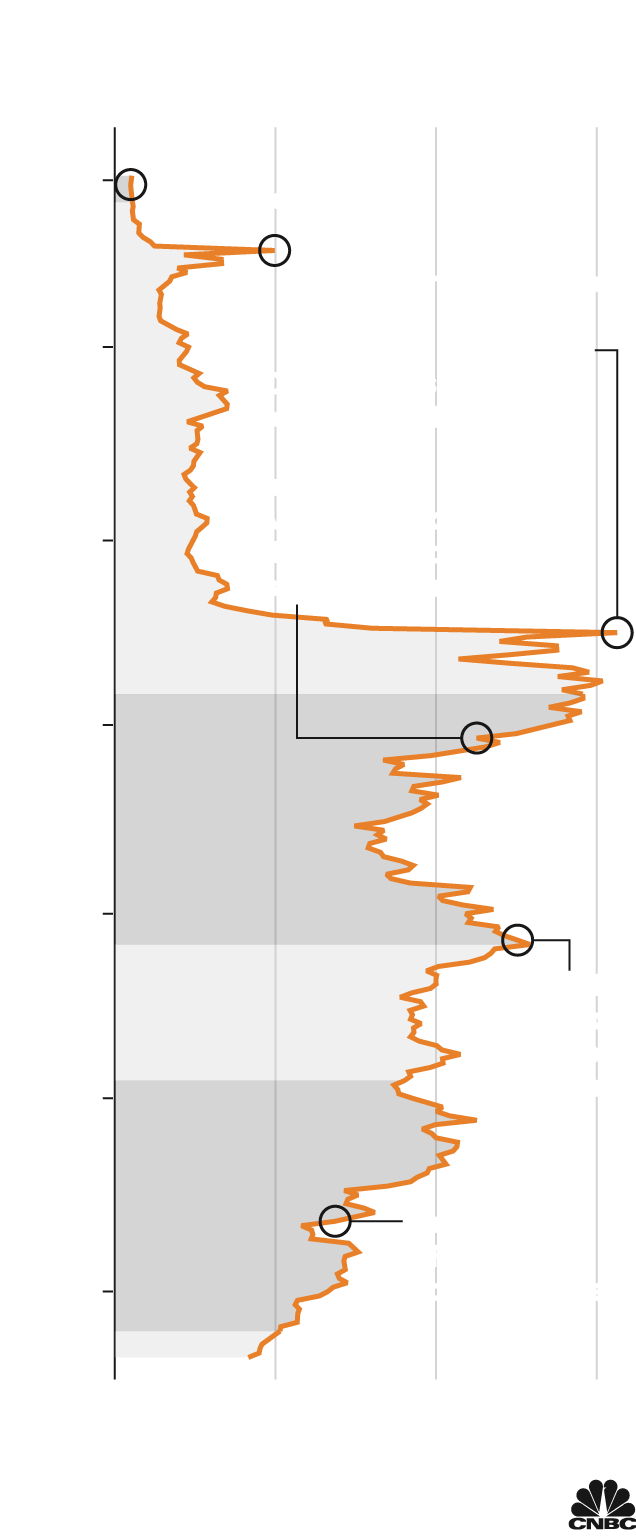

Jan. 5

Worth hits rock bottom

Jan. 27

Reddit customers pile into inventory

June 2

CEO launches shareholder

perks akin to loose popcorn

July 7

AMC says it would possibly not search

shareholder approval to

factor new stocks

Sept. 10

Sturdy field

place of work for

“Shang Chi”

Dec. 10

CFO, CEO promote

portion of stocks

Chart: Nate Rattner / CNBC

Supply: FactSet. As of Jan. 24, 2022.

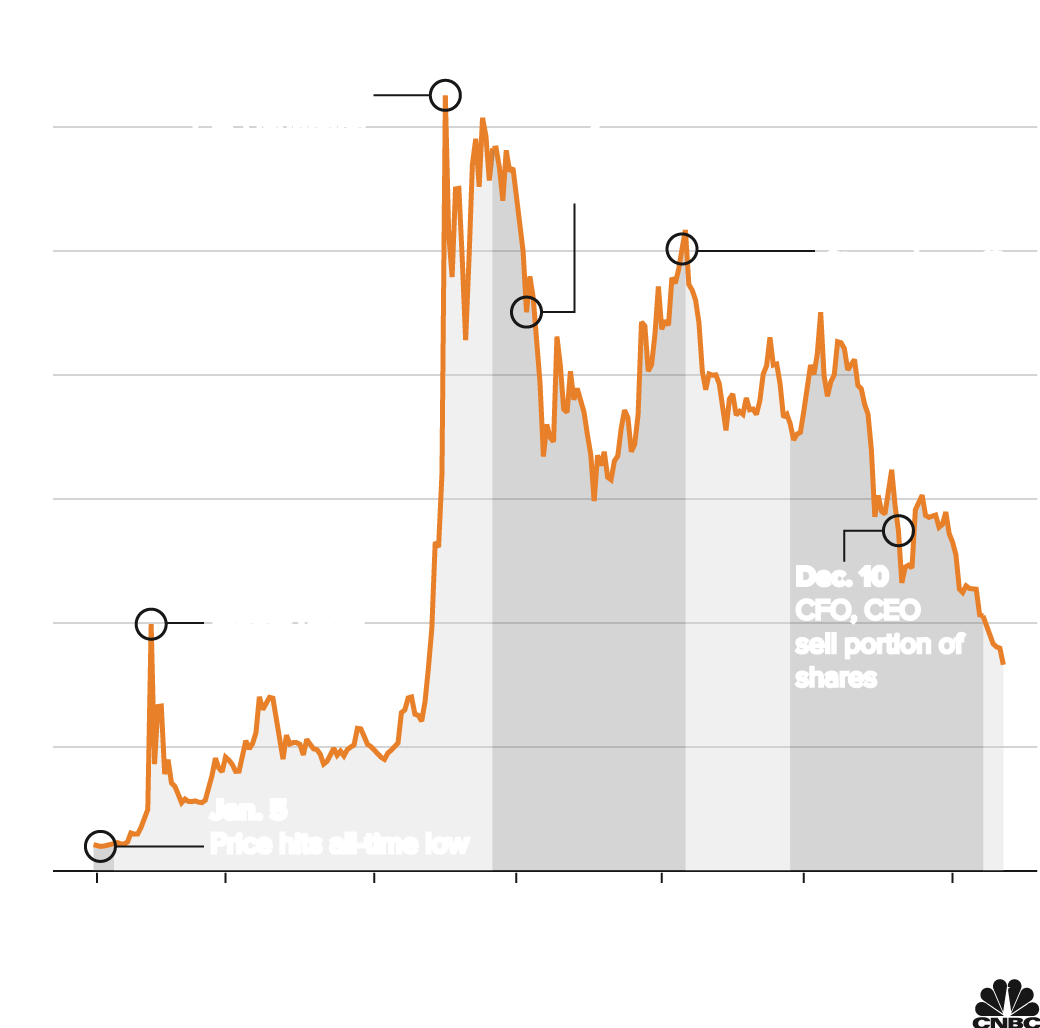

June 2

CEO launches

shareholder perks,

together with loose popcorn

July 7

AMC says it would possibly not search shareholder

approval to factor new stocks

Sept. 10

Sturdy field place of work

for “Shang Chi”

Dec. 10

CFO, CEO

promote portion of

stocks

Jan. 27

Reddit customers

pile into inventory

Jan. 5

Worth hits rock bottom

Chart: Nate Rattner / CNBC

Supply: FactSet. As of Jan. 24, 2022.

A upward thrust in making an investment apps like Robinhood allowed retail buyers to industry shares extra simply and with little to no fee charges. Emboldened through fellow participants of the Reddit neighborhood, those new buyers started concentrated on shares that had been closely shorted, hoping to motive losses for the hedge budget that had wager in opposition to the beat-up shares. GameStop and Mattress Tub and Past had been some of the different shares reinforced through the rage at the moment.

Hedge budget were making a bet in opposition to AMC’s inventory as a result of its troubles had been widely recognized. Film theaters were shuttered for months, and once they reopened, new waves of Covid-19 instances stored audiences house. Vaccines weren’t but extensively to be had and few blockbuster motion pictures had been coming to the large display screen. Those who did had been incessantly launched on streaming platforms at the identical day.

Moreover, whilst the vast majority of AMC’s theaters had been reopened to the general public, native governments had carried out seating caps of between 15% and 60%, a great deal proscribing the selection of tickets the theater may promote.

The brand new buyers briefly was AMC’s majority stakeholders, and persisted to again the inventory, permitting Aron to make some strategic inventory gross sales in Might and June to refill AMC’s coffers.

On Might 13, AMC offered 43 million stocks at just below $10 apiece, elevating $428 million. Following this money infusion, stocks of the corporate jumped to round $25 — an atypical response to such information.

Then on June 1, AMC struck any other maintain Mudrick Capital Control to interchange 8.5 million stocks of the corporate for $230.5 million in money. The fairness was once issued at a value of about $27.12 according to percentage.

The next day to come, retail buyers as soon as once more poured into AMC inventory. Its value skyrocketed to greater than $70. On June 3, AMC offered any other 11 million stocks, this time at $50.85 every, producing just about $600 million in recent capital.

The corporate was once additionally ready to repurchase round $35 million of first lien debt in September, which value $41.3 million, together with predominant and collected and unpaid hobby. This debt relief lowered AMC’s annual hobby prices through $5.25 million.

Wooing the ‘apes’

Wold mentioned Aron was once good to shift his center of attention from trade analysts to the rising selection of retail buyers, who started calling themselves the “ape military.”

AMC shifted its communications approach to discuss at once to shareholders by the use of social media, together with on YouTube. It introduced a portal on its web page for particular person buyers in early June. The website required stockholders to self-identify and join the chain’s loyalty program. In go back, shareholders gained particular gives and corporate updates.

Aron renewed his hobby in Twitter, following loads of accounts tied to the ape military. And the AMC shareholder assembly was once behind schedule through greater than a month to present the apes a chance to wait.

‘An enormous disconnect’

Even with those staunch supporters, one of the vital air got here out of AMC’s inventory. In the second one part of ultimate 12 months, the stocks averaged $40.

The home field place of work had begun to get well. Primary titles like Disney’s “Shang-Chi and the Legend of the Ten Rings,” in September 2021, and Warner Bros.’ “Venom: Let There Be Carnage,” launched Oct. 1, 2021, every generated greater than $200 million in price tag gross sales right through their theatrical runs. However new coronavirus variants — first delta, then omicron — have dampened the trade’s rally.

Older audiences have remained cautious of returning to cinemas. And a few oldsters are staying house as smartly. Youngsters elderly 5 to 11 were not licensed for the Covid vaccine till past due October, and the ones below 5 years previous nonetheless don’t seem to be eligible. It wasn’t till the December free up of Sony’s “Spider-Guy: No Means House” that the film theater industry noticed some semblance of normalcy and that feat would possibly not be simply repeated till a minimum of the second one quarter of 2022, trade analysts say.

Moreover, in spite of warnings that Aron and different executives had plans to scale back their AMC holdings, some buyers was disenchanted. Aron has offered greater than $40 million price of stocks since November as a part of a prearranged property making plans technique.

Via the top of 2021, AMC stocks had fallen to below $30 according to percentage.

“The percentage value decline seems to be essentially associated with shareholders who defected after control offloaded stocks during the last two months,” mentioned Alicia Reese, analyst at Wedbush. “There are, after all, the trustworthy who proceed to cheer every different on and deal with their positions, and in some instances they proceed to shop for stocks.”

In contemporary weeks, AMC’s stocks have additional declined in value, bottoming out at round $16 according to percentage. Handler attributed the decline to buyers “derisking” their portfolios. There additionally is usually a realization that AMC’s valuation is incongruent with its stability sheet, he mentioned.

Lots of the corporate’s retail buyers have mentioned they imagine that there shall be a “mom of all brief squeezes” that may bump AMC’s inventory value to $1,000 according to percentage. Alternatively, that percentage value would put AMC’s marketplace cap at $513 billion, a determine this is 8 instances what all of the theatrical trade made in world earnings prior to the pandemic, Handler defined.

“That is a large disconnect,” he mentioned.

At about $16 according to percentage, AMC is buying and selling at 27 instances its forecasted EBITDA for 2022 and 21 instances its anticipated EBITDA for 2023. Traditionally, film theater firms have traded at between six and 9 instances EBITDA, Handler mentioned, with 9 instances being a historic top.

“This inventory continues to be buying and selling a number of same old deviations above the place it almost certainly will have to be buying and selling,” he mentioned.

The following bankruptcy: Debt compensation

AMC’s subsequent center of attention is on repaying debt. On Monday, the Wall Boulevard Magazine, reported that AMC is in complicated refinancing talks with more than one events to decrease its hobby burden and stretch out its maturities through a number of years.

When reached through CNBC, AMC declined remark at the Magazine’s record. The corporate additionally declined to remark for this newsletter.

Previous this month, Aron recognized debt restructuring as a key purpose for 2022. None of its debt comes due till subsequent 12 months.

“So as to meaningfully pay off AMC’s debt stability, I believe Adam Aron should request extra stocks to promote, from buyers very reluctant to permit additional dilution of AMC inventory,” Reese mentioned. “I believe, as a substitute, he will center of attention on extending maturities and bettering rates of interest through negotiating with borrowers.”

“The hot percentage value decline will make that way more tricky, on the other hand,” she added.