They are saying that purchasing a space is likely one of the greatest bills – if no longer the largest – one will ever have in his or her complete lifetime. If that’s the case, then actual property funding homes are one of the crucial greatest investments any common investor can ever make.

And up to actual property funding in itself is nearly at all times rewarding, a large number of individuals who invested in actual property, particularly condominium homes, didn’t get the go back on funding – regularly referred to as ROI – they anticipated. A number of components will have affected the real ROI. In all probability it’s a foul case of expectation vs fact or perhaps they only failed to make use of the fitting funding equipment and assets, akin to correct information research and excellent money on money go back calculator.

No matter it’s, an investor can most effective cross such a lot on a assets’s mere face-value attainable. To ensure optimal but practical effects, one must at all times have the fitting methods and equipment to make all of the funding adventure pleasant and rewarding.

One of the crucial the most important equipment any investor will want is a money on money ROI calculator. Whilst you’ll simply discover a money on money calculator on-line, calculating money on money go back the usage of the most productive to be had money on money go back calculator can imply the variation between night time and day together with your funding.

That being stated, let’s see how Mashvisor’s funding assets calculator is helping an investor get probably the most optimal money on money go back condominium assets.

A Assessment of Mashvisor’s Funding Assets Calculator (2022 Version)

Any investor value his or her salt won’t ever cross into an funding undertaking with out figuring out the fundamentals of what she or he is coming into. Whether or not it’s making an investment in shares or the 2022 housing marketplace, a excellent investor will at all times make sure that she or he is aware of sufficient concerning the topic to correctly organize expectancies.

So sooner than we bounce proper into the dialogue about what’s excellent money on money go back and the way Mashvisor’s money on money go back calculator is best than the others, let’s communicate concerning the fundamentals first so we’re all at the identical web page.

Definition of Phrases

For those who’re a novice investor and it’s your first time to believe coming into actual property funding, we’ve got defined a couple of fundamental phrases you must be accustomed to.

Capitalization Price

A capitalization price, regularly shortened to cap price, is likely one of the measures buyers and trade insiders use to resolve a assets’s profitability. It may be computed through dividing a assets’s web running source of revenue (or NOI) through its present marketplace price.

Capitalization Price = Internet Running Source of revenue (NOI) x 100

Asset’s present marketplace price

For example, let’s say a assets is estimated to herald $a million value of source of revenue over a ten-year length. Now let’s suppose that the valuables is being bought for $2,375,000. The usage of the formulation above, we arrive at a cap price of 36.36%

Now a large number of buyers may suppose that the upper the cap price, the extra winning the valuables, proper? No longer precisely. Whilst a 36% cap price doesn’t sound so unhealthy in comparison to 12% or 15%, a excellent cap price is topic to an investor’s convenience stage. There are occasions when the next cap price does no longer bode properly for assets house owners.

Remember the fact that a cap price is just one of a number of metrics used to resolve profitability and must no longer be the only foundation of any funding resolution.

Money Float

Let’s set this directly. Money float isn’t synonymous with benefit. They’re two various things. The place benefit represents the variation between the capital and quantity earned, money float refers back to the money transferring into and out of a trade at a given time. It may be certain or detrimental. A good money float signifies that more cash is entering the trade in comparison to all of the running bills. Alternatively, a detrimental money float signifies that the amount of cash being spent on operations outweighs the money coming in.

Money on Money Go back

Money on money go back is a time period utilized in actual property funding assets research to resolve a assets’s price of go back. Merely put, it’s the measure of the yearly go back made on a assets relative to the amount of cash invested in it. Mavens agree that excellent money on money go back price is 8% to twelve%, then again, no longer all investments and homes are created equivalent. Other investments be offering other go back charges so it’s nonetheless very best to calculate money on money go back for every assets you’re taking into consideration.

Median Worth

To not be perplexed with moderate worth, an average worth is just the midpoint in actual property assets costs. Median costs are decided through getting the center price of all observations, the price the place part are better and part are smaller.

Actual Property Comps

Actual property comparables or comps is an appraisal time period for an identical homes you’re taking into consideration in a selected marketplace. Those similar homes are used to resolve a selected assets’s price in line with how a lot they bought.

Condominium Source of revenue

Condominium source of revenue is just the income assets house owners earn through leasing out homes to tenants. They may be able to come from both conventional (long-term) condominium homes or holiday houses (temporary leases) akin to Airbnb.

Go back on Funding

Go back on funding or ROI is a efficiency measure used to price an funding’s potency and profitability. On this case, actual property buyers are at all times looking for homes that experience the prospective to supply prime ROIs. This is the reason having dependable money on money go back calculator together with correct marketplace information is essential.

Why Will have to You Use Mashvisor’s Funding Assets Calculator?

Now that we’ve long past over the fundamentals, let’s take a more in-depth have a look at Mashvisor’s funding assets calculator, together with the money on money go back calculator, and the way it can lend a hand buyers make well-informed selections.

Finding the Proper Assets Fitted to Your Funding Objectives

Mashvisor’s funding assets calculator is likely one of the many equipment and contours introduced at the web site that makes discovering the fitting funding homes sooner and more straightforward.

There are 3 main keys to make sure luck in actual property funding:

- The best location

- The best assets to put money into

- The best condominium technique that traces up together with your instances and objectives

The usage of Mashvisor’s money on money go back actual property calculator lets in buyers to reach those 3 keys because it permits customers to find and analyze the valuables that’s proper for them in a marketplace in their selection. It’s simple to make use of as customers most effective want to enter sure fundamental data in keeping with their funding requirements and standards. The end result is reasonably dependable as the entire to be had information at the platform come from exact actual property comps and trade insiders. The software additionally makes use of conventional and predictive analytics which makes it very user-friendly.

Mashvisor’s funding assets calculator has made weeks-long feasibility research, developing and tabulating spreadsheets, and crunching numbers many times a factor of the previous. What used to take weeks for actual property buyers to perform years in the past can now be carried out in a question of mins with astounding accuracy.

Positive, there are a number of nice funding assets calculators simply obtainable on-line however, consistent with customers and reviewers, the most productive and maximum user-friendly money on money go back calculator as of late is Mashvisor.

Examining A very powerful Knowledge and Data Related to Your Objectives

Mashvisor’s assets research equipment, like its money on money go back calculator, are designed as mathematical fashions that may in the long run receive advantages residential actual property assets buyers. It’s designed conveniently of use in thoughts, taking into consideration how daunting a role it’s to collect and analyze marketplace information, particularly to those that don’t paintings regularly – or properly – sufficient with Spreadsheets.

Knowledge research performs a big function in actual property investments as a result of the entirety rides on getting the correct and right kind data. Maximum calculation mistakes happen on account of inadequate and erroneous information. Mashvisor pulls all of its marketplace information from condominium comps in its database. The provision of such information minimizes the probabilities of inaccurate calculations which in flip will increase an investor’s self belief in making the most productive resolution conceivable a couple of particular assets.

Marketplace and Community Research

One in all two issues that contain in depth research sooner than deciding to drag the cause on a condominium assets funding is the marketplace and group research.

Examining a marketplace manually is probably not not possible to do these days however it is going to take an excessive amount of of an individual’s time, power, and assets to finish. The web site’s money on money go back calculator together with its different forms of assets calculators saves buyers lots of time and cash through permitting them to find the most productive markets and neighborhoods to shop for condominium homes.

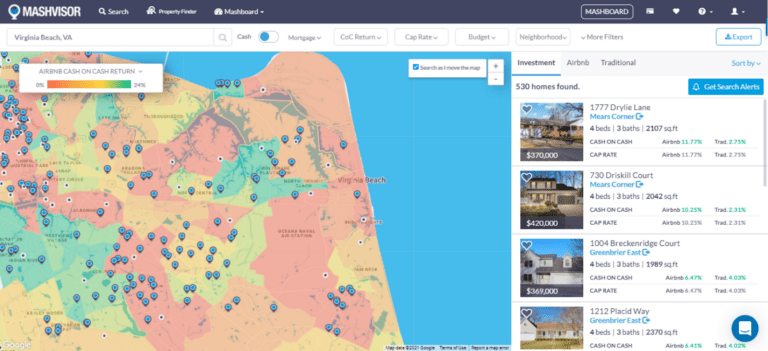

The Actual Property Heatmap software displays the reds (chilly markets) and the vegetables (scorching markets) of a definite town in the USA. After you have narrowed down a excellent group to put money into, the funding assets calculator allow you to analyze the other information had to get a hold of the most productive conceivable choices.

You’ll to find the next information at the Community Analytics web page:

- Median worth

- Reasonable worth in keeping with sq. foot

- Reasonable Airbnb and standard condominium source of revenue

- Reasonable Airbnb and standard money on money go back

- Reasonable Airbnb occupancy price

- Optimum condominium technique

- The optimum collection of bedrooms

- Optimum assets kind

- Collection of conventional and Airbnb homes on the market

- Stroll Ranking

- Mashmeter Ranking

- Actual property comps

On best of getting access to this precious information, customers too can obtain the total group record in Excel structure, together with each indexed assets and its stats. You’ll cross over it for additional learn about and exam and you’ll display it in your actual property agent to invite for their opinion.

Funding Assets Research

After you have already known your group of selection, you could now search for probably the most perfect assets that matches your price range and funding objectives. Learning a assets’s profitability attainable calls for examining a couple of homes and opting for which one works very best on your scenario.

Customers can use Mashvisor’s Assets Finder to find the highest homes that fit their seek standards and be offering promising ROI potentials. After you have narrowed your record down, the web site’s other calculators, together with its money on money go back calculator, allow you to analyze every potential assets in better element.

A number of the extremely helpful data you’ll want to your funding undertaking are:

- Condominium Bills. Working a condominium assets trade comes with other bills. You might have your start-up prices to think about in addition to your common routine running bills. Get started-up prices quilt house upkeep and rehabilitation, furnishings and home equipment, house inspection charges, and shutting prices. Per month running bills, alternatively, come with utilities. repairs, house owners’ affiliation dues, assets insurance coverage, assets taxes, condominium taxes, and assets control charges, to call a couple of.

- Condominium Source of revenue. Mashvisor’s funding calculator additionally serves as a condominium source of revenue calculator as it supplies customers with condominium source of revenue estimates in line with condominium comps information.

- Per month Money Float. Take into account our dialogue on money float previous? That is the place it is available in. Your per 30 days money float can also be computed the usage of an immediate or an oblique approach. However you not want to do it manually as Mashvisor’s money float calculator will already come up with the important correct information in line with actual property comps. For those who’re a novice investor, it’s extremely beneficial so that you can most effective put your cash in homes with certain money flows.

- Go back on Funding. That is the base line of any funding assets research. Traders need to generate excellent ROIs with their ventures. The usage of Mashvisor’s money on money calculator and its cap price calculator will lend a hand buyers analyze the profitability of a couple of homes concurrently. Whilst having the fitting money on money go back formulation will increase one’s probabilities of higher assets research, there are fewer mistakes when one makes use of the web site’s calculator.

- Actual Property Comps. Those are extremely necessary relating to examining a assets’s profitability as buyers want to read about an identical homes that had been just lately bought locally. The web site’s funding assets calculator additionally lists other comps for buyers to take a look at and learn about.

The Backside Line

General, Mashvisor’s funding assets calculator, in particular the money on money go back calculator, lets in buyers to spot which homes are very best suited to their scenario and funding objectives. It provides them a greater thought of what their ROI could be like, particularly when used hand-in-hand with the cap price calculator.

To determine extra about Mashvisor’s funding assets calculator and its different equipment, join a 7-day loose trial on Mashvisor now.